Executive Summary

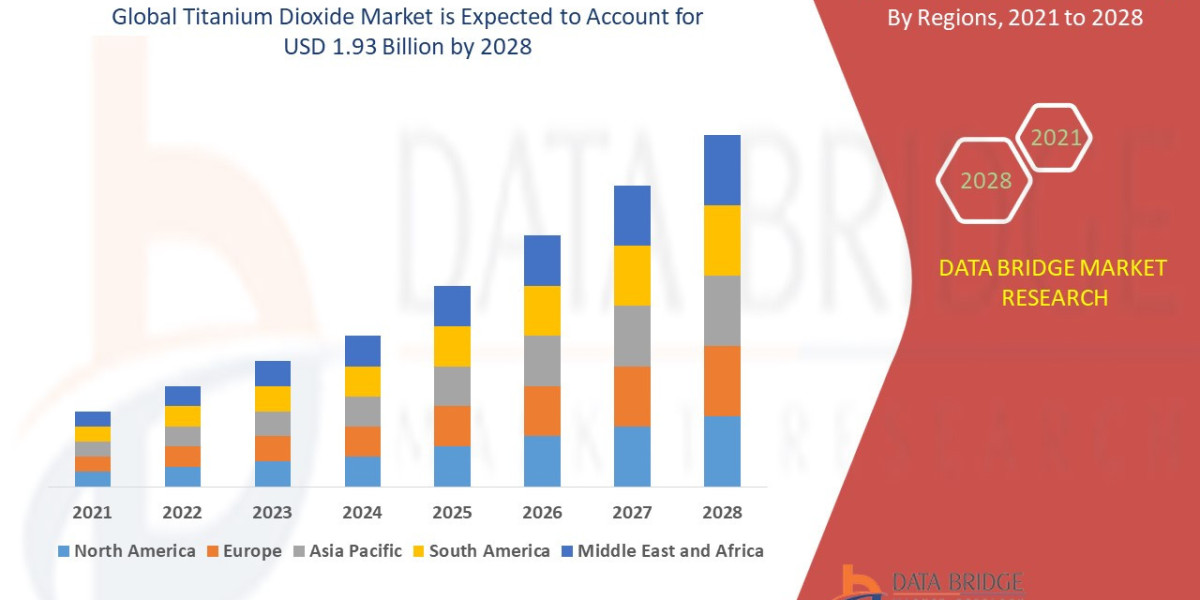

The global titanium dioxide market size was valued at USD 2.47 billion in 2024 and is projected to reach USD 4.80 billion by 2032, with a CAGR of 8.65% during the forecast period of 2025 to 2032.

Market Overview

Titanium Dioxide (TiO2) is an inorganic compound extracted from titanium-bearing mineral ores like ilmenite and rutile. It is the most widely used white pigment, valued for its high refractive index, which imparts maximum opacity, whiteness, and brightness.

Key Segments

The market is segmented primarily by process, grade, and application:

By Process:

Sulfate Process: An older, less energy-intensive process suitable for lower-grade ores, but it generates more waste products. It remains the dominant process in parts of Asia.

Chloride Process: A modern, high-purity process suitable for producing the highest-quality TiO2, yielding superior pigment grades used in high-performance coatings and plastics. It is the preferred technology in North America and Europe.

By Grade:

Pigmentary Grade (>90% of market): Used for opacity and brightness in paints, coatings, plastics, paper, and inks. The two main crystalline forms are Rutile (more stable and opaque) and Anatase (slightly less opaque, used in certain paper and textile applications).

Ultrafine/Nanomaterial Grade: Non-pigmentary uses, often leveraging TiO2's UV-blocking properties (in sunscreens and cosmetics) or its photocatalytic properties (in self-cleaning surfaces and air purification).

By Application:

Paints and Coatings: The largest segment, spanning architectural, automotive, and industrial coatings, where TiO2 provides durability and color retention.

Plastics: Used as a pigment and UV stabilizer in various polymers, including packaging and construction materials.

Paper: Used as a filler and coating pigment to improve whiteness and opacity.

Cosmetics and Sunscreens: Valued for its ability to block ultraviolet light.

Drivers and Dynamics

Surging Construction Activity: The primary driver remains the massive infrastructure and residential construction booms, particularly in the Asia-Pacific region, which translates directly to demand for paints, coatings, and plastic building materials.

