Executive Summary

Global rotomolding market size was valued at USD 1.90 billion in 2024 and is projected to reach USD 3.03 billion by 2032, growing with a CAGR of 6.1% during the forecast period of 2025 to 2032.

Market Overview

The rotomolding market encompasses the machinery, materials (compounds), and services involved in the rotational molding process. This technique involves placing a polymer in a mold, which is then heated and rotated bi-axially, causing the molten plastic to coat the inner surface uniformly. The final product is a hollow, stress-free part with consistent wall thickness, making it ideal for large containers, tanks, and intricate assemblies.

Key Segments

Material Type: Linear Low-Density Polyethylene (LLDPE) is the dominant material, accounting for nearly 80% of consumption due due to its superior impact resistance, chemical stability, and cost-effectiveness. Other materials include High-Density Polyethylene (HDPE), Polypropylene (PP), Nylon, and Polyvinyl Chloride (PVC), often cross-linked (XLPE) for enhanced performance in high-stress applications like chemical storage.

Application: The largest application segment is Storage Tanks (water, chemical, septic), holding the majority market share (over 38%), driven by residential, agricultural, and industrial infrastructure needs. Other key areas include Automotive Components (fuel tanks, interior parts), Consumer Goods (furniture, toys, decorative items), and Recreational Equipment (kayaks, canoes).

End-Use Industry: The Construction and Infrastructure sector is the primary consumer, utilizing rotomolding for large-volume water storage and road safety barriers. The Automotive & Transportation sector is rapidly increasing adoption, particularly in electric vehicles (EVs) for producing lightweight, structural components that improve energy efficiency and reduce carbon footprint.

Core Market Drivers

Demand for Lightweight Solutions: Across automotive and transportation industries, the need to reduce vehicle weight for fuel efficiency and electrification strongly favors rotomolded plastic over traditional metals.

Design Flexibility and Low Tooling Cost: Rotomolding allows for the creation of complex shapes, double-walled parts, and unique surface textures without the high pressure and expensive tooling associated with injection molding, making custom fabrication economical.

Infrastructure Investment: Significant government spending on water management, urban development, and agricultural modernization in emerging economies drives demand for durable polyethylene tanks and containers.

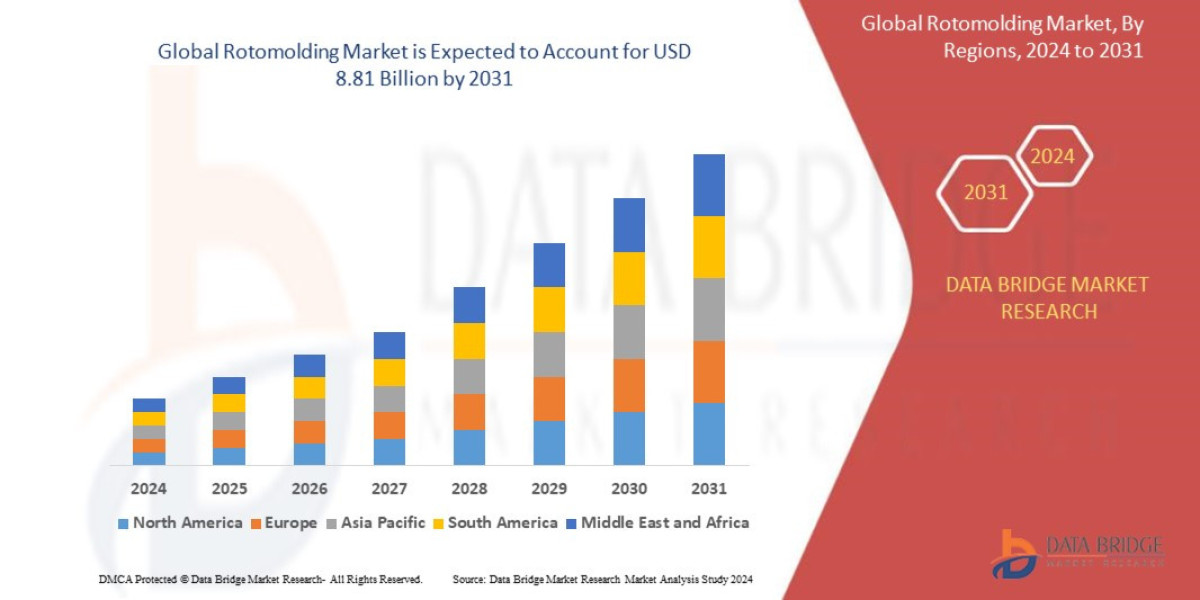

Market Size & Forecast

Global rotomolding market size was valued at USD 1.90 billion in 2024 and is projected to reach USD 3.03 billion by 2032, growing with a CAGR of 6.1% during the forecast period of 2025 to 2032.

For More Information Visit https://www.databridgemarketresearch.com/reports/global-rotomolding-market

Key Trends & Innovations

The future trajectory of the rotomolding market is being shaped by two overarching themes: technological integration and radical sustainability shifts.

