Overview

The global AI Liability Insurance market is experiencing significant growth as organizations increasingly adopt artificial intelligence (AI) technologies across industries. According to Market Intelo, the market was valued at USD 1.53 billion in 2023 and is projected to reach USD 3.92 billion by 2032, expanding at a CAGR of 10.4% during the forecast period (2024–2032). Rising AI adoption, growing regulatory scrutiny, and the need to mitigate risks associated with autonomous decision-making are the primary drivers of this market.

AI liability insurance provides coverage against legal claims and financial losses resulting from AI-driven errors, malfunctioning algorithms, or unintended outcomes. As AI systems become integral to critical processes, organizations are increasingly prioritizing insurance solutions to protect against potential liabilities.

Get Sample Report of AI Liability Insurance Market @ https://marketintelo.com/request-sample/81360

Market Dynamics

Increasing AI Adoption Across Industries

Industries such as healthcare, automotive, finance, and manufacturing are rapidly deploying AI systems for decision-making, automation, and predictive analytics. This expansion has raised concerns about errors, biases, and legal liabilities, driving the demand for AI liability insurance.

Companies are seeking protection against lawsuits, regulatory penalties, and reputational risks arising from AI-driven decisions. Insurance policies help organizations safeguard investments in AI technology while ensuring compliance with emerging legal frameworks and ethical standards.

Get Sample Report of AI Liability Insurance Market @ https://marketintelo.com/request-sample/81360

Technological Advancements and Risk Assessment

Insurance providers are incorporating AI and machine learning to evaluate risks more accurately, customize policies, and optimize premiums. Predictive analytics enables insurers to assess potential liability scenarios, monitor AI performance, and provide proactive risk management solutions.

Additionally, blockchain and IoT integration is helping improve transparency and accountability in AI operations, further supporting the growth of AI liability insurance. Digital platforms streamline policy management, claims processing, and real-time reporting for organizations deploying AI systems.

Market Segmentation

By Coverage Type

General Liability Coverage

Professional Indemnity Coverage

Cyber Liability Coverage

Product Liability Coverage

General liability coverage holds the largest market share, accounting for over 38% of total revenue in 2023, as it protects organizations from claims resulting from AI-related damages or errors. Professional indemnity and cyber liability segments are also witnessing strong growth due to increasing AI system integration and digitalization.

By Industry Application

Healthcare and Life Sciences

Automotive and Transportation

Finance and Banking

Manufacturing and Industrial

Retail and E-commerce

IT and Technology

Healthcare and automotive sectors are key contributors, driven by AI adoption in clinical diagnostics, autonomous vehicles, and safety-critical applications. Finance and banking sectors are also investing in AI liability insurance to mitigate risks associated with algorithmic trading, credit scoring, and fraud detection.

By Organization Size

Small and Medium Enterprises (SMEs)

Large Enterprises

Large enterprises dominate the market, accounting for approximately 55% of total revenue, due to extensive AI deployments and higher exposure to legal liabilities. SMEs are gradually adopting AI liability insurance as AI solutions become more accessible and regulatory scrutiny increases.

Read Full Research Study: https://marketintelo.com/report/ai-liability-insurance-market

