Executive Summary

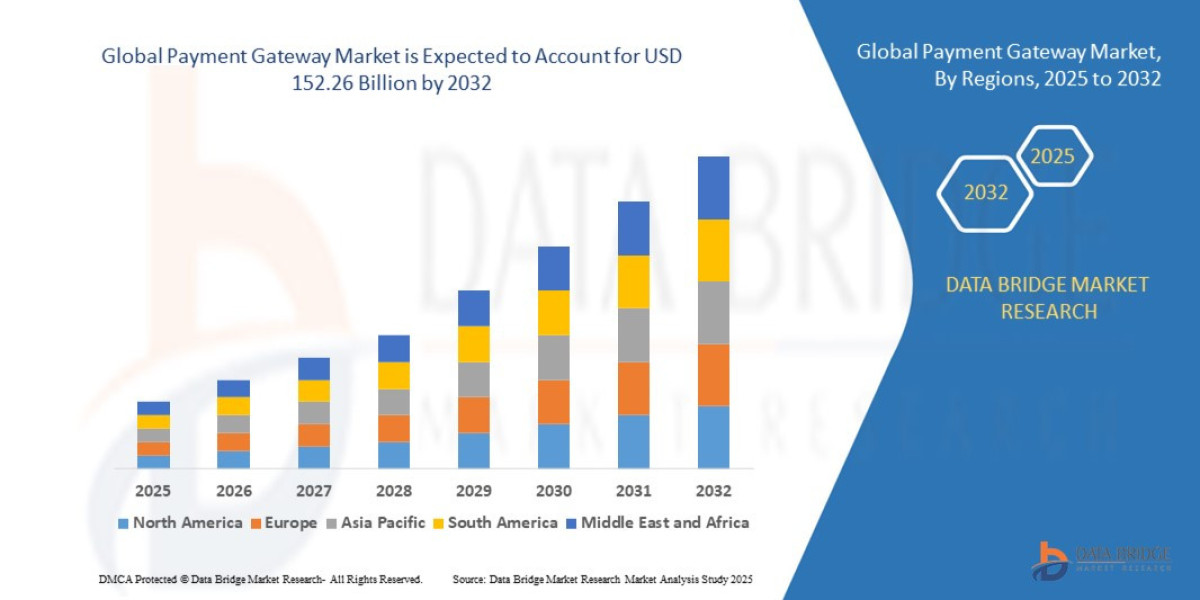

- The global payment gateway market size was valued at USD 35.17 billion in 2024 and is expected to reach USD 152.26 billion by 2032, at a CAGR of 20.10% during the forecast period

Market Overview

Definition and Role

A Payment Gateway is a software application that facilitates and authorizes electronic payments. It acts as the secure conduit that: (1) transmits payment information (like card data) from the merchant’s checkout interface to the acquiring bank/processor, (2) routes the authorization response back to the merchant, and (3) encrypts sensitive data to ensure compliance with standards like PCI DSS (Payment Card Industry Data Security Standard).

Key Market Segments

Type (By Deployment):

Hosted Payment Gateways: Redirects the customer to the gateway provider's secure page to complete the transaction (e.g., PayPal Standard). Easier for merchants but offers less checkout control.

Non-Hosted (API-based) Gateways (Dominant Growth): Integrates directly into the merchant's website via APIs, keeping the customer on the site throughout the transaction. Offers superior user experience and customization.

Organization Size (By Merchant Type):

Large Enterprises: Require highly customized, multi-currency, multi-channel (omnichannel) solutions with complex fraud management tools.

SMEs (Small and Medium-sized Enterprises) & Startups (High Volume Growth): Favor simple, all-in-one solutions that combine gateway services with merchant acquiring and quick setup (e.g., Stripe, Square).

End-User Industry:

Retail & E-commerce (Largest): Driven by global consumer spending.

Travel & Hospitality: Highly reliant on secure, multi-currency processing.

Digital Content & Subscription Services: Needs robust recurring billing infrastructure.

Drivers and Current Dynamics

E-commerce Penetration: The sustained shift of retail activity to online channels globally is the foundational driver, necessitating secure payment infrastructure for every transaction.

The Subscription Economy: The proliferation of Software as a Service (SaaS), media streaming, and curated box services has created massive demand for sophisticated recurring billing management and tokenization capabilities.

Digital Wallet Proliferation: The rising usage of non-card payment methods (Apple Pay, Google Pay, Alipay, regional UPIs) requires gateways to constantly update their integration stack to maximize conversion rates.

Geographic Expansion: As merchants seek international sales, they require gateways that simplify cross-border payment acceptance, manage currency conversion, and comply with varied local regulations (e.g., PSD2 in Europe).

