Market overview

The purging compound market size was valued at USD 786.15 million in 2024 and is projected to register a CAGR of 5.3% from 2025 to 2034.

The global purging compound market plays a critical but often overlooked role in polymer processing and plastics manufacturing. Purging compounds are specialized cleaning agents used to remove residual polymer, colorants, fillers, and degradation products from extruders, injection molding machines, blow molders, and other melt-processing equipment. Their use reduces downtime, improves color-change efficiency, lowers scrap and rework rates, and extends the useful life of processing equipment. Demand for purging compounds is driven by increasing production complexity (more frequent color/grade changes), higher quality standards in finished goods, and a push for more efficient, sustainable manufacturing practices.

The market serves a diverse set of end-use industries including automotive, packaging, medical devices, consumer goods, electronics, and commodities such as pipes and profiles. Purging solutions vary from polymer-based and synthetic formulations to thermally stable inorganic blends and specialty chemistry designed for stubborn degradation products or reactive polymers. Pricing and specification are influenced by machine type, polymer family (e.g., polyolefins, PVC, PET, engineering plastics), regulatory requirements for food/medical contact, and the buyer’s tolerance for downtime and scrap.

Key market growth drivers

- Rising complexity and personalization of plastic products — Shorter production runs, increased color changes, and customized runs for regional markets or limited-edition goods force more frequent purging cycles. Manufacturers seeking to minimize downtime and scrap are adopting advanced purging compounds to speed transitions.

- Stricter quality and regulatory demands — Industries like medical devices, food packaging, and automotive require tight tolerances and contaminant-free surfaces. Purging compounds that deliver trace-level cleaning and quick verification of cleanliness meet these growing regulatory and quality control needs.

- Focus on sustainability and material recovery — Efficient purging reduces scrap during grade and color changes and enables processors to reclaim more product. In turn, this reduces raw-material waste and supports corporate sustainability targets and circular-economy initiatives.

- Automation and process optimization in plastics manufacturing — As factories invest in Industry 4.0 systems, consistent, predictable purging chemistry that integrates with automated purging sequences and predictive maintenance programs becomes more valuable. Suppliers that offer reproducible performance and data-backed benefits see higher adoption.

Market challenges

- Compatibility across diverse polymers and additives — No single purging formulation is optimal for every polymer, filler, or stabilizer system. Processors running a wide mix of materials may need multiple purging products or workflows, complicating procurement and inventory management.

- Perceived cost vs. immediate benefit — While purging compounds reduce scrap and downtime, some processors remain reluctant to invest because the savings are realized over time or dispersed across different cost centers. Convincing cost-sensitive operators requires clear, quantitative ROI demonstrations.

- Health, safety and environmental concerns — Certain purging chemistries can release volatiles or require handling precautions. Regulatory scrutiny and corporate ESG goals are pushing demand toward lower-emission, non-hazardous formulations — but reformulation is technically demanding and can increase R&D costs.

- Fragmented end-user practices and training gaps — Effective purging is as much about correct procedures and machine settings as about chemistry. In many regions, inconsistent training and lack of standardized protocols reduce the effectiveness of advanced purging products and slow adoption.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/purging-compound-market

