Executive Summary

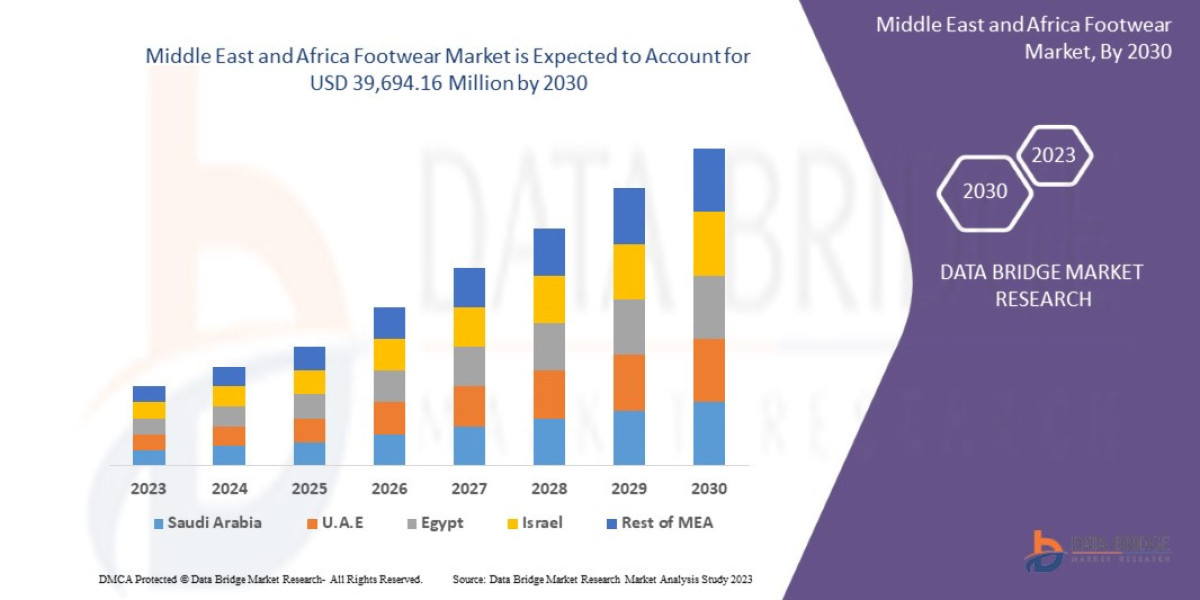

Data Bridge Market Research analyses that the Middle East & Africa footwear market is expected to reach the value of USD 39,694.16 million by 2030, at a CAGR of 4.7% during the forecast period.

Market Overview

The MEA Footwear Market encompasses all types of foot covering sold across a geographically, economically, and culturally diverse region spanning over 70 countries. The market is primarily an import-driven one, characterized by intense competition across all price points.

Key Segments

By Product Type:

Non-Athletic (Dominant Volume): Includes formal shoes, casual footwear (sneakers, slip-ons), boots, and traditional footwear (e.g., Arabian sandals/Na’al). This segment accounts for the majority of the market, driven by fashion and daily utility.

Athletic Footwear (Highest Growth Rate): Includes performance shoes for specific sports and lifestyle sneakers (Athleisure). This segment is rapidly overtaking traditional footwear in urban centers due to the influence of global sports and fashion trends.

By End-User:

Women's Footwear: The largest segment by value, influenced by fast fashion cycles and high discretionary spending, especially in the GCC.

Men's Footwear: Stable demand across formal and increasingly casual/athletic categories.

Children's Footwear: Driven by safety, durability, and high replacement rates due to growth.

By Distribution Channel:

Offline Retail: Hypermarkets, specialty stores, and traditional souks/markets remain essential, especially in Sub-Saharan Africa.

Online Retail (E-commerce): The fastest-growing channel, led by sophisticated markets like the UAE and Saudi Arabia, offering both global brands and local digital marketplaces.

Drivers and Current Dynamics

Demographic Dividend: MEA has one of the world's youngest populations, with a significant youth bulge. This demographic group is highly receptive to global brand trends, social media influence, and the Athleisure aesthetic, driving rapid product cycle turnover.

