"Market Trends Shaping Executive Summary Payment Wallet Market Size and Share

CAGR Value :

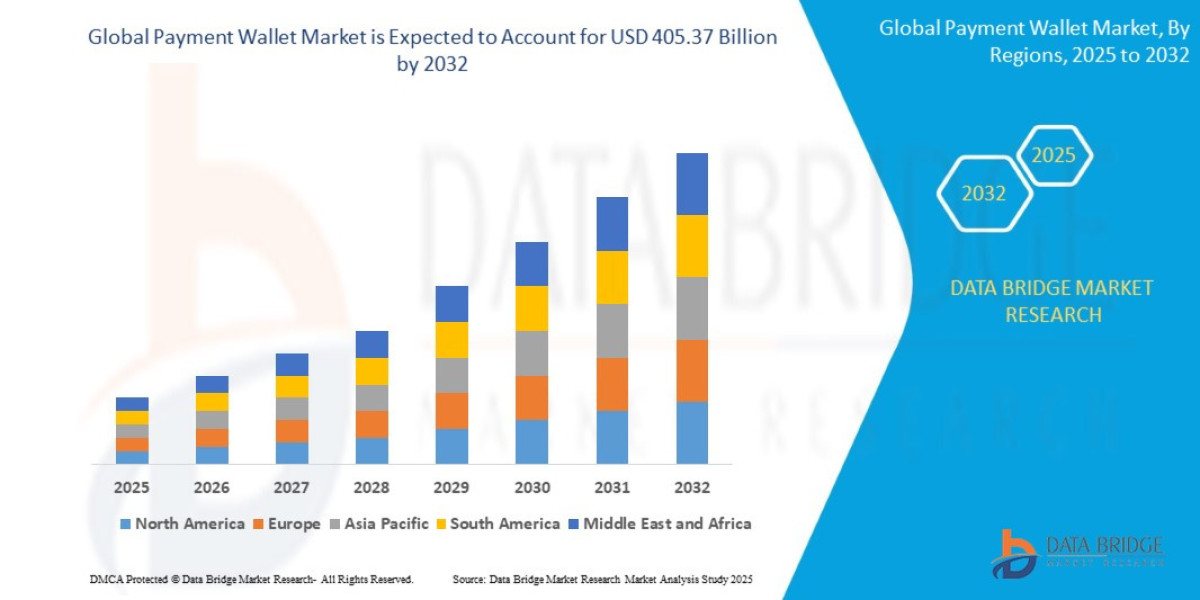

- The global payment wallet market size was valued at USD 117.03 billion in 2024 and is expected to reach USD 405.37 billion by 2032, at a CAGR of 16.8% during the forecast period

An influential Payment Wallet Market report contains key data about the market, emerging trends, product usage, motivating factors for customers and competitors. Moreover, market restraints, brand positioning, and customer behaviour, is also studied with which achieving a success in the competitive marketplace is simplified. With all this information, businesses can successfully make decisions about business strategies to achieve maximum return on investment (ROI). This industry report studies and evaluates facts and figures about the market segmentation very watchfully and represents it in the form of graphs for the better understanding of end user. Payment Wallet Market report comprises of all the crucial parameters mentioned above hence it can be used for the business.

Research and analysis about the key developments in the market, major competitors and detailed competitor analysis included in the large scale Payment Wallet Market report helps businesses envisage the bigger picture of the market place and products which ultimately assists superior business strategies. The market studies, insights and analysis conducted in this market research report keeps marketplace clearly into the focus which helps achieve business goals. Details about the market drivers and market restraints covered in Payment Wallet Market business report helps understand whether the demand of the products will rise or get lower.

Unlock detailed insights into the growth path of the Payment Wallet Market. Download full report here:

https://www.databridgemarketresearch.com/reports/global-payment-wallet-market

Payment Wallet Industry Performance Overview

Segments

- On the basis of type, the global payment wallet market can be segmented into closed, semi-closed, and open wallets. Closed wallets are those issued by a single company for transactions within its ecosystem. Semi-closed wallets can be used for transactions with multiple merchants but not for cash withdrawal. Open wallets allow users to make transactions with any merchant and withdraw cash as well.

