Executive Summary

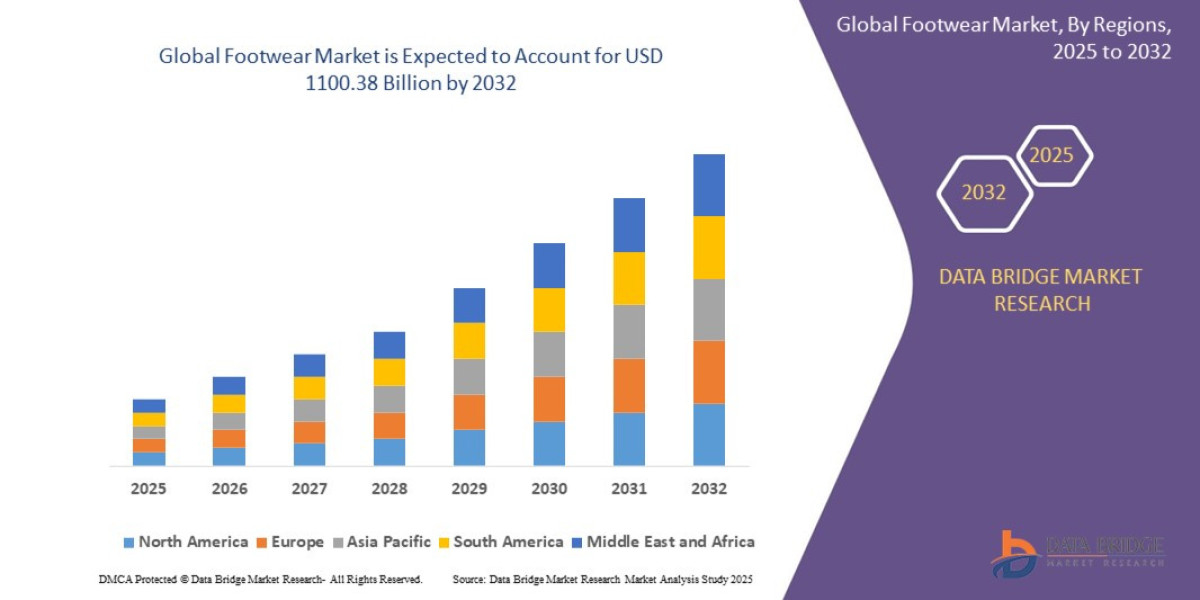

- The global footwear market size was valued at USD 700.90 billion in 2024 and is expected to reach USD 1100.38 billion by 2032, at a CAGR of 5.80% during the forecast period

Market Overview

The Footwear Market involves the design, manufacture, distribution, and retail of all coverings for the feet. It is highly segmented, driven by both functional necessity and fast-moving fashion trends.

Key Segments by Product Type

Non-Athletic/Casual Footwear (Largest Segment): Includes everyday casual shoes, sandals, boots, and formal shoes. Demand here is stable but highly influenced by fashion cycles and seasonal factors.

Athletic Footwear (Fastest Growing Segment): Comprises running shoes, training shoes, basketball shoes, and specialized sport shoes. This segment is bolstered by the athleisure trend, where performance-oriented shoes are worn for daily activities.

Specialty/Protective Footwear: Includes work boots, safety footwear, and medical/orthopedic shoes.

Key Segments by Distribution Channel

Online/E-commerce (Fastest Growing Channel): Includes brand-owned DTC websites and major e-retail platforms (e.g., Amazon, Zalando). Offers speed, greater inventory depth, and direct consumer data capture.

Offline/Retail Stores (Dominant Channel): Includes brand-owned stores, department stores, and multi-brand athletic retailers. Still vital for consumer touchpoints, product fitting, and experiential retail.

Drivers and Current Dynamics

Core Market Drivers:

Athleisure Culture: The cultural acceptance and preference for comfortable, sporty attire has blurred the lines between performance and everyday wear, driving continuous sales growth for sneaker brands.

Health and Wellness Focus: Increased global participation in running, fitness, and outdoor activities drives demand for high-performance, specialized athletic footwear.

Digital Commerce and DTC: Brands are bypassing traditional wholesale partners, allowing for higher margins, better control over brand messaging, and faster reaction times to trend shifts.

