Executive Summary

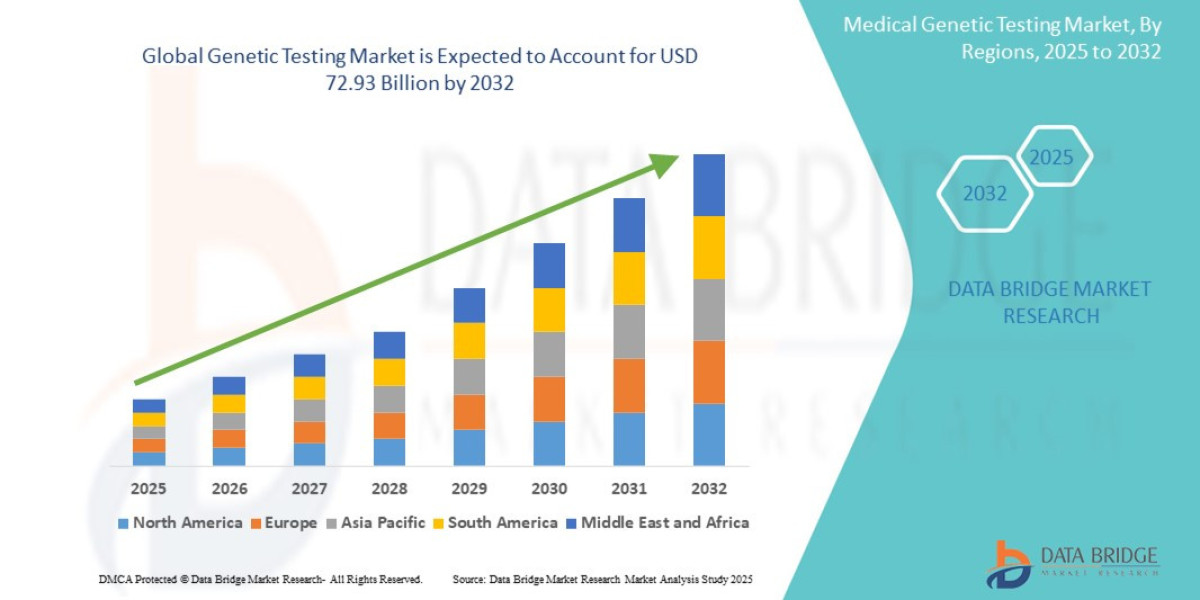

- The global genetic testing market size was valued at USD 21.49 billion in 2024 and is expected to reach USD 72.93 billion by 2032, at a CAGR of 16.5% during the forecast period

Market Overview

The Genetic Testing Market is defined by the services, technologies, and reagents used to analyze deoxyribonucleic acid (DNA), ribonucleic acid (RNA), chromosomes, proteins, and metabolites to detect gene variations (mutations, polymorphisms) associated with hereditary conditions, specific diseases, and drug responses. It provides critical information for diagnosis, prognosis, treatment selection, and risk assessment.

Key Segments

By Type of Test (Clinical Utility):

Oncology Testing (Largest Segment): Includes somatic testing (tumor profiling for targeted therapy selection) and germline testing (identifying inherited cancer risk genes like BRCA1/BRCA2). The rise of liquid biopsy is a key dynamic here.

Prenatal and Newborn Testing: Comprises Non-Invasive Prenatal Testing (NIPT) for chromosomal abnormalities and carrier screening panels. Driven by technological reliability and expanded coverage.

Pharmacogenomics (PGx): Analyzes genetic variations to predict individual responses to drugs, aiming to optimize dosage and minimize adverse reactions.

Infectious Disease Testing: Uses sequencing to identify pathogens, track outbreaks, and determine antibiotic resistance.

By Technology:

Next-Generation Sequencing (NGS): The dominant and fastest-growing segment, enabling rapid, high-throughput, and cost-effective sequencing of large genomic regions or entire genomes.

Polymerase Chain Reaction (PCR): Used for targeted, high-volume, and rapid testing (e.g., infectious diseases, single-gene disorders).

Microarray and Karyotyping: Used for broader copy number variation (CNV) and chromosomal analysis.

Drivers and Current Dynamics

Falling Cost of Sequencing: The cost of sequencing a whole human genome has plummeted from over $100 million two decades ago to near $1000 today. This cost curve is the single most significant factor driving accessibility and scale.

