According to the research report, the global face swiping payment market was valued at USD 5.04 billion in 2022 and is expected to reach USD 29.74 billion by 2032, to grow at a CAGR of 19.4% during the forecast period.

The global face swiping payment market is experiencing rapid growth as businesses and consumers increasingly embrace contactless, secure, and convenient payment methods. Face swiping payment, a form of biometric transaction technology, enables users to complete payments by scanning their facial features, eliminating the need for cash, cards, or mobile devices. The adoption of this technology is being accelerated by the rising demand for digital payment solutions, enhanced security features, and seamless user experiences in retail, banking, transportation, and hospitality sectors.

Market Summary

Face swiping payment systems leverage advanced facial recognition algorithms, AI-driven analytics, and secure authentication protocols to validate users and authorize transactions. These systems integrate hardware components such as high-resolution cameras, infrared sensors, and biometric scanners with software platforms that ensure accuracy, privacy, and fraud prevention.

The market is expanding due to the growing emphasis on contactless payments, digital banking, and smart retail solutions. Consumers increasingly prefer payment methods that are fast, secure, and hygienic, particularly in the post-pandemic era where minimizing physical contact has become a priority. Face swiping payment not only streamlines transactions but also enhances customer engagement by offering personalized services, loyalty rewards, and quick checkout experiences.

The technology is also gaining traction in financial inclusion initiatives, particularly in emerging markets where traditional banking infrastructure may be limited. Biometric payments simplify the process of account access and transactions, offering secure and convenient alternatives to conventional banking services.

Key Market Trends

One prominent trend in the face swiping payment market is the integration of AI and machine learning technologies to improve facial recognition accuracy. Modern algorithms can detect subtle facial features, handle variations in lighting, angles, and expressions, and prevent spoofing attempts using photos or masks. This ensures reliable authentication and reduces transaction failures, enhancing user trust in biometric payment systems.

Another key trend is the adoption of multi-channel and omnichannel payment solutions. Face swiping payment technology is increasingly being integrated with mobile apps, e-wallets, point-of-sale terminals, and online payment platforms. This integration allows consumers to complete transactions seamlessly across physical stores, e-commerce platforms, and self-service kiosks, driving broader adoption.

The rise of contactless payments due to health and safety concerns is also shaping market dynamics. Following global health crises, consumers and businesses have shifted towards payment methods that minimize physical touch, accelerating the adoption of biometric solutions such as face swiping payments. Retail chains, airports, and public transportation systems are increasingly deploying these technologies to provide safe and efficient transactions.

Additionally, the use of facial recognition in financial fraud prevention and authentication is becoming a significant trend. Face swiping payment systems offer enhanced security by linking biometric data with digital wallets, bank accounts, and transaction histories, reducing the risk of unauthorized access and identity theft. Multi-factor authentication, including facial biometrics combined with PINs or QR codes, is being adopted to further enhance security.

The expansion of smart city initiatives and digital payment infrastructure is another trend driving market growth. Integration of face swiping payment technology with public services, transportation networks, and retail ecosystems enables seamless transactions, reduces cash handling, and promotes a more connected urban environment.

Opportunities in the Market

The face swiping payment market offers numerous growth opportunities driven by technological innovation, digital adoption, and evolving consumer preferences. One significant opportunity lies in the rapid adoption of contactless payments in retail and hospitality sectors. Retailers, restaurants, and hotels are increasingly implementing biometric payment solutions to enhance customer experience, reduce checkout times, and boost operational efficiency.

The expansion of digital banking and fintech platforms provides another key growth avenue. Banks and payment service providers are integrating face swiping authentication into mobile banking apps, digital wallets, and ATMs, offering secure and convenient alternatives to traditional authentication methods. This trend is particularly pronounced in emerging markets with growing smartphone penetration and digital payment adoption.

Emerging markets in Asia-Pacific, Latin America, and the Middle East present significant opportunities. Rapid urbanization, increasing smartphone adoption, and government initiatives promoting cashless economies are driving demand for biometric payment systems. Countries such as China, India, Brazil, and the UAE are leading the way in adopting facial recognition payments for retail, transportation, and banking services.

Technological innovations in enhanced security features and AI-driven analytics also create growth potential. Advanced facial recognition algorithms, liveness detection, and real-time transaction monitoring improve accuracy, minimize fraud risks, and increase consumer confidence, driving broader adoption across sectors.

Furthermore, the integration of face swiping payment technology with loyalty programs and personalized services offers unique business opportunities. Retailers and service providers can leverage biometric data to deliver tailored promotions, reward systems, and personalized experiences, enhancing customer engagement and retention.