Increased Automotive Production: TiO2 is essential for white and light-colored automotive coatings, which see demand tied directly to global vehicle production rates.

Substitution Resistance: TiO2's unique combination of high refractive index, chemical inertness, and non-toxicity makes it extremely difficult to substitute economically in high-opacity applications.

Regulatory Scrutiny: Environmental regulations regarding waste disposal from the sulfate process and occupational exposure risks are driving process optimization and the adoption of the cleaner chloride route.

The market currently exhibits a cyclical nature, tightly correlating with global GDP growth and industrial output, with pricing volatility often driven by feedstock costs (ilmenite and rutile) and energy prices.

Market Size & Forecast

The global titanium dioxide market size was valued at USD 2.47 billion in 2024 and is projected to reach USD 4.80 billion by 2032, with a CAGR of 8.65% during the forecast period of 2025 to 2032.

For More Information visit https://www.databridgemarketresearch.com/reports/global-titanium-dioxide-market

Key Trends & Innovations

Innovation in the TiO2 market focuses heavily on maximizing efficiency, enhancing sustainability, and exploring new functional applications.

High-Opacity and Low-Footprint Grades: Manufacturers are developing new TiO2 grades that offer higher opacity at lower loading levels. This allows coatings manufacturers to use less pigment while maintaining coverage, directly addressing cost pressures and environmental concerns.

Surface Treatment Technology: Advanced surface treatments (e.g., using alumina, silica, or zirconia) on TiO2 particles are being used to enhance weathering resistance, improve dispersibility in different polymer matrices, and boost compatibility with waterborne coating systems.

Photocatalytic Applications: Nanoscale Anatase TiO2 is gaining significant traction for its photocatalytic properties, which activate under UV light. Applications include self-cleaning glass and ceramics, air and water purification systems, and coatings that break down NOx pollutants in urban environments.

Sustainability and Circular Economy: There is increasing pressure to improve the sustainability of the production process, particularly managing the significant waste streams generated by the sulfate route. Efforts include investing in cleaner chloride technology and developing methods to reuse or neutralize acidic waste.

Digital Supply Chain Management: Given the commodity nature and logistics complexity, major players are adopting advanced analytics and digital tools to forecast demand more accurately, optimize inventory levels, and navigate volatile shipping costs.

Competitive Landscape

The global TiO2 market is moderately consolidated, dominated by a few multinational chemical giants who control the vast majority of global production capacity, particularly in the high-purity chloride process segment.

Major Global Players:

Tronox Holdings plc: A major global producer with assets across multiple continents, focusing on vertical integration from mining to finished pigment.

Chemours Company: Spun off from DuPont, it is a leading global producer known for its high-quality Ti-Pure brand, primarily utilizing the chloride process.

Venator Materials PLC: A global producer focused on diverse applications, including specialty grades and the European market.

Lomon Billions Group (China): A massive Chinese producer that has expanded rapidly, leveraging the scale and cost-efficiency of the sulfate process, and is increasingly targeting international markets.

KRONOS Worldwide, Inc.: A long-standing industry player with strong ties to the coatings industry.

Competitive Strategies:

Vertical Integration: Companies that control their supply of high-grade feedstock (ilmenite and rutile) have a significant cost advantage and greater resilience against raw material price volatility.

Capacity Expansion in APAC: Major players are strategically expanding or modernizing production facilities in low-cost manufacturing hubs, particularly in China and Southeast Asia, to serve the rapidly growing local demand.

Product Differentiation: Focusing on high-margin, specialized grades—such as UV-grade pigments for sunscreens and photocatalytic nanoparticles—to escape the intense price competition of the general commodity pigment market.

Sustained R&D in Process Efficiency: Continuous research into process improvements for both the chloride and sulfate routes to reduce energy consumption, minimize waste, and lower conversion costs.

Regional Insights

Demand and production dynamics for TiO2 vary significantly by region, primarily reflecting local industrial activity and environmental regulations.

Asia-Pacific (APAC): The largest and fastest-growing market, consuming the majority of global TiO2. This dominance is driven by massive growth in construction, manufacturing, and automotive production, particularly in China and India. APAC is also a major production hub, leveraging cost advantages.

