"Executive Summary Bancassurance Market Size and Share: Global Industry Snapshot

CAGR Value :

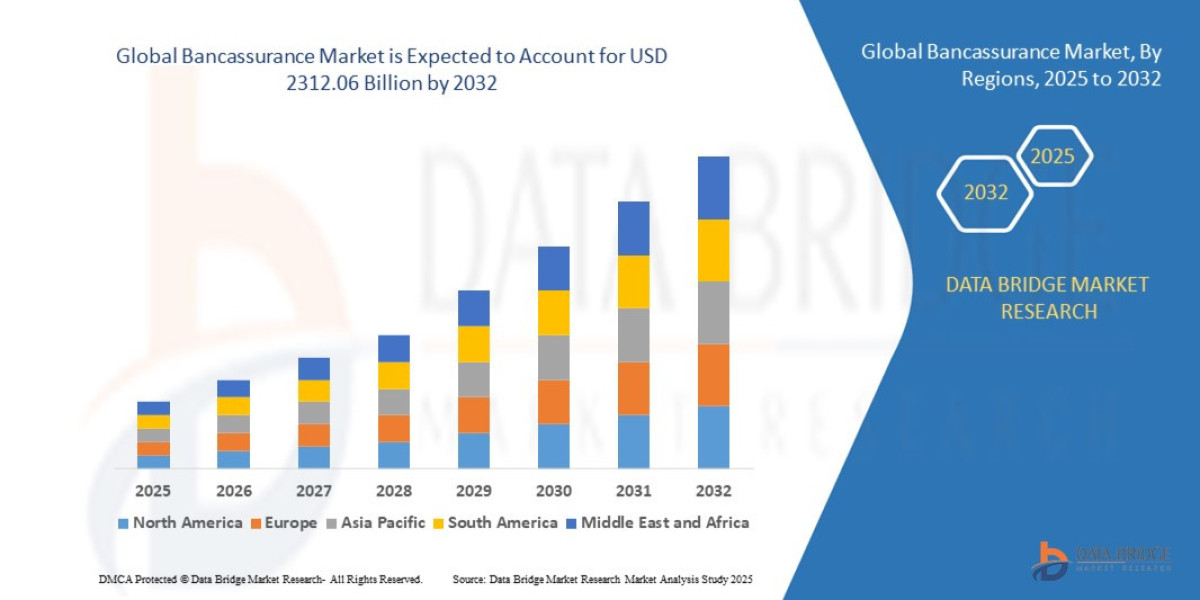

- The global bancassurance market size was valued at USD 1506.54 billion in 2024 and is expected to reach USD 2312.06 billion by 2032, at a CAGR of 5.50% during the forecast period

Bancassurance Market report offers the most appropriate solution for the business requirements in many ways. To be successful in this competitive age, it is very imperative to get well-versed about the major happenings in the Bancassurance Market industry which is possible only with the excellent market report like this one. To make aware about the industry insights so that business never misses anything, this is the valuable market report. The report also analyzes the market status, market share, growth rate, sales volume, future trends, market drivers, market restraints, revenue generation, opportunities and challenges, risks and entry barriers, sales channels, and distributors. A large scale Bancassurance Market report not only assists with the informed decision making but also helps with smart working.

The top notch Bancassurance Market report defines various segments related to Bancassurance Market industry and market with thorough research and analysis. These can be listed as; industry outlook, critical success factors (CSFs), industry dynamics, market drivers, market restraints, market segmentation, value chain analysis, key opportunities, application and technology outlook, regional or geographical insight, country-level analysis, key company profiles, competitive landscape, and company market share analysis. So, business can surely go with an all-embracing Bancassurance Market research report to take business to the highest level of growth and success.

Stay informed with our latest Bancassurance Market research covering strategies, innovations, and forecasts. Download full report: https://www.databridgemarketresearch.com/reports/global-bancassurance-market

Bancassurance Market Trends & Analysis

Segments

- By Type: The global bancassurance market can be segmented into life bancassurance and non-life bancassurance. Life bancassurance involves selling life insurance products through bancassurance channels, whereas non-life bancassurance deals with the distribution of non-life insurance products like property and casualty insurance.