Growth of Personalized Medicine: Genetic testing is fundamental to personalized or precision medicine, allowing treatments (especially in cancer) to be tailored to an individual’s unique genomic profile, significantly improving efficacy and reducing unnecessary treatments.

Expansion of DTC Testing: Companies offering ancestry, wellness, and basic health risk reports are increasing public awareness and consumer comfort with genetic data, creating a large funnel for clinical testing.

Increasing Prevalence of Chronic and Genetic Diseases: The rising global burden of chronic conditions, coupled with improved diagnostics for rare inherited disorders, necessitates more widespread genetic screening.

Market Size & Forecast

- The global genetic testing market size was valued at USD 21.49 billion in 2024 and is expected to reach USD 72.93 billion by 2032, at a CAGR of 16.5% during the forecast period

For More Information Visit https://www.databridgemarketresearch.com/reports/global-genetic-testing-market

Key Trends & Innovations

The market’s future is being shaped by disruptive technologies that increase speed, accuracy, and clinical utility.

Liquid Biopsy and Non-Invasive Testing: This is a game-changer, especially in oncology. Liquid biopsy analyzes circulating tumor DNA (ctDNA) from a simple blood draw, allowing for minimal residual disease (MRD) detection, treatment resistance monitoring, and potentially cancer screening long before symptoms appear.

Integration of AI and Machine Learning (ML): AI is essential for interpreting the massive datasets generated by NGS. ML algorithms are used to distinguish between pathogenic and benign gene variants, improve diagnostic yield, and accelerate the discovery of new therapeutic targets.

Whole Genome Sequencing (WGS) for Routine Care: As costs continue to fall, WGS is increasingly being considered as the front-line diagnostic tool, especially in pediatric and rare disease cases, offering a comprehensive view over targeted panels.

Point-of-Care PGx: Development of smaller, faster sequencing devices and standardized interpretation tools allows for PGx testing to be conducted in clinics or pharmacies, providing rapid results to inform immediate prescription decisions.

Digital Health and Data Integration: The ability to seamlessly integrate genomic data with electronic health records (EHRs) and clinical information systems is crucial for making genetic testing results usable by general practitioners and specialists alike.

Competitive Landscape

The Genetic Testing Market is a dynamic environment featuring established diagnostics giants, specialized genomic sequencing leaders, and emerging DTC innovators. Competition is fierce, focusing on intellectual property, clinical validity, and global regulatory approval.

Major Players:

Illumina, Inc.: The dominant force in the market, controlling a significant share of the global NGS platform market (the "picks and shovels" of genomics). Its strategy focuses on driving down sequencing costs and expanding clinical applications.

Thermo Fisher Scientific Inc.: A major competitor providing a broad portfolio of sequencing instruments, reagents, and specialized diagnostic assays (e.g., PCR and microarray).

Roche Diagnostics (via Foundation Medicine): Strong in the oncology segment, specializing in comprehensive genomic profiling and liquid biopsy for cancer treatment planning.

Exact Sciences Corp.: Known for its focus on molecular diagnostics and non-invasive early cancer detection (e.g., colorectal cancer screening).

DTC Leaders (23andMe, Ancestry$\text{DNA}$): While focused on consumer reports, they hold massive genetic databases that are becoming increasingly valuable for research and potential pharmaceutical partnerships.

Competitive Strategies:

Clinical Validation and Reimbursement: The primary focus for clinical labs is securing robust clinical evidence to justify testing prices and achieving favorable reimbursement policies from government and private payers.

M&A for Portfolio Expansion: Large players frequently acquire smaller, innovative companies with unique assay technologies (e.g., liquid biopsy methods) or specialized clinical focuses (e.g., rare disease diagnostics) to quickly expand their test menu.

Data and AI Platforms: Companies are competing not just on the test itself, but on the sophistication of the AI-driven interpretation platforms that turn raw sequence data into clear, actionable clinical reports for physicians.

Geographical Footprint: Establishing accredited laboratories and distribution networks in high-growth APAC markets and navigating local regulatory frameworks is essential for global market dominance.

Regional Insights

Market adoption and penetration vary significantly based on regulatory maturity, healthcare spending, and reimbursement structures.

North America (Dominant Market): Accounts for the largest market share, driven by high healthcare expenditure, significant research funding, and a well-established private insurance structure that increasingly covers complex genetic tests (especially in oncology). The US is the global hub for NGS technology innovation.