Increased Disposable Income and Urbanization: Rapid economic diversification in the GCC and the growth of emerging middle classes in countries like Nigeria, Egypt, and Kenya translate directly into higher consumer spending on apparel and footwear.

Digital Penetration: The proliferation of smartphones and improved internet access across the region has fundamentally changed how consumers discover, compare, and purchase footwear, accelerating the growth of brand awareness and cross-border trade.

Influence of Global Sports Culture: Major sporting events, particularly football (soccer), drive massive demand for branded performance and lifestyle athletic footwear.

Market Size & Forecast

Data Bridge Market Research analyses that the Middle East & Africa footwear market is expected to reach the value of USD 39,694.16 million by 2030, at a CAGR of 4.7% during the forecast period.

For More Information visit https://www.databridgemarketresearch.com/reports/middle-east-and-africa-footwear-market

Key Trends & Innovations

The MEA market is adopting global footwear trends while simultaneously demanding localization and cultural relevance.

The Athleisure Phenomenon: This remains the single most powerful trend. Sneakers are now socially acceptable across all but the most formal settings. Luxury brands are capitalizing by offering high-end, designer sneakers, while mass-market brands compete on technology, comfort, and bold colors.

Modest and Culturally Sensitive Design: In the Middle East and North Africa (MENA), there is a significant trend toward modest fashion, influencing footwear design. This includes greater demand for stylish closed-toe shoes and designer footwear suitable for use within private home settings or mosques (e.g., highly decorative flat sandals, mules).

Digitalization and Social Commerce: Consumers, especially Gen Z, rely heavily on Instagram, TikTok, and local influencers (micro-influencers) for purchasing decisions. The reliance on visually driven platforms necessitates strong digital marketing and AR (Augmented Reality) try-on features.

Comfort and Ergonomics: Following global trends, there is increasing demand for orthopedic and comfortable footwear across all ages, driven by health awareness and the long walking distances often required in urban environments in Africa.

Emerging Localized Production: Countries like Ethiopia, South Africa, and Morocco are developing leather and shoe manufacturing clusters, driven by access to raw materials and government incentives aimed at job creation. These local hubs are focusing on sustainable practices and regional design.

Competitive Landscape

The MEA market presents a highly stratified competitive structure, ranging from high-end global monopolies to fragmented local suppliers.

Major Players and Strategies:

Global Athletic Giants (Nike, Adidas, Puma): Dominate the premium and mid-range athletic and Athleisure segments. Their strategy relies on heavy investment in localized retail presence (flagship stores, malls), sponsorship of regional sports teams, and celebrity endorsements tailored to local markets.

European Luxury Brands (LVMH, Kering Groups): Control the high-end, formal, and designer segments, primarily in the GCC. Their strategy focuses on exclusivity, luxury mall locations, and high-touch customer service.

Value and Fast Fashion Brands (Zara, H&M, Bata): Compete fiercely in the mid-to-low price segments, offering rapid product turnover and aligning quickly with global fashion trends.

Regional/Local Brands (e.g., Hush Puppies MEA licensees, local artisan workshops): Compete by offering culturally specific products (e.g., high-quality Arabic sandals) and leveraging a deep understanding of local size preferences and materials (leather quality, breathability for arid climates).

Asian Importers (China, Turkey): Command a massive share of the volume market, particularly in Africa, competing aggressively on price and speed of delivery.

The most critical competitive barrier in Africa remains the ability to manage last-mile distribution efficiently across fractured retail landscapes and complex customs borders.

Regional Insights

The MEA market must be broken down into distinct sub-regions, as consumer behavior is highly variable.

Gulf Cooperation Council (GCC) (Saudi Arabia, UAE, Qatar):

Focus: Luxury, premium Athleisure, brand recognition, and rapid e-commerce adoption.

Dynamics: High per capita spending on imported goods. Climate dictates high demand for sandals and lightweight sneakers.

North Africa (Egypt, Morocco, Algeria):

Focus: Value, durability, and a mix of traditional and Western styles.

Dynamics: Economic challenges lead to price sensitivity. Growing local production (especially leather in Morocco) provides competition to imports.

South Africa (Sub-Saharan Anchor):

Focus: Streetwear culture, branded sneakers, and strong local manufacturing base.

