Executive Summary

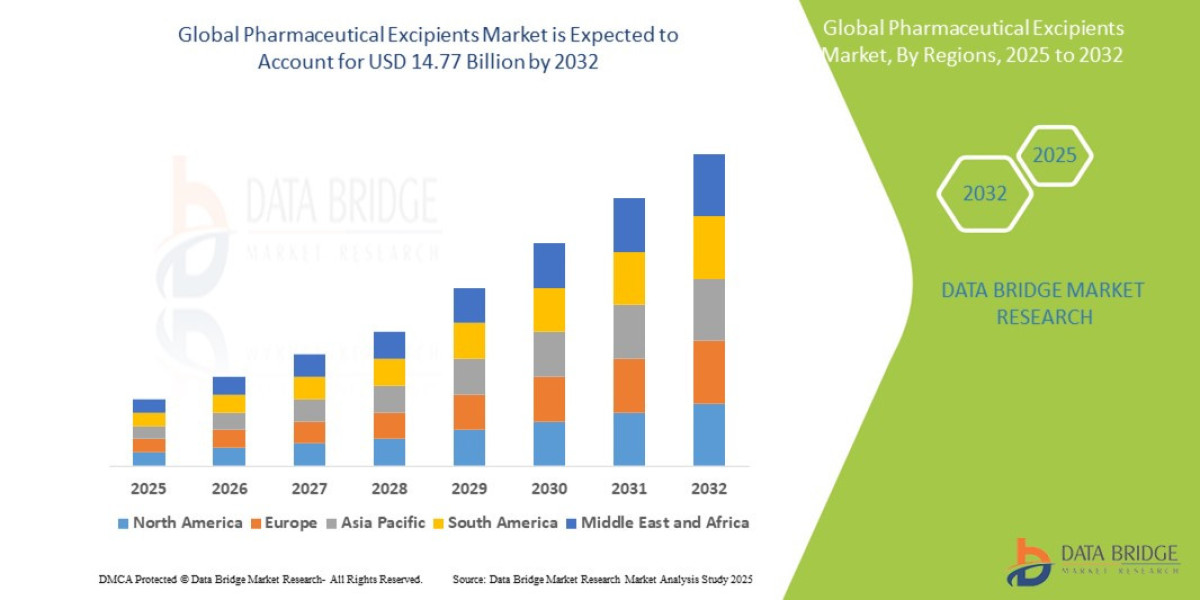

- The global pharmaceutical excipients market size was valued at USD 8.85 billion in 2024 and is expected to reach USD 14.77 billion by 2032, at a CAGR of 6.60% during the forecast period

Market Overview

The Pharmaceutical Excipients Market comprises the substances, other than the active pharmaceutical ingredient (API), that are included in the manufacturing of drug products. Their functions are diverse and crucial, ranging from binding ingredients together and improving taste (sweeteners) to controlling the rate of drug release (controlled-release agents).

Key Market Segmentation

The market is commonly segmented based on two primary dimensions: chemical origin and functional properties.

1. By Chemical Origin:

Inorganic Chemicals: Calcium phosphates, sodium chloride, titanium dioxide.

Organic Chemicals (Largest Share): Carbohydrates (starches, cellulose derivatives), Petrochemicals (propylene glycol), and Oleochemicals (fats and oils).

2. By Functional Property (The Growth Engine):

Fillers/Diluents (Largest Volume): Used to increase the size of tablets or capsules to make them manageable (e.g., lactose, microcrystalline cellulose).

Binders: Ensure ingredients stick together (e.g., povidone, starch paste).

Disintegrants: Help tablets break down in the gastrointestinal tract (e.g., croscarmellose sodium).

Solubilizers/Emulsifiers (Highest Growth): Critical for enhancing the bioavailability of poorly soluble APIs, especially prevalent in modern drug pipelines.

Controlled-Release Agents: Polymers used to modulate the drug release profile over time (e.g., hypromellose).

Key Market Drivers and Current Dynamics

Growth in Biologics and Biosimilars: Biologic drugs (e.g., antibodies, proteins) require highly specialized, high-purity excipients (like specific amino acids and buffers) to maintain stability and prevent aggregation, driving demand for premium, low-trace-contaminant grades.

Proliferation of Generic Drugs: As blockbuster drugs lose patent protection, the vast volumes of generic manufacturing necessitate large, consistent supplies of standard excipients like lactose and cellulose.

