Executive Summary

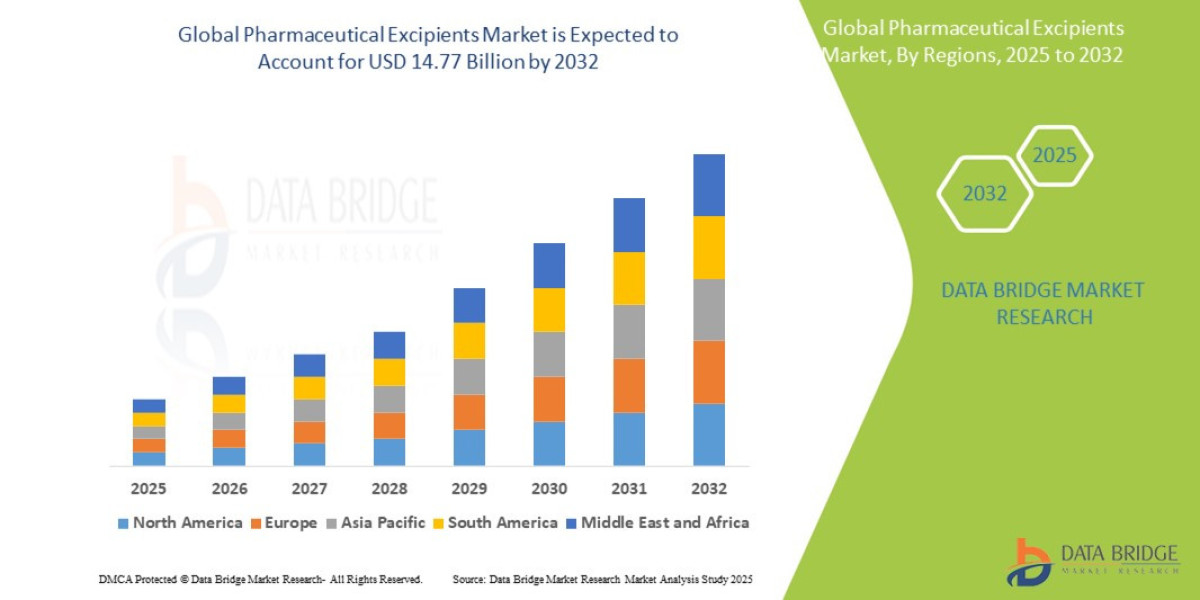

- The global pharmaceutical excipients market size was valued at USD 8.85 billion in 2024 and is expected to reach USD 14.77 billion by 2032, at a CAGR of 6.60% during the forecast period

Market Overview

Definition and Scope

Pharmaceutical excipients are substances, other than the pharmacologically active drug, that are deliberately included in a drug delivery system. Their roles are diverse and fundamental, including acting as binders (holding ingredients together), fillers (bulking agents), disintegrants (helping the drug dissolve), lubricants (preventing sticking), and solubilizers (improving API solubility). Essentially, excipients are the functional materials that turn an API into a marketable, therapeutic drug product.

Key Market Segments

The market can be segmented by product, functionality, and formulation type.

By Product Type (Material Origin):

Polymers (Leading Segment): Including cellulose derivatives (MCC, HPMC), polyols, and polyethylene glycols (PEGs). These are versatile and dominate due to their predictable, high-purity profiles and suitability for controlled-release applications.

Natural Products: Starches, gelatins, sucrose, and mineral salts. They are cost-effective but often face stricter regulatory scrutiny regarding source variability and microbial contamination.

By Functionality:

Fillers/Diluents (Largest Volume Segment): Used to increase the size of the drug formulation to make it easily compressible (e.g., Lactose, Microcrystalline Cellulose).

Binders: Crucial for tablet integrity (e.g., Povidone, Starches).

Disintegrants: Essential for drug release kinetics (e.g., Crospovidone, Sodium Starch Glycolate).

Solubilizers/Emulsifiers: Growing rapidly due to poorly water-soluble APIs (e.g., surfactants, phospholipids).

By Route of Administration: Oral (dominant), Topical, Parenteral, and Inhalable.

Drivers and Current Dynamics

Growth in Generics and Biosimilars: The constant expiration of blockbuster drug patents necessitates high-quality, cost-effective excipients that allow generic manufacturers to replicate the performance and bioavailability of innovator drugs.

Rising Burden of Chronic Diseases: The global increase in chronic conditions (e.g., diabetes, cardiovascular disease) fuels demand for oral solid dosages, the primary application area for excipients.

