Executive Summary

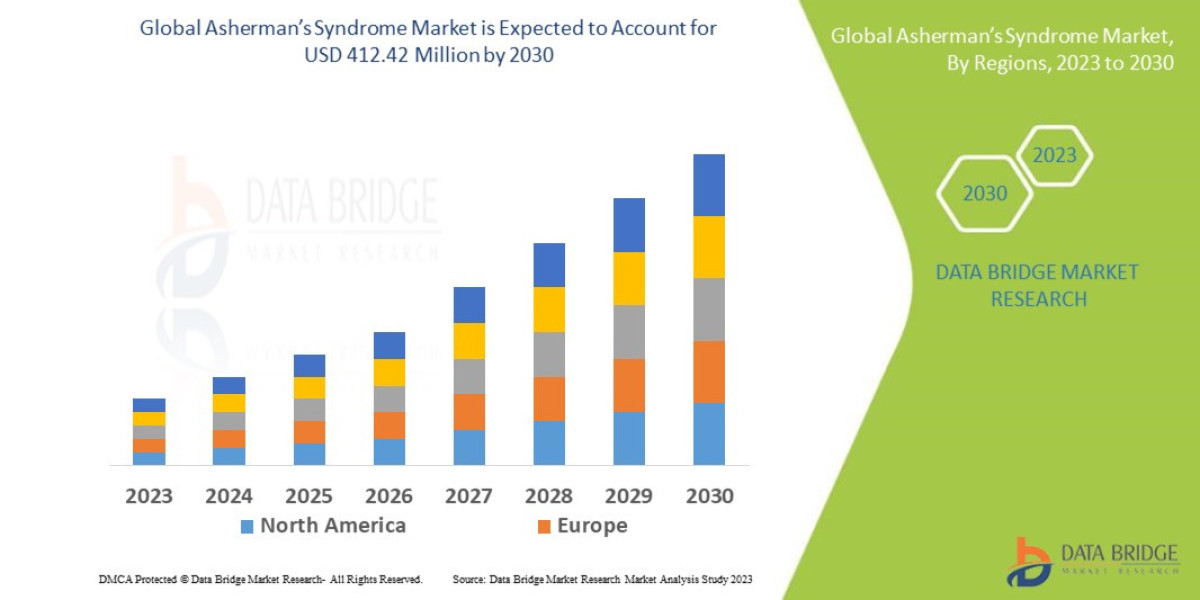

Data Bridge Market Research analyses that the compliance data management market, which was USD 3.05 billion in 2022, is expected to reach USD 13.65 billion by 2030, at a CAGR of 20.60% during the forecast period 2023 to 2030.

Market Overview

The CDM Market is defined by the tools and practices used to ensure the integrity, security, and accessibility of data that must be managed according to internal policies and regulatory mandates across various jurisdictions.

Key Segments by Component

Software Solutions (Largest Segment): Includes specialized Governance, Risk, and Compliance (GRC) platforms, enterprise content management (ECM) tools, data loss prevention (DLP) software, and specialized modules for regulatory reporting.

Services: Encompasses consulting (gap analysis, framework development), implementation, integration, training, and managed services (outsourced monitoring and reporting).

Key Segments by End-User

Banking, Financial Services, and Insurance (BFSI) (Dominant Spender): Driven by stringent financial regulations (Basel III, Dodd-Frank, MiFID II) and anti-money laundering (AML) laws, requiring massive data monitoring and reporting systems.

Healthcare and Life Sciences: Mandated by data privacy laws (HIPAA) and regulatory requirements for clinical trial data integrity and submission (FDA).

Information Technology and Telecom: Highly exposed to global data residency, privacy, and cybersecurity laws (GDPR, CCPA).

Drivers and Current Dynamics

Core Market Drivers:

Explosion of Regulatory Mandates: The continuous introduction and tightening of global regulations (especially in data privacy and ESG) mandate systematic data capture and demonstrable adherence.

Increased Enforcement and Fines: Governments are imposing higher financial penalties for non-compliance (e.g., GDPR fines), making investment in proactive CDM systems a necessary form of risk mitigation.

Data Volume and Velocity: The exponential growth of enterprise data (structured, unstructured, and dark data) makes manual compliance tracking impossible, necessitating automated, scalable solutions.