Focus on Drug Delivery Enhancement: Approximately 40% of newly developed APIs exhibit poor aqueous solubility. This drives intense demand for functional excipients—such as liposomes, cyclodextrins, and novel polymers—that improve solubility, dissolution rates, and overall bioavailability.

Adoption of Continuous Manufacturing (CM): CM requires excipients with extremely consistent flow properties, particle size distribution, and compressibility to maintain uninterrupted production flow, creating demand for pre-processed or engineered materials.

Market Size & Forecast

- The global pharmaceutical excipients market size was valued at USD 8.85 billion in 2024 and is expected to reach USD 14.77 billion by 2032, at a CAGR of 6.60% during the forecast period

For More Information visit https://www.databridgemarketresearch.com/reports/global-pharmaceutical-excipients-market

Key Trends & Innovations

The future of the excipients market is defined by materials engineering, improved process efficiency, and patient-centric delivery systems.

1. Co-Processed Excipients (CPEs)

CPEs are materials composed of two or more existing excipients physically processed together (e.g., spray-drying, co-granulation) to create a single product with superior functionality. They offer enhanced properties like better flowability, higher compressibility, and faster disintegration than their individual components. CPEs reduce the complexity and variability of the formulation process, making them ideal for the efficiency demands of continuous manufacturing.

2. Excipients for Novel Delivery Systems

Innovations are focused on enabling complex drug forms:

Parenteral Excipients: Ultra-high purity buffers, stabilizers (e.g., trehalose, polysorbates), and specific amino acids are required for injectable and lyophilized (freeze-dried) biologic products to ensure protein stability throughout the shelf life.

3D Printing (Additive Manufacturing): Customized filament and powder excipients (often highly compressible polymers) are being developed to serve the pharmaceutical 3D printing sector, enabling personalized, on-demand dosage forms.

3. Regulatory Clarity and Standardization

There is an increasing global movement to establish clearer regulatory standards specifically for excipients, often mirroring the rigor applied to APIs. Initiatives like the International Pharmaceutical Excipients Council (IPEC) are pushing for standardized Good Manufacturing Practices (GMPs) for excipient supply chains, driving quality and discouraging the use of industrial-grade materials in drug products.

4. Development of Polymeric Excipients

Polymers, such as polyvinylpyrrolidone (PVP), cellulose derivatives, and poly(lactic-co-glycolic acid) (PLGA), are foundational to advanced delivery. Research is focused on creating bio-degradable and bio-compatible polymers that offer fine-tuned control over the degradation rate, which is essential for long-acting injectables and implants.

Competitive Landscape

The excipients market is a mature landscape characterized by a blend of large, diversified chemical/food ingredient companies and highly specialized, pharmaceutical-focused firms.

Major Players and Market Structure

Large Diversified Producers: Companies like Ashland Global Holdings Inc., DuPont, and BASF SE leverage their massive chemical production scale and R&D capabilities to supply a broad portfolio of cellulose derivatives, polymers, and standard excipients. They typically command market share through volume and global distribution networks.

Specialty/Pharma-Focused Players: Firms such as Evonik Industries AG and Roquette Frères concentrate heavily on developing high-margin, functional excipients, including specialized carriers for solubility enhancement, parenteral applications, and pediatric formulations. Their strategy centers on patent protection and deep collaboration with pharmaceutical R&D teams.

Regional Dominance: The market for standard excipients (e.g., lactose, starch) often remains regional, influenced by local sourcing and regulatory requirements.

Competitive Strategies

Innovation through Collaboration: Key players actively engage in joint ventures and strategic R&D agreements with major pharmaceutical companies (Big Pharma) to co-develop novel excipients tailored to specific drug delivery challenges.

Vertical Integration and Supply Security: Due to the critical nature of supply, leading manufacturers are integrating backwards into key raw material supply chains to ensure consistency and minimize geopolitical supply risk.

Certification and Compliance: Competition is increasingly focused on quality assurance. Excipient suppliers gain competitive advantage by offering comprehensive documentation, full traceability, and compliance with the most stringent global quality standards (e.g., IPEC-GMP).

Regional Insights

Market demand and growth vectors are distinctly polarized between highly regulated mature regions and rapidly expanding manufacturing hubs.

North America & Europe (Maturity and High Value)

These regions represent the largest revenue share, driven by robust spending on R&D, a high concentration of biopharmaceutical innovation, and stringent regulatory oversight.

Focus: Strongest demand for specialty and ultra-high purity excipients for complex generics, biologics, and novel drug delivery platforms. The regulatory environment here demands top-tier quality standards.