Rise of Emerging Economies: Increasing disposable income among the middle classes in Asia-Pacific and Latin America translates into higher average expenditure on branded, high-quality footwear.

Current Dynamics: The market is intensely competitive, forcing brands to differentiate through material innovation (e.g., carbon fiber plates, new foam technologies) and hyper-personalized marketing fueled by e-commerce data. Supply chain resilience remains a major focus following recent global disruptions.

Market Size & Forecast

- The global footwear market size was valued at USD 700.90 billion in 2024 and is expected to reach USD 1100.38 billion by 2032, at a CAGR of 5.80% during the forecast period

For More Information Visit https://www.databridgemarketresearch.com/reports/global-footwear-market

Key Trends & Innovations

Innovation is focused on performance, personalized fit, and environmental impact across the entire product lifecycle.

1. Advanced Material Science and Performance

The "Race for the Best Foam" continues in the athletic sector, with brands competing on energy return, weight, and durability. Key innovations include:

Bio-Based Materials: Utilizing algae, mushroom leather, and recycled plastics to reduce dependence on virgin petroleum-based materials.

3D Printing/Additive Manufacturing: Used for prototyping and, increasingly, for producing specialized components like midsoles and specialized support structures, allowing for unparalleled geometric complexity and customization.

Carbon Fiber Plating: Integration of rigid plates into running shoes to enhance energy return and speed, driving a new class of high-performance footwear.

2. Hyper-Digitalization and Data-Driven Design

Brands are utilizing data from DTC channels to inform design and inventory decisions, moving toward a "demand-driven" manufacturing model:

Virtual Try-Ons (VTO): Using AR/VR technologies via mobile apps to help customers visualize shoes, improving the online shopping experience and reducing return rates.

NFTs and Digital Collectibles: Leveraging blockchain technology for product authentication, ownership tracking, and launching exclusive "digital twins" of physical shoes to engage high-value collectors.

3. Circular Economy Models (Take-Back and Recycling)

The need to address the environmental footprint of discarded footwear is accelerating circular economy initiatives. Brands are implementing large-scale take-back programs and investing in technologies to successfully deconstruct complex, multi-material shoes (like sneakers) for viable recycling into new products.

4. Comfort and Ergonomics in All Categories

Driven by the athleisure shift, even traditionally formal or fashion-forward categories (like dress shoes and boots) are incorporating athletic technology components, such as lightweight midsoles, advanced cushioning, and durable outsoles.

Competitive Landscape

The market is highly bifurcated: a top tier of dominant global athletic brands and a highly fragmented landscape of casual, luxury, and regional players.

Major Players and Strategic Strategies

The Global Athletic Leaders (e.g., Nike, Adidas, Puma): Their strategy is IP and Ecosystem Dominance. They focus on continuous product innovation (R&D), massive athlete endorsement budgets, and aggressive DTC channel expansion. Their competitive edge is their ability to define and drive global cultural trends.

Specialized Performance Brands (e.g., ASICS, Brooks, Hoka One One): Their strategy is Technical Specialization. They focus on deep biomechanical research to dominate specific niche performance segments (e.g., serious runners, trail running), competing on technical superiority and specialized fit rather than pure fashion.

Fast Fashion and Vertical Retailers (e.g., Zara, H&M, Shein): Their strategy is Speed-to-Market. They utilize ultra-agile supply chains to rapidly translate runway or social media trends into affordable, short-lifespan footwear, competing on price and trend responsiveness.

The competitive battleground is increasingly centered on speed of fulfillment and the authenticity of sustainability claims made to a skeptical consumer base.

Regional Insights

Market maturity and growth rates vary significantly based on economic development and local cultural preferences for footwear categories.

North America (Innovation and Premiumization)

Performance: A mature but high-value market characterized by high consumer spending on premium athletic and outdoor footwear. The region leads in DTC adoption and digital engagement.

Opportunity: Strong demand for high-tech, performance-driven footwear, particularly in the running and trail sectors, and a high willingness to pay a premium for authenticated sustainable products.

Asia-Pacific (APAC) (The Primary Growth Engine)

Performance: The fastest-growing region, driven by urbanization, rising middle-class income, and the adoption of Western-style casual and athletic footwear. China and India are the dominant growth vectors.

