Executive Summary

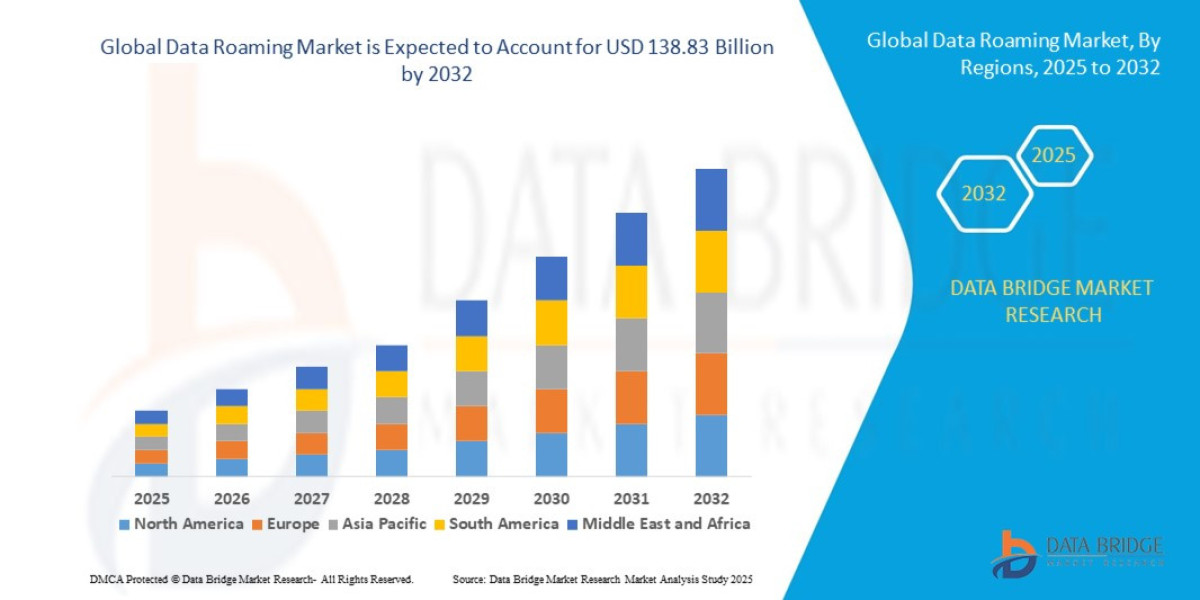

- The global data roaming market size was valued at USD 94.61 billion in 2024 and is expected to reach USD 138.83 billion by 2032, at a CAGR of 4.91% during the forecast period

Market Overview

The Data Roaming Market covers the entire ecosystem necessary for a subscriber (the "roamer") to seamlessly use mobile data services (4G/LTE and 5G) on a visited network (the "roaming partner"). This is facilitated by complex commercial agreements (inter-operator tariffs, or IOTs) and technical protocols (such as GTP for tunneling).

Key Segments

By Technology:

4G/LTE Roaming (Dominant Current Volume): Still accounts for the majority of data consumption, having replaced 3G as the primary roaming standard globally.

5G Roaming (Fastest Growth Rate): Critical for supporting high-bandwidth applications (AR/VR, video streaming) and low latency. Requires complex standardization (5G Standalone roaming).

By Service:

Sponsored Roaming (Wholesale): The wholesale market where MNOs negotiate IOTs and manage technical connectivity through clearing houses.

Retail Roaming (Consumer): The bundled service offered directly to the consumer, usually as daily passes, fixed bundles, or pay-as-you-go rates.

By End-User:

Consumer/Leisure Travelers (Largest Segment): Driven by social media, messaging, and navigation. Highly price sensitive.

Business Travelers: Requires reliability, security, and high performance. Less price sensitive than leisure travelers.

IoT/M2M Roaming: Emerging segment driven by globally connected devices (e.g., connected cars, asset trackers) that require seamless, low-cost cross-border connectivity.

Drivers and Current Dynamics

Explosion of Global Data Consumption: The average traveler’s data usage has surged, driven by rich content like video and reliance on cloud applications, making connectivity a necessity, not a luxury.

Regulatory Intervention: Policies like the EU's 'Roam Like At Home' have demonstrated that low, transparent pricing stimulates massive volume growth, putting pressure on MNOs in other regions to follow suit.

IoT Cross-Border Needs: The deployment of global devices requires continuous connectivity, necessitating standardized, low-cost roaming solutions that bypass traditional consumer tariff models.

Rise of Alternative Providers: The emergence of eSIM aggregators and virtual network operators (MVNOs) is fragmenting the retail market, offering consumers cheaper, more flexible options and forcing MNOs to re-evaluate their pricing strategy.

Market Size & Forecast

- The global data roaming market size was valued at USD 94.61 billion in 2024 and is expected to reach USD 138.83 billion by 2032, at a CAGR of 4.91% during the forecast period

For More Information Visit https://www.databridgemarketresearch.com/reports/global-data-roaming-market

Key Trends & Innovations

The market’s future is being defined by technologies that simplify access, optimize cost, and enhance performance.

eSIM Technology Adoption: The biggest disruptor. eSIM allows users to switch service providers digitally without changing physical SIM cards. This lowers the barrier to entry for local and third-party global providers (e.g., travel eSIM apps), creating intense retail price competition for MNOs.

5G Stand-Alone (SA) Roaming: Moving beyond 5G Non-Standalone (NSA), true 5G SA roaming enables critical features like ultra-low latency and network slicing, opening the door for specialized wholesale agreements for enterprise-grade 5G applications (e.g., remote surgery, automated vehicles).

