Executive Summary

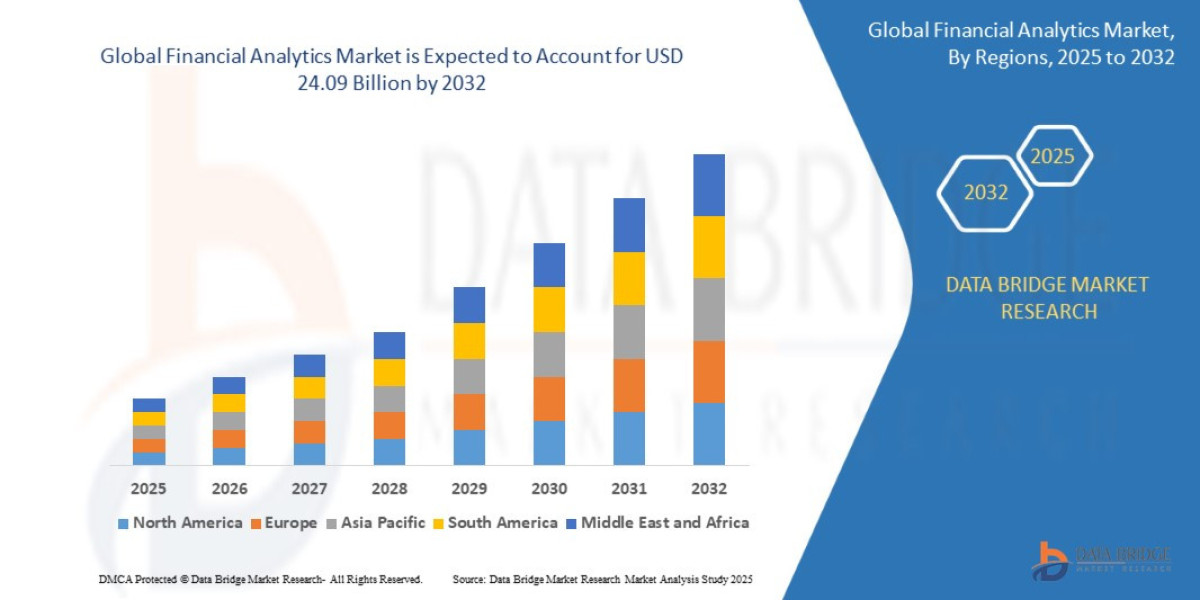

- The global financial analytics market was valued at USD 10.99 billion in 2024 and is expected to reach USD 24.09 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.30%,

Market Overview

Financial analytics solutions provide the capability to model, forecast, and manage financial performance. They move beyond traditional Business Intelligence (BI) by applying statistical methods and computational techniques to financial data to quantify risk, identify fraudulent activity, and inform strategic capital allocation.

Key Segmentation by Component and Application

The market is typically segmented by solution type (software vs. services) and, more critically, by functional application:

1. By Component:

Software: Includes core platforms, dedicated modules (e.g., liquidity risk software), and specialized applications (e.g., algorithmic trading tools). This segment holds the largest market share.

Services: Professional consulting, system integration, training, and managed services for implementing and maintaining complex platforms.

2. By Application (The Value Drivers):

Risk Analytics (Dominant Segment): Credit risk modeling, market risk assessment, regulatory capital calculation, and stress testing.

Fraud Detection and Security Analytics: Real-time transaction monitoring, anti-money laundering (AML), and customer authentication.

Portfolio, Performance, and Profitability Analytics (PPA): Customer lifetime value (CLV) calculation, product profitability analysis, and investment strategy back-testing.

Customer Analytics: Hyper-personalization, churn prediction, and targeted marketing campaigns.

Key Market Drivers and Current Dynamics

Big Data Explosion in Finance: The exponential increase in transactional data, alternative data sources (e.g., social media sentiment, satellite imagery), and IoT data necessitates sophisticated tools to process, clean, and derive value from unstructured data.

Intensifying Regulatory Pressure: Post-financial crisis regulations demand increasingly complex and granular reporting, particularly in stress testing and liquidity risk. Analytics solutions are essential for achieving compliance efficiently.

Digital Transformation of Banking: The shift to digital-first banking and open banking APIs generates real-time data streams that require immediate analysis for competitive advantage and enhanced customer experience.

