Executive Summary

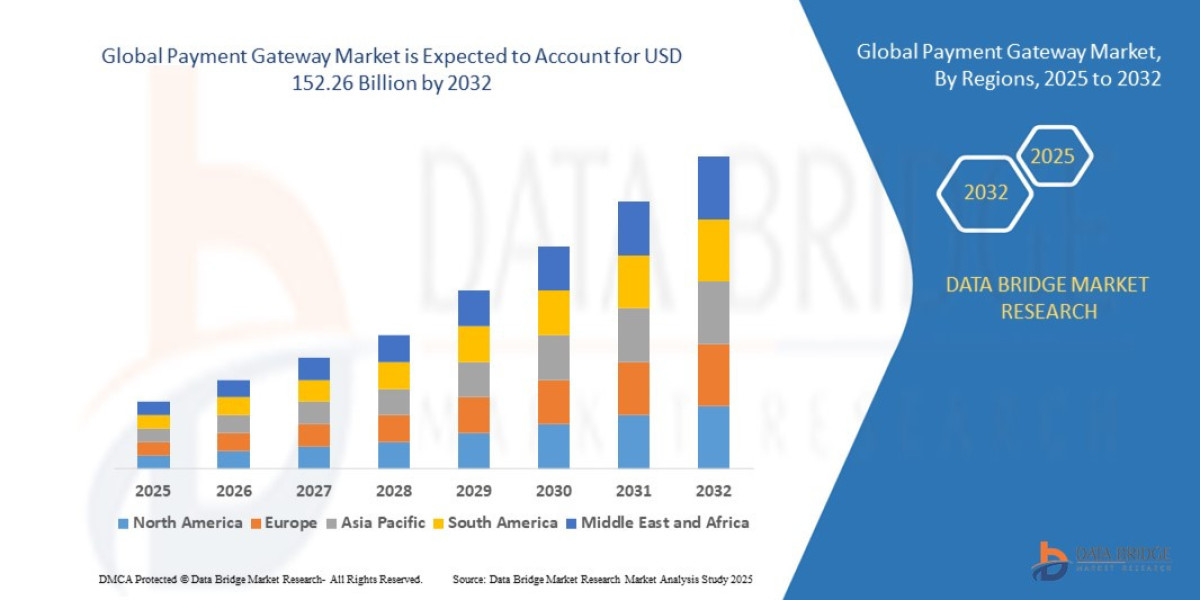

- The global payment gateway market size was valued at USD 35.17 billion in 2024 and is expected to reach USD 152.26 billion by 2032, at a CAGR of 20.10% during the forecast period

2. Market Overview

Defining the Payment Gateway Market

A Payment Gateway is a merchant service provided by an e-commerce application service provider that authorizes card or direct payment processing for online and traditional brick-and-mortar businesses. It securely facilitates the transfer of information between the payment portal (e.g., a merchant's website or POS system) and the acquiring bank, ensuring the authorization, capture, and settlement of funds.

Key Market Segmentation

The market is typically segmented across three primary axes:

Type of Gateway:

Hosted: The customer is redirected to the gateway provider's platform for payment. Easy to implement, higher security assurance, popular with SMEs. (Currently holds a dominant revenue share).

Non-Hosted/API: Allows merchants to retain full control over the checkout experience on their site using APIs. Offers greater customization and flexibility, essential for large enterprises and B2B platforms. (Projected for the fastest CAGR).

Enterprise Size:

Large Enterprises: Account for the largest volume of transactions and market share due to complex, cross-border operations and high transaction throughput.

Small and Medium Enterprises (SMEs): Fastest-growing segment, fueled by global digital transformation and the need for cost-effective, easy-to-integrate solutions.

End-User Vertical:

Retail & E-commerce: The largest consumer of payment gateway services, driven by the shift to online shopping.

BFSI (Banking, Financial Services, and Insurance): Expected to see the fastest growth due to the push for digital banking, mobile payments, and regulatory compliance requirements.

Other Key Verticals: Media & Entertainment (subscription models), Travel & Hospitality (multi-currency booking), and Healthcare (online billing).

Core Market Drivers

The confluence of several macroeconomic and technological factors is fueling this growth:

E-commerce Expansion: The continuous global shift of consumer spending from physical retail to online platforms remains the single most powerful driver.

Mobile-First Transactions: Increasing smartphone penetration and consumer comfort with mobile wallets (Apple Pay, Google Pay) necessitate robust gateway support for mobile-optimized checkout.

Globalization of Commerce: Gateways are crucial for enabling cross-border transactions, managing multi-currency conversions, and navigating complex international tax and compliance regimes.

Subscription Economy: The rise of SaaS, streaming services, and membership models requires sophisticated recurring billing and tokenization capabilities provided by modern gateways.

3. Market Size & Forecast

- The global payment gateway market size was valued at USD 35.17 billion in 2024 and is expected to reach USD 152.26 billion by 2032, at a CAGR of 20.10% during the forecast period

For More Information visit https://www.databridgemarketresearch.com/reports/global-payment-gateway-market

4. Key Trends & Innovations

The payment gateway landscape is defined by continuous technological innovation aimed at increasing speed, security, and flexibility.

