Executive Summary

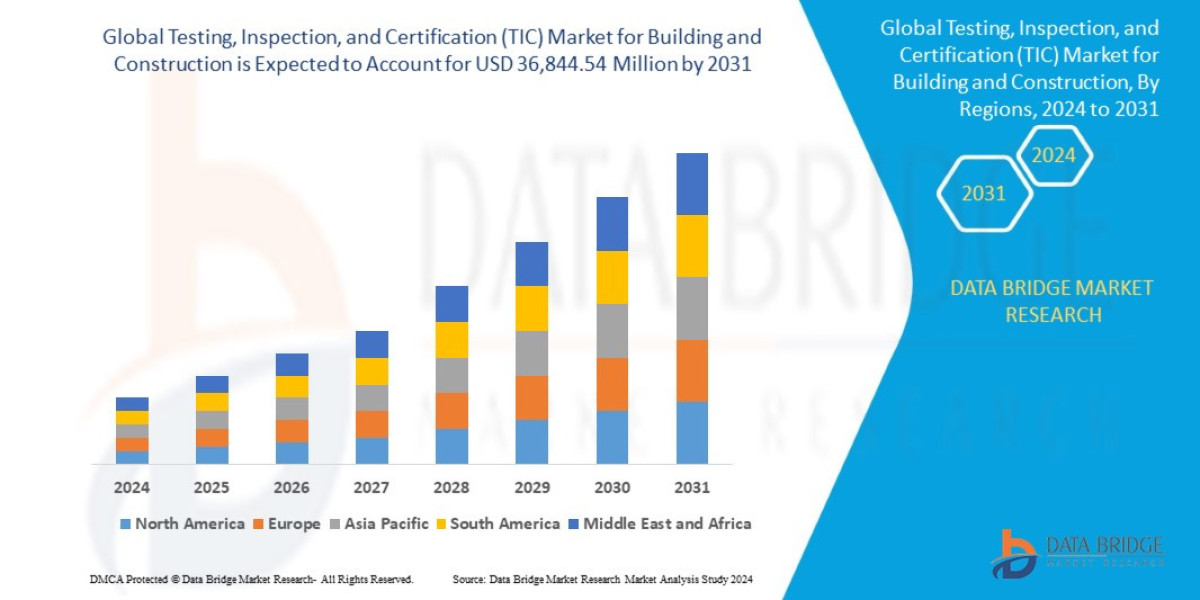

Data Bridge Market Research analyses that the global testing, inspection, and certification (TIC) market for building and construction valued at USD 23,468.63 million in 2023, will reach USD 36,844.54 million by 2031, growing at a CAGR of 5.8% during the forecast period of 2024 to 2031.

Market Overview

Definition and Scope

The TIC market for Building and Construction involves a portfolio of specialized services applied throughout the project lifecycle: from material sourcing and design validation to on-site construction monitoring and final occupancy certification. These services ensure that all components and processes comply with local, national, and international standards (ASTM, ISO, EN).

Key Segments by Service Type

Testing (Largest Segment by Volume): Involves laboratory-based or on-site evaluation of physical properties. Key areas include testing of concrete strength, steel composition, soil mechanics, asphalt quality, and fire resistance of materials.

Inspection (Highest Growth Rate): Involves visual and non-destructive examination (NDE) during the construction phase. Includes foundation checks, structural steel fit-up, welding inspections, and periodic mandatory building inspections (e.g., plumbing, electrical, seismic).

Certification (Highest Margin): Involves third-party assurance that products, management systems, or entire buildings comply with specific standards. This includes product certification (e.g., CE marking, UL listing), system certification (ISO9001), and high-value Green Building certifications.

Drivers and Current Dynamics

Regulatory Complexity: Post-disaster legislative responses (e.g., fire safety mandates in Europe, seismic codes in Asia) necessitate continuous, sophisticated compliance checks, creating non-discretionary demand for TIC services.

Massive Infrastructure Investment: Government stimulus in North America (US Infrastructure Act) and continuous urbanization across APAC drive high volume in civil engineering projects (roads, bridges, utilities), which require mandatory material and structural testing.

The Sustainability Premium: Owners and investors are demanding certified green buildings to achieve better financing, higher rents, and meet ESG reporting requirements. This mandatory push for sustainable materials and performance verification is fueling the high-margin certification segment.

Risk Mitigation: The complexity of modern construction (e.g., modular, mass timber) and rising insurance costs drive project stakeholders (developers, insurers) to seek higher levels of third-party verification to reduce liability.