- By Application: Segmentation based on application includes wealth management, personal insurance, business insurance, and others. Wealth management involves helping customers manage their finances and investments, while personal insurance provides coverage for individuals and families. Business insurance caters to the insurance needs of companies and organizations.

Market Players

- BNP Paribas Cardif: BNP Paribas Cardif is a key player in the global bancassurance market, offering a wide range of life and non-life insurance products through partnerships with banks worldwide.

- AXA: AXA is another major player in the bancassurance market, known for its strong presence in both life and non-life insurance segments through collaborations with banks across different regions.

- Allianz: Allianz is a leading bancassurance provider, offering a diverse portfolio of insurance products through bank distribution channels in various countries.

- Nippon Life Insurance Company: Nippon Life Insurance Company is a prominent player in the bancassurance sector, focusing on providing life insurance products through strategic partnerships with banks.

- Prudential Financial Inc.: Prudential Financial Inc. is a well-known name in the bancassurance industry, offering a range of insurance solutions through partnerships with banks to reach a wider customer base.

These market players are actively involved in strategic collaborations and innovations to enhance their bancassurance offerings and expand their market presence globally. The increasing demand for convenient and integrated financial services has driven the growth of the bancassurance market, with key players leveraging technology and data analytics to provide personalized insurance solutions to customers through banking channels.

The global bancassurance market is poised for significant growth in the coming years, driven by factors such as increasing insurance awareness, rising disposable incomes, and the growing trend of bundling financial products for customer convenience. The evolving regulatory landscape and shifting consumer preferences are also shaping the bancassurance market dynamics, prompting market players to adapt and innovate to stay competitive.

[]()The global bancassurance market is undergoing significant transformations driven by technological advancements, changing consumer behaviors, and regulatory frameworks. One emerging trend in the market is the increasing emphasis on digital bancassurance solutions, enabling seamless insurance transactions and enhanced customer experiences. Market players are investing in digital platforms, mobile applications, and online portals to offer convenient access to insurance products and services, catering to the shifting preferences of tech-savvy customers.

Moreover, the integration of advanced analytics and artificial intelligence (AI) technologies is revolutionizing the bancassurance sector by enabling data-driven decision-making, personalized product recommendations, and targeted marketing strategies. Market players are leveraging big data analytics to gain valuable insights into customer behavior, preferences, and risk profiles, allowing them to design tailored insurance solutions that meet the individual needs of clients.

Another key aspect impacting the bancassurance market is the increasing focus on sustainability and environmental, social, and governance (ESG) criteria. Customers are increasingly seeking insurance products that align with their values and promote social responsibility and environmental sustainability. Market players are responding to this trend by introducing ESG-focused insurance offerings and collaborating with sustainable finance initiatives to address climate change, social inequality, and other global challenges.

Furthermore, the rise of InsurTech startups and digital disruptors is reshaping the competitive landscape of the bancassurance market. These agile and innovative companies are introducing new business models, products, and distribution channels, challenging traditional insurance providers and banks to adapt and embrace digital transformation to stay competitive.

In conclusion, the global bancassurance market is witnessing a paradigm shift driven by digitalization, data analytics, ESG considerations, and the emergence of InsurTech disruptors. Market players must proactively respond to these trends by embracing technology, fostering strategic partnerships, and prioritizing customer-centric innovation to capture new growth opportunities and establish a sustainable competitive advantage in the evolving market landscape.One notable aspect influencing the bancassurance market is the increasing emphasis on customer-centricity and personalized services. Market players are leveraging data analytics and AI technologies to gain a deeper understanding of customer needs, preferences, and behaviors. By analyzing vast amounts of data, including transaction history, demographic information, and online interactions, insurers can tailor their insurance products and services to align with individual customer profiles. This approach enhances customer engagement, improves retention rates, and boosts overall satisfaction levels.

