Executive Summary

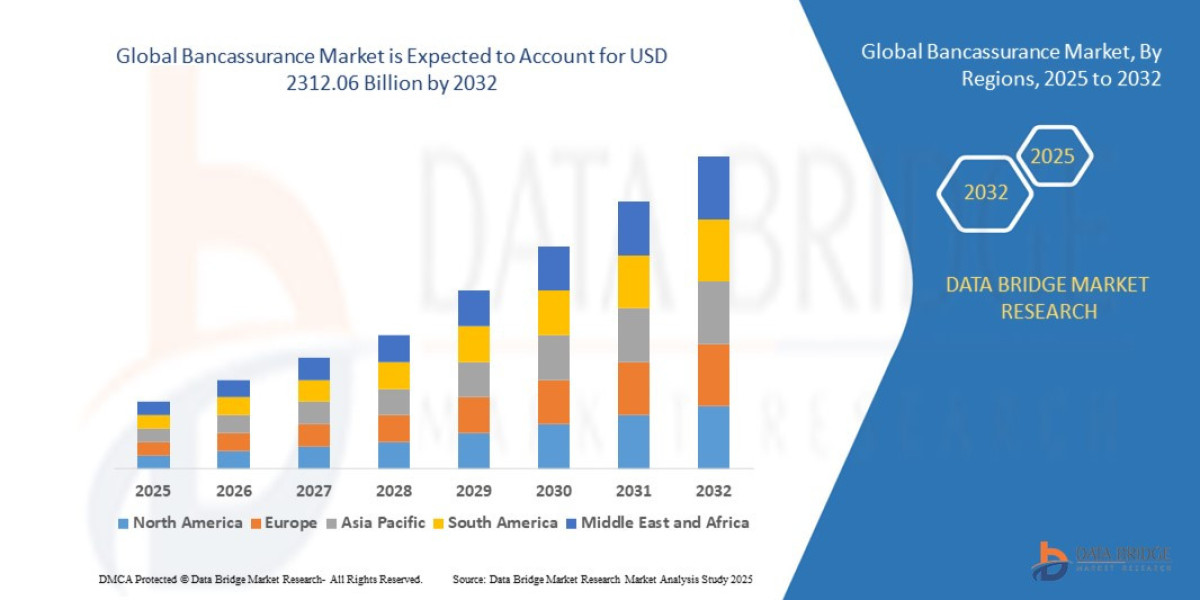

- The global bancassurance market size was valued at USD 1506.54 billion in 2024 and is expected to reach USD 2312.06 billion by 2032, at a CAGR of 5.50% during the forecast period

Market Overview

Bancassurance is an arrangement in which a bank and an insurance company form a partnership, allowing the insurer to sell its products to the bank's client base. This symbiotic relationship provides banks with valuable fee income and cross-selling opportunities, while giving insurers efficient, low-cost access to an established and trusted customer distribution channel.

Key Segmentation

The market is commonly analyzed across three critical dimensions:

By Product Type:

Life Insurance: Dominant segment (holding over 60% of the revenue share), encompassing annuities, endowment plans, unit-linked insurance plans ($\text{ULIP}$s), and term life policies. Its stability is driven by rising retirement and savings planning needs globally.

Non-Life Insurance: The fastest-growing segment, including general insurance products such as health, motor, property, travel, and casualty insurance. Growth is propelled by increased regulatory mandates (e.g., motor insurance) and rising health awareness.

By Model Type: The structure of the partnership dictates its success:

Pure Distributor: The bank simply distributes the insurer’s products for a commission, requiring minimal internal investment. This model is often favored for its cost-effectiveness and scalability.

Strategic Alliance/Exclusive Partnership: A deeper, long-term relationship where the bank commits to one insurer, often involving shared branding and technology.

Joint Venture/Financial Holding: The highest level of integration, where the bank and insurer jointly own the entity or the bank acquires the insurer. This provides full control over product manufacturing and distribution.

By Customer Type:

Individual: The largest consumer base, driven by retail cross-selling of mortgages and consumer loans bundled with protection products.

Corporate: The fastest-growing segment, focusing on group insurance policies, employee benefits schemes, and risk management solutions bundled with business banking services.

Market Drivers and Current Dynamics

The bancassurance market's current momentum is sustained by several powerful drivers:

Customer Trust and Convenience: Banks are inherently trusted financial custodians. Selling insurance through a familiar, single platform offers consumers unmatched convenience and a single point of contact for financial needs, significantly boosting sales conversion rates.

Digital Transformation and Distribution: The widespread adoption of digital banking channels has revolutionized bancassurance. Banks are embedding insurance products directly into mobile applications and online portals, offering seamless, contextual, and event-driven purchasing experiences (e.g., offering travel insurance immediately after a flight booking through a banking app).

