Executive Summary

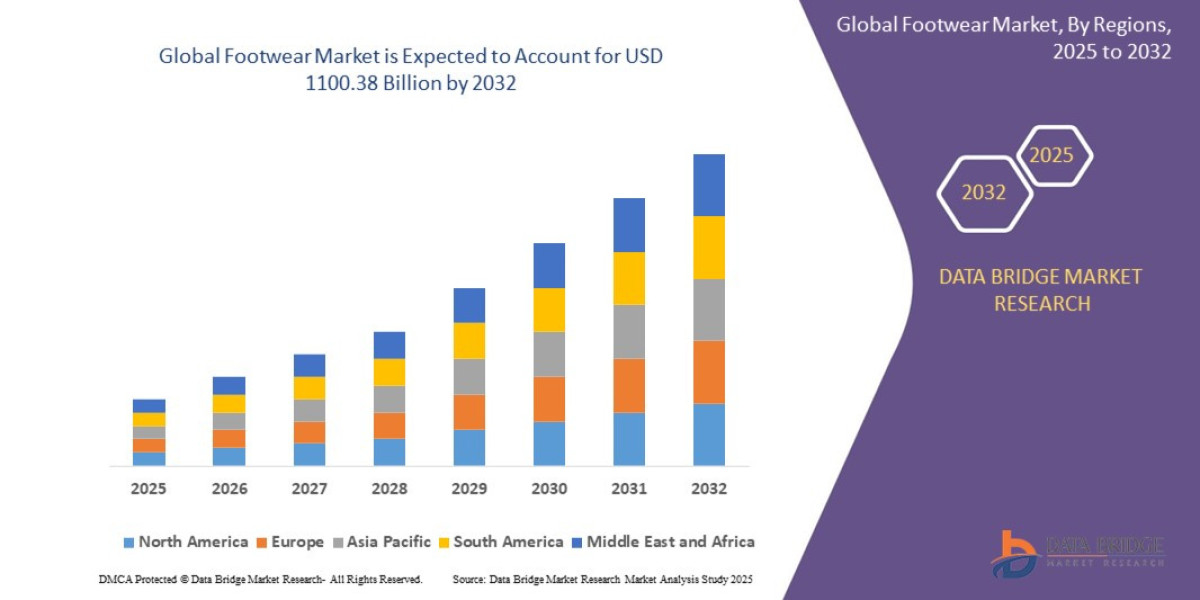

- The global footwear market size was valued at USD 700.90 billion in 2024 and is expected to reach USD 1100.38 billion by 2032, at a CAGR of 5.80% during the forecast period

Market Overview

The footwear market encompasses the design, manufacture, distribution, and sale of all types of footwear, segmented broadly into Athletic and Non-Athletic (Casual, Formal, Specialty) categories. This definition covers everything from high-performance running shoes and basketball sneakers to fashion boots, luxury leather goods, and utilitarian work wear.

Key Market Segments and Dynamics

Product Type:

Non-Athletic: Dominates revenue share (historically over 55%) due to sheer volume and diverse usage (lifestyle, formal, work). Casual sneakers, slip-ons, and sandals lead this segment, benefiting from the blurring lines between work, life, and leisure attire.

Athletic: Exhibits the highest growth CAGR, driven by innovation in performance gear (running, training, outdoor) and the global mainstream adoption of athleisure.

End User: While the men's segment traditionally holds the largest market value, the women's and kids' segments are projected to record the fastest growth, particularly in developing economies where purchasing power parity is increasing.

Distribution Channel: The ecosystem is a hybrid model, with Specialty Stores and branded D2C (Direct-to-Consumer) physical locations remaining crucial for "fit and feel" assurance, while Online Retail Stores are growing at the fastest rate, leveraging convenience and AR-driven try-on technologies.

Core Market Drivers

The primary drivers of this market include the global rise in health and fitness awareness, translating directly into demand for specialized athletic and comfortable athleisure products. Concurrently, increasing disposable incomes in emerging markets, coupled with the rapid influence of social media and celebrity endorsements, accelerate demand for frequent replacement and style-conscious purchases. Furthermore, the imperative for brands to meet rigorous ESG (Environmental, Social, and Governance) demands is forcing innovative product development, creating new market opportunities centered on premium, sustainable offerings.