Regional analysis

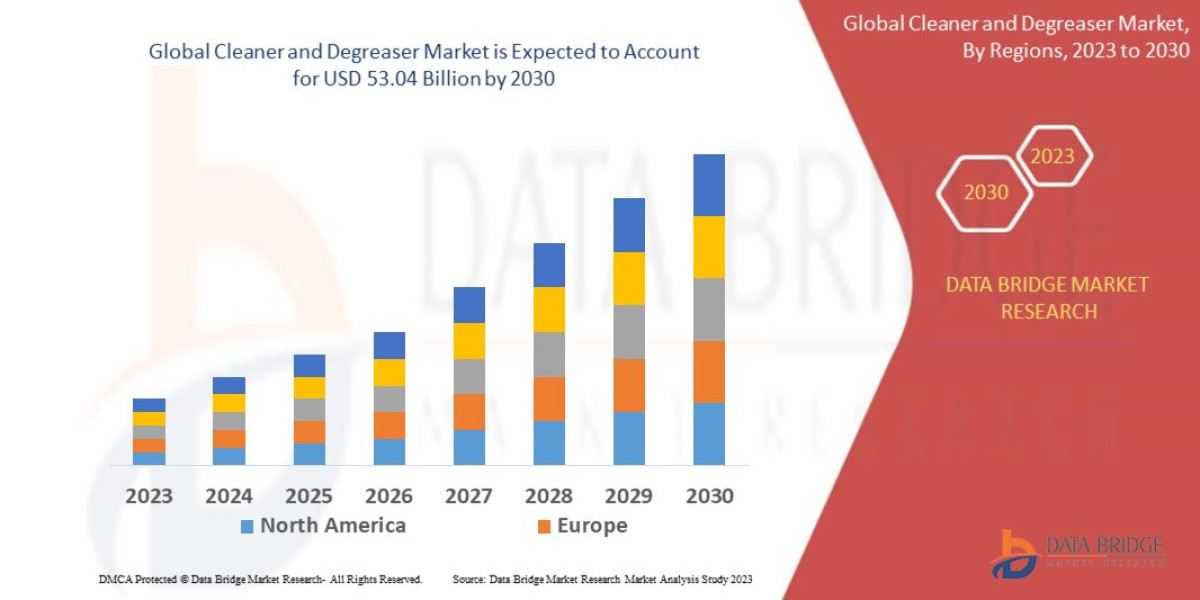

North America

North America remains a strong market driven by automotive, medical, and engineered plastics processing. High automation levels and robust aftermarket services strengthen demand for advanced purging solutions. Premiumization and regulatory requirements in medical and food-contact industries favor suppliers that offer certified, high-performance products.

Europe

Europe shows steady growth led by strict regulatory regimes, large-scale automotive and packaging manufacturing, and a strong emphasis on sustainability. Producers here increasingly prefer low-emission, recyclable-friendly purging chemistries. The region’s focus on plastics recycling and circular economy initiatives also encourages purging solutions that support reprocessing workflows.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to expanding plastics manufacturing, growth in packaging and consumer electronics, and rapidly increasing capacity in automotive and medical device production. Cost-sensitivity is higher, but leading-tier processors in China, India, Japan, and Southeast Asia are adopting higher-performance purging compounds to boost throughput and reduce scrap.

Latin America & Middle East & Africa (MEA)

These regions are more fragmented with growth pockets in packaging, construction, and automotive retrofit markets. Adoption is often driven by large-scale converters and multinational OEMs; however, constrained capital expenditure and supply-chain logistics can slow broad uptake. Training and local technical support are major levers for market expansion.

Key companies

- Calsak Corporation

- Plastic Solutions, Inc.

- Neutrex, Inc.

- Perfect Colourants & Plastics Pvt. Ltd.

- Asahi Kasei Corporation

- Chem‑Trend L.P.

- 3M

- Clariant

- Kuraray Co., Ltd.

- Daicel Corporation

Strategic trends & supplier responses

Suppliers are responding to market needs by launching targeted purging formulations for specific polymer families (e.g., PET-specific purges for bottle lines), low-emission and food/medical-grade chemistries, and concentrates compatible with automated purge sequences. Value-added services — such as on-site trials, operator training, validated cleaning protocols, and digital tools to predict purge cycles — are increasingly used to differentiate offerings and demonstrate ROI. Partnerships with OEMs and equipment dealers for co-developed purging packages are also growing, enabling tighter integration of chemistry and machine controls.

Applications & end-user benefits

- Injection molding — Faster color/grade changes, lower scrap during multi-cavity mold swaps.

- Extrusion (films, sheets, pipes, profiles) — Removal of cross-contaminants and easier line start-ups for consecutive runs.

- Blow molding — Improved interior cleanliness for thin-wall bottles and reduced contamination that can result in blow defects.

- Compounding & recycling lines — Cleaner transitions between contaminated feedstock and virgin resins, enabling higher-quality regrinds and blends.

Market outlook & forecast drivers

The purging compound market is expected to expand at a steady pace as manufacturers prioritize efficiency and waste reduction. Key contributors to future growth will be continued globalization of automotive and medical device supply chains, stricter end-use regulatory requirements, and increasing use of recycled/residual materials that raise the need for more powerful and flexible purging chemistries. In parallel, suppliers that can deliver demonstrable cost-savings, comply with environmental and worker-safety expectations, and support customers with training and analytics will capture the highest market share gains.

Conclusion

The Purging Compound market occupies a vital niche in modern plastics processing: small in unit price compared with resins, but outsized in impact on productivity, quality, and sustainability. As production patterns shift toward smaller runs, greater material variety, and higher quality expectations, purging solutions — and the training and services that accompany them — will become strategic tools for processors seeking to optimize operations. Suppliers that innovate around polymer-specific chemistries, low-emission formulations, and integrated service offerings are well-positioned to lead the market as processors worldwide pursue higher efficiency and lower environmental footprints.

More Trending Latest Reports By Polaris Market Research:

Recycled Ocean Plastics Market

Location-based Entertainment Market

Tea Extracts Market: Have A Healthy Cup of Tea!

Recycled Ocean Plastics Market

Microcrystalline Cellulose Market

Automotive Catalytic Converter Market

Veterinary Anti-infectives Market

Clinical Trial Patient Recruitment Services Market

A Rise in Therapeutic Benefit from Phytosterols to Drive Significant Market Growth

Automotive Catalytic Converter Market

U.S. Industrial Cleaning Chemicals market