- By application, the market can be categorized into retail, transportation, dining, and others. Retail applications include shopping at stores and online, while transportation applications involve paying for rideshares and public transit. Dining applications pertain to restaurants, cafes, and food delivery services. Other applications cover various industries where payment wallets are used for transactions.

Market Players

- Some of the key players in the global payment wallet market include:

- PayPal Holdings, Inc.: A prominent player in the payment wallet industry, offering services for online payments and money transfers.

- Amazon Pay (Amazon.com, Inc.): Amazon's payment wallet that allows users to make purchases on the e-commerce platform and other partner websites.

- Apple Inc.: Known for its Apple Pay wallet, which enables contactless payments using Apple devices.

- Google LLC: Google Pay is a popular payment wallet that allows users to store credit and debit cards for online and in-store transactions.

- Samsung Electronics Co., Ltd.: Samsung Pay is a mobile payment wallet that works with NFC and MST technologies for secure transactions.

- Alipay (Ant Group Co., Ltd.): A leading digital payment platform in China, offering various financial services through its mobile app.

- Paytm (One97 Communications Ltd.): Paytm is a major player in the Indian payment wallet market, providing digital payment solutions to users and merchants.

- WeChat Pay (Tencent Holdings Limited): Integrated within the WeChat messaging app, WeChat Pay is a widely used payment wallet in China.

The global payment wallet market is a highly competitive landscape with key players constantly innovating to improve user experience and security. The market is driven by the increasing adoption of digital payments, convenience in transactions, and the growing trend of cashless economies. As technology advances and consumer behavior shifts towards contactless and mobile payments, the payment wallet market is expected to witness significant growth in the coming years.

DDDDDThe global payment wallet market is experiencing notable growth driven by the evolution of digital payment trends and the increasing preference for cashless transactions across various industries. As the market continues to expand, key players are focusing on enhancing user experience and security features to stay competitive. One significant trend shaping the market is the integration of payment wallets into popular platforms and applications, making transactions more seamless and convenient for users. This integration not only boosts adoption rates but also fosters customer loyalty through a unified payment experience.

Moreover, the rise of mobile payments and contactless transactions is reshaping consumer behavior and propelling the demand for payment wallet solutions. With the convenience of making quick and secure payments using mobile devices, consumers are increasingly embracing this technology for various transactions, from retail purchases to transportation and dining services. This shift towards digital payments is further supported by the proliferation of smartphones and the growing accessibility of internet connectivity, making payment wallets an essential tool for modern-day consumers.

Another significant factor driving the growth of the payment wallet market is the increasing emphasis on financial inclusion and the digitization of payment systems in emerging economies. Payment wallets provide a convenient and cost-effective solution for individuals who may not have access to traditional banking services, thereby bridging the gap and enabling financial empowerment. This inclusive approach not only broadens the market reach for payment wallet providers but also contributes to the overall socio-economic development of underserved communities.

Furthermore, the evolving regulatory landscape surrounding digital payments and data protection is influencing the strategies adopted by market players to ensure compliance and build trust among users. As data security and privacy concerns become paramount, businesses are investing in robust encryption technologies and transparency measures to safeguard sensitive information and enhance consumer confidence in using payment wallets for transactions.

In conclusion, the global payment wallet market is poised for continued growth and innovation, driven by the changing dynamics of digital payments, the surge in mobile commerce, and the imperative of financial inclusion. As market players navigate these trends and challenges, the focus on enhancing user experience, security, and regulatory compliance will be critical in shaping the future landscape of the payment wallet industry. The evolution of payment technologies and consumer preferences will pave the way for further advancements and opportunities in this rapidly evolving market segment.The global payment wallet market is witnessing remarkable growth propelled by the digital payment evolution and the increasing inclination towards cashless transactions. This shift is prevalent across various industries, including retail, transportation, dining, and beyond, where payment wallets offer convenience, speed, and security in transactions. Key market players are focusing on enhancing user experiences and security features to remain competitive in this rapidly evolving landscape. There is a notable trend of integrating payment wallets into popular platforms and applications, streamlining transactions for users and fostering customer loyalty.

