"Executive Summary Artificial Intelligence (AI) Insurtech Market :

"Executive Summary Artificial Intelligence (AI) Insurtech Market :

CAGR Value

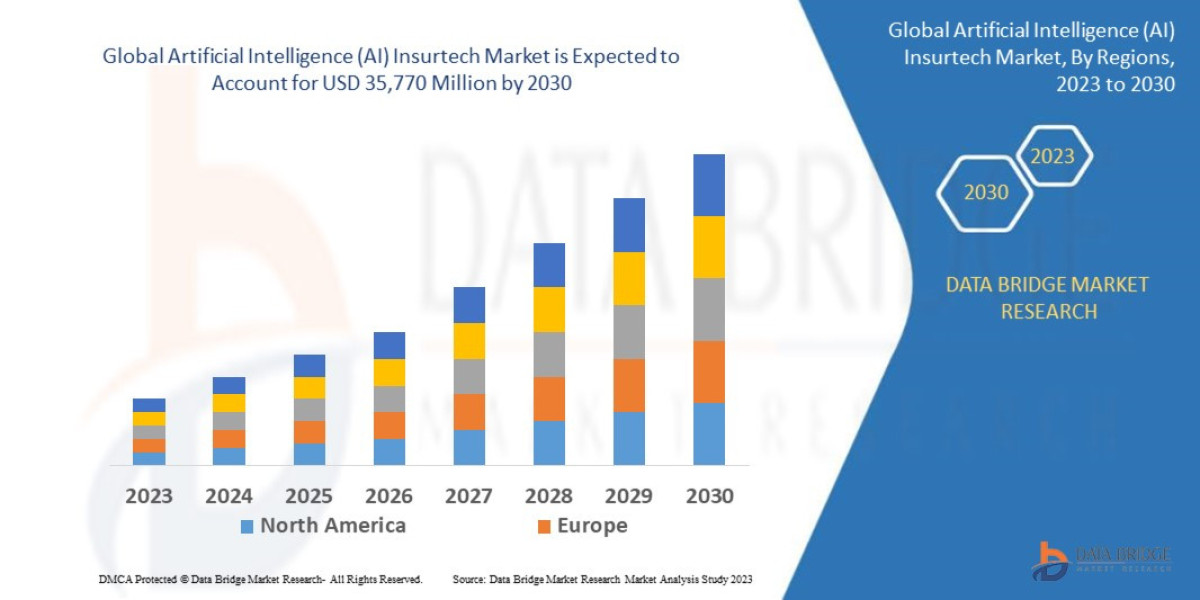

Data Bridge Market Research analyses that the global artificial intelligence (AI) insurtech market which was USD 3,640 million in 2022, is expected to reach USD 35,770 million by 2030, and is expected to undergo a CAGR of 33.06% during the forecast period of 2023 to 2030.

The analysis and estimations conducted via the winning Artificial Intelligence (AI) Insurtech Market report help to get an idea about the product launches, future products, joint ventures, Market strategy, developments, mergers and acquisitions and effect of the same on sales, Market, promotions, revenue, import, export, and CAGR values. The industry analysis report assists in determining and optimizing each stage in the lifecycle of industrial process that includes engagement, acquisition, retention, and monetization. This comprehensive report has estimations of CAGR values which are very important for businesses in deciding upon the investment value over the time period. Artificial Intelligence (AI) Insurtech Market report examines market drivers, market restraints, challenges, opportunities and key developments in the industry.