Current Dynamics: The market is shifting from siloed, point solutions for specific regulations to unified, integrated GRC platforms that provide a holistic view of an organization's compliance posture. There is a strong movement toward proactive compliance-by-design principles, embedding controls directly into business processes.

Market Size & Forecast

Data Bridge Market Research analyses that the compliance data management market, which was USD 3.05 billion in 2022, is expected to reach USD 13.65 billion by 2030, at a CAGR of 20.60% during the forecast period 2023 to 2030.

For More information visit https://www.databridgemarketresearch.com/reports/global-compliance-data-management-market

Key Trends & Innovations

The future of CDM is defined by automation, intelligent data processing, and proactive risk detection.

1. AI and Machine Learning for Intelligent Compliance

AI is transforming CDM by handling previously manual, labor-intensive tasks:

Regulatory Change Management (RegTech): AI scans global regulatory updates, identifies relevant changes, and maps them directly to internal controls, significantly reducing the compliance gap time.

Automated Data Discovery: ML algorithms automatically identify and categorize sensitive data (PII, PHI) across vast, unstructured repositories, crucial for data privacy and e-discovery.

Fraud and AML Monitoring: AI models analyze transaction patterns in real-time to detect anomalous activity that traditional rule-based systems often miss.

2. Privacy Enhancing Technologies (PETs)

The rise of PETs, such as homomorphic encryption and federated learning, allows organizations to analyze sensitive data and derive compliance insights without needing to decrypt or centralize the data. This is a critical trend for managing cross-border data transfer compliance while enabling data utility.

3. Integrated Risk and Compliance (IRCM) Platforms

The trend moves away from purchasing separate software for IT risk, operational risk, and legal compliance. Integrated Risk and Compliance Management (IRCM) platforms use a single source of truth (the GRC framework) to centralize risk assessments, control monitoring, and regulatory mapping, optimizing resource allocation.

4. Continuous Control Monitoring (CCM)

CCM leverages robotic process automation (RPA) and real-time monitoring tools to continuously test the effectiveness of internal controls against regulations. This shifts audits from infrequent, reactive exercises to ongoing, proactive assurance processes.

Competitive Landscape

The market is fragmented but consolidating, featuring large enterprise software vendors, specialized RegTech startups, and traditional consulting firms pivoting to managed services.

Major Players and Strategic Strategies

Enterprise Software Giants (e.g., SAP, Oracle, IBM): Strategy is Platform Integration and BFSI Dominance. They leverage existing ERP and core banking system footprints to sell GRC modules that integrate seamlessly with operational data.

Specialized GRC/RegTech Providers (e.g., MetricStream, OneTrust, LogicManager): Strategy is Agility and Deep Domain Expertise. They focus on rapid deployment, user-friendly interfaces, and quick updates to address new regulations, particularly in emerging areas like data privacy and ESG.

Consulting Firms and Integrators (e.g., Deloitte, PwC, KPMG): Strategy is Managed Services and Implementation. They use their regulatory expertise to design compliance frameworks and then offer to implement and manage the technology stack (often third-party software) for clients.

The competitive differentiator is moving from mere functionality to the ability to integrate AI-driven automation and provide regulatory content expertise that automatically updates the client's control environment.

Regional Insights

Regulatory mandates are the primary drivers, leading to distinct growth patterns based on the maturity of local legal frameworks.

