Executive Summary

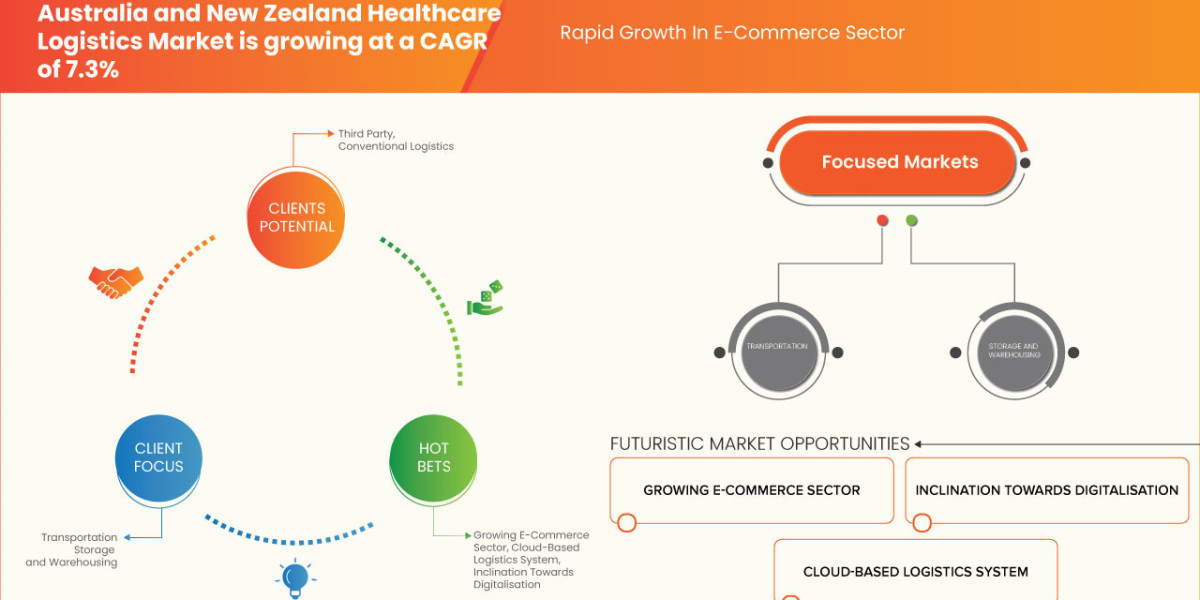

Data Bridge Market Research analyzes that the Australia healthcare logistics market is expected to reach the value of USD 843.59 million by 2030, at a CAGR of 7.6%, and the New Zealand healthcare logistics market is expected to reach the value of USD 108.03 million by 2030, at a CAGR of 5.5% during the forecast period.

Market Overview

The ANZ Healthcare Logistics Market encompasses the supply chain management services dedicated to the movement, storage, and handling of healthcare products—from raw materials to finished pharmaceuticals and biological samples. The market serves both public (Medicare/PHARMAC) and private healthcare systems.

Key Segments

By Service Type:

Transportation (Largest Segment): Includes primary freight (international imports), secondary distribution (national and regional freight), and last-mile delivery. The high demand for Air Freight for fast, cross-country transport is a unique feature of the large Australian geography.

Warehousing and Storage (W&S): Specialized facilities for controlled storage, inventory management, and fulfillment. The most critical sub-segment is Cold Chain Storage (refrigerated and cryogenic storage) for biologics, vaccines, and advanced therapies.

Value-Added Services (Fastest Growing): Includes kitting, labeling, packaging, customs brokerage, returns management, and direct-to-patient home delivery.

By Product Type:

Pharmaceuticals (Dominant): Traditional drugs, specialty pharmaceuticals, and biologics (e.g., vaccines, insulin). This segment requires the highest level of compliance.

Medical Devices and Equipment: Includes surgical instruments, diagnostics, and high-value capital equipment.

Clinical Trial Materials: Specialized logistics for sensitive samples, investigational products, and trial equipment.

Drivers and Current Dynamics

Aging Population and Chronic Disease: The demographic structure of both countries is skewing older, driving higher consumption of maintenance drugs, complex devices, and diagnostics, necessitating robust supply chains.