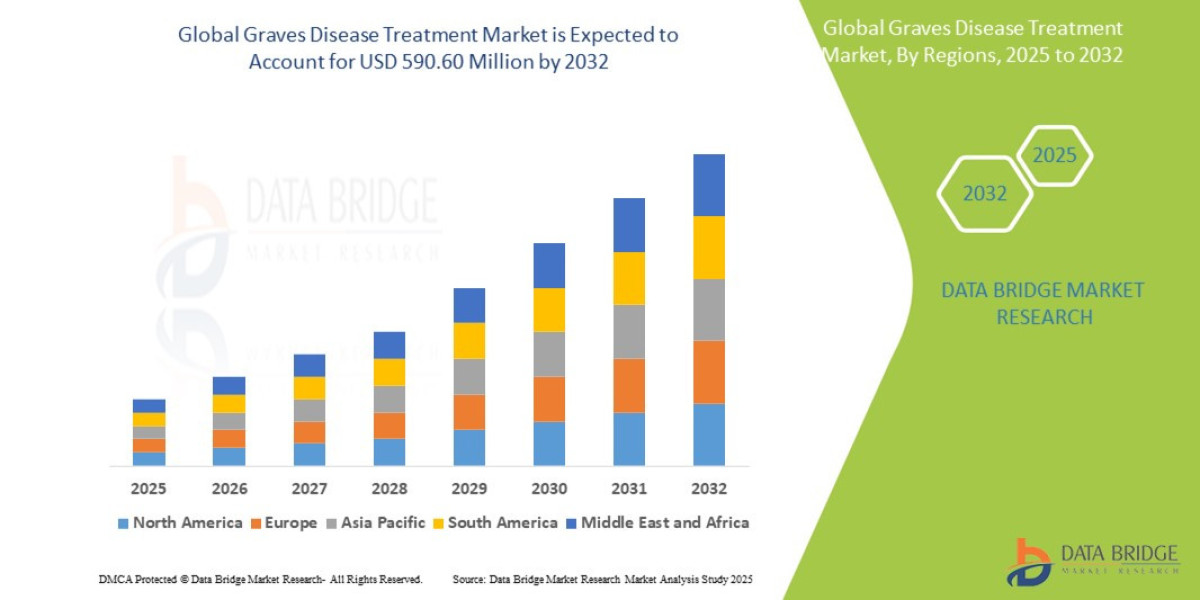

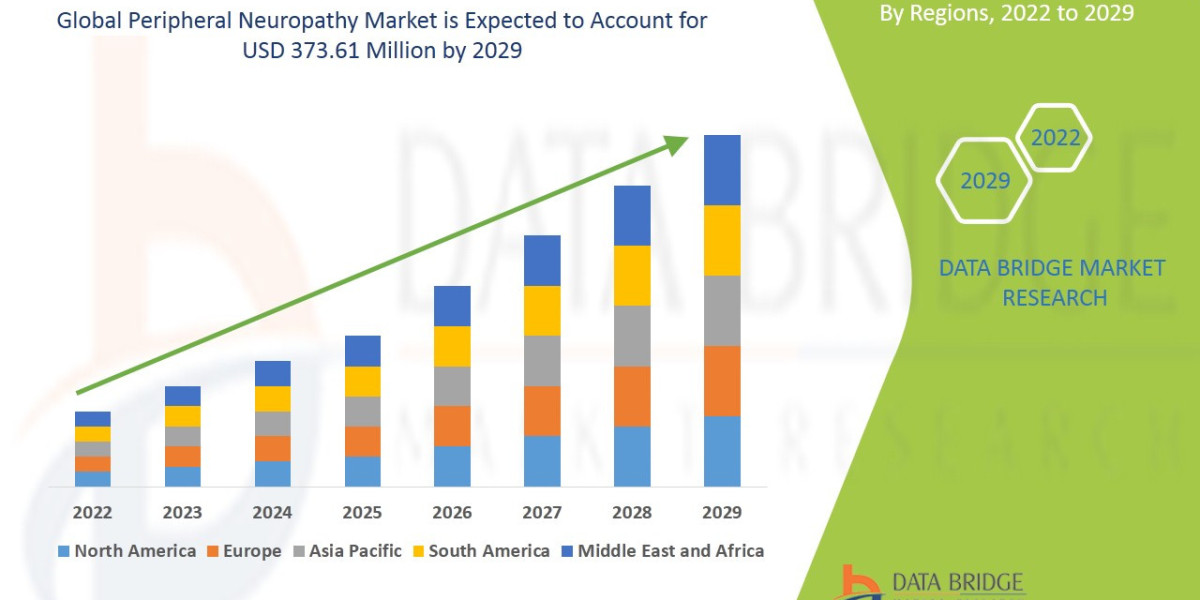

Regional Insights

North America

North America holds the largest market share, contributing over 40% of total revenue in 2023. The region benefits from early AI adoption, robust regulatory frameworks, and a strong presence of technology companies. The U.S. leads in AI liability insurance demand due to extensive use of AI in healthcare, finance, and autonomous vehicles.

Europe

Europe represents a significant market, driven by AI regulations such as the EU AI Act and growing awareness of ethical AI use. Countries including Germany, the U.K., and France are adopting AI liability insurance to safeguard businesses and ensure compliance with emerging legal standards.

Asia Pacific

Asia Pacific is projected to witness the fastest CAGR of 11.6% during 2024–2032, driven by rapid AI adoption in China, Japan, India, and Southeast Asia. Government initiatives, digital transformation programs, and investment in AI startups are boosting the demand for liability coverage.

Latin America and Middle East & Africa

Emerging markets in Latin America and the Middle East & Africa are gradually adopting AI liability insurance due to increasing AI investments, technology-driven industries, and growing awareness of potential risks. Insurers are introducing region-specific products tailored to local business needs.

Market Drivers and Challenges

Key Drivers

Rapid AI Adoption: Increased deployment of AI systems across multiple sectors.

Regulatory Compliance: Rising legal scrutiny and ethical concerns in AI usage.

Risk Mitigation: Need to safeguard organizations from financial, reputational, and operational risks.

Major Challenges

Complexity of AI Systems: Difficulty in assessing risks due to algorithmic complexity and opacity.

High Premium Costs: Small and medium enterprises may find policies expensive.

Evolving Legal Landscape: Uncertainty in liability frameworks for AI-generated decisions.

Competitive Landscape

The global AI liability insurance market is moderately competitive, with insurers focusing on product innovation, risk modeling, and digital platforms. Key market players include:

Allianz SE

AXA SA

Chubb Limited

Zurich Insurance Group

Lloyd’s of London

AIG Insurance

Generali Group

Tokio Marine & Nichido

Berkshire Hathaway Specialty Insurance

Munich Re

These companies are investing in AI-based underwriting, predictive analytics, and partnerships with technology firms to expand market penetration. Customizable coverage, flexible policies, and digital claim platforms are key differentiators in this evolving market.

Future Outlook

The AI liability insurance market is poised for rapid growth as AI adoption expands and organizations seek robust risk management solutions. Emerging technologies such as AI-powered claims assessment, blockchain for accountability, and IoT-based monitoring will enhance policy accuracy and reduce exposure.

By 2032, insurers are expected to offer highly tailored, scalable policies for large enterprises and SMEs alike. Increasing focus on ethical AI, transparency, and compliance will further drive demand globally.

Conclusion

The AI Liability Insurance Market is set for substantial growth over the next decade, driven by widespread AI adoption, regulatory oversight, and increasing risk awareness. Comprehensive insurance solutions will remain crucial for organizations seeking to safeguard AI-driven operations, manage liabilities, and ensure business continuity across industries.

Related Report