Mobile payments and contactless transactions are shaping consumer behavior, leading to a surge in demand for payment wallet solutions. Consumers are gravitating towards the convenience of making quick and secure payments using their mobile devices, driving the adoption of payment wallets for a wide range of transactions. The proliferation of smartphones and the increased connectivity to the internet further bolster the appeal of payment wallets as an essential tool in the contemporary consumer's financial arsenal.

Moreover, the emphasis on financial inclusion and the digitization of payment systems in emerging economies are key drivers for the growth of payment wallets. These solutions offer a cost-effective and hassle-free alternative for individuals with limited access to traditional banking services, bridging the gap and empowering underserved communities financially. This inclusive approach not only expands the market reach for payment wallet providers but also contributes to the overall socio-economic development of regions with limited financial infrastructure.

Regulatory frameworks pertaining to digital payments and data protection are also impacting market strategies, leading companies to invest in robust encryption technologies and transparency measures. Ensuring compliance and building trust among users regarding data security and privacy are critical aspects for businesses operating in the payment wallet industry. Strengthening these aspects will help to enhance consumer confidence and foster a secure environment for the continued growth of the market.

In conclusion, the global payment wallet market presents significant opportunities for innovation and expansion driven by the transformative forces of digital payments, mobile commerce growth, and the drive towards financial inclusion. Market players navigating these trends with a focus on user experience, security, and regulatory compliance are poised to shape the future of the payment wallet industry. The evolving landscape of payment technologies and evolving consumer preferences will continue to drive advancements and shape the trajectory of this dynamic market segment.

Check out detailed stats on company market coverage

https://www.databridgemarketresearch.com/reports/global-payment-wallet-market/companies

In-Depth Market Research Questions for Payment Wallet Market Studies

- What’s the market's carbon emission status?

- What is the CAGR by segment type?

- How are digital twins used in this Payment Wallet Market industry?

- Which consumer pain points are unmet?

- How do brands manage product recalls?

- What return on innovation is seen by top players in Payment Wallet Market?

- What innovations are improving durability?

- How is multilingual marketing impacting reach for Payment Wallet Market?

- What incentives are offered in B2B contracts?

- How do geopolitical crises impact exports for Payment Wallet Market?

- What is the lifecycle cost of a product?

- What are the unmet needs of rural consumers?

- How do brands handle fake or counterfeit products?

- Which regions have the most favorable logistics?

Browse More Reports:

Global Clostridial Diseases Market

France Aluminum Pigments Market

Global Optical Spectrum Analyzer Market

Asia-Pacific Rice Husk Ash Market

Global Rugged Smartphones Sensors Market

Global Protein Labelling Market

North America Laminated Busbar Market

Global Behavioral Health Care Software and Services Market

North America Topical Corticosteroids Market

Global Dairy Desserts Market

Europe Genetic Testing Market

Global Tissue Banking Market

Global Xylose Market

Global Pulmonary Embolism Market

Middle East and Africa Healthcare Logistics Market

Middle East and Africa Rowing Boats and Kayaks Market

Europe Unmanned Ground Vehicle Market

Global Unidirectional Tapes Market

Global Voice Termination Market

Global Plant-Based Milk Market

Global Ion Milling System Market

Europe Hydrographic Survey Equipment Market

Global Wind Turbine Pitch System Market

Global Industrial Vehicles Market

Europe Data Integration Market

Asia-Pacific Fuse Market

Global Non Hodgkin Lymphoma Market

Global Dairy Flavours Market

Global Immune Health Supplements Market

Global Bone Conduction Hearing Aids Market

North America Plastic Compounding Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"