Executive Summary

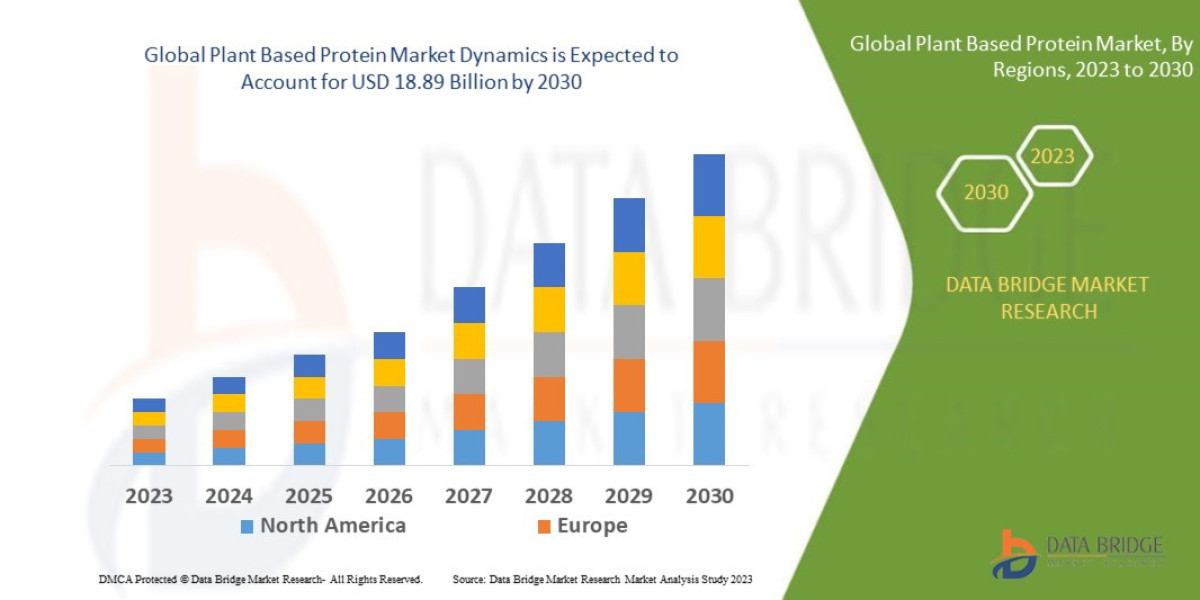

Data Bridge Market Research analyses the global plant based protein market, which was USD 12.24 billion in 2023, is expected to reach USD 20.10 billion by 2031, at a CAGR of 6.40% during the forecast period 2024 to 2031.

Market Overview

Definition and Scope

The plant-based protein market encompasses all protein concentrates, isolates, and textured forms derived from non-animal sources used in commercial food and industrial applications. These ingredients serve two primary functions: as a nutritional supplement to enhance protein content and as a functional ingredient to replace meat, dairy, or egg components, offering structural and textural qualities.

Key Market Segments by Source

Soy Protein (Dominant): Includes concentrates, isolates, and Textured Soy Protein (TSP). It remains the market leader due to its functional versatility, complete amino acid profile, and low cost.

Pea Protein (Fastest Growing): Highly sought after for its non-GMO status, allergen-friendliness (dairy, soy, gluten-free), and excellent functional properties in meat alternatives.

Wheat Protein (Gluten): Used extensively in baked goods and as a structure builder in meat alternatives (e.g., seitan). Growth is somewhat constrained by gluten sensitivity trends.

Emerging & Novel Proteins: Includes protein derived from Fava Bean, Chickpea, Potato, Rice, Hemp, Algae, and Fungi (Mycoprotein). This segment is crucial for market diversification and allergen reduction.

Drivers and Current Dynamics

Sustainability and Environmental Imperative: Conventional meat production is resource-intensive. Consumer awareness regarding the carbon footprint, water usage, and land-use intensity of animal agriculture is a primary macro driver shifting demand toward plant-based alternatives.

The Rise of Flexitarianism: The largest consumer segment is no longer strictly vegetarian/vegan but includes individuals actively reducing meat consumption for health, ethics, or environmental reasons. This broadens the target demographic significantly.

Health and Wellness Focus: Plant proteins are often marketed as being cholesterol-free, lower in saturated fat, and higher in fiber than animal sources, appealing to consumers seeking heart health and weight management solutions.

Technological Advancements in Processing: Improved extraction and processing technologies (e.g., High-Moisture Extrusion, cold-press separation) are successfully mitigating historical challenges like off-flavors and gritty textures, driving consumer acceptance.