Market Size & Forecast

- The global payment gateway market size was valued at USD 35.17 billion in 2024 and is expected to reach USD 152.26 billion by 2032, at a CAGR of 20.10% during the forecast period

For More Information Visit https://www.databridgemarketresearch.com/reports/global-payment-gateway-market

Key Trends & Innovations

Innovation is focused on improving conversion rates, enhancing security, and expanding service offerings to the merchant.

1. Embedded Finance and Banking-as-a-Service (BaaS)

Gateways are leveraging the transaction data they collect to become providers of financial services:

Instant Payouts and Working Capital: Offering merchants instant access to earned revenue (instead of waiting for bank settlements) and providing data-driven, short-term working capital loans based on sales history.

Merchant Acquiring Integration: The convergence of the gateway function and the acquiring bank function into a single platform (full-stack payment processing) simplifies integration, reduces transaction latency, and lowers total cost for the merchant.

2. Local Payment Methods (LPM) Proliferation

For global merchants, accepting only Visa/Mastercard is insufficient. Gateways are rapidly integrating regional LPMs:

"Pay-by-Bank" Schemes (Open Banking): Gateways are leveraging PSD2 and Open Banking APIs to facilitate direct bank transfers, which reduces interchange fees and fraud risk.

Regional Wallet Integration: Mandatory integration with popular national wallets (e.g., Paytm, Pix, M-Pesa) to access local customer bases, often driving conversion rates by 10-20% in those markets.

3. AI-Driven Fraud and Risk Management

The sophistication of payment fraud (account takeover, synthetic identity) necessitates advanced risk tools:

Behavioral Biometrics: Analyzing customer keystrokes, mouse movements, and navigation patterns during checkout to detect high-risk users before the transaction is authorized.

Machine Learning Chargeback Prediction: Using AI to predict the probability of a chargeback based on transaction velocity, geolocation, and device fingerprinting, allowing the merchant to block the payment or use 3D Secure authentication selectively.

4. Cryptocurrencies and Blockchain Integration

While still nascent, major gateways are preparing their infrastructure to handle digital assets:

Crypto-as-a-Payment: Enabling merchants to accept payments in cryptocurrencies (like Bitcoin or stablecoins) with instant fiat conversion, mitigating volatility risk for the merchant.

Blockchain for B2B Payments: Utilizing distributed ledger technology for transparent and low-cost international B2B payments, bypassing slow, costly legacy wire transfers.

Competitive Landscape

The market is fiercely competitive, split between established global giants and agile, specialized FinTech innovators.

Major Players and Strategies

Global Full-Stack Leaders (The Aggregators): Stripe, Adyen, and Square (Block Inc.) compete on developer-friendliness (APIs), speed of global expansion, and the breadth of their value-added services (lending, issuing cards, fraud tools). Their strategy is vertical integration, controlling every part of the payment flow.

Legacy Gateways & PayPal: PayPal (Braintree), Fiserv, and Worldline. These companies leverage vast brand recognition and established market share, particularly in North America and Europe. Their strategy often involves defensive acquisitions and leveraging existing merchant relationships to cross-sell new FinTech products.

Regional Specialists: Companies like PayU (Prosus), dLocal, and Checkout.com focus on superior local execution, deep knowledge of regional LPMs, and regulatory compliance, particularly in high-growth, fragmented markets like LATAM and APAC.

Key Competitive Strategies

Time-to-Market for New Payment Methods: Speed is a key differentiator. The gateway that integrates a new, popular payment method (e.g., a new "Buy Now, Pay Later" provider or a local UPI) fastest gains a competitive edge.

Conversion Optimization: Competing on checkout success rates by optimizing routing (smart transaction routing to acquirers with the best success rate) and reducing latency. A 1% increase in conversion can mean millions in revenue for a large merchant.

Developer Experience (DevEx): Offering clean, well-documented APIs, easy SDKs, and ready-made integrations with major e-commerce platforms (Shopify, WooCommerce) is critical for capturing the SME and startup market.

Omnichannel Unification: Providing a single gateway solution that seamlessly handles online e-commerce, mobile apps, and physical Point-of-Sale (POS) transactions, simplifying the merchant's view of their customer data.

Regional Insights

North America (NA) and Europe (EU)

Mature and Highly Regulated. NA remains dominated by card payments, while the EU is characterized by compliance with PSD2 (Revised Payment Services Directive), which drives Open Banking and increases security via Strong Customer Authentication (SCA). Competition is focused on bundled services, fraud prevention, and cross-border B2B payments.

Asia-Pacific (APAC)

Highly Fragmented and Fastest Growing. APAC is characterized by a massive diversity of local payment methods (e-wallets, bank transfers, QR codes) and a high mobile-first population. Growth is exponential, but requires gateway providers to tailor their offerings country-by-country, often necessitating regional partnerships. China, India (UPI), and Southeast Asia (mobile wallets) are the primary growth centers.