Europe (Steady Growth): Characterized by high government investment in centralized healthcare systems. Growth is spurred by national genomics initiatives and increasing harmonization of clinical guidelines across the European Union. PGx adoption is particularly strong in several EU nations aiming to optimize drug efficacy.

Asia-Pacific (APAC) (Fastest Growth): Represents the highest CAGR due to a large patient population, rapid modernization of healthcare infrastructure (especially in China, Japan, and India), and growing awareness of NIPT and cancer screening. Local governments are heavily investing in indigenous sequencing and clinical laboratory capacity.

Latin America and MEA: Emerging markets with lower current penetration. Growth is primarily restricted to private healthcare sectors and major urban centers, with substantial opportunity for basic carrier screening and infectious disease testing as cold chain logistics improve.

Challenges & Risks

Despite the momentum, the market faces significant structural and ethical hurdles.

Reimbursement and Payor Coverage: The lack of standardized clinical utility guidelines and fragmented insurance coverage remains a major barrier. Many new, high-value tests struggle to gain universal reimbursement, hindering widespread adoption.

Regulatory Complexity and Lack of Standardization: The regulatory landscape is highly fragmented. In the US, Laboratory Developed Tests (LDTs) have different oversight rules than FDA-approved kits, creating a lack of uniformity in quality and validity across labs.

Ethical, Legal, and Social Implications (ELSI): Concerns regarding data privacy, potential genetic discrimination (e.g., in employment or insurance), and the complex ethics of predisposition testing require robust legal frameworks and consumer safeguards.

Data Interpretation and Talent Gap: The bottleneck is shifting from data generation to data interpretation. There is a global shortage of qualified bioinformaticians, genetic counselors, and physicians trained to properly use and counsel patients on complex genomic data.

Opportunities & Strategic Recommendations

The confluence of falling costs and rising clinical utility presents immense opportunities for stakeholders who adopt future-proof strategies.

For Manufacturers (Technology and Reagents):

Democratize WGS: Invest heavily in automating sample preparation and refining AI interpretation software to make Whole Genome Sequencing a cost-effective, routine clinical tool (targeting the sub-$500 genome).

Focus on DTC-to-Clinical Bridge: Develop compliant, scalable platforms that allow consumers who start with DTC ancestry testing to seamlessly transition their raw data into physician-ordered, clinically validated diagnostic tests.

For Healthcare Systems and Payers:

Establish PGx as Standard of Care: Proactively integrate PGx testing into EHRs and develop clear clinical decision support systems to ensure optimal drug prescribing, leading to significant long-term cost savings by reducing adverse drug reactions.

Implement Value-Based Reimbursement: Move away from fee-for-service payment models for genetic testing. Instead, tie reimbursement to proven patient outcomes (e.g., successful therapy selection in oncology).

For Software and AI Innovators:

Develop Clinical Genomics AI: Focus on AI tools that standardize variant classification and automatically generate physician-ready, templated clinical reports that prioritize actionable findings, thereby overcoming the interpretation talent gap.

Build Secure Data Ecosystems: Invest in highly secure, interoperable data platforms (using blockchain or similar technologies) that allow patients to control access to their genomic data while enabling ethical, large-scale research.

Browse More Reports:

Global Liquid Packaging Market

Global Vegetable Snacks Market

LATAM Footwear Market

North America Botanical Extract Market

Global Microgrid Market

Global Infection Surveillance Solutions Systems Market

Global Strongyloidiasis Treatment Market

Global Isosorbide Market

Global End User Experience Monitoring (EUEM) Market

Global Air Pollution Control Systems Market

Global Bouillon Market

Global Flight Data Recorder Market

Global Contact Tracing Application Market

Global Cysticercosis Treatment Market

Global Hematology Analyser Market

Middle East and Africa Xylose Market

Asia-Pacific Hand Holes Market

Europe Footwear Market

Asia-Pacific Internet of Things (IoT) Node and Gateway Market

Global Facility Management Services Market

Global Biometrics in Government Market

North America Feed Flavors and Sweeteners Market

Global Electric Hair Clipper and Trimmer Market

Global Preliminary Screening Tests Market

Global Document Imaging Market

Global Cloud Migration Services Market

North America Heavy Duty Corrugated Packaging Market

Middle East and Africa Retail Analytics Market

Asia Pacific Biometrics in Government Market

Global Agammaglobulinemia Treatment Market

Global Cloud Assurance MarketNorth America Pulmonary Function Testing Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com