Market Size & Forecast

Data Bridge Market Research analyses that the global testing, inspection, and certification (TIC) market for building and construction valued at USD 23,468.63 million in 2023, will reach USD 36,844.54 million by 2031, growing at a CAGR of 5.8% during the forecast period of 2024 to 2031.

For More Information visit https://www.databridgemarketresearch.com/reports/global-testing-inspection-and-certification-tic-market

Key Trends & Innovations

The TIC sector is undergoing a transformation driven by data, remote capability, and the need to verify sustainability.

1. Digitalization and Remote TIC (RTIC)

The integration of digital tools is shifting TIC from episodic manual checks to continuous, data-driven assurance:

Drone and Robotics Inspection: Use of Unmanned Aerial Vehicles ($\text{UAV}$s) and ground robots equipped with thermal, visual, and ultrasonic sensors for high-risk or difficult-to-access inspections (e.g., high-rise façades, bridge decks). This vastly increases speed and safety.

IoT and Smart Materials: Embedding sensors into critical structural components (e.g., concrete curing sensors, strain gauges) allows for real-time monitoring of material performance and health, moving from post-hoc inspection to predictive maintenance.

BIM Integration: TIC firms are linking inspection data and certification status directly into the project's BIM model. This provides a digital, auditable record of quality assurance, reducing errors and enabling faster project handovers.

2. Deep Focus on Structural Health Monitoring (SHM)

Driven by the aging infrastructure crisis in developed economies, SHM is a high-growth TIC sub-segment. This involves using non-destructive testing (NDT) methods (e.g., ultrasonic testing, ground-penetrating radar) to assess the integrity of existing assets like bridges, tunnels, and dams, creating recurring service revenue for TIC providers.

3. The Sustainability Verification Mandate

This trend extends TIC services far beyond traditional safety:

Embodied Carbon Verification: Testing and certifying the lifecycle CO2 emissions embedded in construction materials (e.g., low-carbon concrete, mass timber) to meet new EU and US buy-clean mandates.

Circular Economy Validation: Certifying the source and percentage of recycled content in materials and validating the construction process for deconstruction readiness.

Health and Wellness Certifications: Growth in certifications like WELL and Fitwel focuses on indoor air quality, thermal comfort, and lighting, requiring specialized TIC testing services.

Competitive Landscape

The global TIC market is characterized by a "Big Four" that dominate global market share, complemented by thousands of regional and niche specialists.

Major Players and Strategies

Global Leaders (The Big Four): SGS, Bureau Veritas, Intertek, and TUV Rheinland/Sud. These firms leverage their established global footprints, brand trust, and comprehensive service portfolios. Their strategy involves horizontal and vertical M&A to acquire niche technologies (AI inspection) and expand into fast-growing regions (APAC).

Regional Specialists (The Niche Experts): Firms like UL (North America), DEKRA (Europe), and various local material testing laboratories. These players focus on highly localized expertise (e.g., specific regional building codes, unique soil conditions) and product certification. UL, for instance, dominates fire safety and product listing certification in the US.

Emerging Tech Providers: Software and hardware companies offering PropTech solutions (e.g., drone mapping, AI defect detection). They compete not by offering certification, but by providing high-efficiency data collection tools that TIC providers must integrate to remain competitive.

Key Competitive Strategies

Digital Integration (The Core Differentiator): TIC leaders are aggressively integrating drone fleets, proprietary data platforms, and automated reporting into their core service offering to provide faster, more consistent results than purely manual competitors.

Service Bundling: Offering full-project solutions—from soil testing at the start to Green Building certification at completion—to lock in clients for the entire project lifecycle, increasing switching costs.

Accreditation and Regulatory Advocacy: Investing heavily in securing new accreditations for emerging standards (SAF in materials, BIM compliance) and working closely with regulatory bodies to shape future standards, ensuring their services remain mandatory.

Regional Insights

Asia-Pacific (APAC)

Highest Volume Growth. APAC is the primary driver of market growth due to massive, ongoing urbanization, large-scale infrastructure projects (e.g., China's Belt and Road Initiative, India's smart city programs), and rising public awareness of safety standards. The market is highly price-sensitive but seeing rapid adoption of Digital TIC to manage sheer project scale.

North America (NA)

Focus on Structural Integrity and Tech Adoption. The NA market is mature and driven by replacement cycles for aging infrastructure and strict local building codes. It exhibits the highest willingness to adopt expensive, advanced technologies like AI-driven defect detection and sophisticated SHM services, capitalizing on large public infrastructure spending.

Europe

Regulatory and ESG Leadership. Europe leads the market in the complexity of its regulatory landscape (CE marking, EU construction product regulations) and its deep commitment to ESG and decarbonization. The demand for Embodied Carbon Verification and high-level Green Building certifications is most mature and commands the highest fee premium here.