Market Size & Forecast

Data Bridge Market Research analyses the global plant based protein market, which was USD 12.24 billion in 2023, is expected to reach USD 20.10 billion by 2031, at a CAGR of 6.40% during the forecast period 2024 to 2031.

For More information Visit https://www.databridgemarketresearch.com/reports/global-plant-based-protein-market

Key Trends & Innovations

The future success of plant-based protein rests entirely on science and processing innovation designed to close the gap on sensory experience and cost.

1. Next-Generation Flavor and Texture Masking

The "off-flavor" inherent to many plant proteins (especially pea and hemp) is the single biggest barrier to mass adoption. Innovations are focused on:

Enzymatic Treatment: Using specific enzymes during protein extraction to cleave peptides responsible for grassy or bitter notes.

Microencapsulation: Encasing the protein isolate to prevent flavor release until consumption.

Advanced High-Moisture Extrusion (HME): This technology mimics the fibrous, complex texture of whole muscle meat, moving beyond minced products to create highly realistic steaks, chicken breasts, and seafood alternatives.

2. Precision Fermentation

This is perhaps the most disruptive trend. Precision fermentation utilizes microorganisms (like yeast or fungi) programmed to produce specific proteins (e.g., casein, whey, egg albumen) that are molecularly identical to animal proteins, but without the animal. This innovation is primarily focused on creating "animal-free dairy" and egg proteins that offer unparalleled functionality (e.g., melt, stretch, foam) and purity.

3. Diversification of Protein Sources

Dependence on just soy and pea carries risks related to supply chain concentration and consumer fatigue. There is a strong strategic push towards Potato Protein, offering superior solubility and foaming capabilities; Fava Bean, valued for its neutral flavor profile; and Mycoprotein (from fungi), known for its sustainable cultivation and highly fibrous texture. This diversification ensures market stability and expands the allergen-friendly portfolio.

4. Clean Label and Minimally Processed Ingredients

Consumers are increasingly scrutinizing ingredient lists. This drives demand for protein ingredients that are non-GMO, organic, and utilize minimal processing techniques, pushing manufacturers toward mechanical (vs. chemical) extraction methods and natural masking agents.

Competitive Landscape

The market is characterized by a "dual-structure" competition: large, integrated commodity processors competing with agile, VC-backed food tech innovators.

Major Players and Strategies

Ingredient Giants (B2B): Companies like ADM, Cargill, Roquette, and Ingredion dominate the bulk ingredient supply. Their strategy is centered on backward integration (securing raw material supply chains), massive scale, and expanding their portfolio across all major protein sources (soy, pea, wheat) to serve global food manufacturers.

End-Product Innovators (B2C): Brands like Beyond Meat and Impossible Foods are the primary drivers of consumer awareness and demand, spending heavily on R&D to improve sensory attributes and achieve shelf parity in the retail environment. Their success relies on patenting the finished product formulation and high marketing velocity.

Dairy/Meat Industry Entrants: Traditional food giants (e.g., Nestle, Unilever, JBS) are aggressively launching their own plant-based lines or acquiring successful startups to capture market share and diversify their risk.

Key Competitive Strategies

M&A Activity: Large ingredient companies are acquiring smaller food tech startups to gain access to novel extraction patents, proprietary flavor masking techniques, and emerging protein sources (e.g., algae, fungal).

Global Capacity Expansion: Significant capital expenditure is being directed toward building large-scale pea and fava bean processing facilities, particularly in North America and Europe, to secure supply and reduce high transportation costs.

Functional Formulation IP: Competition is shifting from selling bulk protein to selling customized protein solutions (e.g., a "Meat-Free Chicken Isolate" blend) optimized for specific client applications, thus creating higher switching costs.

Regional Insights

North America (NA) and Europe (EU)

These regions are the maturity and innovation hubs of the market. They generate the largest current revenue and are characterized by high consumer awareness and willingness to pay a premium for ethical and sustainable products. The focus here is on next-gen products (precision fermentation, whole-cut meat alternatives) and the consolidation of retail shelf space. Regulatory frameworks in the EU (e.g., Novel Food approvals) are more complex but offer clear standards.

Asia-Pacific (APAC)

APAC is the primary engine for volume growth. Driven by rapid urbanization, rising middle-class consumption, and government initiatives promoting healthier diets, this region is projected to be the fastest-growing market segment. While Soy remains a culturally established staple, demand for western-style meat alternatives and non-soy proteins (due to allergen concerns) is soaring in countries like China, Japan, and Australia.