1. Integration of Industry 4.0 and Automation

Manufacturers are moving away from manual, labor-intensive processes toward smart manufacturing.

Advanced Machine Automation: The adoption of robotic arms for tasks such as mold loading, part removal, and post-molding finishing is improving operational consistency and reducing cycle times. Automated shuttle, carousel, and vertical wheel machines are being integrated with networked control systems.

Process Digitization and Smart Controls: Advanced sensors and digital monitoring are now crucial components. These systems track internal mold temperature, air temperature, and polymer melting behavior in real-time, allowing for closed-loop control. This precision minimizes energy waste, ensures uniform wall thickness, and significantly reduces the scrap rate, overcoming the historical challenge of long, inconsistent cycle times.

2. Focus on Sustainable and Advanced Materials

Environmental pressures and regulatory changes are accelerating the development of specialized polymer compounds.

Recycled and Bio-Based Plastics: There is a significant commercial push towards utilizing post-consumer and post-industrial recycled Polyethylene (r-PE) in rotomolding. While virgin materials currently dominate for quality reasons, innovation in compounding additives is improving the mechanical properties of recycled content, making it viable for less structurally critical components. Bio-based plastics are also emerging, aligning the market with global circular economy goals.

Performance Enhancement: Innovation is centered on improving the end-use capabilities of rotomolded parts. This includes the development of:

Reinforced Compounds: Using structural reinforcements (like fibers or fillers) integrated into the polymer to significantly boost the stiffness, impact resistance, and load-bearing capacity of the final product, enabling rotomolding's use in demanding engineering applications.

Anti-Microbial and UV-Resistant Formulations: Essential for applications in the medical sector (containers, devices) and outdoor recreational equipment, these specialized materials extend product lifespan and enhance hygiene.

3. Customized and Complex Design

The versatility of rotomolding is being leveraged to produce increasingly complex, customized parts, including multi-layer products. Techniques like "drop-box" molding allow manufacturers to create items with varying wall thicknesses, internal threads, or foamed centers for insulation (e.g., in industrial coolers and insulated containers), expanding its competitive edge against blow molding and injection molding in specialized markets.

Competitive Landscape

The rotomolding market is characterized by a fragmented structure, comprising large multinational chemical companies that supply the core resins, specialized machinery manufacturers, and thousands of regional rotomolders that serve specific end-user industries.

Key Market Players

Leading players span the entire value chain:

Material Suppliers (Compounds): Major resin producers (e.g., suppliers of LLDPE, HDPE powder) who often drive material innovation.

Machinery Manufacturers: Companies like Rotoline, Ferry Industries, and others specializing in producing advanced carousel, shuttle, and rock & roll molding machines.

Rotomolders/Converters: End-product manufacturers focused on specific verticals. Notable examples include Rotoplas S.A. (a dominant player, especially in water storage in Latin America), Myers Industries Inc., Centro Incorporated, and Den Hartog Industries Inc. Strategic mergers and acquisitions (M&A) are common, exemplified by large holding companies like Tank Holding Corp. acquiring regional molders (e.g., Dutchland Plastics LLC) to consolidate market share and expand proprietary product lines.

Competitive Strategies

Vertical Integration and Consolidation: Large molders are acquiring smaller, niche players to expand their geographic footprint, diversify their product portfolio (e.g., moving from agricultural to medical products), and leverage economies of scale in raw material purchasing.

R&D in Materials: Competition is fierce in developing specialized compounds. Companies are investing heavily in polymers that offer better thermal stability, shorter cure times, and superior final-part properties (e.g., enhanced stress-crack resistance).

Efficiency via Technology: Implementing automated handling systems and IoT-enabled quality control is a crucial competitive strategy. Molders who can reliably reduce cycle times and consistently deliver high-quality products without defects gain a significant edge over traditional, less automated operations.

Regional Insights

Market performance is strongly correlated with regional infrastructure and industrial output, showcasing a global shift toward Asia-Pacific dominance.

Asia-Pacific (APAC): The Growth Nexus

APAC is the fastest-growing and largest regional market, projected to account for over 50% of the global market share by 2035.

Drivers: Rapid urbanization, massive infrastructure development (water management, sanitation), a booming automotive sector (especially EV production in China), and rising disposable incomes driving demand for consumer and recreational goods.

Key Markets: China, India, and Southeast Asian nations are the primary contributors. In India, for instance, the scarcity of water combined with high residential and commercial construction rates drives exponential demand for large polyethylene water tanks.

North America (NA): Technology and High Value

North America, particularly the United States, holds a significant market share and is defined by high-value, niche applications and technological adoption.

Drivers: A mature manufacturing base, early adoption of high-performance engineered plastics, and strong demand from the materials handling (pallets, containers), medical, and advanced defense sectors. NA is a leader in adopting automation and implementing complex, customized rotomolded parts.