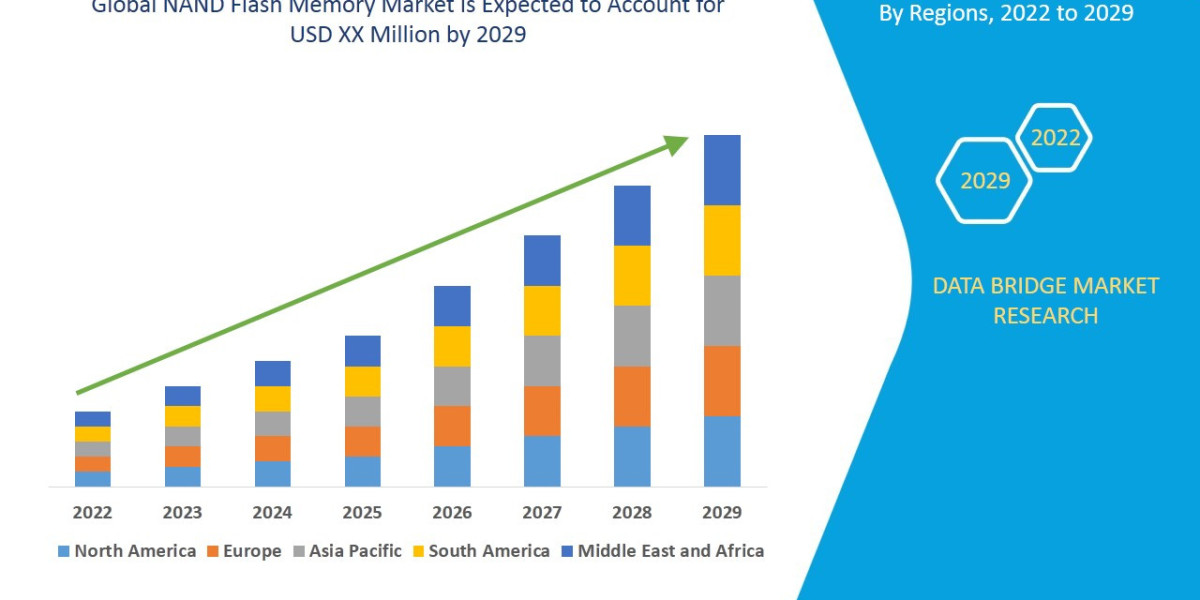

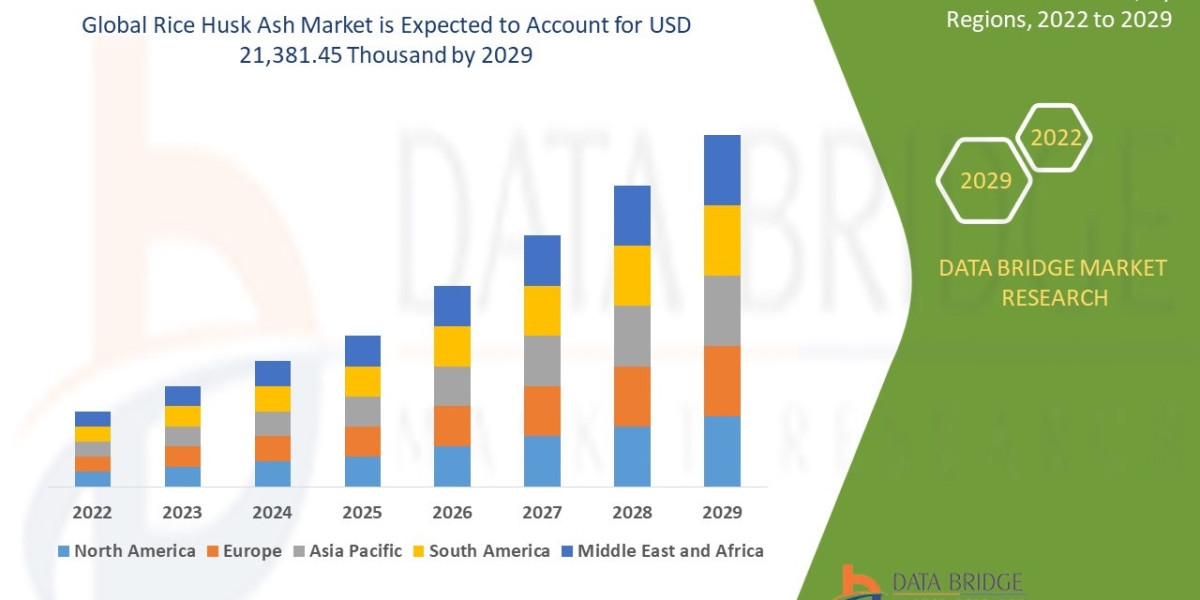

North America (Technology Adoption and Financial Compliance)

Performance: The largest market, driven by highly developed financial regulations (SOX, AML, FFIEC) and rapidly evolving state-level data privacy laws (CCPA, VCDPA).

Opportunity: High demand for solutions integrating financial data with cybersecurity and cloud governance, driven by SEC disclosures and litigation risk.

Europe (Data Privacy and ESG Lead)

Performance: High growth driven by the rigorous enforcement of the General Data Protection Regulation (GDPR) and upcoming ESG mandates (CSRD). This necessitates pan-European data mapping and reporting tools.

