Executive Summary

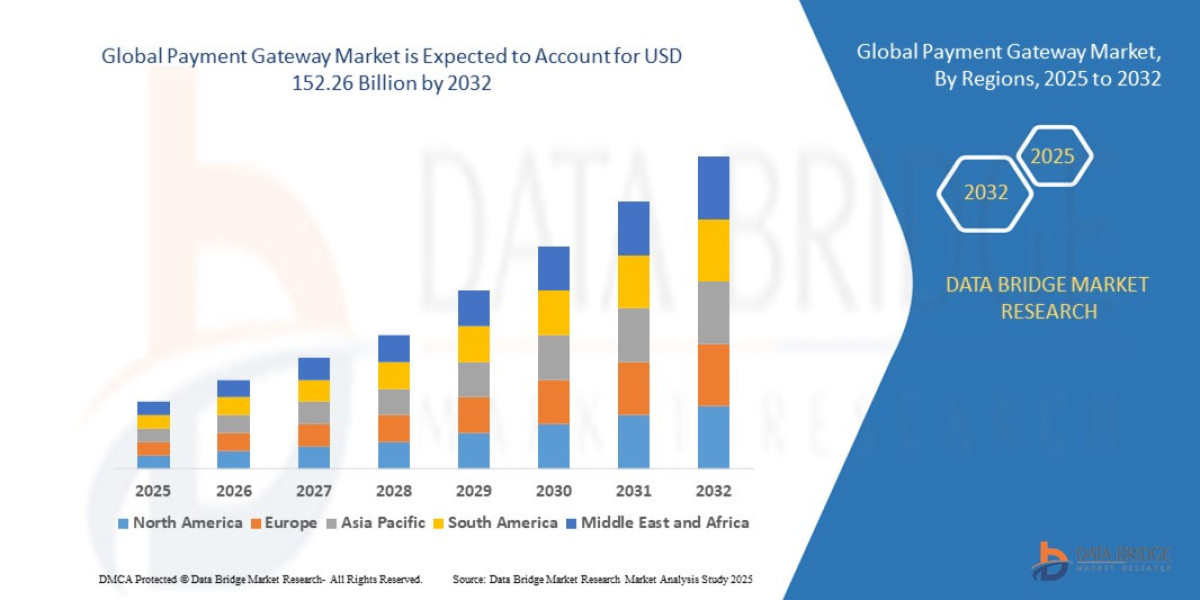

- The global payment gateway market size was valued at USD 35.17 billion in 2024 and is expected to reach USD 152.26 billion by 2032, at a CAGR of 20.10% during the forecast period

Market Overview

The Payment Gateway Market encompasses the technology and services that authorize and process digital payments for e-commerce, mobile, and brick-and-mortar transactions. A payment gateway is essentially a software application that transmits transaction information from the merchant's website or POS system to the acquiring bank and subsequently back to the merchant. This process involves encryption, tokenization, fraud screening, and communication with the payment network (e.g., Visa, Mastercard).

The market is highly diversified and can be segmented based on several key factors:

By Type:

Hosted Payment Gateways: Direct the customer away from the merchant's site to the gateway’s secure, external page for payment processing. This is simpler and offers the highest security compliance (lower PCI scope) but provides less control over the user experience.

Non-Hosted Payment Gateways (Direct/Integrated): Allow merchants to integrate the gateway directly into their website via APIs. This offers a seamless checkout experience and greater control over branding, but places a higher burden of security compliance on the merchant. This segment is experiencing faster growth, driven by developers and large e-commerce enterprises.

By Payment Mode: Includes credit/debit cards, e-wallets, bank transfers (ACH/SEPA), and Buy Now, Pay Later (BNPL) options. The shift towards e-wallets and BNPL is a dominant trend.

By Enterprise Size:

Small and Medium Enterprises (SMEs): A high-growth segment, leveraging easy-to-integrate SaaS-based gateway solutions.

Large Enterprises/Multinationals: Require complex, custom gateway solutions capable of handling massive transaction volumes and global, multi-currency operations.

