Introduction

The Infectious Disease Diagnostics Market has been valued at USD 25.5 billion in 2024 and is projected to grow steadily at a compound annual growth rate (CAGR) of 2.75%, reaching USD 33.46 billion by 2034. With the rising burden of infectious diseases such as tuberculosis, HIV, influenza, hepatitis, and emerging pathogens, the demand for accurate and timely diagnostics has never been greater.

Diagnostics form the backbone of effective disease management by enabling early detection, timely treatment, and outbreak control. Increasing global focus on point-of-care testing, molecular diagnostics, and rapid diagnostic tests is accelerating adoption in clinical laboratories, hospitals, and decentralized healthcare settings.

Market Dynamics

Key Growth Drivers

- Rising Prevalence of Infectious Diseases

Infectious diseases remain a leading cause of mortality worldwide, particularly in low- and middle-income countries. Diagnostic tools are critical for disease surveillance, especially during outbreaks and pandemics. - Technological Advancements

Innovations in molecular diagnostics, next-generation sequencing, and microfluidics are enabling faster, more accurate detection of pathogens. Multiplex testing panels are now capable of identifying multiple infections from a single sample. - Growing Point-of-Care Testing

The demand for decentralized testing solutions is increasing due to their ability to provide results quickly, even in resource-limited areas. This is especially important for rural healthcare systems and during public health emergencies. - Government & NGO Initiatives

Public health programs targeting diseases such as malaria, HIV, and tuberculosis are boosting investments in diagnostics. International agencies like the WHO and Global Fund are increasing access to affordable tests. - Post-Pandemic Preparedness

The COVID-19 pandemic reshaped the global diagnostics industry, highlighting the importance of rapid testing infrastructure. Countries are investing heavily in diagnostics preparedness for future pandemics.

Challenges

- High Costs of Advanced Testing: Molecular tests, though accurate, can be cost-prohibitive in low-resource settings.

- Regulatory Barriers: Lengthy approval timelines and stringent compliance requirements can delay product launches.

- Shortage of Skilled Personnel: Operating advanced diagnostic equipment requires specialized training.

- Infrastructure Gaps: Many developing nations lack reliable laboratory facilities, limiting access to advanced diagnostics.

Market Segmentation

By Product & Service

- Reagents, Kits & Consumables: The largest revenue share due to their recurring demand in diagnostic procedures.

- Instruments: Includes PCR machines, sequencing platforms, immunoassay analyzers, and point-of-care devices.

- Software & Services: Growing role in data management, analytics, and digital healthcare integration.

By Technology

- Molecular Diagnostics: Includes PCR, NGS, and hybridization technologies; expected to dominate due to accuracy and speed.

- Immunodiagnostics: Widely used in detecting viral and bacterial infections via antigen-antibody reactions.

- Microbiology: Traditional culture methods, still relevant for confirmatory testing.

- Other Technologies: Biosensors, microfluidics, and nanotechnology-driven diagnostics.

By Disease Type

- HIV & STDs

- Hepatitis

- Respiratory Infections (Influenza, COVID-19, Tuberculosis)

- Tropical Diseases (Malaria, Dengue, Zika)

- Healthcare-Associated Infections (HAIs)

By End User

- Hospitals & Clinics: Major users of diagnostic systems for routine testing.

- Clinical Laboratories: Account for a large market share due to high testing volumes.

- Research Institutes: Contribute through R&D in molecular testing and epidemiology.

- Point-of-Care Settings: Rapidly growing due to the global push for accessible and portable diagnostics.