Opportunity: Massive market size allows for scaling mid-tier, value-focused athletic brands. Localized distribution and tailored size profiles are critical for success.

Europe (Fashion and Sustainability Focus)

Performance: A large, diverse market where casual, fashion, and luxury categories hold significant power alongside athletic wear. High regulatory pressure exists regarding materials and environmental impact.

Opportunity: Strong consumer demand for ethical sourcing, transparent supply chains, and classic, timeless designs (e.g., premium leather goods), alongside the rise of local eco-friendly startup brands.

Challenges & Risks

The industry faces significant operational and ethical challenges that require deep strategic commitment to overcome.

1. Supply Chain Resilience and Sourcing

The reliance on outsourced, concentrated manufacturing in Asia (primarily Vietnam, China, and Indonesia) creates fragility. Risks include geopolitical instability, labor disputes, and dependence on a few key raw material sources, leading to volatile production costs and delivery times.

2. Environmental Footprint

Footwear, especially complex athletic shoes, often uses a mix of synthetic materials that are difficult to recycle (plastics, foams, adhesives). The industry faces increasing pressure from regulators and consumers to reduce material waste, energy use, and chemical contamination, posing a substantial R&D challenge.

3. Counterfeiting and IP Theft

The high profitability and brand recognition of premium sneakers make the market a prime target for counterfeiting. This erodes brand value, damages consumer trust, and requires continuous investment in authentication technologies (e.g., NFC tags, blockchain solutions).

4. Retail Channel Conflict

The strategic shift to high-margin DTC channels often creates tension with long-standing wholesale partners (e.g., sporting goods stores, department stores), requiring delicate negotiation to maintain distribution reach while maximizing profitability.

Opportunities & Strategic Recommendations

Success in the footwear market requires a blend of high-tech manufacturing, agile supply chain management, and authentic consumer connection through sustainability.

Strategic Recommendations for Stakeholders

Re-Engineer for Circularity (Manufacturers): Design products for disassembly and material separation from the outset. Invest in proprietary recycling or upcycling technologies that can handle complex multi-polymer products to future-proof the product line against impending waste regulations.

Optimize the Omnichannel Funnel (Brands): The focus must be on creating a seamless customer journey between physical retail (for fitting and brand experience) and e-commerce (for convenience and depth of inventory). Utilize customer data gathered online to inform inventory placement in physical stores.

Localize Production for Speed (Startups/Mid-Tier): Explore smaller, localized manufacturing hubs (e.g., nearshoring to Mexico for North America, or Eastern Europe for Western Europe). While initial costs may be higher, the benefits of faster lead times, reduced shipping costs, and improved supply chain resilience can justify the shift.

Harness Digital Product Creation: Transition design and prototyping fully into 3D digital environments. This allows for rapid iteration, reduces the need for physical samples (lowering waste and time), and directly feeds into 3D printing or customized manufacturing processes.

Browse More Reports:

Global Pediatric Imaging Market

Global Space Situational Awareness Market

Global Ophthalmology Small Molecule API Market

North America Wind Turbine Pitch System Market

Europe Diet and Nutrition Apps Market

Global Bunyavirus Infections Market

Asia-Pacific Diet and Nutrition Apps Market

Global Bio preservation Market

Global Carded Blister Packaging Market

Global Heavy Duty Corrugated Packaging Market

Global Engine and Transmission Thermal Systems Market

Global Dental Practice Management Software Market

Global Cigarette Butt Market

Global Sachet Packaging Market

Global Compostable Toothbrush Market

Global Noise Source Mapping Market

Global Ballistic Protection Bulletproof Glass Market

Global Hair Relaxer Market

Global Fortified Breakfast Cereals Market

Global Robotic Prosthetics Market

Global Micro and Nano Programmable Logic Controller (PLC) Market

Global Fiber Drums Market

Europe Plant-Based Milk Market

North America Xylose Market

Global Laboratory Sterilizer Market

Global Aircraft Soft Goods Market

Global Duvet Covers Market

Middle East and Africa Hand Holes Market

Global Landau-Kleffner Treatment Market

Global Tralokinumab Market

Global LED Matrix Boards Outdoor LED Display Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com