Cost Optimization and Efficiency: Firms utilize analytics to optimize back-office operations, reduce manual errors, and automate key financial processes, directly impacting the bottom line.

Market Size & Forecast

- The global financial analytics market was valued at USD 10.99 billion in 2024 and is expected to reach USD 24.09 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.30%,

For More Information Visit https://www.databridgemarketresearch.com/reports/global-financial-analytics-market

Key Trends & Innovations

The current wave of innovation is centered on augmenting human decision-making with automated, real-time insights powered by AI.

1. Generative AI for Financial Modeling and Reporting

Generative AI (GenAI) is transforming back-office efficiency. It can automatically generate draft financial reports, synthesize complex regulatory documents, and create realistic synthetic data sets for stress testing and model validation, dramatically reducing the time spent on manual preparation and review.

2. Real-Time Transaction and Liquidity Analytics

The move toward instant payments necessitates real-time risk scoring. Solutions are evolving to process millions of transactions per second, enabling FIs to block fraudulent payments immediately, manage liquidity needs with zero latency, and provide instant credit approvals based on dynamic risk profiles.

3. Explainable AI (XAI) and Model Risk Governance

Given the highly regulated nature of finance, the use of "black-box" ML models is a significant risk. XAI tools are crucial innovations, providing transparent insights into how AI models arrive at a specific decision (e.g., why a loan was denied). This ensures compliance, builds trust, and allows human analysts to audit and validate complex predictive systems.

4. Cloud-Native and Modular Architecture

Modern financial analytics platforms are almost exclusively cloud-native, leveraging hyperscale computing resources. They are designed using modular, API-first microservices, allowing FIs to integrate specific analytic capabilities (e.g., climate risk modeling, alternative data ingestion) without replacing their entire legacy infrastructure.

Competitive Landscape

The market is highly competitive, featuring established enterprise software vendors, specialized FinTech players, and major cloud providers, often collaborating through ecosystems.

Major Players and Market Strategies

Enterprise Software Giants: Companies like SAP, Oracle, and IBM leverage their deep integration within large corporate enterprise resource planning (ERP) and legacy systems. Their strategy focuses on offering integrated, end-to-end financial management and analytics suites.

Specialized Risk & Compliance Vendors: Firms such as Fiserv, Moody's Analytics, and SAS Institute dominate specific high-value niches like credit risk scoring, regulatory reporting, and fraud detection. Their competitive advantage lies in deep domain expertise and proprietary financial models.

Cloud Platform Providers: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) are increasingly offering native analytical services (AI/ML platforms, large-scale data warehousing) that serve as the foundation for FinTech and in-house development teams, fundamentally changing the market's infrastructure layer.

Competitive Dynamics

Ecosystem Building: The trend is shifting from selling monolithic software to building an API-driven ecosystem where solutions from different providers (e.g., a credit risk model from one vendor, a market data feed from another) can easily integrate onto a client's cloud platform.

Talent and Domain Expertise: The crucial differentiator is the ability to combine data science expertise with deep financial domain knowledge. Vendors must not only provide algorithms but also regulatory and financial modeling consultants.

Pricing Models: Subscription-based Software-as-a-Service (SaaS) and consumption-based pricing models are replacing traditional licensing, providing FIs with greater flexibility and lower upfront CapEx.

Regional Insights

Market maturity tracks closely with the development of financial infrastructure, regulatory complexity, and the adoption rate of cloud technologies.

North America (Technology Leader and Largest Market)

North America is the largest revenue contributor, driven by a high concentration of sophisticated capital markets, advanced FinTech innovation, and strict regulatory enforcement.

Focus: Leading the adoption of AI/ML for algorithmic trading, predictive credit modeling, and utilizing alternative data sources.

Europe (Regulatory Compliance Driver)

Europe exhibits strong demand driven heavily by complex, pan-European regulatory mandates (e.g., MiFID II, GDPR, and ESG reporting requirements).

Focus: High investment in risk and compliance analytics. Cloud adoption is accelerating, though often tempered by data residency and security concerns specific to the GDPR.

Asia-Pacific (APAC) (Fastest Growing)

APAC is the fastest-growing market, fueled by rapid economic expansion, increasing disposable incomes, and the digital transformation of financial services in countries like China, India, and Southeast Asia.