Opportunity: Significant investment in Data Residency and Sovereignty solutions as organizations navigate data storage restrictions across member states.

Asia-Pacific (APAC) (Catch-Up Growth and Digitalization)

Performance: The fastest-growing region, fueled by rapid digitalization, financial sector expansion, and the adoption of national data privacy laws (e.g., China's PIPL, India's DPDP).

Opportunity: High demand for basic and mid-tier GRC solutions, with a strong emphasis on cloud compliance and regulatory training services for newly established frameworks.

Challenges & Risks

The market faces structural challenges related to technical complexity, data integrity, and securing organizational buy-in.

1. Regulatory Fragmentation and Interoperability

The primary risk is the sheer volume of fragmented global regulations. Solutions designed for one region often fail to meet requirements in another, forcing organizations to manage complex, non-interoperable systems.

2. Data Quality and "Dark Data"

CDM solutions rely on clean, accessible data. A major challenge is the poor quality of source data and the existence of "dark data" (unclassified, unmonitored data) across legacy systems, which creates massive, hidden compliance risk.

3. High Implementation Costs and Change Management

Initial deployment of integrated GRC/CDM systems is often complex, costly, and requires significant organizational change management. Failure to secure executive buy-in for cross-departmental data governance is a major cause of project failure.

4. Talent Gap in RegTech Skills

There is a chronic shortage of professionals who understand both the deep regulatory requirements (e.g., financial reporting standards, privacy law) and the technical architecture (cloud security, AI governance) needed to effectively implement modern CDM platforms.

Opportunities & Strategic Recommendations

Future market success hinges on leveraging automation to reduce the compliance burden and transforming the compliance function from a cost center into a strategic risk management asset.

Strategic Recommendations for Stakeholders

Prioritize AI-Powered Regulatory Mapping (Software Providers): Invest heavily in machine learning engines that can ingest legal text and automatically generate risk and control statements for clients. This solves the largest recurring compliance pain point: staying current with regulatory changes.

Develop Unified ESG Data Platforms (Startups/Vendors): Target the explosion in ESG reporting demand by building platforms that can effectively ingest, standardize, and audit non-financial data (e.g., carbon emissions, water use, diversity metrics) across the entire supply chain, offering an auditable 'single pane of glass' for all sustainability reporting.

Offer Verticalized, Managed Compliance Services (Consulting Firms): Move away from one-off projects toward high-margin, subscription-based managed services. Provide ongoing, remote monitoring of a client’s control environment using the firm’s proprietary RegTech tools, guaranteeing continuous compliance posture for highly regulated industries like BFSI and Healthcare.

Adopt Policy-as-Code for Cloud Governance (Enterprises): Implement infrastructure-as-code principles for cloud environments. Use automated tools to write compliance policies directly into the code that manages cloud resources (e.g., using specialized compliance-as-code platforms), ensuring that security and data residency rules are enforced before any resource is deployed.

Browse More Reports:

Global Sezary Syndrome Treatment Market

Global Dispensing Caps Market

North America Rotomolding Market

Global Diabetic Neuropathy Market

Global Nano GPS (Global Positioning System) Chip Market

Global Data Roaming Market

Global Citric Acid Market

Global Wipes Market

Global Aquatic Feed Enzymes Market

Global Waste Management Market

Global Mist Eliminators Market

Global Asphalt Additive Market

Global Regulatory Technology (Regtech) Market

Europe Infection Surveillance Solution Systems Market

Global Vehicle Tracking System Market

U.S. Health, Safety, and Environment (HSE) Training Services Market

North America Dental Practice Management Software Market

Global Sludge Treatment Chemicals Market

Global Tinted Glass Market

Global Network Security Market

Global Front and Rear Air-Conditioning (AC) Thermal Systems Market

Global Polymeric Biomaterial Market

Global Household Cleaning Products Market

Europe Electrosurgery Market

Global Bilateral Cystoid Macular Edema Market

Global Edge Banding Materials Market

Global Speciality Malts Market

Middle East and Africa Weight Loss and Obesity Management Market

Middle East and Africa Hydrographic Survey Equipment Market

North America Food Bags Market

Global Surface Roughness Measurement (SRM) Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com