Blockchain for IOT Settlement: The use of blockchain technology to automate and streamline the complex, often slow, billing and settlement process between MNOs (the IOT component). This reduces administrative costs and settlement disputes.

AI and ML for Fraud Detection and Pricing: MNOs are deploying AI to analyze roaming traffic patterns to preemptively detect fraud (SIM cloning, inflated billing) and to dynamically price retail bundles based on destination, demand, and wholesale costs in real-time.

Wi-Fi Roaming Offloading: Utilizing secure Wi-Fi networks (like those in airports, hotels, and public transport) to offload data traffic, reducing the cost burden on the mobile network infrastructure while ensuring seamless connectivity for the user.

Competitive Landscape

The Data Roaming Market is fundamentally controlled by major Tier 1 MNOs and global signaling providers, but competition is intensifying from specialized digital players.

Major Players:

Tier 1 MNOs (e.g., Vodafone Group, Deutsche Telekom, Telefonica): They dominate the wholesale market due to extensive network reach and high volumes, controlling most IOT rates and bilateral agreements.

Roaming Hub Providers (e.g., BICS, Syniverse, Tata Communications): These clearing house and signaling providers manage the complex technical and financial interconnections between hundreds of MNOs globally, facilitating seamless roaming.

eSIM Aggregators and MVNOs (e.g., Airalo, Holafly): These emerging digital players buy wholesale capacity from MNOs and resell it directly to consumers via eSIM, undercutting traditional retail prices and offering unprecedented consumer choice.

Competitive Strategies:

Wholesale Cost Optimization: Large MNOs focus on negotiating highly favorable bilateral IOT rates or joining large roaming alliances (like the FreeMove alliance) to minimize wholesale costs and preserve retail margins.

Seamless 5G Handover: Investing in the necessary infrastructure and testing to ensure smooth transition between 5G networks internationally, crucial for attracting high-value business roaming traffic.

Product Bundling and Simplification: MNOs are competing with eSIM apps by offering highly transparent, single-price global passes or regional passes, simplifying the confusing tariff structure that historically drove customers away.

Security and Fraud Mitigation: Investing in advanced signaling firewalls and AI-driven security solutions to protect the network from fraudulent activities and signaling abuses that can lead to large financial losses.

Regional Insights

Regulatory mandates have created stark differences in market structure and pricing across major geographies.

Europe (Highest Volume, Lowest ARPU): Dominated by the 'Roam Like At Home' regulation, effectively eliminating retail roaming charges within the EEA. This led to massive volume growth but drastically reduced the per-unit revenue for MNOs. European operators are now focused on monetizing traffic outside the EEA.

North America (High Value Wholesale): Driven by high-value international business travel and large internal roaming volumes. US operators typically include high-volume roaming in premium domestic plans, pushing the market towards volume over explicit retail charges.

Asia-Pacific (Rapid Growth and Complexity): Characterized by high population mobility (e.g., intra-Asia travel) and fragmentation. The lack of a unified regulatory body leads to highly disparate pricing and high IOT rates in many countries, presenting significant opportunity for eSIM disruptors.

Middle East and Africa (High Margin Potential): Retail prices remain high due to complex geopolitical and infrastructural challenges that drive up wholesale costs. This region is ripe for digital disruption if eSIM providers can negotiate better IOT rates.

Challenges & Risks

The Data Roaming Market faces threats from both market fragmentation and technological complexity.

Loss of Retail Revenue to eSIM Aggregators: MNOs risk being relegated to mere wholesale providers as consumers increasingly turn to eSIM apps for superior pricing and experience, cutting MNOs out of the lucrative retail margin.

5G Interworking Complexity: Establishing bilateral agreements for 5G SA roaming is technically complex and slow, hindering the monetization of next-generation services globally.

Regulatory Cost Pressure: The threat of further regulatory intervention (beyond the EU) in other major economic blocs (e.g., ASEAN or GCC) could dramatically reduce wholesale and retail ARPU overnight.

SIM Box Fraud and Wastage: Roaming traffic is a prime target for fraud schemes (such as SIM box bypass) and network abuse, requiring continuous, expensive monitoring systems.

Opportunities & Strategic Recommendations

The path forward for MNOs and new market entrants requires strategic embrace of digitalization and volume-based pricing.

For Mobile Network Operators (MNOs):

Launch Branded eSIM Solutions: Combat DTC competitors by launching proprietary digital roaming apps offering instant activation and highly transparent, volume-based roaming packages that leverage their own network scale and brand trust.

Monetize IoT Roamers: Create standardized global connectivity agreements for IoT devices (M2M), ensuring low, flat rates for essential data, providing a stable, high-volume recurring revenue stream.

Invest in Home Routing Intelligence: Utilize AI to route roaming traffic intelligently across multiple partners to always achieve the lowest wholesale IOT cost, even if the primary partner is busy or expensive.

For eSIM Aggregators and MVNOs:

Focus on Niche Traveler Segments: Target specific groups like cruise ship travelers, digital nomads, or specific regional corridors with tailored, hyper-competitive data plans.

Provide Value-Added Services: Integrate offerings like VPN access, international emergency calling, and travel insurance directly into their eSIM apps to enhance customer lock-in beyond just price.

For Infrastructure Providers:

Develop 5G SA Interworking Solutions: Focus development on highly scalable, secure, and automated clearing and signaling solutions specifically designed for the complexity and quality-of-service demands of 5G Standalone roaming.

Blockchain Adoption: Pioneer the shift to blockchain-based IOT settlement platforms to drastically reduce the current 90-day settlement cycles, freeing up capital for