Market Size & Forecast

- The global footwear market size was valued at USD 700.90 billion in 2024 and is expected to reach USD 1100.38 billion by 2032, at a CAGR of 5.80% during the forecast period

For More Information Visit https://www.databridgemarketresearch.com/reports/global-footwear-market

Key Trends & Innovations

Innovation in the footwear industry is currently focused on two primary pillars: Digital Customization and Radical Sustainability.

1. The Sustainability Imperative

Sustainability has transitioned from a niche concern to a core consumer demand, driven primarily by Millennial and Gen Z buying power. Brands are addressing this through:

Circular Materials: Extensive research and use of non-virgin inputs, including recycled ocean plastics (e.g., Adidas x Parley), recycled rubber, and innovative bio-based materials like mushroom leather (mycelium) and pineapple leaf fibers.

Design for Disassembly: Creating shoes that can be easily broken down into their base components for recycling, directly addressing the end-of-life challenge for complex multi-material footwear.

Traceability: Implementation of digital product IDs and blockchain-based tools to provide consumers with full transparency regarding sourcing, manufacturing conditions, and carbon footprint. This is increasingly mandated by new EU legislation focusing on textiles and circularity.

2. Advanced Manufacturing and Digital Experience

Technological integration is reshaping both the factory floor and the customer journey:

3D Printing (Additive Manufacturing): Utilized beyond simple prototyping, 3D printing is now used for direct production of midsoles and personalized components. This reduces material waste and enables custom-fit footwear tailored to an individual’s gait or foot anatomy, particularly in the high-performance running and orthopedic segments.

Smart Footwear: The integration of sensors, GPS, and Bluetooth into shoes to monitor steps, gait, posture, and even detect diabetic foot complications. While nascent, the smart shoe market is projected for significant growth as the intersection of health-tech and apparel matures.

Augmented Reality (AR): Virtual try-on features via mobile apps are boosting e-commerce conversion rates and simultaneously reducing product returns, addressing a major logistical and environmental pain point in online retail.

Competitive Landscape

The global footwear market features a tiered competitive structure, dominated by global athletic powerhouses at the premium and mass-market levels, alongside a rapidly growing ecosystem of agile D2C and specialty brands.

Major Global Players and Market Strategies

The market leadership is concentrated among a few conglomerates, with Nike Inc. and Adidas AG maintaining significant market share, especially in the highly profitable athletic segment. Other dominant global players include Puma SE, Skechers USA, Inc., VF Corporation (owners of Timberland, Vans, etc.), and specialized comfort brands like Crocs, Inc. and ECCO Sko A/S.

Competitive strategies revolve around four key pillars:

D2C and Digitalization: Brands are aggressively shifting sales channels to proprietary e-commerce platforms and physical brand houses to control the customer experience, gather proprietary data, and maximize profit margins by bypassing traditional retail markups.

Influencer and Collaboration Economy: High-impact, limited-edition collaborations (with designers, athletes, or cultural icons) drive brand heat, create scarcity, and justify premium pricing, particularly targeting the digitally native Gen Z and sneakerhead cultures.

Performance Technology: Continuous R&D into proprietary cushioning systems (e.g., Nike Air, Adidas Boost) and lightweight, durable materials is crucial to maintaining dominance in the highly competitive performance athletic sub-segment.

Supply Chain Agility: Following geopolitical and trade instability, leading players are implementing diversification strategies, reducing reliance on single manufacturing geographies (e.g., China) and exploring nearshoring or advanced automated facilities to shorten lead times and improve responsiveness to shifting trends.

Regional Insights

Market growth is highly geographically asymmetrical, with Asia-Pacific serving as the engine for volume and value expansion.

Asia-Pacific (APAC)

APAC is the undisputed growth leader, holding the largest market share and demonstrating the fastest CAGR globally. This is primarily driven by:

Demographic Dividend: A massive, young, and increasingly affluent population base, particularly in China, India, and Southeast Asian nations.

Urbanization and D-commerce: Rapid urbanization exposes new consumer segments to global fashion and lifestyle trends, while the explosive growth of local e-commerce and digital wallets dramatically improves product accessibility.

Manufacturing Shift: Countries like India and Vietnam are becoming increasingly important as global manufacturing hubs, benefiting from government policies (e.g., India's PLI scheme) and lower operational costs, positioning them as critical nodes in the global supply chain.

North America and Europe

These regions represent mature markets characterized by high Average Selling Prices (ASP) and a strong focus on premiumization and brand loyalty. Key dynamics include:

Premium and Athleisure Dominance: Strong demand for high-end athletic, comfort, and lifestyle sneakers continues to define these markets.