Complexity of Novel APIs: Approximately 40-70% of new APIs are poorly water-soluble (Class II and Class IV in the Biopharmaceutical Classification System). This drives demand for advanced solubilizing and specialized excipients like lipid-based systems, cyclodextrins, and specialized polymers.

Advancements in Drug Delivery: Increasing focus on controlled-release, delayed-release, and taste-masking technologies, all of which rely heavily on customized excipients for successful implementation.

Market Size & Forecast

- The global pharmaceutical excipients market size was valued at USD 8.85 billion in 2024 and is expected to reach USD 14.77 billion by 2032, at a CAGR of 6.60% during the forecast period

For More information visit https://www.databridgemarketresearch.com/reports/global-pharmaceutical-excipients-market

Key Trends & Innovations

Innovation in excipients is less about radical new molecules and more about superior physical properties, purity, and multifunctional capabilities.

1. Co-Processed Excipients (CPEs)

CPEs represent a pivotal shift. These are mixtures of two or more established excipients processed together (e.g., spray drying) to create a single material with enhanced functionality (e.g., improved flow, compressibility, and disintegration time). CPEs simplify formulation, reduce the number of ingredients, and lower overall manufacturing costs, making them highly attractive for challenging direct compression processes.

2. Specialized Excipients for Biologics

The expansion of the biologics and large molecule pipeline requires excipients—specifically stabilizers, buffers, and surfactants—with extremely high purity and low endotoxin levels. These parenteral-grade excipients are essential for maintaining the stability of sensitive proteins during manufacturing, storage, and administration.

3. Excipients in Continuous Manufacturing and 3D Printing

The pharmaceutical industry is gradually shifting towards continuous manufacturing (CM) to improve efficiency and quality. CM requires excipients with exceptionally consistent and predictable flow properties. Furthermore, 3D printing of pharmaceuticals (producing personalized dosages) is an emerging field relying on specialized polymer excipients that can be extruded or printed with high precision and melt/dissolve predictably.

4. Enhanced Regulatory Focus on Functionality

Regulatory bodies like the FDA and EMA are increasingly emphasizing the functional role of the excipient rather than just its chemical identity. The drive for Quality by Design (QbD) principles pushes manufacturers to understand and control Critical Material Attributes (CMAs) of excipients, leading to stricter supplier qualification and a higher barrier to entry for lower-quality suppliers.

Competitive Landscape

The market is characterized by a moderate degree of consolidation among specialty players, with intense price competition in the commodity segment.

Major Players and Market Share

Key global players include:

Global Chemical Giants (e.g., DuPont, Dow, BASF): Leveraging their chemical synthesis expertise to dominate the polymer-based and cellulose-derived excipient segments.

Specialty Pharma Ingredients Suppliers (e.g., Ashland, Roquette, JRS Pharma, Colorcon): Focused purely on pharmaceutical applications, specializing in advanced formulations like co-processed materials and customized coating systems.

Regional Niche Players: Important in localized markets (e.g., India, China) and often focusing on high-volume, cost-competitive generics excipients.

Competitive Strategies

Vertical Integration and Supply Security: Leading players are investing in secure, traceable supply chains to guarantee consistent quality and volume, addressing pharmaceutical manufacturers' primary concern about excipient sourcing.

Portfolio Diversification: Companies are strategically acquiring or developing new functionalities, particularly in the solubilizer and customized release areas, to cater to complex APIs and advanced drug delivery methods.

Regulatory Excellence: Offering full regulatory documentation (e.g., drug master files, technical service support) is a non-negotiable competitive advantage, allowing customers to accelerate their regulatory submissions.

Customer Collaboration: Early involvement with pharmaceutical R&D teams to co-develop novel excipients tailored to specific API characteristics is a growing trend, creating high-switching-cost relationships.

Regional Insights

Regional dynamics are shaped by manufacturing activity, regulatory standards, and R&D concentration.

North America and Europe

These regions are the largest revenue contributors, driven by high R&D spending and the presence of major biopharma companies. The focus here is on high-end, specialty excipients for biologics, parenteral formulations, and advanced drug delivery systems (e.g., sustained release tablets). Regulatory stringency is the highest, demanding premium-priced, documented, and fully tested materials.

Asia-Pacific (APAC)

APAC, led by China and India, is the fastest-growing region. The growth is fueled by massive domestic demand, the region's emergence as a global generics manufacturing hub, and lower manufacturing costs. While the region currently consumes high volumes of commodity excipients (fillers, binders), there is rapidly increasing demand for specialty excipients as local companies pivot to developing biosimilars and exporting advanced finished dosages to regulated markets.