The current market dynamic is characterized by intense competition and a continuous drive toward value-added services. Gateways are no longer passive conduits; they are active partners in commerce, offering sophisticated tools for subscription management, dynamic currency conversion, and revenue optimization. Key market drivers include the accelerating digital shift, increased regulatory requirements for consumer protection (e.g., Strong Customer Authentication), and the globalization of online retail.

Market Size & Forecast

- The global payment gateway market size was valued at USD 35.17 billion in 2024 and is expected to reach USD 152.26 billion by 2032, at a CAGR of 20.10% during the forecast period

For More Information Visit https://www.databridgemarketresearch.com/reports/global-payment-gateway-market

Key Trends & Innovations

Innovation is paramount in the Payment Gateway Market, with competition driving rapid technological shifts in security, speed, and intelligence.

AI and Machine Learning for Fraud Prevention: Advanced gateways now leverage AI models to analyze transactional data in real time, identifying subtle patterns indicative of fraud that traditional rule-based systems miss. This significantly lowers chargeback rates and improves authorization success rates for legitimate customers.

Tokenization and Vaulting: To enhance security and minimize PCI compliance scope for merchants, most modern gateways use tokenization, replacing sensitive card details with non-sensitive "tokens." This is crucial for seamless recurring payments and subscription services.

Mobile and Alternative Payment Methods (APMs): The market is shifting away from cards toward mobile wallets (Apple Pay, Google Pay), instant bank transfers (e.g., India’s UPI, Brazil’s Pix), and BNPL services (e.g., Klarna, Afterpay). Gateways must be capable of integrating dozens of regional APMs to facilitate market penetration.

Open Banking Integration: Driven by global regulatory frameworks, open banking allows third-party providers to securely access financial data. Payment gateways are leveraging this to offer Account-to-Account (A2A) payments, bypassing traditional card networks entirely, offering lower fees and immediate settlement.

Unified Commerce and Omnichannel Solutions: Gateways are building unified platforms that process transactions seamlessly across all channels—e-commerce, mobile apps, and physical POS systems. This provides merchants with a single view of customer data and inventory.

Competitive Landscape

The Payment Gateway Market features a highly competitive landscape dominated by a few global technology-focused entities and specialized processors. The industry can be broadly categorized into tech-first companies, legacy processors, and vertical specialists.

Major Players and Strategies:

Stripe: A technology leader known for its developer-centric focus, powerful APIs, and speed of integration. Its strategy is to target startups and high-growth e-commerce platforms by offering a complete stack of financial services beyond basic payments (Treasury, Billing, Identity).

PayPal/Braintree: PayPal remains dominant in consumer e-commerce checkout, while its subsidiary Braintree focuses on providing robust gateway and processing services to large, global enterprises and marketplaces, prioritizing security and consumer trust.

Adyen: Distinguished by its single-platform approach, which connects merchants directly to card networks globally, reducing complexity and increasing authorization rates. Adyen strategically targets multinational corporations and major omnichannel retailers.

Fiserv (and associated brands) & Worldline: These are major legacy processors with vast infrastructure, particularly strong in traditional banking relationships, physical POS systems, and European markets. Their strategy involves integrating modern digital capabilities with their established banking networks.

Regional Specialists: Companies like Razorpay (India), PPRO (aggregating APMs), and other local providers compete fiercely by excelling at local payment methods and regulatory compliance in specific high-growth regions.

The key strategic focus across the board is on becoming the indispensable "operating system" for commerce by bundling payments with other value-added services like lending, fraud, and analytics.

Regional Insights

The Data Roaming Market exhibits varied dynamics across different regions of the world, influenced by economic development, regulatory environments, and mobile penetration rates.

Asia-Pacific (APAC): The fastest-growing region globally, driven by massive e-commerce adoption in China, India, and Southeast Asia. The defining characteristic is the dominance of Alternative Payment Methods (APMs), such as WeChat Pay, AliPay, and UPI. Gateways must prioritize integration with these local wallets and instant payment schemes.

North America: A mature market characterized by high card usage and advanced security requirements. The focus is heavily on SaaS-integration (Stripe's dominance), subscription billing, and sophisticated fraud management tools for both e-commerce and retail.