Asia-Pacific (APAC) (Fastest-Growing Market)

APAC is projected to exhibit the highest CAGR due to explosive growth in generic drug manufacturing, burgeoning domestic pharmaceutical R&D, and increasing healthcare access.

Dynamics: India and China are major hubs for both consumption and low-cost production of standard excipients. The market presents massive opportunities for imported specialty excipients, as local manufacturers strive to meet global quality expectations for exports.

Latin America & Middle East/Africa (MEA)

These regions currently rely heavily on imported excipients. Growth is linked to foreign investment and the establishment of local formulation and finishing plants, driving moderate but steady demand for basic and imported certified excipients.

Challenges & Risks

The excipients market faces unique risks associated with regulatory rigor and complex supply chain logistics.

1. Regulatory Heterogeneity and Approval Complexity

Unlike APIs, excipients often lack a unified, global regulatory approval pathway. Changes in excipient sourcing or grade can trigger extensive and costly re-testing and regulatory filing changes for the final drug product, creating a strong disincentive for pharmaceutical companies to switch suppliers.

2. Supply Chain Fragility and Raw Material Dependency

Many excipients are derivatives of commodities (e.g., cellulose from wood pulp, lactose from milk). Volatility in agricultural markets, coupled with geopolitical risks and the difficulty of maintaining pharmaceutical-grade purity across a globalized, multi-step supply chain, presents a constant risk to supply security and cost.

3. Intellectual Property (IP) Constraints

The IP landscape for excipients is challenging. Since most specialty excipients are modifications of existing materials, securing broad patent protection can be difficult, leaving innovative firms vulnerable to swift generic competition or reverse-engineering.

4. High Barrier to Entry for Specialty Materials

The development of a truly novel, high-purity excipient requires years of clinical and toxicological testing (often exceeding $1 million per material) before it can be used in a new drug formulation, creating a significant and lengthy financial hurdle.

Opportunities & Strategic Recommendations

Success in the modern excipients market requires a strategy centered on high functionality, quality assurance, and solving formulation-level challenges for drug developers.

Strategic Recommendations for Stakeholders

Invest in Co-Processing Technology: Excipient manufacturers should shift CapEx from basic material synthesis to advanced particle engineering (e.g., spray drying, melt extrusion). This enables the creation of high-margin, functionally superior CPEs that simplify formulation for customers and command premium pricing.

Target Biologics and Parenteral Markets: Investors should prioritize companies specializing in ultra-high-purity, low-endotoxin excipients and stabilizers (e.g., specific phospholipids and buffers) essential for injectable and temperature-sensitive biologic drugs, the highest growth segment in pharma R&D.

Leverage Digital Traceability: Implement blockchain or advanced serialization technology across the entire supply chain. Offering customers immutable proof of excipient origin, handling, and quality reduces their regulatory risk and establishes the supplier as a preferred, trusted partner.

Embrace Standardization and Global Quality: Proactively adhere to and promote unified global excipient quality standards (like IPEC-GMP). Establishing a reputation for uncompromising quality is a necessity for gaining market share in regulated markets (North America, EU) and for supporting APAC manufacturers in their drive for export compliance.

Browse More Reports:

Middle East and Africa Microgrid Market

Global Febuxostat Market

Global Carbon Steel Market

Global Consumer Chemical Packaging Market

Global Plasmonic Solar Cell Market

Global Electro-medical and Electrotherapeutic Apparatus Market

Global Network Test Lab Automation Market

Global Reclaimed Rubber Market

Global Personal Care Ingredients Market

Global Protein Ingredients in Infant Nutrition Market

Middle East and Africa Frozen Ready Meals Market

Global Surgical Gown Market

Global Navigation Satellite System (NSS) Chip Market

Saudi Arabia q-PCR Reagents Market

Global Aluminum Pigments Market

Global Bearing Isolators Market

Asia-Pacific Ostomy Devices Market

North America Digital Farming Software Market

Global Reconstituted Juice Market

Global Organic Emulsifier Market

Global Metal Cans Market

Asia-Pacific Healthcare Logistics Market

Global Protein Ingredients Market

Global Regulatory Affairs Outsourcing Market

Global Self-Service Kiosks Market

Global Specialty Gas Market

Global Bathroom - Toilet Assist Devices Market

Global Benzenecarboxylic Acid Market

Global Aerospace Fasteners Market

Global Phenol Derivatives Market

Global Mucosal Atomization Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com