?????? ???? ????????:

https://www.polarismarketresearch.com/industry-analysis/face-swiping-payment-market

Regional Analysis

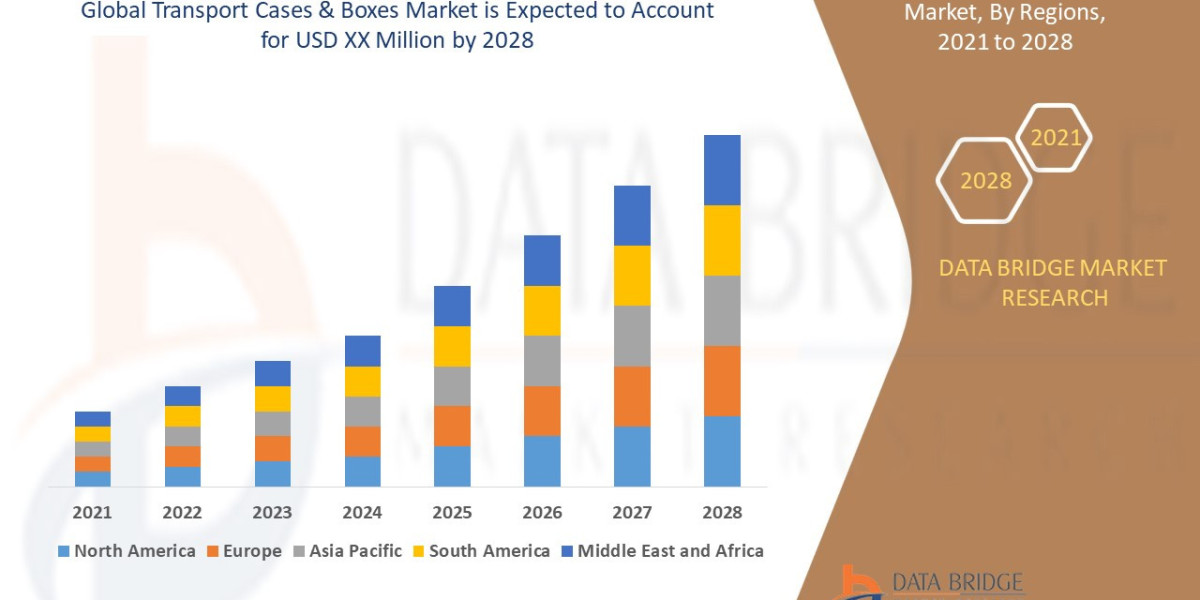

The face swiping payment market is geographically diverse, with North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa exhibiting distinct growth patterns.

North America is a leading market due to the widespread adoption of digital payment technologies, strong fintech infrastructure, and high consumer awareness of contactless solutions. The United States and Canada are driving adoption in retail, hospitality, and transportation sectors, supported by investments in AI and biometric technologies.

Europe is another key market, particularly in the United Kingdom, Germany, France, and the Nordic countries. Europe’s emphasis on secure digital transactions, privacy regulations, and smart city projects has contributed to the growth of facial recognition payment systems. Retailers and financial institutions are actively implementing these solutions to improve convenience and security.

Asia-Pacific is expected to witness the fastest growth, driven by high smartphone penetration, government initiatives promoting cashless transactions, and rapid adoption of biometric technologies. China, Japan, South Korea, and India are emerging as major hubs for face swiping payments, leveraging the technology in retail, transportation, and banking sectors.

Latin America and the Middle East & Africa are also emerging markets, fueled by growing urbanization, digital payment adoption, and investments in smart infrastructure. Brazil, Mexico, UAE, and Saudi Arabia are witnessing increasing deployment of facial recognition payments across retail, airports, and public transportation networks.

Key Companies

The face swiping payment market is competitive, comprising technology providers, financial service companies, and hardware manufacturers. Key players include:

Alibaba Group (Ant Financial)

Tencent Holdings Limited

NEC Corporation

IDEMIA Group

Mastercard Inc.

Visa Inc.

ZKTeco Co., Ltd.

Face++ (Megvii Technology)

Cognitec Systems GmbH

Fujitsu Limited

PayPal Holdings, Inc.

Honeywell International Inc.

Hikvision Digital Technology Co., Ltd.

Innovatrics

Aware, Inc.

These companies are investing in AI-driven facial recognition algorithms, advanced authentication solutions, and partnerships with financial institutions and retailers to expand their presence in the global face swiping payment market. Strategic initiatives include mergers and acquisitions, technological innovation, and regional expansion to enhance market reach and capabilities.

Conclusion

The face swiping payment market is poised for rapid growth as consumers and businesses increasingly seek contactless, secure, and convenient transaction methods. Rising adoption of digital banking, retail automation, smart city initiatives, and contactless payment solutions is fueling market expansion across global regions.

More Trending Latest Reports By Polaris Market Research:

Fungal Staining Reagent Market

Contact Center Software Market

Automotive engineering services market: A future for more secure and interconnected vehicles

Contact Center Software Market

IT Asset Disposition (ITAD) Market