A. The Real-Time Payment Revolution

Driven by initiatives like SEPA Instant Credit Transfer in Europe and UPI in India, Real-Time Payments (RTP) and Account-to-Account (A2A) payments are rapidly displacing traditional card rails in certain markets. Gateways must evolve to offer seamless integration with national RTP infrastructures, allowing merchants to accept instant bank transfers, often at a lower cost than card transactions, thereby driving profit margins. The European Payments Initiative (EPI) and its Wero digital wallet further cement the trend towards unified, instant A2A solutions across the EU.

B. Embedded Finance and the Commerce OS

The concept of "Embedded Payments" is transforming the role of the gateway. Gateways are no longer standalone tools but deeply integrated features within vertical software platforms (e.g., Shopify, Mindbody, Toast). Providers like Stripe pioneered this approach, effectively turning their gateways into a Commerce Operating System (OS) that combines payment processing with lending, issuance, treasury management, and fraud protection, creating an end-to-end financial ecosystem for merchants.

C. Advanced Security via AI and Biometrics

As transaction volumes surge, so does fraud risk. Artificial Intelligence (AI) and Machine Learning (ML) are becoming indispensable for real-time fraud detection, analyzing vast datasets to identify subtle, evolving threat patterns more effectively than rules-based systems. Simultaneously, Tokenization (replacing sensitive card data with non-sensitive tokens) and Biometric Authentication (fingerprint, face ID) are enhancing security at the point of transaction, improving both conversion rates and consumer trust.

D. Alternative Payment Methods (APMs)

Gateways must integrate a rapidly expanding array of APMs to cater to global consumers:

Buy Now, Pay Later (BNPL): Services like Klarna and Affirm, offering installment plans, have become mandatory checkout options, driving higher Average Order Value (AOV).

Digital Wallets: Global giants (PayPal, Apple Pay) and regional powerhouses (Alipay, WeChat Pay, PhonePe) remain critical, dominating online transactions in many regions.

Cryptocurrency and CBDCs: While niche, payment gateways are increasingly adding support for direct cryptocurrency settlement. The rise of Central Bank Digital Currencies (CBDCs) represents a future regulatory framework that gateways are preparing to integrate.

5. Competitive Landscape

The Payment Gateway Market is intensely competitive, characterized by high consolidation among major players and rapid innovation from fintech challengers.

Key Market Categories

The competitive field can be broadly categorized:

Pure-Play Gateway/Platform Specialists: Companies whose core business is providing developer-friendly, modern payment infrastructure.

Key Players: Stripe, Adyen, Braintree (a PayPal company). These firms focus on complex, high-growth merchant needs, emphasizing API flexibility and global reach.

Integrated Financial Ecosystems: Traditional players or digital giants that integrate gateways into broader financial services.

Key Players: PayPal (dominant online wallet and payment processor), Block (Square, focused on SMBs and integrated hardware/software), FIS (Worldpay), and Fiserv (Clover).

Card Networks and Acquirers: Traditional processors leveraging their existing infrastructure and banking relationships.

Key Players: Visa, Mastercard, Global Payments, J.P. Morgan.

Strategic Dynamics and Market Share

Market share data remains fragmented, but Amazon Payments and PayPal traditionally hold a significant portion of the total transaction volume. However, companies like Stripe and Adyen have captured major market share from the most demanding, high-volume e-commerce platforms.

Competitive strategies are focused on:

Global Expansion: Rapidly adding local payment methods, currencies, and regulatory compliance in emerging markets (e.g., Adyen’s focus on APAC, PayPal's international platform launches).

Vertical Specialization: Tailoring platform offerings (e.g., risk profiles, recurring billing, marketplace features) to specific industries like SaaS, gambling, or travel.

Fintech M&A: Strategic acquisitions (like Stripe buying Paystack) to gain instant market presence and access to specialized technology or regional expertise.

6. Regional Insights

Regional performance dictates global market momentum, with significant divergence in adoption rates and preferred payment methods.

North America (NA)

North America currently holds the largest revenue share (over 35% in 2024), driven by high consumer purchasing power, mature e-commerce infrastructure, and the presence of major tech firms (Stripe, PayPal, Block). Growth is sustained by the ongoing digital migration of SMEs and the high adoption of integrated, non-hosted gateway solutions that allow for ultimate customization. The US market continues to be heavily reliant on card networks (Visa/Mastercard), although digital wallets are growing.

Asia Pacific (APAC)

APAC is the fastest-growing region globally, projected to expand at a CAGR exceeding 21%. This acceleration is fueled by:

Massive Internet Penetration: Rapid digitalization in China, India, and Southeast Asia.

Government Initiatives: Public digital infrastructure, such as India’s Unified Payments Interface (UPI) and the government’s push for cashless economies, creates enormous, low-cost transaction volume.

Mobile-First Mentality: Digital wallets and QR-code-based payments dominate, requiring gateways to support a vast array of local APMs (e.g., Paytm, Alipay, WeChat Pay).