Regulatory Pressure: European markets are at the forefront of implementing stringent sustainability and ethical sourcing regulations, forcing brands to overhaul their material sourcing and production transparency.

Challenges & Risks

Despite the positive forecast, the market faces several structural and operational risks that can impede growth and profitability.

1. Supply Chain Volatility and Raw Material Costs

The industry remains dependent on complex global supply chains, making it highly susceptible to geopolitical instability, trade tariffs, and localized logistical disruptions. Volatility in the price of key raw materials—from petroleum-based synthetics and natural rubber to the rising cost and restricted supply of high-grade leather—significantly pressures profit margins.

2. Counterfeit Products and IP Infringement

The proliferation of sophisticated counterfeit products, particularly through online marketplaces and social media channels, poses a severe risk to brand equity and consumer trust. Combating intellectual property (IP) infringement requires continuous investment in digital monitoring and legal action, raising operational costs.

3. Regulatory and ESG Compliance Costs

Meeting increasingly complex environmental, social, and labor standards worldwide (especially in the EU and US) demands substantial investment in sustainable production methods, supply chain auditing, and transparent reporting. Failure to comply or evidence "greenwashing" can lead to severe reputational and financial penalties.

Opportunities & Strategic Recommendations

For investors, manufacturers, and innovative startups, the current market dynamic offers several high-value avenues for strategic entry and growth.

1. Hyper-Focus on Circularity and Material Science

Recommendation: Invest heavily in R&D partnerships focused on scalable, regenerative, and biodegradable materials (e.g., bio-synthetics, fully recyclable polymers). The future premium segment will be defined not just by brand, but by verifiable carbon neutrality and ethical sourcing. Startups should aim to develop drop-in alternatives for common shoe components (midsoles, outsoles, uppers) that simplify the recycling process for large manufacturers.

2. Embrace Data-Driven Personalization and D2C

Recommendation: Accelerate the shift to D2C channels and leverage digital engagement tools. Use AI and 3D foot scanning technology to move beyond standard sizing and offer true custom-fit products. This enhances customer satisfaction, minimizes costly returns, and provides invaluable first-party data for inventory optimization and demand forecasting. Digital-native brands can gain a quick competitive edge by utilizing personalization as a core, rather than peripheral, offering.

3. Regional Diversification and Nearshoring

Recommendation: Manufacturers should execute a phased diversification of their production footprint across Asia-Pacific (e.g., Vietnam, India, Indonesia) and explore modular, automated production closer to key consumption markets (nearshoring to Central America/Mexico for the US, or Eastern Europe for the EU). This strategy mitigates single-region risk and reduces carbon emissions and lead times, offering a crucial competitive advantage in fast-moving fashion cycles.

4. Wellness and Specialized Utility Footwear

Recommendation: Target underserved utility niches, moving beyond mainstream running and training. Focus on specialized segments like orthopedic/comfort footwear for aging populations, purpose-built occupational safety shoes, and premium outdoor/trekking gear. The intersection of technology and utility (e.g., smart shoes for gait analysis or specialized medical conditions) presents a high-margin, defensive growth opportunity shielded from volatile fashion trends.

Browse More Reports:

Global Ring Pull Caps Market

Middle East and Africa Fuse Market

Global Automotive Cluster Market

Global Aerospace and Defense C Class Parts Market

Global Ostomy Devices Market

Global Disconnector Market

Middle East and Africa Rice Husk Ash Market

Europe Retail Analytics Market

Global D-Malic Acid Market

Global Hereditary Breast and Ovarian Cancer Syndrome Treatment Market

Global High Intensity Discharge (HID) Light Market

Global Visual Electrophysiology Testing Devices Market

Global Next-Generation Sequencing (NGS) Services Market

Global Spark Plug Market

Global Agriculture Biological Control Agents Market

Europe Fuse Market

Global Abatacept Market

Global Whole Genome Bisulfite Sequencing (WGBS) Market

Global Cervical Intraepithelial Neoplasia Drugs Market

Global Facial Tissue Paper Market

Global Wrist Replacement Orthopedic Devices Market

Global Frozen Ready Meals Market

Global Medical Device Interface Market

Global Mass Notification Systems Market

Global Chondrodermatitis Nodularis Helicis Market

Global Indium Market

Global Winged Bean Seeds Market

Global Porcine Vaccines Market

Global Metal Trauma Implants Market

Global Maple Syrup Urine Disease Treatment Market

Global Performance Analytics Market

Middle East and Africa Panel Mount Industrial Display Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com