Latin America and the Middle East & Africa (LAMEA)

These regions represent smaller, developing markets with high growth potential, primarily importing excipients from major global suppliers. Opportunities exist for simplified, easy-to-formulate products to support local manufacturing initiatives.

Challenges & Risks

Despite robust growth, the market faces inherent challenges related to quality, regulation, and economics.

1. High Regulatory Burden and Variability

Excipients are regulated as components of a drug, not as drugs themselves, which complicates approval pathways. Lack of a unified, global excipient-specific regulatory framework means compliance requires navigating multiple pharmacopeias (USP, EP, JP) and ensuring quality standards like cGMP (current Good Manufacturing Practices), which adds significant cost.

2. Quality and Counterfeiting Concerns

The vast majority of excipients are commodity chemicals with dual uses (food, industrial). This makes adulteration or counterfeiting a persistent risk, especially in loosely regulated markets. Ensuring supplier integrity and material traceability (from source to final drug product) remains a key challenge for global pharmaceutical manufacturers.

3. Pricing Pressure in the Generics Segment

While specialty excipients command high prices, the commodity segment (the largest by volume) is under constant, intense pressure from generic drug manufacturers to lower costs, squeezing margins for basic excipient suppliers.

4. Technical Challenges with Novel Excipients

Introducing truly novel excipients (materials never used before in drugs) is exceptionally difficult due to the rigorous, decade-long toxicology and safety data required for regulatory approval, making innovation often focused on modifying existing, approved compounds.

Opportunities & Strategic Recommendations

Stakeholder Group | Strategic Recommendation | Rationale |

|---|---|---|

Manufacturers | Invest in Co-processing and Multifunctionality R&D. Prioritize the development of patented CPEs and multifunctional excipients (e.g., combining binder, disintegrant, and lubricant properties). | Offers superior functionality, justifies premium pricing, and creates defensible intellectual property against commodity competition. |

Startups/Innovators | Target Specialty Solubilization Techniques. Focus on next-generation solubilizers for parenteral or novel oral delivery (e.g., polymeric micelles, amorphous solid dispersions). | Addresses the most critical formulation challenge—poor API solubility—and aligns with the growth of biopharma. |

Investors | Acquire APAC Specialty Excipient Players. Target companies in high-growth regions that demonstrate high-quality manufacturing and clear plans to expand into patented specialty/multifunctional excipients. | Captures the rapid market expansion of APAC while mitigating low-margin commodity risk. |

Excipient Suppliers | Mandate and Market cGMP Compliance & Traceability. Provide advanced quality assurance documentation and use digital solutions (e.g., blockchain) to prove supply chain security and material origin. | Elevates the supplier's position from a commodity provider to a trusted strategic partner, essential for securing high-value contracts. |

Pharma R&D | Integrate Excipient Selection Early (QbD). Involve excipient suppliers at the API discovery phase, not the formulation phase, to leverage material science expertise and accelerate the transition to clinical trials. | Reduces costly formulation failure later in development by selecting materials optimized for the API's specific physicochemical properties from the outset. |

Browse More Reports:

Global Transcritical CO2 Systems Market

Asia-Pacific Bio Preservation Market

Global Orthopedic Navigation Systems Market

Europe Electric Enclosure Market

Middle East and Africa Sludge Treatment Chemicals Market

Global Antimicrobial Drugs Market

Global Ballistic Composites Market

Global IoT Gateways Market

Global Mini Truck Market

Global Sustainable Toys Market

Global Empty Capsules Market

Global All Wheel Drive (AWD) Systems Market

Global Unmanned Ground Vehicle Market

Global Green Tea Market

Global Panniculitis Market

Asia-Pacific pH sensors Market

Global Facial Tracking Solutions Market

Global Skid Steer Loaders For Construction Market

Global Geographic Information System (GIS) Software Market

Asia-Pacific Plastic Compounding Market

Asia-Pacific Data Integration Market

Middle East and Africa Infection Surveillance Solution Systems Market

Global Candy Coated Chocolate Market

Global Water-Based High-Performance Coatings Market

Global Abscisic Acid (ABA) Market

Global Flake Ice Machine Market

Global Text-To-Speech Market

Middle East and Africa Acute Lymphocytic/Lymphoblastic Leukemia (ALL) Diagnostics Market

Global Toaster Market

Global Haematococcus Market

Global Bio-Based Hot Melt Adhesive (HMA) Market

Asia-Pacific Grinding Machinery Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com