The Financial Leasing Market is experiencing a significant surge in growth as enterprises and consumers alike increasingly favor leasing over purchasing to conserve capital, enhance operational agility, and optimize tax benefits. Financial leasing is proving to be a vital alternative to traditional asset acquisition, especially across capital-intensive sectors such as transportation, construction, and healthcare.

As global economies transition toward flexible financial solutions in uncertain markets, the demand for structured and asset-backed leasing contracts is growing. This market is supported by evolving regulatory frameworks, technological innovation, and a strong push from emerging economies embracing asset-light models.

Key Drivers Fueling Market Expansion

Several fundamental factors are contributing to the consistent expansion of the Financial Leasing Market:

Shift Towards Asset-Light Models: Companies are minimizing ownership and instead opting to lease high-value assets, promoting leaner balance sheets.

Increasing SME Adoption: Small and medium-sized enterprises are leveraging leasing to access expensive equipment and infrastructure without upfront capital strain.

Technological Upgrades: Advancements in digital leasing platforms and e-signatures have streamlined the lease origination and approval processes.

Request a Sample Report: https://dataintelo.com/request-sample/159832

Market Restraints and Challenges

Despite robust momentum, the market faces a few challenges that could impede growth:

Regulatory and Compliance Complexities: Financial leasing is heavily regulated, and cross-border transactions often face inconsistent legal and tax treatments.

Credit Risk Exposure: Default risk from lessees, particularly during economic downturns, poses a potential threat to lessors.

Limited Awareness in Emerging Regions: In several developing countries, the benefits of financial leasing remain underutilized due to low awareness.

These restraints, however, are gradually being addressed through policy reforms and industry education initiatives.

Promising Opportunities in Emerging Markets

The Financial Leasing Market is ripe with potential as businesses and consumers seek adaptable financial options. Key opportunities include:

Green and Sustainable Leasing: Financing for renewable energy systems, electric vehicles, and eco-friendly machinery is opening new avenues.

Leasing in Infrastructure and Public Utilities: Governments are increasingly considering leasing options for public transit, IT infrastructure, and medical equipment.

Integration of AI and Blockchain: Automation and secure record-keeping technologies are transforming lease lifecycle management and fraud prevention.

View Full Report: https://dataintelo.com/report/global-financial-leasing-market

Market Dynamics and Value Insights

According to current projections, the Financial Leasing Market is set to expand at a compound annual growth rate (CAGR) in the high single digits through the forecast period. This growth is expected to be driven by increased demand in both B2B and B2C leasing models.

Estimated market valuation figures indicate:

A steady increase in global lease transactions across transportation, IT, and medical sectors

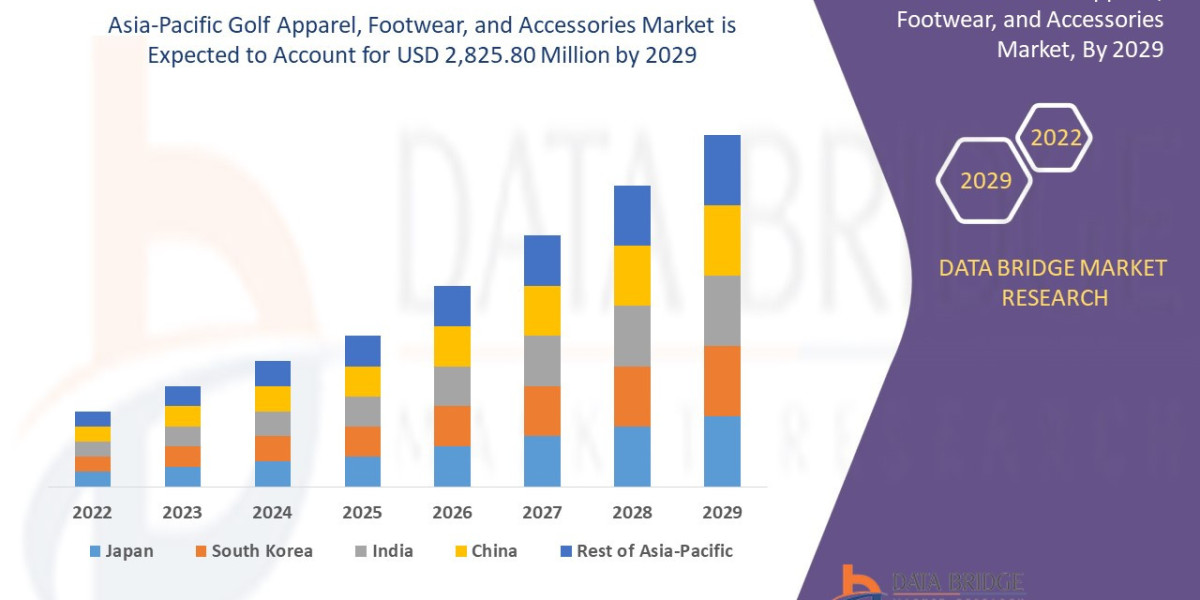

Higher adoption in Asia-Pacific, especially in China and India, where startups and infrastructure development are booming