Increased R&D and Biologics: Heavy investment in the biotech sector is leading to a greater number of complex, temperature-sensitive products (biologics, cell and gene therapies) entering the market, drastically increasing the need for sophisticated Cold Chain logistics.

Government Healthcare Investment: Consistent, substantial public funding for healthcare in both Australia (PBS) and New Zealand (PHARMAC) provides a stable, predictable foundation for demand, particularly for pharmaceutical distribution.

Decentralization of Care: There is a pronounced shift toward providing care outside of hospitals (home infusions, telehealth monitoring), demanding sophisticated, patient-centric, and last-mile logistics networks.

Market Size & Forecast

Data Bridge Market Research analyzes that the Australia healthcare logistics market is expected to reach the value of USD 843.59 million by 2030, at a CAGR of 7.6%, and the New Zealand healthcare logistics market is expected to reach the value of USD 108.03 million by 2030, at a CAGR of 5.5% during the forecast period.

For More Information Visit https://www.databridgemarketresearch.com/reports/australia-and-new-zealand-healthcare-logistics-market

Key Trends & Innovations

Innovation in the ANZ market is focused heavily on compliance, visibility, and minimizing geographic barriers.

Digital Transformation and End-to-End Visibility: The critical trend is the adoption of integrated platforms using IoT sensors, RFID tags, and cloud software to provide real-time location and temperature data for every shipment. This is crucial for regulatory compliance and mitigating risk.

Cold Chain Advancements: Moving beyond basic refrigeration to specialized solutions for ultra-low temperature (ULT) storage (-80∘C) required for mRNA vaccines and cell therapies. This includes specialized containers, cryogenic transport capabilities, and N2 charging stations.

Direct-to-Patient (DTP) Logistics: The rising demand for specialty drugs and clinical trial materials to be delivered directly to the patient's home requires 3PLs to integrate with telehealth providers and offer white-glove delivery services that prioritize discretion and patient scheduling.

Sustainable Logistics: Growing pressure from pharmaceutical clients and governments to reduce Scope 3 emissions. This drives investment in electric vehicle fleets for urban deliveries, optimized route planning, and reusable cold chain packaging solutions.

Competitive Landscape

The ANZ Healthcare Logistics Market is competitive, featuring a mix of highly specialized global 3PLs and nimble local distributors who leverage regional expertise.

Major Players:

DHL Supply Chain: A global leader with significant cold chain expertise and extensive regional infrastructure, leveraging its global network for imports.

Toll Group: A large APAC logistics provider with deep domestic networks, capable of reaching remote Australian and New Zealand communities.

DB Schenker: Strong in air and ocean freight, often managing the complex primary import logistics for large pharmaceutical manufacturers.

Specialized Local 3PLs (e.g., Linfox Healthcare): Focus on domestic secondary distribution, leveraging deep understanding of local regulatory requirements and hospital delivery protocols.

Competitive Strategies:

Compliance and Quality Assurance (QA): Competition is primarily won on maintaining impeccable regulatory records (TGA in Australia, Medsafe in NZ), validated systems, and redundant Cold Chain capacity.

M&A for Specialization: Larger global players frequently acquire smaller, highly specialized local companies (e.g., those focused on DTP or ultra-low temperature storage) to quickly gain niche expertise and market access.

IT and Digital Investment: The ability to offer customers real-time, customizable reporting and digital integration with their Enterprise Resource Planning (ERP) systems is a non-negotiable differentiator.

Regional Network Optimization: Investing in efficient cross-Tasman logistics chains and consolidating distribution centers near major clinical hubs (Sydney, Melbourne, Auckland) to reduce transit times and costs.

Regional Insights

While geographically close, the Australian and New Zealand markets present distinct operational challenges and regulatory environments.

Australia (Scale and Distance):

Challenge: Extremely long domestic freight distances between major coastal cities (e.g., Perth to Sydney) and very low-density populations in the interior, driving up domestic air freight costs.

Focus: High investment in technology to manage complex inventory and transport across state lines, each potentially having slightly varying logistics standards. The DTP model is rapidly growing here.

New Zealand (Island Geography):

Challenge: Reliance on inter-island ferry and air transport, particularly between the North and South Islands.