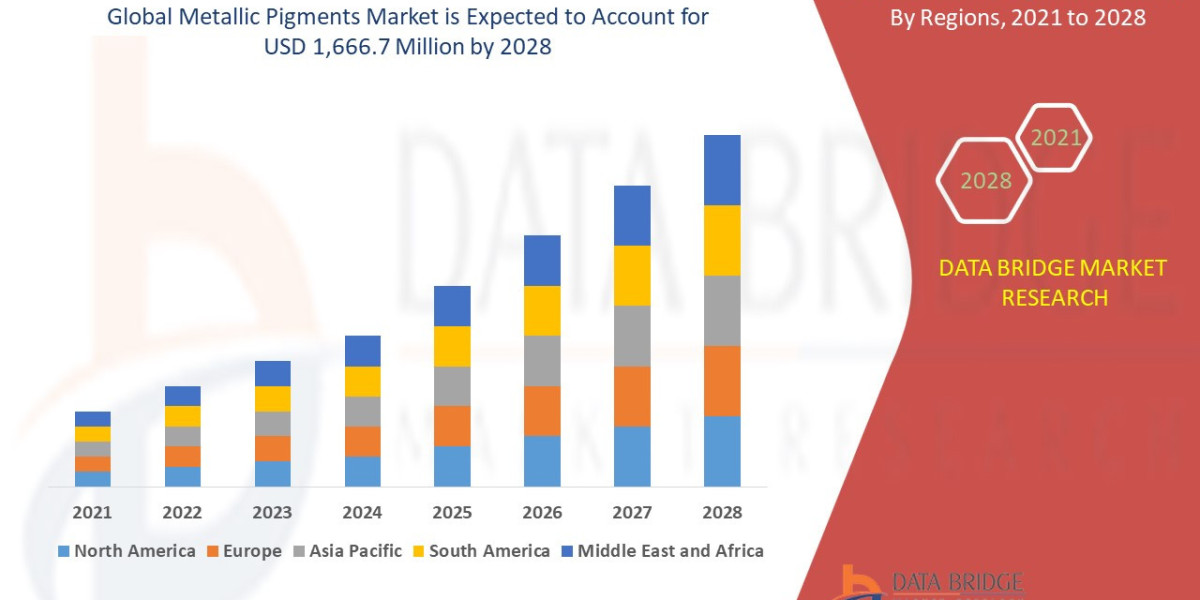

Regional Outlook

- North America: Holds the largest share, driven by high healthcare spending, advanced diagnostic infrastructure, and leading biotechnology firms. The U.S. remains a pioneer in molecular diagnostics and rapid diagnostic test adoption.

- Europe: Strong growth supported by government initiatives, universal healthcare systems, and a high prevalence of infectious diseases in certain regions. The EU is investing in next-generation sequencing and antimicrobial resistance testing.

- Asia Pacific: The fastest-growing region, fueled by high population density, increasing incidence of communicable diseases, and rising healthcare investments. Countries like India and China are scaling up testing infrastructure.

- Latin America: Expanding adoption in Brazil, Mexico, and Argentina due to increasing healthcare reforms and international funding for disease control.

- Middle East & Africa: Growth is primarily driven by international aid programs, expansion of diagnostic laboratories, and efforts to combat diseases like HIV and malaria.

Competitive Landscape

The market is moderately consolidated with several multinational players leading innovation while regional companies compete on affordability and accessibility.

Key Companies

- Abbott Laboratories

- F. Hoffmann-La Roche AG

- Danaher Corporation (Cepheid)

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers

- Hologic, Inc.

- Qiagen N.V.

- Becton, Dickinson and Company (BD)

- BioMérieux SA

Strategic Initiatives

- Product Launches: Focus on portable point-of-care testing kits.

- M&A Activity: Larger firms acquiring startups specializing in molecular diagnostics.

- Collaborations: Partnerships with governments and NGOs to expand reach in developing markets.

- AI & Automation: Integration of artificial intelligence for predictive diagnostics and faster result interpretation.

Future Outlook

The future of infectious disease diagnostics lies in digital health integration, AI-powered analysis, and decentralized testing ecosystems. Key trends include:

- Personalized Medicine: Tailoring diagnostics and treatments to individual genetic profiles.

- Home-Based Testing: Expansion of self-testing kits for HIV, COVID-19, and other common infections.

- Data-Driven Surveillance: Real-time analytics to track outbreaks and improve response times.

- Affordable Diagnostics: Increasing emphasis on low-cost rapid diagnostic tests for developing economies.

Conclusion

The global infectious disease diagnostics industry is undergoing rapid transformation, fueled by molecular diagnostics innovation, growing point-of-care testing, and the increasing need for rapid diagnostic tests. While challenges such as affordability and infrastructure gaps remain, the market is expected to expand steadily as healthcare systems worldwide prioritize preparedness against emerging pathogens.

For further details, read the latest Infectious Disease Diagnostics insights.

More Trending Latest Reports By Polaris Market Research:

The Future of Helideck Monitoring System market

Europe Renewable Methanol Market

Increasing Cases of Urinary Incontinence to Propel Market Growth