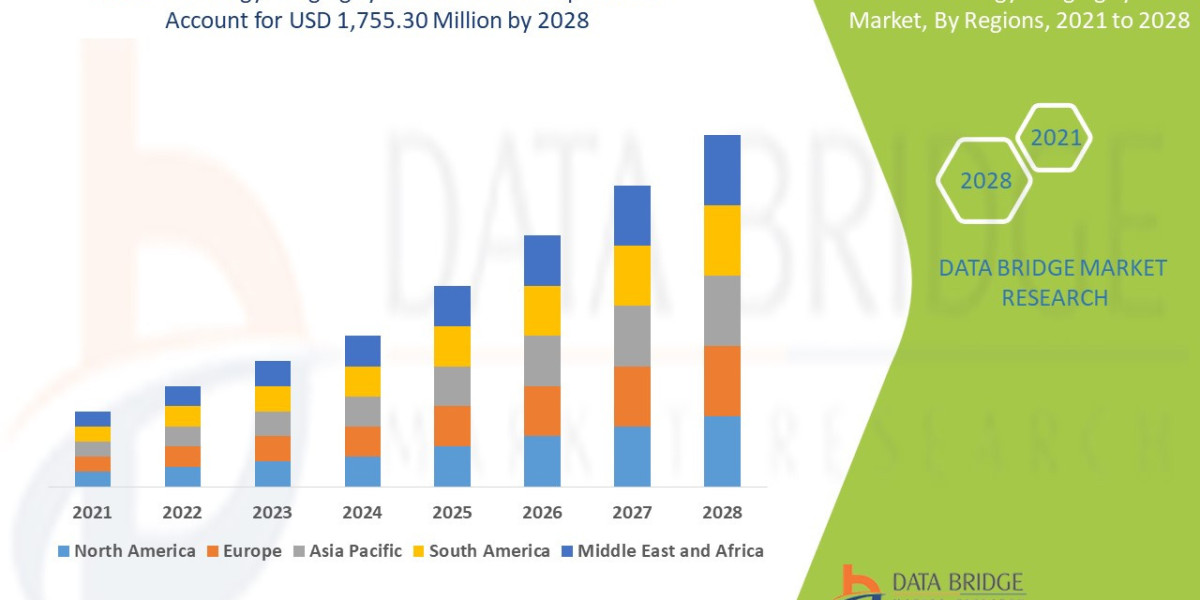

Rising volume of operational and capital leases in developed markets such as North America and Europe

Segment Analysis

By Type:

Capital Lease

Operating Lease

Leveraged Lease

Sale and Leaseback

By Application:

Transportation

Construction Equipment

IT Equipment

Healthcare

Manufacturing

By End User:

Corporates

Government Agencies

SMEs

Individuals

Among these, the transportation and IT equipment segments are dominating due to consistent demand for vehicles, fleets, and digital assets under flexible financial terms.

Regional Breakdown

North America

Leading the market due to advanced financial infrastructure and high adoption by large enterprises. The U.S. shows strong demand in automotive and healthcare leasing.

Europe

Countries like Germany, the UK, and France are seeing rising adoption of leasing in renewable energy, telecom, and smart infrastructure projects.

Asia-Pacific

A rapidly growing region, APAC is witnessing a surge in financial leasing activities led by China’s government initiatives and India’s startup ecosystem. The leasing of heavy machinery, telecom equipment, and commercial vehicles is on the rise.

Check Out the Report: https://dataintelo.com/checkout/159832

Latest Industry Trends

Several key trends are shaping the trajectory of the Financial Leasing Market:

Digital Transformation: Lease management platforms are offering cloud-based solutions for contract generation, payments, and compliance tracking.

Sustainable Asset Leasing: The demand for green energy and low-emission vehicles has prompted eco-conscious leasing agreements.

Flexible Lease Terms: More providers now offer customizable leasing contracts that adapt to client-specific needs.

These trends are enhancing customer satisfaction and promoting long-term market retention for leasing providers.

Strategic Recommendations for Stakeholders

To harness the full potential of the Financial Leasing Market, market players and stakeholders should consider:

Expanding to Under-Served Markets: Tapping into tier-2 and tier-3 cities and offering tailored lease plans can unlock new growth opportunities.

Investing in Customer Education: Informing clients about tax advantages, depreciation benefits, and cost savings of leasing can boost conversion rates.

Building Strategic Partnerships: Collaborating with manufacturers, fintech companies, and financial institutions can enhance distribution and service reach.

Future Outlook

As businesses prioritize financial agility and cost-efficiency, leasing continues to emerge as a compelling solution. The Financial Leasing Market will play a central role in:

Supporting infrastructure projects in emerging markets

Enabling startups and SMEs to access high-value equipment affordably

Facilitating public sector modernization through smarter leasing of capital assets

With digital innovation and evolving financial strategies, the market is poised for substantial expansion over the next decade.

Conclusion

The Financial Leasing Market stands at the crossroads of innovation, accessibility, and fiscal efficiency. As both organizations and individuals seek smarter financial models, leasing is no longer a convenience—it’s a necessity. Backed by economic shifts and digital integration, this market is well-positioned to drive value for stakeholders across the globe.

For a comprehensive view of the market landscape, growth strategies, and future projections, access the full report from Dataintelo today.