Latin America (LATAM) and Middle East & Africa (MEA)

These are emerging markets with vast agricultural potential. LATAM, particularly Brazil and Argentina, is critical for raw material sourcing (soy, pea) but also offers rapidly growing consumer markets focused on affordable, high-quality nutrition. MEA is growing, primarily in high-end retail sectors, driven by health trends and imports.

Challenges & Risks

Sustained market growth is contingent upon overcoming fundamental obstacles related to sensory experience, cost, and raw material supply.

1. Achieving Price and Sensory Parity

Plant-based products often remain 1.5x to 3x more expensive than their conventional counterparts. Achieving cost parity requires massive scaling and optimization of processing technology. Furthermore, the persistent challenge of achieving the exact juiciness, melt, and succulence of animal fat remains a major hurdle for consumer retention.

2. Supply Chain and Source Variability

Relying on agricultural crops exposes the supply chain to climate volatility and yield inconsistency. For specialty proteins (like pea or fava bean), the limited current cultivation scale can lead to price spikes and shortages, hindering long-term contract predictability necessary for major food manufacturers.

3. The "Highly Processed" Perception

Many advanced meat and dairy alternatives require extensive processing (extraction, texturization, binding) and lengthy ingredient lists, leading to a consumer perception that these products are "less natural" or "highly processed," which contradicts the core health-driven motivation of many buyers.

4. Regulatory Clarity (Labeling)

Confusion persists over labeling standards, particularly the use of terms like "milk," "meat," or "burger" for plant-based alternatives. Divergent regulatory positions across geographies create complexity and legal risk for global brands.

Opportunities & Strategic Recommendations

Stakeholder Group | Strategic Recommendation | Rationale |

|---|---|---|

Ingredient Manufacturers | Focus on Hybridization & Functionality. Develop hybrid ingredient systems that blend optimized plant proteins with molecularly identical proteins derived from precision fermentation. | Offers the best balance of scale (plant) and functional excellence (fermentation), rapidly closing the sensory gap with conventional products. |

Startups/Innovators | Specialize in Novel Sources and Water Conservation. Invest in sources like microalgae (high protein, low footprint) or develop dry fractionation methods. | Creates niche, patent-protected market segments that are immune to commodity price wars and appeal to the high-value sustainability buyer. |

Investors | Target Infrastructure & Enabling Technology. Focus on investment in large-scale HME facilities, specialized flavor/masking technology firms, and advanced protein separation equipment. | Infrastructure solves the core scalability and cost issues, yielding stable, long-term returns regardless of which specific B2C brand wins. |

Finished Product Brands | Prioritize "Clean Label" Alternatives. Shift away from products with excessively long ingredient lists to those featuring single or co-processed protein sources. | Directly addresses the major consumer concern about highly processed foods, reinforcing the health and wellness narrative. |

Agricultural Sector | Integrate Identity Preserved Sourcing. Work directly with processors to grow specific, high-protein varieties of peas, chickpeas, or beans under guaranteed contracts. | Ensures consistent quality and minimizes flavor variability that plagues the market, securing a premium supply chain position. |

Browse More Reports:

Global Rice Cakes Market

South America Fuse Market

Global Eicosapentaenoic Acid Market

Global Sound Enclosure Commercial Beverage Blender Market

Global Building Thermal Insulation Market

Europe Composite bearings Market

North America Ostomy Devices Market

Asia-Pacific Methylene Diphenyl Diisocyanate (MDI) Toluene Diisocyanate (TDI) and Polyurethane Market

Global pH Sensors Market

Global Recreational Boats Market

Global Diet and Nutrition Apps Market

Global Mobility Scooters Market

North America pH Sensors Market

Global Rare Gas Market

Global Chocolate Packaging Market

Global Modified Potato Starch Market

Global Orthopaedic Braces Market

Global Aircraft Mount Market

Global Big Data as a Service (BDaaS) Market

Asia-Pacific Cloud Storage Market

Global Bioactive Peptides Market

Global Polypropylene Lamination Films Market

North America Electrosurgery Market

Global Environment Testing Market

Global Myxoid Liposarcoma Treatment Market

Global Open Frame Industrial Display Market

Global Connected Device Analytics Market

Global Paclitaxel Injection Market

Global Dental Crown Market

Middle East and Africa Plant Based Protein Market

Global Chocolate Couverture Market

Global Helicopter Simulator Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com