The high quality Artificial Intelligence (AI) Insurtech Market document contains market insights and analysis for industry which are backed up by SWOT analysis. This report provides a broader perspective of the market place with its comprehensive market insights and analysis which eases surviving and succeeding in the market. Moreover, such market report explains better market perspective in terms of product trends, Market strategy, future products, new geographical markets, future events, sales strategies, customer actions or behaviours. Artificial Intelligence (AI) Insurtech Market research report encompasses a far-reaching research on the current conditions of the industry, potential of the market in the present and the future prospects.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Artificial Intelligence (AI) Insurtech Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-insurtech-market

Artificial Intelligence (AI) Insurtech Market Overview

**Segments**

- **By Offering:**

- Software Tools

- Services

- **By Application:**

- Customer Service

- Claims Management

- Chatbots

- Personalized Marketing

- Others

- **By End-User:**

- Insurance Companies

- Insurance Agents

- Others

- **By Geography:**

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Artificial Intelligence (AI) has been disrupting the insurance industry, offering innovative solutions to improve operational efficiency, customer service, and risk management. In the AI insurtech market, offerings can be segmented into software tools and services. Software tools encompass various technologies like machine learning algorithms, predictive analytics, and natural language processing, while services include consulting, implementation, and maintenance. Applications of AI in insurtech span across customer service, claims management, chatbots for assistance, personalized marketing based on customer data analysis, and other bespoke solutions tailored to insurance needs. End-users primarily consist of insurance companies utilizing AI to streamline their processes, insurance agents leveraging AI for better client interactions, and other stakeholders benefiting from AI-driven insurance solutions. Geographically, the market is spread across North America, Europe, Asia-Pacific, South America, and the Middle East and Africa, with varying adoption rates and regulatory environments.

**Market Players**

- **IBM Corporation**

- **Microsoft Corporation**

- **Oracle**

- **SAP SE**

- **SAS Institute Inc.**

- **LexisNexis Risk Solutions Group**

Market players driving innovation in the AI insurtech sector include industry giants like IBM Corporation, Microsoft Corporation, Oracle, SAP SE, and SAS Institute Inc. These companies offer a suite of AI solutions tailored for the insurance industry, ranging from predictive analytics tools to AI-driven platforms for claims processing and customer insights. Other key players like LexisNexis Risk Solutions Group provide data and analytics solutions that are integral to AI implementation in insurance operations. The competitive landscape is dynamic, with startups and tech firms also making significant inroads into the AI insurtech market with specialized offerings. Collaboration, partnerships, and acquisitions are common strategies among market players to enhance their AI capabilities and expand their market reach.

The AI insurtech market is witnessing a significant transformation as artificial intelligence continues to revolutionize the insurance industry. One emerging trend in the market is the convergence of AI with Internet of Things (IoT) technologies to enable real-time data monitoring and proactive risk management strategies. This integration allows insurers to offer usage-based insurance policies, where premiums are calculated based on actual data collected through IoT sensors, leading to more personalized and dynamic pricing models. This trend is reshaping the traditional insurance landscape by fostering more transparent and customer-centric approaches, enhancing customer engagement, and improving the overall industry's efficiency.

Another notable development in the AI insurtech market is the increasing focus on regulatory compliance and risk assessment using AI-powered solutions. Insurers are leveraging advanced AI algorithms to analyze vast amounts of data to detect fraudulent activities, assess underwriting risks more accurately, and ensure compliance with evolving regulatory requirements. This emphasis on risk management is crucial in mitigating potential financial losses and maintaining the stability of the insurance sector.

Furthermore, the adoption of AI-powered chatbots and virtual assistants in customer service is gaining traction in the insurance industry. These intelligent bots can provide instant support to policyholders, offer personalized recommendations, and streamline the claims process by answering queries and guiding customers through complex insurance procedures. By integrating AI chatbots into their customer service operations, insurers can enhance the overall customer experience, reduce response times, and increase operational efficiency.

Moreover, the AI insurtech market is witnessing a surge in demand for AI-driven personalized marketing solutions. Insurers are leveraging AI algorithms to analyze customer data, segment policyholders based on behavior and preferences, and deliver targeted marketing campaigns that resonate with individual customers. This personalized approach enables insurers to improve customer retention, cross-selling, and upselling opportunities, thereby maximizing the lifetime value of each policyholder and driving revenue growth.