Demographic Tailwinds: In mature economies like Europe, an aging population increases the demand for pension, life, and long-term savings products. Conversely, in APAC, a rapidly expanding, financially literate middle class with increasing disposable income creates a massive, untapped market for entry-level protection products.

Revenue Diversification: For banks, bancassurance provides a capital-light source of fee income, reducing reliance on traditional interest-based lending and improving Return on Equity (ROE). For insurers, it dramatically lowers customer acquisition costs compared to traditional agency models.

Market Size & Forecast

- The global bancassurance market size was valued at USD 1506.54 billion in 2024 and is expected to reach USD 2312.06 billion by 2032, at a CAGR of 5.50% during the forecast period

For More Information Visit https://www.databridgemarketresearch.com/reports/global-bancassurance-market

Key Trends & Innovations

Innovation in bancassurance is intrinsically linked to the financial technology (FinTech) revolution, pivoting the model from mere cross-selling to truly integrated financial advice.

1. The Rise of Embedded Insurance

Embedded insurance is the most significant technological trend, involving the programmatic integration of insurance offers directly into the customer journey, typically within a bank's digital interface. This moves insurance from a discrete purchase decision to a contextual recommendation. For example, a customer applying for a car loan automatically receives an API-driven quote for comprehensive motor insurance. This not only improves customer experience by offering instant, relevant protection but also drives higher attachment rates and significantly lowers customer acquisition costs (CAC) for the insurer.

2. AI and Predictive Analytics

Bancassurers are increasingly leveraging Artificial Intelligence (AI) and machine learning for propensity modeling. Banks hold unique transaction, savings, and loan data that, when combined with AI-driven analytics, can accurately predict a customer's need for a specific insurance product before they even express interest. This enables highly targeted marketing and personalized product design, moving away from generic, mass-market offerings to tailor-made solutions.

3. Protection-Led Product Shifts

There is a global structural shift in demand from savings-led insurance products (which are often sensitive to interest rate fluctuations) to protection-led products, such as term life, critical illness, and pure health coverage. This trend is driven by post-pandemic awareness of health and income security, offering both banks and insurers higher margin potential and more resilient long-term revenue streams.

4. Hybrid Distribution Models

While digital adoption is soaring, especially for simple, high-frequency products, complex products (like sophisticated retirement planning or annuities) still require face-to-face or video advisory services. The most successful modern bancassurance strategies employ a hybrid distribution model, where digital channels handle lead generation and simple transactions, while trained human advisors manage complex needs, ensuring both efficiency and compliance with suitability rules.

Competitive Landscape

The competitive environment in bancassurance is characterized by strong strategic alliances, high barrier-to-entry for full-stack integration, and the increasing convergence of traditional players with FinTech.

Major Players and Strategic Activity

Global leadership in bancassurance is typically held by large financial groups with fully integrated business models or robust exclusive partnerships. Key players include:

Integrated Giants: AXA, Allianz, BNP Paribas Cardif, Zurich Insurance Group, and Assicurazioni Generali S.p.A. These entities often own or have deep financial holdings in their distribution partners, allowing for full control over the value chain.

Bank-Led Distributors: Large banks like Banco Santander and HSBC leverage their massive customer bases and brand strength to cross-sell insurance, forming strategic alliances with manufacturing partners.

Competitive Strategies

The primary competitive edge is achieved through:

Deep Operational Integration: Success hinges on the seamless connection of IT systems (core banking, CRM, and insurer policy administration systems) to ensure data synchronization and a consistent customer experience.

Product Alignment: Insurers must co-manufacture products that align perfectly with the bank’s core offerings—for example, a mortgage protection policy that can be approved instantly alongside the mortgage application.

M&A Activity: Strategic mergers and acquisitions remain crucial, allowing banking groups to acquire insurance manufacturing capabilities or insurers to secure exclusive long-term distribution rights with major regional banks. This ongoing consolidation contributes to market valuation and strengthens existing partnerships.

Regional Insights

Bancassurance adoption and maturity vary dramatically across the globe, reflecting diverse regulatory frameworks and economic conditions.

Asia Pacific (APAC) — The Growth Engine

APAC is the undisputed growth leader, projected to register the fastest CAGR (upwards of 12%) during the forecast period. This acceleration is fueled by:

Massive Under-Penetration: Compared to North America and Europe, insurance penetration is low, creating a vast, untapped market.

Rising Middle Class: Rapid urbanization and increasing disposable incomes, particularly in China, India, and Southeast Asian nations, drive demand for basic protection and investment products.

Favorable Regulations: Governments in markets like India and China are actively promoting bancassurance to boost financial inclusion, providing a conducive regulatory environment for expansion.