Moreover, the integration of digital bancassurance solutions is reshaping the way insurance products are distributed and consumed. With the proliferation of smartphones and internet connectivity, customers are increasingly seeking seamless and convenient ways to purchase and manage their insurance policies. Market players are investing in user-friendly mobile apps, online portals, and digital platforms to offer a streamlined and intuitive experience for customers. This shift towards digitalization not only enhances accessibility but also enables insurers to reach a broader audience and tap into new market segments.

Another significant trend impacting the bancassurance market is the growing focus on sustainability and ESG considerations. Today's consumers are more socially conscious and environmentally aware, seeking insurance products that reflect their values and contribute to sustainable initiatives. Market players are responding to this demand by introducing ESG-focused insurance offerings that promote environmental protection, social responsibility, and ethical business practices. By aligning their products with ESG criteria, insurers can attract a niche segment of customers who prioritize sustainability, thereby differentiating themselves in a competitive market landscape.

Furthermore, the rise of InsurTech startups and digital disruptors is fostering innovation and competition in the bancassurance sector. These agile and tech-driven companies are leveraging cutting-edge technologies such as blockchain, IoT, and machine learning to revolutionize insurance processes, streamline operations, and enhance customer experiences. By introducing disruptive business models and customer-centric solutions, InsurTech firms are challenging traditional incumbents to adapt and evolve in an increasingly digital environment. This trend is driving incumbents to embrace digital transformation, foster a culture of innovation, and explore new partnership opportunities to stay ahead in a rapidly evolving market.

In conclusion, the bancassurance market continues to evolve rapidly, driven by digitalization, data analytics, ESG considerations, and the influence of InsurTech disruptors. Market players need to embrace these trends, leverage technology to enhance customer engagement, and prioritize sustainability to meet changing consumer preferences. By staying agile, innovative, and customer-focused, insurers can capitalize on new growth opportunities, strengthen their market position, and create sustainable value in the dynamic bancassurance landscape.

Learn about the company’s position within the industry

https://www.databridgemarketresearch.com/reports/global-bancassurance-market/companies

Bancassurance Market Overview: Strategic Questions for Analysis

- What does the current research say about the size of the Bancassurance Market?

- What is the predicted CAGR until the end of the forecast period?

- What are the significant components of the Bancassurance Market segmentation?

- Which market players hold a competitive edge?

- What innovations have taken place recently in the Bancassurance Market?

- What countries form the scope of the geographical study?

- Which region holds the title of fastest-growing?

- Which country is expected to hold a leadership position?

- Where is the majority of Bancassurance Market value concentrated?

- Which country’s growth outpaces others?

Browse More Reports:

Global Sezary Syndrome Treatment Market

Global Dispensing Caps Market

North America Rotomolding Market

Global Diabetic Neuropathy Market

Global Nano GPS (Global Positioning System) Chip Market

Global Data Roaming Market

Global Citric Acid Market

Global Wipes Market

Global Aquatic Feed Enzymes Market

Global Waste Management Market

Global Mist Eliminators Market

Global Asphalt Additive Market

Global Regulatory Technology (Regtech) Market

Europe Infection Surveillance Solution Systems Market

Global Vehicle Tracking System Market

U.S. Health, Safety, and Environment (HSE) Training Services Market

North America Dental Practice Management Software Market

Global Sludge Treatment Chemicals Market

Global Tinted Glass Market

Global Network Security Market

Global Front and Rear Air-Conditioning (AC) Thermal Systems Market

Global Polymeric Biomaterial Market

Global Household Cleaning Products Market

Europe Electrosurgery Market

Global Bilateral Cystoid Macular Edema Market

Global Edge Banding Materials Market

Global Speciality Malts Market

Middle East and Africa Weight Loss and Obesity Management Market

Middle East and Africa Hydrographic Survey Equipment Market

North America Food Bags Market

Global Surface Roughness Measurement (SRM) Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"