Latin America (LATAM) and Middle East & Africa (MEA)

High Opportunity for FinTech Disruption. These regions are seeing accelerated migration from cash to digital, often bypassing cards entirely for digital wallets and instant payment systems (e.g., Brazil's Pix). Gateways that can manage high transaction success rates and navigate complex currency fluctuations and regulatory environments will capture this high-growth potential.

Challenges & Risks

1. Fragmentation of Payment Methods

The explosion of new payment methods globally, driven by local regulators and FinTechs, forces gateways into a continuous integration treadmill. Failure to support a popular local method directly translates to lost conversion for their merchant clients.

2. Regulatory Compliance and Cross-Border Complexity

Navigating the patchwork of global payment regulations—including KYC/AML, data sovereignty laws (GDPR), and local licensing requirements (e-money licenses)—is enormously complex and expensive, creating significant barriers to entry for new players.

3. Fraud and Chargeback Liability

As the volume of transactions increases, so does the absolute volume of fraud attempts. Gateways are on the frontline of managing this risk. An overly aggressive fraud detection system blocks legitimate sales, while a weak system exposes merchants to costly chargeback losses, leading to high churn.

4. The Commoditization of Basic Gateway Services

The foundational technology of processing a payment is becoming increasingly commoditized, driving down per-transaction margins for basic services. Survival depends on the successful monetization of high-value ancillary services (e.g., lending, subscription management).

Opportunities & Strategic Recommendations

Stakeholder Group | Strategic Recommendation | Rationale |

|---|---|---|

Payment Gateway Providers | Become a Single API for Global Localization. Invest heavily in a modular API architecture that allows any merchant to instantly enable any LPM, currency, or regulatory feature (e.g., local invoicing) via a single integration point. | This addresses the massive challenge of global fragmentation, allowing merchants to unlock new markets quickly, creating a high-stickiness product. |

Traditional Financial Institutions (Banks) | Focus on API-First Commercial Banking. Offer modern, scalable APIs for direct bank transfer and account data access to emerging non-bank gateway providers. | Compete not by building gateways, but by simplifying the back-end connectivity, generating revenue via BaaS fees without the high-cost merchant support required by a full-stack PSP. |

E-commerce Platforms (Shopify, etc.) | Deepen Embedded FinTech Partnerships. Rather than solely offering third-party gateways, strategically partner or acquire gateway technology to offer branded, high-margin financial tools (e.g., instant working capital loans, business credit cards) to their ecosystem of merchants. | Creates a massive new revenue stream (interest and fees) that leverages the existing payment flow data and reduces merchant churn. |

Investors & Venture Capital | Target Niche B2B Payment Solutions. Invest in gateways specializing in complex verticals like cross-border B2B invoicing, recurring payments for utilities, or regulated industries (e.g., cannabis, gaming). | These niches require specialized compliance and complex logic, offering higher margin protection against the commoditization seen in mass-market e-commerce. |

Merchants (Large Enterprises) | Adopt Multi-Gateway Routing. Implement smart routing technology that automatically sends a payment to the optimal gateway/acquirer based on cost, success rate, and fraud profile for that specific geography/card type. | Maximizes conversion rates and minimizes processing costs by mitigating dependence on any single provider. |

Browse More Reports:

Global Nootropics Products Market

Global Johnson Neuroectodermal Syndrome Market

Global Natural Fiber Packaging Market

Global Barbecue (BBQ) Sauces and Rubs Market

North America Healthcare Logistics Market

Europe Frozen Ready Meals Market

Global Scoliosis Treatment Market

Global Cloth Self Adhesive Tape Market

Asia-Pacific Aromatherapy Market

Global Crystallization Equipment Market

Global Sugar Confectionery Market

North America Genetic Testing Market

Global Botanical Extracts Market

Global Feed Flavors and Sweeteners Market

Global Industrial Floor Scrubbers Market

Global Plastic Compounding Market

Global Squamous Cell Carcinoma Treatment Market

Global Caffeine Supplements Market

Europe Aromatherapy Market

Global Custom Procedure Kits Market

Europe Testing, Inspection, and Certification (TIC) Market for Building and Construction – Industry Trends and Forecast to 2028

Global Blood Processing Devices and Consumables Market

Global Eosinophil Driven Diseases Market

Global Polyphenylene Market

North America Network Test Lab Automation Market

Middle East and Africa Footwear Market

Global Influenza Diagnostics Market

Global Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market

Middle East and Africa Testing, Inspection, and Certification (TIC) Market for Building and Construction – Industry Trends and Forecast to 2028

Global Sulfur Fertilizers Market

Asia-Pacific Specialty Gas Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"