Europe

Europe is a complex, regulatory-driven market. While overall growth is strong, it is fundamentally shaped by directives like the Revised Payment Services Directive (PSD2) and Open Banking. These regulations have stimulated competition by mandating API access, accelerating the growth of A2A payments and enabling pan-European initiatives like Wero. Digital wallets are highly popular for online shopping, leading to fierce competition between global and domestic players.

7. Challenges & Risks

Despite the buoyant market conditions, several strategic challenges pose barriers to sustained growth and market entry.

Regulatory Fragmentation and Compliance

The most significant operational challenge is navigating the patchwork of global financial regulations. Gateways must achieve and maintain compliance with standards like PCI DSS (data security), GDPR (data privacy), and region-specific AML/KYC laws. For cross-border players, scaling operations means meeting dozens of different national regulatory requirements, a costly and time-consuming undertaking that creates a high barrier to entry for smaller startups.

Technical Debt and Integration Complexity

Many large, established retailers and institutions operate on complex legacy payment systems. Integrating a modern, API-driven payment gateway into these existing Enterprise Resource Planning (ERP) or core banking systems can be technically challenging, expensive, and a source of friction, slowing down innovation adoption.

Fraud Evolution and Cybersecurity Costs

As gateway security improves, fraud actors become more sophisticated. The constant evolution of phishing, account takeover (ATO), and synthetic identity fraud necessitates continuous, multi-million-dollar investment in advanced cybersecurity and AI tools, driving up operational costs for providers. Furthermore, reliance on third-party security certifications can create liability risks for the merchant.

8. Opportunities & Strategic Recommendations

The payment gateway market presents vast opportunities for existing players and new entrants who adopt forward-looking strategies.

A. Strategic Recommendations for Gateway Providers

Embrace Hyper-Localization: Move beyond basic multi-currency support to offer seamless integration of local payment methods, local currency settlement, and locally optimized fraud scoring in target high-growth regions (e.g., Latin America, Southeast Asia).

Become a Full-Stack Commerce Enabler: Expand the product offering beyond transaction processing. Integrate value-added services such as embedded working capital loans, automated tax compliance (VAT/GST), and fully automated financial reconciliation dashboards. The goal is to maximize Lifetime Value (LTV) per merchant.

Invest in A2A Infrastructure: Strategically prioritize integrations with national RTP schemes and Open Banking APIs. Position A2A as a lower-cost, high-conversion alternative to card processing, especially for high-volume B2B and subscription merchants.

B. Strategic Guidance for Merchants

Adopt an Omnichannel Gateway Strategy: Select a gateway provider that seamlessly unifies online, mobile, and in-person transactions under a single data view. This allows for better customer tracking, simplified compliance, and integrated loyalty programs.

Leverage AI for Conversion and Risk: Utilize the advanced fraud tools offered by modern gateways. Use data analytics from the payment provider to identify checkout abandonment points and optimize payment routing to maximize approval rates.

Future-Proof Payment Methods: Ensure the gateway platform offers flexible integration for emerging payment methods like BNPL, digital wallets, and, if applicable, cryptocurrency, to cater to a global and increasingly diverse customer base.

C. Opportunities for Investors and Startups

Niche Vertical Platforms: Invest in fintech solutions that embed payment processing within highly specialized software platforms (e.g., construction management, veterinary clinics, or specific B2B supply chain logistics). Vertical SaaS with embedded payments commands high valuations and strong stickiness.

Focus on Regulatory Tech (RegTech) and Fraud Mitigation: Solutions that use AI to simplify cross-border KYC/AML compliance and provide superior, proactive fraud scoring represent essential, high-value tools needed by all existing gateway providers.

Emerging Corridor Expansion: Fund startups focused exclusively on localizing payment infrastructure in underserved high-growth markets, particularly in Sub-Saharan Africa and specific markets within Latin America, where digital migration is still in its infancy but accelerating rapidly.

Browse More Reports:

Global Algae Fertilizers Market

Global Construction Film Market

Global Antimicrobial Agent Market

Global Benchtop Laboratory Water Purifier Market

Asia-Pacific Feed Flavours and Sweeteners Market

Global Catenary Infrastructure Market

Global Bus Public Transport Market

Latin America Point of Care Infectious Disease Market

Global Innovation Management Market

Middle East and Africa Indium Market

Global Antibiotics Market

Global Potassium Humate Biostimulants Market

Africa MDI, TDI, Polyurethane Market

Global Dental Diode Lasers Market

Middle East and Africa Artificial Turf Market

Global Hematologic Malignancies Market

Latin America Ostomy Devices Market

Asia-Pacific Rotomolding Market

Philippines Microgrid Market

Global Automated Beverage Carton Packaging Machinery Market

Global Surgical Power Tools Market

Europe Intensive Care Unit (ICU) Ventilators Market

Global Vasodilators Market

Global Methylene Diphenyl Diisocyanate (MDI), Toluene Diisocyanate (TDI) and Polyurethane Market

Global Constrictive Pericarditis Market

Middle East and Africa q-PCR Reagents Market

Global Artificial Turf Market

Global Styrene Butadiene Latex Market

Global Digital Farming Software Market

Global Alpha Linolenic Acid Market

Global Head and Neck Cancer Drug Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com