Europe: Defined by stringent regulation, particularly PSD2 and SCA, which mandate two-factor authentication for many online transactions. This has driven innovation in frictionless authentication methods and A2A payments via Open Banking. Germany and the Nordics show a strong preference for bank transfers.

Latin America (LATAM): A high-potential region characterized by low credit card penetration but high mobile usage. The key dynamic is the necessity of supporting local payment methods (e.g., Boleto Bancário in Brazil, OXXO in Mexico) and addressing currency volatility.

Challenges & Risks

Despite the massive growth potential, the Payment Gateway Market faces significant operational and regulatory hurdles.

Fragmented Regulatory Landscape: Managing compliance with dozens of different national and regional regulations (GDPR, PCI DSS, PSD2, data localization laws, etc.) is complex and resource-intensive, particularly for global operators. Non-compliance carries severe financial penalties.

Persistent Fraud and Chargebacks: As digital commerce grows, so does the sophistication of cybercrime. Gateways are on the front line of defense, and failing to prevent fraud leads to substantial chargebacks, which damage merchant trust and profitability.

Interoperability and Legacy Systems: Many large enterprises still rely on older, in-house legacy payment systems. Integrating modern, API-driven gateways with these outdated infrastructures can be a time-consuming and expensive challenge.

High Cost of Cross-Border Transactions: The complexity of currency conversion, international compliance, and multiple intermediary banks makes cross-border payments expensive, creating a continuous need for more cost-effective solutions.

Opportunities & Strategic Recommendations

The challenges in the market are fueling innovation, creating massive opportunities for stakeholders who are prepared to adapt and specialize.

For Manufacturers/Gateways:

Prioritize Verticalization: Move beyond horizontal services and develop specialized gateway stacks for high-growth sectors like marketplaces, SaaS/subscription providers, or logistics platforms, incorporating industry-specific risk and billing features.

Embrace Open Banking: Invest heavily in A2A payment integration and instant settlement capabilities to capture market share from traditional card networks.

Focus on Emerging Markets: Aggressively expand market presence in APAC and LATAM by localizing integration—supporting indigenous payment methods and complying with local regulatory nuances is the key to winning.

For Investors:

Look for companies that offer specialized vertical solutions or those developing AI/ML fraud prevention tools that can be sold as a service to existing gateways and merchants.

Invest in infrastructure that enables low-cost cross-border payments (e.g., real-time gross settlement systems or blockchain-enabled solutions) to address one of the industry's biggest pain points.

For Merchants and Enterprises:

Adopt a Multi-Gateway Strategy: To optimize for redundancy, lowest cost, and highest authorization rates, enterprises should avoid relying on a single provider and strategically route transactions based on region, currency, and payment type.

Leverage Tokenization: Utilize gateway tokenization services to minimize your own PCI compliance burden and ensure a seamless, secure experience for returning customers.

Browse More Reports:

Global Algae Fertilizers Market

Global Construction Film Market

Global Antimicrobial Agent Market

Global Benchtop Laboratory Water Purifier Market

Asia-Pacific Feed Flavours and Sweeteners Market

Global Catenary Infrastructure Market

Global Bus Public Transport Market

Latin America Point of Care Infectious Disease Market

Global Innovation Management Market

Middle East and Africa Indium Market

Global Antibiotics Market

Global Potassium Humate Biostimulants Market

Africa MDI, TDI, Polyurethane Market

Global Dental Diode Lasers Market

Middle East and Africa Artificial Turf Market

Global Hematologic Malignancies Market

Latin America Ostomy Devices Market

Asia-Pacific Rotomolding Market

Philippines Microgrid Market

Global Automated Beverage Carton Packaging Machinery Market

Global Surgical Power Tools Market

Europe Intensive Care Unit (ICU) Ventilators Market

Global Vasodilators Market

Global Methylene Diphenyl Diisocyanate (MDI), Toluene Diisocyanate (TDI) and Polyurethane Market

Global Constrictive Pericarditis Market

Middle East and Africa q-PCR Reagents Market

Global Artificial Turf Market

Global Styrene Butadiene Latex Market

Global Digital Farming Software Market

Global Alpha Linolenic Acid Market

Global Head and Neck Cancer Drug Market

Europe Graft-Versus-Host Disease (GVHD) Treatment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com