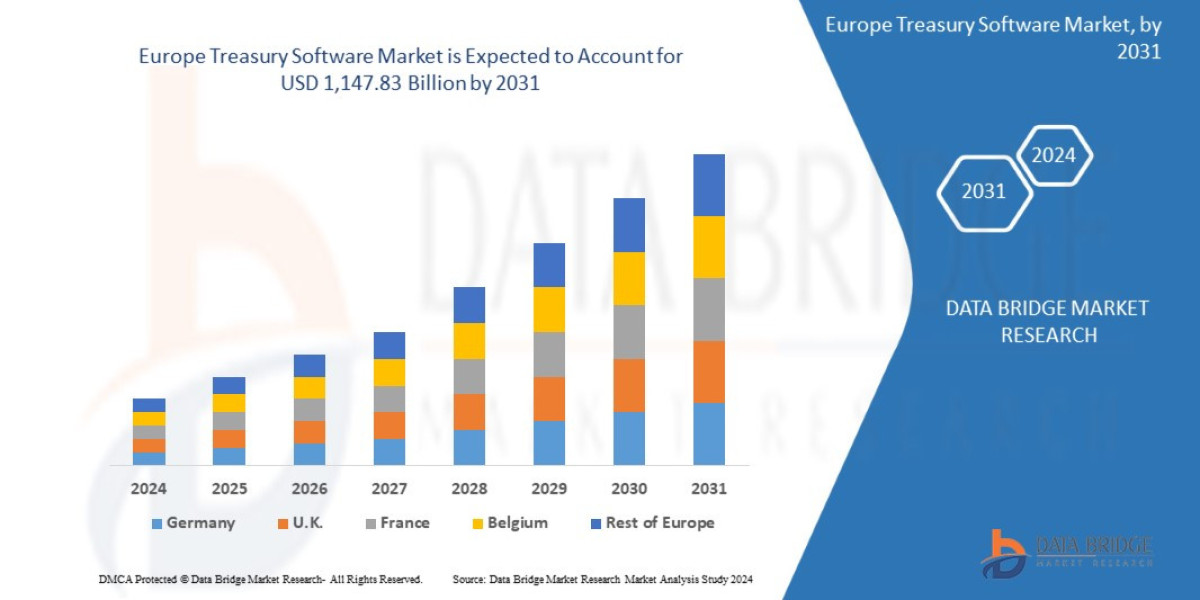

"Executive Summary Europe Treasury Software Market :

The data within the Europe Treasury Software Market report is showcased in a statistical format to offer a better understanding upon the dynamics. The market report also computes the market size and revenue generated from the sales. What is more, this market report analyses and provides the historic data along with the current performance of the market. Europe Treasury Software Market report is a comprehensive background analysis of the industry, which includes an assessment of the parental market. The Europe Treasury Software Market is supposed to demonstrate a considerable growth during the forecast period.

The emerging trends along with major drivers, challenges and opportunities in the market are also identified and analysed in this report. Europe Treasury Software Market report is a systematic synopsis on the study for market and how it is affecting the industry. This report studies the potential and prospects of the market in the present and the future from various points of views. SWOT analysis and Porter's Five Forces Analysis are the two consistently and promisingly used tools for generating this report. Europe Treasury Software Market report is prepared using data sourced from in-house databases, secondary and primary research performed by a team of industry experts.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Europe Treasury Software Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/europe-treasury-software-market

Europe Treasury Software Market Overview

**Segments**

- On-Premise

- Cloud-Based

The Europe treasury software market can be segmented based on deployment mode into on-premise and cloud-based solutions. On-premise treasury software is installed and operated from a user's in-house server and computing infrastructure. This deployment model offers more control and customization options for the users, but requires higher initial investment and maintenance costs. On the other hand, cloud-based treasury software is hosted on the vendor's servers and accessed through the internet. This model is gaining popularity due to its lower costs, scalability, and ease of implementation. With the increasing adoption of cloud technology across various industries, the demand for cloud-based treasury software is expected to grow significantly in the European market.

**Market Players**

- FIS

- Kyriba

- GTreasury

- Bellin

- ION Treasury

- OpenLink Financial

- SAP SE

- TreasuryXpress

- Reval

Key players in the Europe treasury software market include established companies such as FIS, Kyriba, GTreasury, Bellin, ION Treasury, OpenLink Financial, SAP SE, TreasuryXpress, and Reval. These companies offer a wide range of treasury management solutions catering to the needs of businesses of all sizes across various industries. They compete on the basis of product features, pricing, customer service, and technological advancements. With the increasing focus on digital transformation and the need for more efficient financial operations, these market players are continuously innovating and expanding their product portfolios to gain a competitive edge in the European market.

The Europe treasury software market is witnessing significant growth propelled by the increasing adoption of digital solutions and the need for efficient financial management practices. In addition to the deployment mode segmentation of on-premise and cloud-based solutions, there are several other factors influencing the market landscape. One notable trend is the emphasis on real-time data analytics and reporting capabilities within treasury software. As businesses strive to make data-driven decisions and enhance their risk management strategies, the integration of advanced analytics tools into treasury software has become crucial. Market players are investing in developing sophisticated analytics features to empower users with actionable insights and enhance overall financial performance.

Another key aspect shaping the Europe treasury software market is the focus on cybersecurity and data protection. With the rising threat of cyberattacks and data breaches, organizations are increasingly prioritizing the security of their financial information and transactions. Treasury software providers are incorporating robust security features such as encryption, multi-factor authentication, and secure data storage to ensure the confidentiality and integrity of sensitive financial data. Compliance with data protection regulations such as GDPR (General Data Protection Regulation) is also a critical consideration for market players to maintain trust and credibility among their customer base.

