Executive Summary

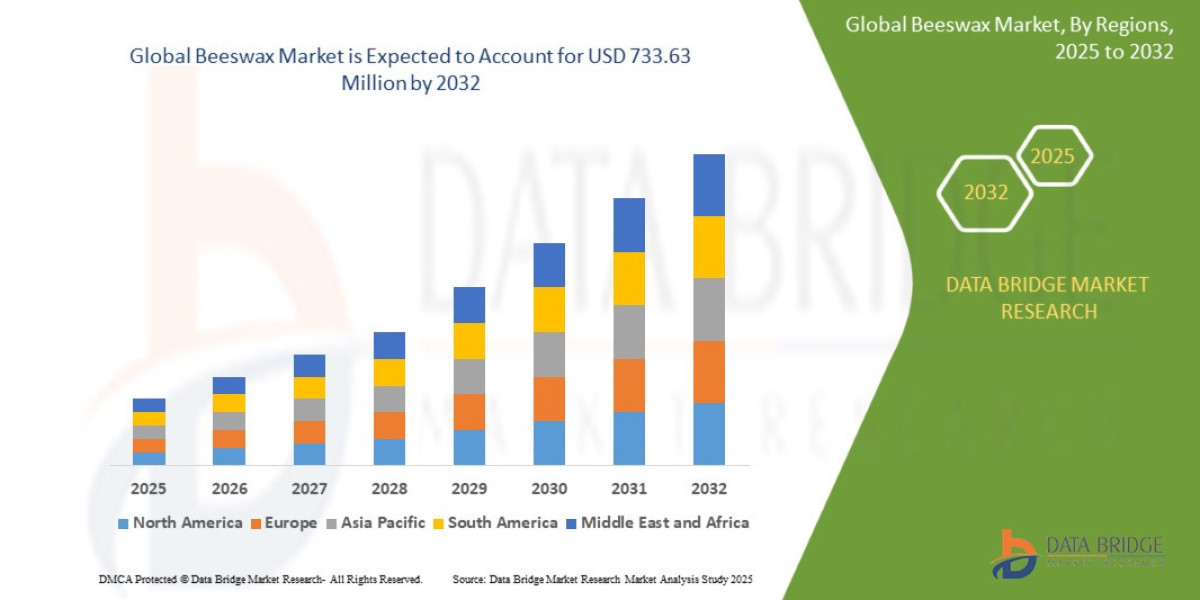

- The global beeswax market was valued at USD 579.14 million in 2024 and is expected to reach USD 733.63 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.00%,

Market Overview

Beeswax is a natural wax produced by worker honeybees, prized for its unique chemical composition, which provides exceptional emulsifying, emollient, and film-forming properties. It is chemically composed primarily of esters of long-chain alcohols and fatty acids.

Key Segmentation by Product Type and Application

The market is commonly segmented based on the degree of processing and the final end-use application:

1. By Product Type:

Yellow Beeswax (Crude/Unrefined): The least processed form, retaining its natural yellow color, slight fragrance, and higher propolis content. Used widely in candle making and certain industrial applications.

White Beeswax (Refined/Bleached): Processed via methods like solar bleaching or activated carbon filtration to remove impurities and color. This premium grade is essential for pharmaceuticals and high-end cosmetics where color consistency is paramount. This segment commands the highest price point.

2. By Application (The Primary Demand Driver):

Cosmetics and Personal Care (Dominant Segment): Used in lip balms, lotions, creams, deodorants, and makeup for its natural texture and moisturizing properties.

Pharmaceuticals: Employed as a coating agent for tablets, a vehicle for drug delivery (e.g., suppositories), and a stiffening agent in medicinal ointments.

Food and Beverages: Used as a natural glazing agent for candies, fruits, and chewing gum, and as a release agent for bakery products.

Industrial Applications: Includes manufacturing of candles, furniture polish, leather treatment, and dental impression wax.

Key Market Drivers and Current Dynamics

Clean Label and Natural Ingredients Trend: The dominant driver is the accelerating consumer preference for "clean label" products, pushing manufacturers away from petroleum-derived waxes and synthetic polymers toward natural, sustainably sourced alternatives like beeswax.

Growth in Nutraceuticals and Functional Foods: Increased usage as an encapsulating or coating agent for nutritional supplements and functional food components to enhance stability and controlled release.

Strict Pharmaceutical Standards: Its inert, non-toxic, and biocompatible nature ensures continued high demand within regulated pharmaceutical and medical device manufacturing.