Dynamics: The most sophisticated consumer market in Africa with deep brand loyalty. High rates of unemployment skew demand towards affordable/second-hand options outside major metropolitan areas.

West and East Africa (Nigeria, Kenya, Ghana):

Focus: Practicality, affordability, and utility.

Dynamics: Dominated by the informal retail sector and high volumes of unbranded or counterfeit imports. Massive growth potential driven by digital finance and improving logistics.

Challenges & Risks

Despite the substantial growth, stakeholders must address systemic challenges inherent to the region.

Pervasive Counterfeiting and Grey Market: The proliferation of high-quality counterfeits, particularly of major sneaker brands, erodes brand value and legitimate revenue streams. This is a massive issue across most MEA ports and digital marketplaces.

Currency Volatility and Import Duties: Extreme fluctuations in local currencies (e.g., Nigerian Naira, Egyptian Pound, Turkish Lira) make pricing and inventory management incredibly challenging for importers. High import duties in many African nations inflate retail costs.

Infrastructure Deficiencies: Poor transportation networks, unreliable power supply, and lack of formalized cold chains hinder efficient distribution and increase logistics costs, particularly in rural African markets.

Sizing and Fit Discrepancies: European or North American sizing standards often do not correlate perfectly with local customer foot sizes and shapes, leading to high return rates and customer dissatisfaction if not addressed through localized sizing.

Opportunities & Strategic Recommendations

The MEA market offers immense opportunities for stakeholders who adopt patient, long-term, and localized strategies.

For Manufacturers and Global Brands:

Localized E-commerce and Mobile First Strategy: Partner with established regional marketplaces (e.g., Namshi, Jumia) or develop dedicated mobile apps. Integrate local payment options (cash on delivery remains crucial in many areas).

Invest in Localized Design Centers: Open R&D facilities to focus on region-specific needs: materials for extreme heat, modesty-aligned designs, and ergonomic fits tailored to local consumer data.

Address the Athleisure Value Segment: While the GCC buys premium, the African mass market requires durable, attractive, and affordable athletic-inspired footwear priced between $15-$30.

For Retailers and Distributors:

Hybrid Retail Models: Maintain a strong physical presence in key malls while simultaneously investing in sophisticated omni-channel capabilities (click-and-collect, seamless returns).

Form Partnerships for Anti-Counterfeiting: Collaborate with customs agencies and regional trade associations to establish anti-counterfeiting measures that protect genuine products throughout the supply chain.

For Investors and Supply Chain Stakeholders:

Fund Local Manufacturing Hubs: Support the development of footwear manufacturing in countries with established leather industries (Ethiopia, Morocco) to create regional production and bypass import tariffs.

Fintech Integration: Invest in logistics technology that integrates mobile money and decentralized payment solutions, addressing the low banking penetration rate in Sub-Saharan Africa and streamlining transactions.

Browse More Reports:

Global Sezary Syndrome Treatment Market

Global Dispensing Caps Market

North America Rotomolding Market

Global Diabetic Neuropathy Market

Global Nano GPS (Global Positioning System) Chip Market

Global Data Roaming Market

Global Citric Acid Market

Global Wipes Market

Global Aquatic Feed Enzymes Market

Global Waste Management Market

Global Mist Eliminators Market

Global Asphalt Additive Market

Global Regulatory Technology (Regtech) Market

Europe Infection Surveillance Solution Systems Market

Global Vehicle Tracking System Market

U.S. Health, Safety, and Environment (HSE) Training Services Market

North America Dental Practice Management Software Market

Global Sludge Treatment Chemicals Market

Global Tinted Glass Market

Global Network Security Market

Global Front and Rear Air-Conditioning (AC) Thermal Systems Market

Global Polymeric Biomaterial Market

Global Household Cleaning Products Market

Europe Electrosurgery Market

Global Bilateral Cystoid Macular Edema Market

Global Edge Banding Materials Market

Global Speciality Malts Market

Middle East and Africa Weight Loss and Obesity Management Market

Middle East and Africa Hydrographic Survey Equipment Market

North America Food Bags Market

Global Surface Roughness Measurement (SRM) Market

Global Filter Integrity Test Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"