Dynamics: Significant greenfield opportunities for deploying modern, cloud-native analytics infrastructure, leapfrogging the need for legacy systems.

Challenges & Risks

Despite the momentum, the market must address significant structural and technical hurdles to achieve its full potential.

1. Data Silos and Quality

A major barrier remains the fragmentation of data across legacy systems (data silos) within FIs. Analytics platforms are only as effective as the data they process; ensuring data quality, consistency, and clean lineage across various departments remains a massive integration challenge.

2. Regulatory and Ethical Concerns for AI

The use of AI in finance raises ethical risks related to bias (e.g., discriminatory loan approvals) and fairness. Regulators are increasing scrutiny on model validation and auditing, necessitating significant investment in Model Risk Governance (MRG) frameworks and XAI tools, which slow deployment.

3. Talent Gap

There is a severe global shortage of professionals capable of bridging the gap between advanced data science (AI/ML engineering) and specialized financial domain knowledge (e.g., risk quantification, portfolio theory). This talent gap drives up service costs and limits in-house development capabilities.

4. Integration with Legacy Core Systems

Many large FIs still rely on decades-old core banking systems. Integrating modern, cloud-native analytics solutions with these rigid, on-premise platforms is expensive, time-consuming, and a primary source of project failure.

Opportunities & Strategic Recommendations

The path to market leadership lies in providing high-performance, trustworthy, and specialized solutions that can navigate complex regulatory environments.

Strategic Recommendations for Vendors and Startups

Specialize in Regulatory Niche-Tech: Develop proprietary AI/ML models explicitly trained for high-complexity regulatory areas, such as Climate Risk (ESG) Stress Testing or IFRS 17/9 provisioning. These specialized solutions command high margins and are recession-resistant due to mandatory compliance.

Prioritize XAI and Governance: Do not market powerful algorithms without an equally robust Explainable AI (XAI) component. Transparency is the new compliance standard; vendors must position their solutions as "auditor-ready."

Offer "Analytics-as-a-Service" (AaaS): Focus on developing modular, easily integrated APIs for specific financial functions (e.g., a "Real-Time Liquidity Predictor API") rather than large, complex platforms. This accelerates adoption by allowing customers to buy precisely what they need.

Recommendations for Financial Institutions and Investors

Invest in Data Infrastructure First: FIs should prioritize the creation of a centralized cloud-based Data Lake or Data Mesh architecture before purchasing expensive analytic software. Clean, centralized data is the prerequisite for AI success.

Target Regional Growth in APAC: Investors should seek opportunities in local FinTech firms in high-growth APAC markets that are deploying modern, modular analytic solutions, as these often have a competitive advantage over legacy global providers struggling with local compliance.

Upskill the Workforce: FIs must invest in extensive training to create "citizen data scientists"—business users who understand how to leverage analytics tools effectively, maximizing the ROI on software investments.

Browse More Reports:

Middle East and Africa Microgrid Market

Global Febuxostat Market

Global Carbon Steel Market

Global Consumer Chemical Packaging Market

Global Plasmonic Solar Cell Market

Global Electro-medical and Electrotherapeutic Apparatus Market

Global Network Test Lab Automation Market

Global Reclaimed Rubber Market

Global Personal Care Ingredients Market

Global Protein Ingredients in Infant Nutrition Market

Middle East and Africa Frozen Ready Meals Market

Global Surgical Gown Market

Global Navigation Satellite System (NSS) Chip Market

Saudi Arabia q-PCR Reagents Market

Global Aluminum Pigments Market

Global Bearing Isolators Market

Asia-Pacific Ostomy Devices Market

North America Digital Farming Software Market

Global Reconstituted Juice Market

Global Organic Emulsifier Market

Global Metal Cans Market

Asia-Pacific Healthcare Logistics Market

Global Protein Ingredients Market

Global Regulatory Affairs Outsourcing Market

Global Self-Service Kiosks Market

Global Specialty Gas Market

Global Bathroom - Toilet Assist Devices Market

Global Benzenecarboxylic Acid Market

Global Aerospace Fasteners Market

Global Phenol Derivatives Market

Global Mucosal Atomization Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com