North America — The Digital Dominator

North America held the largest revenue share (over 42% in 2024), supported by high insurance penetration and widespread digital banking adoption. The market here is characterized by:

Sophistication: Focus on advanced wealth management products, annuities, and complex life insurance.

Digital Leadership: Strong cross-selling fueled by AI-driven advisory platforms and mobile-first, personalized offerings. The US market, in particular, drives significant volume through its fragmented, yet digitally enabled, regional banking system.

Europe — Maturity and Regulatory Scrutiny

Europe is a mature market, holding the second-largest share, but characterized by highly differentiated regional performance.

Southern Europe (e.g., Italy, Spain, France): Historically strong, driven by exclusive bank-insurer relationships and high life insurance adoption.

DACH Region (e.g., Germany): While large, penetration has been traditionally lower due to a reliance on brokers, though bancassurance is steadily growing.

Regulatory Focus: Regulatory bodies (like EIOPA) are increasing scrutiny over the sale of investment-linked products to protect consumers from mis-selling, demanding higher governance, transparency, and training for banking staff.

Challenges & Risks

While the outlook is positive, stakeholders face significant hurdles that can impede market entry and margin sustainability.

Regulatory Complexity and Compliance: Varying global regulations create a compliance labyrinth. Rules governing data privacy (like GDPR), customer suitability, licensing, and commission structures differ by country, raising the cost and complexity of scaling multi-regional bancassurance operations.

Channel Conflict and Cultural Misalignment: The fundamental conflict arises when a bank's staff, whose primary incentive is banking services, is asked to sell insurance. This can lead to mis-selling, poor customer service, and damage to the bank's reputation—a critical risk in a trust-based model. Aligning the incentives and training bank personnel to provide genuine, needs-based insurance advice remains a major operational challenge.

IT and Data Integration: Legacy core banking systems often struggle to communicate in real-time with modern insurance policy administration systems. Achieving the seamless, "embedded" experience requires significant, non-trivial investment in API layers, data security, and cloud infrastructure.

Competition from Aggregators and InsurTechs: The market faces intense competition from agile direct-to-consumer digital insurers and price comparison aggregators, which pressure margins and make customer acquisition more challenging outside the bank branch ecosystem.

Opportunities & Strategic Recommendations

The bancassurance model remains a potent channel for growth, provided organizations adopt a future-proof, digitally-led strategy.

Strategic Guidance for Stakeholders

Stakeholder Group | Strategic Recommendation | Rationale |

|---|---|---|

Banks | Prioritize Protection-Led Bundling. Pivot sales focus toward high-margin, high-value protection products (life, health, retirement). Embed these offers contextually during loan and mortgage approvals for maximum conversion. | Diversifies revenue away from volatile savings products and leverages bank data assets for relevance. |

Insurers | Invest in API Gateways and Microservices. Develop light, flexible systems capable of instant, real-time integration with multiple banking partners' digital interfaces. | Enables rapid deployment of embedded insurance and lowers operational integration costs. |

Investors | Target APAC Digital Partnerships. Focus investment on strategic alliances in high-growth APAC and MEA markets that combine a large bank's distribution with a modern insurer's digital manufacturing capability. | Capitalizes on the highest projected CAGR driven by demographic and economic factors. |

New Entrants/FinTechs | Develop SME Bundles and Niche Products. Focus on the fast-growing corporate segment by offering bundled risk solutions (cyber, property, liability) integrated directly into business banking dashboards. | $\text{SME}$s are currently underserved, and this niche offers strong recurring revenue opportunities. |

Browse More Reports:

Global Testing, Inspection, and Certification (TIC) Market

Global Probe Card Market

Global Acute Lymphocytic/Lymphoblastic Leukemia (ALL) Diagnostics Market

Global Coconut Syrup Market

Middle East and Africa Biometrics in Government Market

Global Cleaning Service Software Market

Global Energy Efficient Windows Market

Global Complex Fertilizers Market

Global Bleeding Disorders Treatment Market

Global Automotive Torque Actuator Motor Market

Global Predictive Asset Management Manufacturing Analytics Market

North America Artificial Turf Market

Europe Topical Corticosteroids Market

Global Compliance Data Management Market

Global Optical Emission Spectroscopy Market

Australia and New Zealand Healthcare Logistics Market

Global Hand Holes Market

North America Pulses Market

Global Epidermolytic Ichthyosis Market

Global Epithelioid Sarcoma Treatment Market

North America Potato Processing Market

Global Medical Imaging (3D and 4D) Software Market

Global Castleman Disease Drug Market

Global Natural Fertility Supplements Market

North America Rice Husk Ash Market

Global Catalytic Converter Market

Global Grain Processing Equipment Market

Global Cylindrical Lock Market

North America Flotation Reagents Market

Global Pet Water Dispenser Market

Global Underwater Cameras Market

Middle East and Africa Bladder Disorders Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com