Focus: A smaller, more centralized healthcare system (PHARMAC) leads to high procurement leverage and demand for cost-efficient, fast distribution into a few key distribution points before localized last-mile delivery. The DTP market is also emerging strongly.

Across both nations, the demand for services in major metropolitan centers (Sydney, Melbourne, Brisbane, Auckland) dictates the location of most major distribution centers (DCs), while reaching rural and remote Indigenous communities remains the costliest and most challenging logistical hurdle.

Challenges & Risks

The ANZ market is defined by its high standards, which translate into significant operational risks and cost pressures.

Regulatory Complexity: Operating under two distinct and highly stringent regulatory bodies (TGA and Medsafe), requiring dual compliance, documentation, and operational protocols.

Cost of Cold Chain Integrity: Maintaining strict temperature parameters (+2∘C to +8∘C, -20∘C, -80∘C) across vast, temperature-variable distances (from Australian desert heat to Tasmanian cold) significantly elevates operational expenditure.

Geographic Sparsity and Last-Mile Cost: The low population density, particularly in regional Australia, means the cost per delivery stop is exceptionally high, pressuring profitability for 3PLs serving nationwide contracts.

Supply Chain Resilience: High reliance on international air and sea freight for product imports makes the supply chain vulnerable to global disruptions (e.g., pandemic, geopolitical events), necessitating robust local inventory buffers and contingency planning.

Opportunities & Strategic Recommendations

The ANZ market offers premium opportunities for specialists who can guarantee compliance and leverage technology to optimize the complex logistics equation.

For Logistics Providers and 3PLs:

Specialize in DTP and Home Care: Invest aggressively in decentralized fulfillment centers, patient scheduling systems, and discreet, certified drivers to capture the high-value direct-to-patient segment, particularly for high-cost specialty pharmaceuticals.

Build ULT Capacity: Secure the high-margin market for advanced therapies (cell and gene) by expanding ULT storage and transport capabilities, moving beyond simple vaccine storage.

For Technology and Software Innovators:

Develop Compliance as a Service: Create software solutions that automatically map global product data against TGA and Medsafe requirements, automating documentation and risk assessment throughout the transport process.

AI-Powered Route Optimization: Focus on AI tools tailored for ANZ geography that factor in real-time weather, traffic, and ferry schedules to dynamically optimize routes, minimizing both delivery costs and carbon footprint.

For Manufacturers and Investors:

Regional Hub Consolidation: Consolidate APAC distribution through a single, highly compliant hub (e.g., Singapore or Melbourne) that meets both Australian and New Zealand import requirements, streamlining customs and regulatory complexity.

Public-Private Partnerships (PPPs): Partner with state and federal health organizations to build subsidized regional logistics hubs that ensure equitable access to essential medicines in remote areas, simultaneously securing public funding and long-term contracts.

Browse More Reports:

Global Testing, Inspection, and Certification (TIC) Market

Global Probe Card Market

Global Acute Lymphocytic/Lymphoblastic Leukemia (ALL) Diagnostics Market

Global Coconut Syrup Market

Middle East and Africa Biometrics in Government Market

Global Cleaning Service Software Market

Global Energy Efficient Windows Market

Global Complex Fertilizers Market

Global Bleeding Disorders Treatment Market

Global Automotive Torque Actuator Motor Market

Global Predictive Asset Management Manufacturing Analytics Market

North America Artificial Turf Market

Europe Topical Corticosteroids Market

Global Compliance Data Management Market

Global Optical Emission Spectroscopy Market

Australia and New Zealand Healthcare Logistics Market

Global Hand Holes Market

North America Pulses Market

Global Epidermolytic Ichthyosis Market

Global Epithelioid Sarcoma Treatment Market

North America Potato Processing Market

Global Medical Imaging (3D and 4D) Software Market

Global Castleman Disease Drug Market

Global Natural Fertility Supplements Market

North America Rice Husk Ash Market

Global Catalytic Converter Market

Global Grain Processing Equipment Market

Global Cylindrical Lock Market

North America Flotation Reagents Market

Global Pet Water Dispenser Market

Global Underwater Cameras Market

Global AI-Optimized Bioprocessing Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com