India's beer market is undergoing a strategic transformation, emerging as a dynamic segment within the alcoholic beverages industry. With a compound annual growth rate (CAGR) projected at over 8% through 2030, beer is steadily gaining ground despite the dominance of spirits in the Indian alcohol consumption landscape.

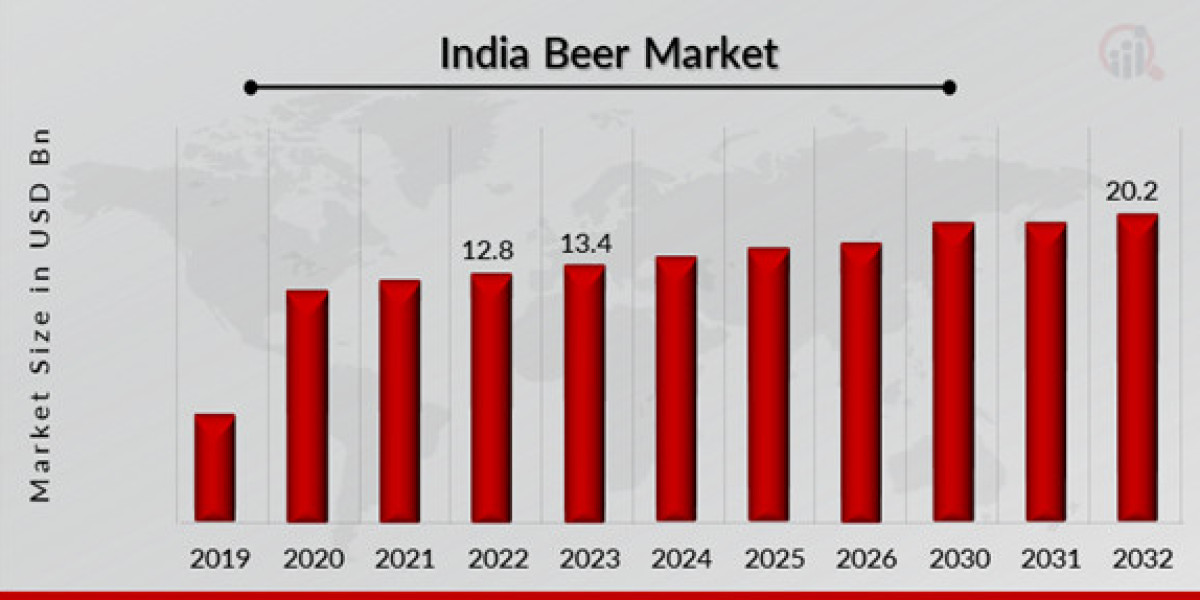

India Beer Industry is projected to grow from USD 13.4 Billion in 2024 to USD 20.2 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.20% during the forecast period (2024 - 2032).

This shift is fueled by demographic and socio-economic factors. India’s large youth population, urbanization trends, and increasing disposable incomes are fostering a more liberalized approach to casual drinking. Beer, often seen as a social drink with lower alcohol content, is becoming the beverage of choice among the millennial and Gen Z cohorts, particularly in metro cities.

From a business standpoint, the market is witnessing bifurcation into mass-market strong beers and a rapidly expanding premium and craft segment. Major players such as United Breweries (Kingfisher), AB InBev (Budweiser, Corona), and Carlsberg dominate volume sales, while newer entrants like Bira 91 and Simba focus on niche flavors and branding appeal. This segmentation offers investors and stakeholders distinct avenues for market penetration and portfolio diversification.

However, the regulatory environment poses a persistent challenge. High excise duties, a lack of uniform policy across states, and restrictions on advertising significantly impact profit margins and marketing strategies. These hurdles necessitate adaptive business models, including surrogate branding, localized production, and direct-to-consumer engagement through experiential marketing.

Opportunities for growth lie in innovation and expansion. Non-alcoholic and low-calorie beers, flavored variants, and craft microbreweries present high-margin potential. Additionally, the growing influence of digital platforms, food delivery services, and the relaxation of some state-level e-commerce restrictions signal an evolving distribution ecosystem.

In conclusion, while regulatory and operational complexities remain, the Indian beer market offers strong growth potential for brands that can align with shifting consumer behaviors, leverage innovation, and navigate the regional regulatory framework effectively.