Europe: Sustainability and Regulations

Europe is a key market driven by stringent environmental regulations and a focus on circular economy initiatives.

Drivers: The automotive and industrial sectors in countries like Germany and the UK heavily utilize rotomolded parts. The region is a leader in incorporating recycled and bio-based plastics into production, often setting the global standard for sustainable manufacturing practices in the industry.

Challenges & Risks

While the market trajectory is positive, stakeholders must navigate several persistent challenges.

Raw Material Price Volatility: The primary materials (Polyethylene and Polypropylene) are petrochemical derivatives, leaving manufacturers highly susceptible to the volatility of global crude oil and natural gas prices. Unpredictable input costs severely compress profit margins, especially for regional molders with less pricing power.

Competition from Alternative Molding Techniques: Rotomolding faces intense competition from established, high-volume methods like injection molding and blow molding. For standard, mass-produced items or parts requiring extremely tight tolerances, these competing processes often offer lower per-unit costs and faster cycle times, limiting rotomolding's competitive advantage to large, complex, or low-volume custom products.

Environmental and Disposal Concerns: Despite the process itself being relatively low-waste, the final product is often a large, durable plastic item, contributing to overall plastic waste concerns. Increasing public scrutiny and stringent government regulations regarding plastic disposal, recycling, and the use of virgin polymers pose a long-term risk to market growth if sustainability innovations cannot keep pace.

High Cycle Time: Compared to injection molding (cycles measured in seconds), rotomolding cycles (measured in minutes or hours) remain inherently slow due to the nature of heating and cooling a massive mold and polymer mass, presenting an operational bottleneck.

Opportunities & Strategic Recommendations

For stakeholders across the value chain—from investors to manufacturers and raw material suppliers—the market presents clear pathways for strategic growth and risk mitigation.

1. Focus on Performance Polymers and Material Science

Recommendation: Manufacturers should aggressively invest in R&D partnerships with chemical suppliers to commercialize high-performance, non-PE polymers (Nylon, PC, PP) and multi-layer composites.

Actionable Insight: The greatest opportunity lies in moving beyond basic LLDPE tanks to niche, high-margin applications requiring superior chemical, fire, or thermal resistance (e.g., aerospace components, medical clean-room equipment, specialized agricultural silos). This diversifies revenue streams away from commoditized construction segments.

2. Embrace Digitization for Operational Excellence

Recommendation: Capital expenditure should prioritize automation and process control systems over expanding conventional molding lines.

Actionable Insight: Integrating robotic mold handling and smart sensors is necessary to reduce the long cycle time disadvantage. Digitally optimized production facilities can yield a 15-20% reduction in cycle time and waste, offering a critical competitive edge and improving margin stability against raw material fluctuations.

3. Target High-Growth Niche Applications

Recommendation: Shift focus from low-margin consumer goods to specific industrial sectors where rotomolding's advantages are non-negotiable.

Actionable Insight: Key targets include the EV battery enclosure market (for customized, electrically insulated, impact-resistant casings), complex HVAC ducting systems, and the water treatment/purification infrastructure segment in APAC and Africa. These markets prioritize rotomolding's seamlessness and superior structural integrity.

4. Strategic Geographic Expansion and M&A

Recommendation: Investors and large molders should target acquisitions of established, well-run regional firms in high-growth APAC markets.

Actionable Insight: Acquiring local manufacturing and distribution capabilities in China and India is the most effective way to capture the massive demand for infrastructure and automotive components fueled by regional industrial policy and development funds. This strategy ensures proximity to the fastest-growing end-user base.

Browse More Reports:

Global Algae Fertilizers Market

Global Construction Film Market

Global Antimicrobial Agent Market

Global Benchtop Laboratory Water Purifier Market

Asia-Pacific Feed Flavours and Sweeteners Market

Global Catenary Infrastructure Market

Global Bus Public Transport Market

Latin America Point of Care Infectious Disease Market

Global Innovation Management Market

Middle East and Africa Indium Market

Global Antibiotics Market

Global Potassium Humate Biostimulants Market

Africa MDI, TDI, Polyurethane Market

Global Dental Diode Lasers Market

Middle East and Africa Artificial Turf Market

Global Hematologic Malignancies Market

Latin America Ostomy Devices Market

Asia-Pacific Rotomolding Market

Philippines Microgrid Market

Global Automated Beverage Carton Packaging Machinery Market

Global Surgical Power Tools Market

Europe Intensive Care Unit (ICU) Ventilators Market

Global Vasodilators Market

Global Methylene Diphenyl Diisocyanate (MDI), Toluene Diisocyanate (TDI) and Polyurethane Market

Global Constrictive Pericarditis Market

Middle East and Africa q-PCR Reagents Market

Global Artificial Turf Market

Global Styrene Butadiene Latex Market

Global Digital Farming Software Market

Global Alpha Linolenic Acid Market

Global Head and Neck Cancer Drug MarketGlobal Bannayan Riley Ruvalcaba Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com