North America: A mature market characterized by a high preference for the higher-quality, cleaner Chloride Process TiO2. Demand is steady, driven by infrastructure maintenance and the plastics and aerospace sectors.

Europe: A mature market defined by strict environmental regulations (REACH compliance) and a strong focus on sustainability. Growth is focused on high-performance coatings, decorative paints, and specialty applications (e.g., photocatalytic road surfaces).

Latin America and the Middle East & Africa (LAMEA): These regions represent growing but volatile markets. Demand is tied to urbanization and domestic industrialization, with consumption often met through imports from APAC and Europe.

Challenges & Risks

The TiO2 market faces several macroeconomic and environmental challenges that must be carefully managed.

Raw Material Volatility: The cost and availability of primary feedstocks (ilmenite, rutile) are subject to mining output, geopolitical factors, and transportation costs, directly impacting the final price of TiO2.

Energy Intensity of Production: Both the chloride and sulfate processes are highly energy-intensive. Fluctuations in natural gas and electricity prices can dramatically affect operating margins, particularly for sulfate-based producers.

Regulatory Compliance and Waste Disposal: Stricter environmental rules are increasing compliance costs, especially concerning the disposal of large volumes of solid and liquid waste generated by the sulfate process.

Substitution Threats (Minimal but Present): While difficult, research continues into potential substitutes (e.g., calcium carbonate or specialty silicates) for certain lower-performance applications, driven primarily by cost-cutting measures in coatings.

Opportunities & Strategic Recommendations

Despite its inherent commodity volatility, the TiO2 market offers substantial opportunities, especially in high-growth, specialty segments.

For Manufacturers and Producers:

Accelerate Chloride Process Adoption: Invest aggressively in the cleaner, higher-quality chloride technology to improve environmental compliance, reduce waste costs, and access premium-segment customers.

Feedstock Security: Secure long-term contracts or invest in vertical integration to lock in raw material supply and mitigate commodity price risk.

Focus on Specialty Grades: Shift R&D investment toward high-margin, functional grades: UV-absorbers for sunscreens, photocatalytic TiO2, and highly engineered pigments for plastic masterbatches.

For End-Users (Coatings, Plastics):

Optimize Loading: Work with TiO2 manufacturers to utilize the new generation of high-opacity pigments, enabling the use of less TiO2 per batch without sacrificing performance, thereby managing input costs.

Explore Alternative Whites: While not a direct replacement, investigate cost-effective fillers and extenders for non-critical coating layers to manage TiO2 usage more strategically.

For Investors:

Target Vertically Integrated Players: Invest in companies that have a secure, low-cost supply of titanium feedstock, as this provides a significant competitive moat.

Look to APAC Expansion: Fund companies with proven technology and strategic production capacity in high-growth APAC and LAMEA markets where demand is expected to outstrip domestic supply.

Browse More Reports:

Global Nanomedicine in Central Nervous System Injury and Repair Market

Global Glucose Syrup Market

Global Agile IoT Market

Global Recycled Carbon Fiber Market

Global Automotive Embedded Systems in Automobile Market

Global Laser Cleaning Market

Global Skydiving Equipment Market

Asia-Pacific Acute Lymphocytic/Lymphoblastic Leukemia (ALL) Diagnostics Market

Global Intestinal Pseudo Obstruction Treatment Market

Global Programmable Application Specific Integrated Circuit (ASIC) Market

Asia-Pacific Lung Cancer Diagnostics Market

Global B-cell lymphoma treatment Market

Global Portable Patient Isolation Market

Global Foodborne Trematodiases Disease Market

North America MDI, TDI, Polyurethane Market

Global Ozone Generator Market

Europe Specialty Gas Market

Global Automotive Seat Heater Market

Asia-Pacific Testing, Inspection, and Certification (TIC) Market for Building and Construction – Industry Trends and Forecast to 2028

Global Thrombocytopenia Market

Global Polyester Stick Packaging Market

Global Cloud Storage Market

Global Hammocks Market

Global Ready to Drink Alcoholic Tea Market

Middle East and Africa Flotation Reagents Market

Middle East and Africa Plastic Compounding Market

Global Potato Processing Market

North America q-PCR Reagents Market

Asia-Pacific Rowing Boats and Kayaks Market

Global Water Soluble NPK Fertilizers Market

Global Rowing Boats and Kayaks Market

Middle East and Africa Agricultural Pheromones Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com