Supply Chain Vulnerability: Current market dynamics are heavily influenced by the volatile supply of crude beeswax, directly tied to honeybee health (Colony Collapse Disorder, pesticide use) and global beekeeping economics.

Market Size & Forecast

- The global beeswax market was valued at USD 579.14 million in 2024 and is expected to reach USD 733.63 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.00%,

For More Information Visit https://www.databridgemarketresearch.com/reports/global-beeswax-market

Key Trends & Innovations

Innovation in the beeswax market is less about fundamental material science and more about process engineering, quality control, and ethical sourcing practices.

1. Advanced Refining and Purification Technologies

Manufacturers are investing in advanced refining methods (e.g., specific filtration, solvent-free purification) to eliminate trace contaminants, such as pesticide residues and heavy metals, which are frequently found in crude wax due to environmental exposure. This is crucial for meeting the stringent purity requirements of the pharmaceutical and specialized food sectors.

2. Traceability and Origin Certification

The "natural" claim is insufficient for modern consumers. The key trend is the demand for complete supply chain traceability. Brands are adopting technology (e.g., QR codes, digital ledger systems) to prove the wax's origin, the beekeeper's practices, and verify that the harvesting methods are non-harmful to the bee colony (ethical sourcing). Certifications from organizations like the Organic Trade Association or specific regional beekeeper associations are becoming non-negotiable.

3. Sustainable and Ethical Sourcing Initiatives

Major corporate buyers are establishing long-term, direct partnerships with beekeeper cooperatives to ensure fair trade practices and encourage sustainable beekeeping. This trend helps mitigate supply risk while bolstering the ethical credentials of the final product—a major selling point in the beauty market.

4. Co-Excipient Development

In pharmaceuticals, beeswax is increasingly being co-processed with other polymers or fats to create novel functional excipients. This combination can fine-tune the wax's physical properties (e.g., melting point, viscosity) for specific controlled-release drug delivery systems or specialized medical device coatings.

Competitive Landscape

The market is characterized by a fragmented supply side (millions of small beekeepers) and a concentrated demand side, dominated by a few large refiners, distributors, and major corporate end-users.

Major Players and Market Structure

Refiners and Processors (Market Dominators): Companies such as Koster Keunen, Poth Hille & Co. Ltd., and Strahl & Pitsch, Inc. specialize in sourcing crude wax globally, managing purification processes, and providing consistent, standardized grades (e.g., pharmaceutical-grade white wax) to large industrial clients. They control the value-added segment.

Regional Cooperatives: Beekeeping associations and regional co-ops play a crucial role as aggregators of crude wax, often acting as the primary point of contact between thousands of small beekeepers and large-scale refiners.

Major End-Users: Large multinational cosmetic (e.g., L'Oréal, Estée Lauder) and pharmaceutical firms drive the quality specifications and purchasing volumes, often demanding direct relationships or multi-sourcing contracts with certified refiners.

Competitive Strategies

Quality Standardization: Competition among refiners is based on the ability to consistently deliver wax that meets low pesticide residue thresholds and precise melting points, regardless of the crude wax's country of origin. USP/NF and Ph. Eur. certification is a competitive baseline in pharma.

Vertical Partnership and Sourcing Security: Leading refiners secure long-term, often exclusive, sourcing agreements with large, well-managed beekeeping operations or cooperatives in stable geographies to guarantee raw material supply and price stability.

Diversification of End-Use: Successful players actively seek to expand their portfolio across multiple sectors (e.g., selling food-grade wax alongside cosmetic-grade wax) to mitigate risk associated with cyclical demand in any single industry.

Regional Insights

Beeswax production is globally dispersed, but consumption is concentrated in regions with large pharmaceutical and cosmetics industries.

Asia-Pacific (APAC) (Leading Producer and Growth Market)

APAC, particularly China, India, and Turkey, is a major global producer of crude beeswax, primarily due to the vast scale of local beekeeping operations.

Dynamics: While a key supplier of crude wax, the region is also rapidly growing as a consumer, driven by a burgeoning middle class demanding natural and organic personal care products. This creates a high demand for imported, high-purity refined wax for local production.

North America & Europe (High-Value Consumption)

These regions are the largest markets by value, characterized by mature consumer demand for premium products and the strictest regulatory requirements.

Focus: Dominated by the demand for highly refined, certified white beeswax for pharmaceuticals and high-end cosmetics. Consumption is less affected by price and more by proven quality and ethical sourcing credentials.