Overall, the AI insurtech market is poised for substantial growth and innovation, fueled by advancements in artificial intelligence, IoT integration, regulatory compliance solutions, customer service enhancements, and personalized marketing strategies. As the industry continues to evolve, collaboration between traditional insurers, technology providers, and insurtech startups will be essential to drive digital transformation, improve operational efficiencies, and deliver enhanced value propositions to policyholders in a rapidly changing competitive landscape.The AI insurtech market is currently experiencing a significant shift driven by the integration of artificial intelligence with IoT technologies, leading to real-time data monitoring and proactive risk management strategies. The convergence of AI and IoT allows insurers to offer usage-based insurance policies, thereby refining premium calculations based on actual data collected through IoT sensors. This trend is fostering more personalized and dynamic pricing models, altering the traditional insurance landscape towards customer-centric and transparent approaches. Additionally, a notable development in this market is the heightened focus on regulatory compliance and risk assessment utilizing AI-powered solutions. Insurers are deploying advanced AI algorithms to detect fraudulent activities, evaluate underwriting risks more precisely, and ensure compliance with evolving regulatory standards. This emphasis on risk management is crucial for mitigating financial losses and upholding the stability of the insurance industry.

AI-powered chatbots and virtual assistants are gaining prominence in the insurance sector, enhancing customer service by providing instant support to policyholders, offering personalized recommendations, and simplifying the claims process through efficient responses and guidance. Integration of AI chatbots into customer service operations enables insurers to elevate the overall customer experience, decrease response times, and improve operational efficiency. Moreover, there is a surge in demand for AI-driven personalized marketing solutions within the AI insurtech market. Insurers are leveraging AI algorithms to analyze customer data, segment policyholders based on behavior and preferences, and execute targeted marketing campaigns that resonate with individual customers. This personalized marketing approach facilitates customer retention, enhances cross-selling and upselling opportunities, ultimately maximizing the lifetime value of each policyholder and driving revenue growth.

The AI insurtech market is poised for substantial growth and innovation, propelled by advancements in artificial intelligence, IoT integration, regulatory compliance solutions, customer service enhancements, and personalized marketing strategies. Collaboration among traditional insurers, technology providers, and insurtech startups will be instrumental in propelling digital transformation, enhancing operational efficiencies, and delivering improved value propositions to policyholders in an evolving competitive landscape. The dynamic nature of the market presents opportunities for market players to innovate further, expand their offerings, and establish strategic partnerships to stay ahead in this rapidly evolving sector.

The Artificial Intelligence (AI) Insurtech Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-insurtech-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Table of Contents:

- Artificial Intelligence (AI) Insurtech Market Overview

- Economic Impact on Industry

- Competition by Manufacturers

- Production, Revenue (Value) by Region

- Supply (Production), Consumption, Export, Import by Regions

- Production, Revenue (Value), Price Trend by Type

- Market by Application

- Manufacturing Cost Analysis

- Industrial Chain, Sourcing Strategy and Downstream Buyers

- Artificial Intelligence (AI) Insurtech Market Strategy Analysis, Distributors/Traders

- Artificial Intelligence (AI) Insurtech Market Effect Factors Analysis

- Artificial Intelligence (AI) Insurtech Market Forecast

- Appendix

Browse More Reports:

Europe Slimming Devices Market

Global Goat Milk Powder Market

Global Aquaponics Market

Europe Kirsten Rat Sarcoma (KRAS) Market

Global Embolization Particle Market

Global Biofungicides for Soil Treatment Market

North America Industrial Valves Market

Global Minimally Invasive Medical Robotics, Imaging and Visualization Systems and Surgical Instruments Market

Global Enzyme Immunoassay (EIA) Reagents and Devices Market

Asia-Pacific Document Camera Market

North America Espresso Coffee Market

Asia-Pacific Baby Feeding Bottle Market

Global Orange Juices Market

Global Ring Layer Gyroscopes Market

Global Coating Resins Market

Global High Intensity Focused Ultrasound (HIFU) Market

Global Laboratory Filtration Market

Global Soybean Derivatives Market

Global Cerebral Aneurysm Treatment Market

Global Smart Television (TV) Sticks Market

Global Packaging Tensioner Market

Global Industrial Valves Market

North America Busbar Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"