Middle East & Africa (MEA)

Project-Specific and Luxury Focus. Growth is dominated by mega-projects (e.g., NEOM in Saudi Arabia) which require the highest levels of international certification and quality control (often importing TIC expertise). The challenge is scaling compliance from these luxury/giga-projects to the mass housing market.

Challenges & Risks

1. Digitization and Data Integrity

The high upfront capital expenditure required for drones, sensor equipment, and proprietary AI platforms poses a barrier to entry for smaller, regional TIC firms. Furthermore, ensuring the security and legal admissibility of remotely collected digital data remains a technical and regulatory challenge.

2. Skilled Labor Shortage and Brain Drain

There is a critical global shortage of highly qualified and accredited inspectors, engineers, and non-destructive testing (NDT) technicians. This shortage, coupled with the high demand for specialized skills (e.g., fire modeling, seismic assessment), limits the ability of the industry to scale service delivery rapidly.

3. Fragmentation and Lack of Regulatory Harmony

While international standards like ISO exist, actual building codes remain localized at the municipal or state level. This fragmentation creates complexity and high operational costs for global TIC firms attempting to standardize their processes across different markets.

4. Perception of Conflict of Interest

As TIC firms increasingly offer consulting and compliance preparation services alongside certification, the public perception of conflict of interest risk remains. Maintaining absolute independence and transparency in auditing and verification is crucial to upholding market trust.

Opportunities & Strategic Recommendations

Stakeholder Group | Strategic Recommendation | Rationale |

|---|---|---|

TIC Providers | Develop BIM-Integrated Quality Gateways. Create proprietary software that links live field inspection data (collected via mobile/drone) directly to the BIM model, triggering automated sign-offs or immediate alerts for non-conformance. | Shifts TIC from a cost center to a vital project management tool, dramatically reducing project risk, delays, and subsequent liability. |

Construction $\text{OEM}$s/Material Producers | Seek Proactive Product Certification for ESG Claims. Invest in third-party validation and certification of all sustainability metrics (embodied carbon, recycled content, waste-free manufacturing). | Transforms sustainability from a marketing claim into a verified product attribute, enabling access to high-value markets (Europe, green infrastructure) where compliance is mandatory. |

Investors & Private Equity | Target SHM and Existing Asset Retrofit Service Firms. Invest in regional TIC specialists focused on structural health monitoring and building envelope performance testing for energy efficiency retrofits. | Captures the high-margin, recurring revenue potential from the massive global market for maintaining and upgrading aging infrastructure, which is less dependent on new construction cycles. |

Startups (PropTech) | Focus on AI-Driven Defect Detection and Automated Reporting. Develop easily deployable hardware/software that can autonomously scan complex areas (e.g., welding seams, concrete pours) and generate final compliance reports with minimal human intervention. | Provides the TIC industry with the scalable, high-speed tools necessary to overcome the skilled labor shortage and manage large volumes of data. |

Governments & Regulatory Bodies | Harmonize Core Digital Reporting Standards. Mandate the use of digital formats and data taxonomies for all TIC reporting on public projects, making data automatically machine-readable and auditable across local jurisdictions. | Reduces administrative burden and compliance costs for the entire industry, enabling faster, cross-border TIC service delivery. |

Browse More Reports:

Global Ring Pull Caps Market

Middle East and Africa Fuse Market

Global Automotive Cluster Market

Global Aerospace and Defense C Class Parts Market

Global Ostomy Devices Market

Global Disconnector Market

Middle East and Africa Rice Husk Ash Market

Europe Retail Analytics Market

Global D-Malic Acid Market

Global Hereditary Breast and Ovarian Cancer Syndrome Treatment Market

Global High Intensity Discharge (HID) Light Market

Global Visual Electrophysiology Testing Devices Market

Global Next-Generation Sequencing (NGS) Services Market

Global Spark Plug Market

Global Agriculture Biological Control Agents Market

Europe Fuse Market

Global Abatacept Market

Global Whole Genome Bisulfite Sequencing (WGBS) Market

Global Cervical Intraepithelial Neoplasia Drugs Market

Global Facial Tissue Paper Market

Global Wrist Replacement Orthopedic Devices Market

Global Frozen Ready Meals Market

Global Medical Device Interface Market

Global Mass Notification Systems Market

Global Chondrodermatitis Nodularis Helicis Market

Global Indium Market

Global Winged Bean Seeds Market

Global Porcine Vaccines Market

Global Metal Trauma Implants Market

Global Maple Syrup Urine Disease Treatment Market

Global Performance Analytics Market

Global Ruminant Feed Carotenoids Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com