Moreover, the integration of artificial intelligence (AI) and machine learning capabilities in treasury software is poised to transform traditional treasury management processes. AI algorithms can assist in automating manual tasks, predicting cash flow patterns, optimizing investment strategies, and detecting anomalies or fraud risks in real-time. By harnessing the power of AI-driven insights, businesses can streamline their treasury operations, reduce operational costs, and enhance decision-making agility. Market players are increasingly investing in AI-driven technologies to offer customers cutting-edge solutions that drive efficiency and competitiveness in the market.

Furthermore, the emergence of blockchain technology is also impacting the Europe treasury software market. Blockchain offers secure and transparent transaction tracking, which can revolutionize payment processing, trade finance, and supply chain management within treasury functions. Market players are exploring the potential of blockchain to improve transaction speed, reduce costs, and enhance auditability in treasury operations. Collaborations and partnerships between treasury software vendors and blockchain technology providers are expected to drive innovation and introduce new solutions that leverage the benefits of distributed ledger technology.

In conclusion, the Europe treasury software market is witnessing dynamic growth driven by technological advancements, changing customer preferences, and evolving regulatory landscapes. Market players are continuously evolving their product offerings to meet the increasing demands for efficiency, security, and intelligence in treasury management. As the digital transformation wave sweeps across industries, the adoption of innovative treasury software solutions will play a pivotal role in shaping the financial landscape of the European market.The Europe treasury software market is experiencing a transformative shift driven by technological advancements and changing market dynamics. One key factor impacting the market is the increasing emphasis on real-time data analytics and reporting capabilities within treasury software. Businesses are leveraging advanced analytics tools to make data-driven decisions, enhance risk management strategies, and improve overall financial performance. Market players are investing in developing sophisticated analytics features to empower users with actionable insights, thereby enhancing the efficiency of treasury operations.

Another significant trend shaping the Europe treasury software market is the focus on cybersecurity and data protection. With the escalation of cyber threats and data breaches, organizations are prioritizing the security of financial information and transactions. Treasury software providers are integrating robust security features such as encryption, multi-factor authentication, and secure data storage to safeguard sensitive financial data. Compliance with regulations like GDPR is crucial for market players to ensure data privacy and maintain trust among customers.

Moreover, the integration of artificial intelligence (AI) and machine learning capabilities in treasury software is revolutionizing traditional treasury management processes. AI algorithms enable automation of manual tasks, prediction of cash flow patterns, optimization of investment strategies, and real-time detection of anomalies or fraud risks. By harnessing AI-driven insights, businesses can streamline treasury operations, reduce costs, and improve decision-making agility. Market players are investing in AI technologies to deliver innovative solutions that drive efficiency and competitiveness in the market.

Additionally, the emergence of blockchain technology is poised to disrupt the Europe treasury software market by revolutionizing transaction tracking, payment processing, trade finance, and supply chain management. Blockchain offers secure and transparent transaction verification, improving transaction speed, reducing costs, and enhancing auditability in treasury operations. Collaborations between treasury software vendors and blockchain providers are expected to introduce innovative solutions leveraging distributed ledger technology, paving the way for enhanced operational efficiency and transparency in financial transactions.

In conclusion, the Europe treasury software market is evolving rapidly, propelled by technological innovations, changing customer needs, and regulatory requirements. Market players are actively adapting their product offerings to meet the evolving demands for efficiency, security, and intelligence in treasury management. As digital transformation reshapes the financial landscape, the adoption of advanced treasury software solutions will play a crucial role in driving growth and competitiveness in the European market.

The Europe Treasury Software Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/europe-treasury-software-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The report can answer the following questions:

- Global major manufacturers' operating situation (sales, revenue, growth rate and gross margin) of Europe Treasury Software Market

- Global major countries (United States, Canada, Germany, France, UK, Italy, Russia, Spain, China, Japan, Korea, India, Australia, New Zealand, Southeast Asia, Middle East, Africa, Mexico, Brazil, C. America, Chile, Peru, Colombia) market size (sales, revenue and growth rate) of Europe Treasury Software Market

- Different types and applications of Europe Treasury Software Market share of each type and application by revenue.

- Global of Europe Treasury Software Market size (sales, revenue) forecast by regions and countries from 2022 to 2028 of Europe Treasury Software Market

- Upstream raw materials and manufacturing equipment, industry chain analysis of Europe Treasury Software Market

- SWOT analysis of Europe Treasury Software Market

- New Project Investment Feasibility Analysis of Europe Treasury Software Market

Browse More Reports:

Global Bio Sensors Technology Market

Global Data Zero Trust Security Market

Global Vertical Turbine Pump Market

Global Ceiling Tiles Market

Global Wheat Gluten Market

Global Data Logger Market

Global Phytogenic Feed Additives Market

Global Tunnel Boring Machine Market

Global Automotive Brake Shoe Market

Global Anastrozole Tablets Market

Global Fatty Alcohols Market

Global Hexamethylenediamine Market

Global Digital Freight Matching Market

Global High Temperature Insulation Market

Global Identity Verification Market

North America Melanoma Cancer Diagnostics Market

Global Berry Wax Market

Global Flat Glass Coatings Market

Global Closed System Transfer Devices Market

Global Programmatic Advertising Market

Global Active, Smart and Intelligent Packaging Market

Middle East and Africa B2B Air Care Market

Global Thermal Spray Coatings Market

Global Organic Fertilizers for Turfgrass Market

Global Post-Consumer Recycled Plastics Market

Global Neurology Ultrasonic Aspirators Market

Global Oxytocin Injection Market

Middle East and Africa Wound Debridement Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com