Latin America & Africa (Emerging Sourcing Hubs)

These regions are increasingly targeted as alternative sourcing hubs (e.g., Ethiopia, Tanzania, Brazil) to diversify supply away from traditional Asian sources, often offering high-quality, ethically-certified wax. Investment in local processing capabilities is a key emerging opportunity here.

Challenges & Risks

The market is fundamentally challenged by biological and environmental risks that threaten the stability of the entire supply chain.

1. Supply Chain Instability (Bee Health)

The most critical risk is the direct correlation between global honeybee health (threatened by climate change, pests like the Varroa mite, and widespread pesticide use) and the volume of crude beeswax production. Volatile supply leads to unpredictable price fluctuations and security of sourcing issues.

2. Adulteration and Quality Control

Crude beeswax is highly susceptible to adulteration, where cheap fillers like paraffin wax or tallow are added to increase volume and profit. Detecting sophisticated adulteration requires advanced analytical testing (e.g., chromatographic techniques), increasing costs and posing a constant quality control challenge for refiners and end-users.

3. Regulatory Contaminant Limits

For pharmaceutical and food-grade applications, the risk of pesticide and heavy metal residues is a serious barrier. The cost of sourcing crude wax clean enough to meet these limits, and the expensive purification process required, adds significant pressure to manufacturers' margins.

4. Competition from Natural Substitutes

While synthetic alternatives face a consumer backlash, other natural waxes, such as candelilla, carnauba, and rice bran wax, pose competitive risks, especially in formulations where a slightly different texture or melting point is desired.

Opportunities & Strategic Recommendations

Market success requires mitigating supply risks through sustainable practices and establishing unassailable quality control standards.

Strategic Recommendations for Manufacturers and Refiners

Invest in API-Grade Purification: Refiners must invest in state-of-the-art purification technology capable of ensuring traceability and near-zero residue levels. Position products not just as "natural" but as "pharmaceutical-grade natural," justifying the premium price point.

Direct Sourcing Partnership Model: Shift away from spot market purchases. Establish long-term, fair-trade contracts with beekeeper cooperatives. This secures supply volume, ensures ethical compliance, and provides powerful marketing storytelling for the end-user brands.

Digital Transparency Integration: Implement a blockchain or digital ledger system to record quality checkpoints (pesticide screening, purity tests) and geographical origin for every batch. Offer this transparency data directly to high-volume corporate buyers.

Recommendations for End-Users and Investors

Diversify Geographical Sourcing: Invest in developing sourcing relationships in underutilized regions (e.g., Africa, Latin America) known for lower pesticide usage and strong beekeeper organization to mitigate reliance on volatile Asian supply.

Focus on Cosmetic/Pharma Hybrids: Target investment in specialty wax processors that are developing co-processed beeswax excipients tailored for advanced, high-value drug delivery or high-performance, anhydrous (waterless) cosmetic formulations.

Sponsor Bee Health Initiatives: Major corporate end-users should dedicate funding to local beekeeping education, pest control, and sustainable agriculture practices. This stabilizes their own supply chain while fulfilling rising ESG (Environmental, Social, and Governance) obligations.

Browse More Reports:

Global Testing, Inspection, and Certification (TIC) Market

Global Probe Card Market

Global Acute Lymphocytic/Lymphoblastic Leukemia (ALL) Diagnostics Market

Global Coconut Syrup Market

Middle East and Africa Biometrics in Government Market

Global Cleaning Service Software Market

Global Energy Efficient Windows Market

Global Complex Fertilizers Market

Global Bleeding Disorders Treatment Market

Global Automotive Torque Actuator Motor Market

Global Predictive Asset Management Manufacturing Analytics Market

North America Artificial Turf Market

Europe Topical Corticosteroids Market

Global Compliance Data Management Market

Global Optical Emission Spectroscopy Market

Australia and New Zealand Healthcare Logistics Market

Global Hand Holes Market

North America Pulses Market

Global Epidermolytic Ichthyosis Market

Global Epithelioid Sarcoma Treatment Market

North America Potato Processing Market

Global Medical Imaging (3D and 4D) Software Market

Global Castleman Disease Drug Market

Global Natural Fertility Supplements Market

North America Rice Husk Ash Market

Global Catalytic Converter Market

Global Grain Processing Equipment Market

Global Cylindrical Lock Market

North America Flotation Reagents Market

Global Pet Water Dispenser Market

Global Underwater Cameras Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com