Executive Summary

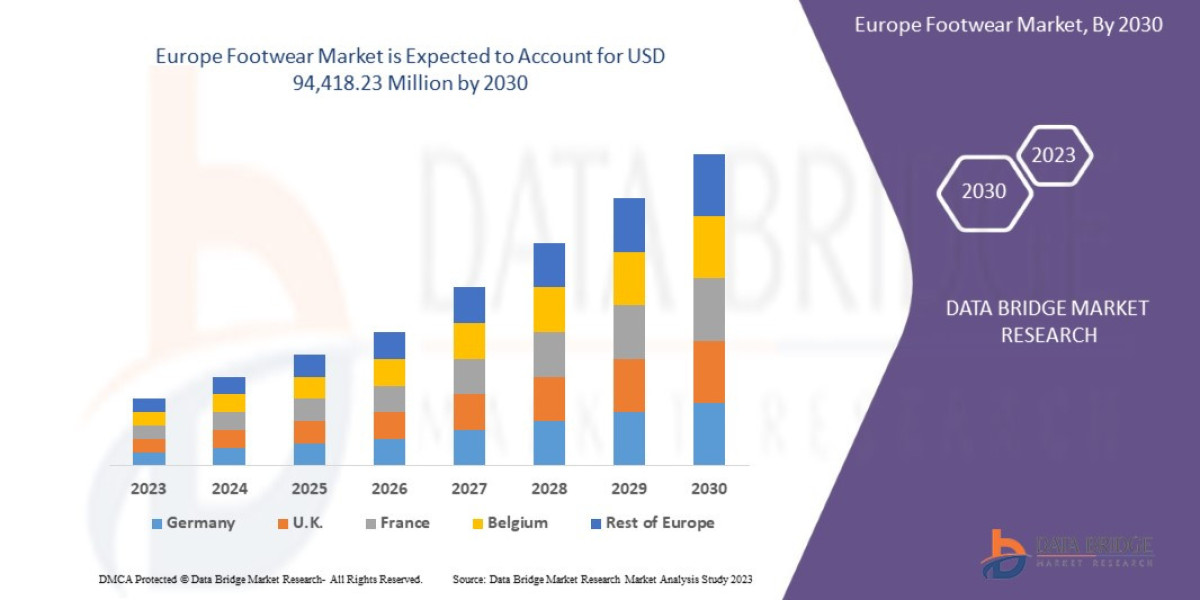

Data Bridge Market Research analyses that the footwear market in Europe is expected to reach the value of USD 94,418.23 million by 2030, at a CAGR of 5.7% during the forecast period.

Market Overview

The Europe Footwear Market encompasses all types of footwear sold across the European Union (EU), the UK, and non-EU countries like Switzerland, serving a consumer base that values both style and quality.

Key Segments by Product Type

Non-Athletic/Lifestyle Footwear (Dominant Segment): Includes formal shoes, casual leather goods, boots, and sandals. While mature, this segment is facing significant pressure from the athleisure trend.

Athletic Footwear (Fastest Growing): Driven by the sustained adoption of sports and performance-inspired shoes for everyday wear. Innovation in lightweight materials and cushioning technology is key here.

Specialty/Functional Footwear: Includes work and safety shoes (driven by strict industrial safety laws) and specialized orthopedic footwear.

Key Segments by Material

Leather: Maintains a strong presence, particularly in Southern European markets (Italy, Spain) and the luxury segment, but faces increasing competitive pressure from synthetics due to cost and ethical concerns.

Synthetics and Textiles (Growing): Dominant in the athletic and mass-market segments, benefiting from innovations in recycled plastics and bio-based materials.

Drivers and Current Dynamics

Core Market Drivers:

Athleisure Penetration: The cultural shift toward comfort and versatile style continues to drive sales of sneakers and athletic-inspired casual footwear across all demographics.

Sustainability Mandates: EU-level regulations, particularly those related to the Circular Economy Action Plan and the upcoming Green Claims Directive, compel manufacturers to redesign products for durability, repairability, and recyclability.

Digital Commerce Acceleration: The pandemic permanently accelerated the shift to online shopping, making DTC and sophisticated e-commerce logistics crucial for market access.

Current Dynamics: The market is increasingly bifurcated: the premium/luxury end is focusing on artisanal quality and traceable sustainability, while the mass-market end is driven by speed-to-market and low-cost manufacturing, though both are converging on recycled material use.

Market Size & Forecast

Data Bridge Market Research analyses that the footwear market in Europe is expected to reach the value of USD 94,418.23 million by 2030, at a CAGR of 5.7% during the forecast period.

For More Information Visit https://www.databridgemarketresearch.com/reports/europe-footwear-market

Key Trends & Innovations

Innovation in the European market is heavily concentrated in material science, retail technology, and circularity principles.

1. The Circularity and Durability Focus

European regulation and consumer demand are mandating a shift from a linear to a circular model:

Design for Disassembly (DfD): Designing footwear that can be easily taken apart to separate material streams (e.g., rubber, plastic, textile) for high-quality recycling.

Recycled and Bio-Based Materials: Widespread adoption of materials like recycled polyethylene terephthalate (rPET) for uppers, recycled rubber for outsoles, and bio-based polymers (e.g., derived from corn or fungi).

Repair Services: Brands like Adidas and specialized startups are launching in-house repair and maintenance services to extend product lifecycle, a key measure under the proposed EU durability requirements.

2. Hyper-Personalization and Custom Fit

Technology is being used to deliver personalized comfort and fit, a significant value addition in the premium segment:

3D Printing/Additive Manufacturing: Used increasingly for prototyping, but also for small-scale, customized production of highly complex components like midsoles and insoles (e.g., using digital light synthesis technology).

AI-Powered Sizing: Digital tools use $\text{AI}$ and $\text{3D}$ scanning via smartphone cameras to accurately recommend sizes, drastically reducing return rates—a massive logistical cost for e-commerce.

3. DTC and Omnichannel Excellence

The most successful brands are those that seamlessly integrate their online and physical presence:

Flagship Experience Stores: Physical stores are evolving into "experience centers" focused on brand storytelling, personalization, and community, rather than inventory storage.

Quick Commerce Logistics: Utilizing micro-fulfillment centers and dark stores to facilitate rapid local delivery and seamless click-and-collect services.

Competitive Landscape

The European market is highly competitive, dominated by global athletic giants, Italian luxury houses, and powerful fast-fashion retailers.

Major Players and Strategic Strategies

Athletic Giants (e.g., Nike, Adidas, Puma): Strategy is DTC Acceleration and Performance Innovation. They focus on growing their high-margin DTC channels, leveraging their R&D budget to drive performance advantages, and dominating the athletic/lifestyle segments.

Luxury and Fashion Houses (e.g., LVMH, Kering, Prada): Strategy is Craftsmanship and Exclusive Sustainability. They emphasize leather traceability, artisanal production in Italy/Spain, and limited-edition releases to maintain high margins and brand equity.

Fast-Fashion/Mass Retailers (e.g., Zara, H&M): Strategy is Speed and Trend Replication. They focus on short lead times and rapid inventory turnover, though they are increasingly integrating sustainability pledges to meet European consumer scrutiny.

The critical competitive battleground is E-commerce Customer Experience—specifically, delivery speed, returns logistics, and personalized digital engagement.

Regional Insights

While Western Europe dominates consumption value, Central and Eastern Europe (CEE) represent key manufacturing and high-growth retail hubs.

Western Europe (Germany, UK, France)

Performance: Represents the highest value and most mature consumption base, characterized by strong demand for premium brands, clear segmentation between formal and athletic wear, and advanced e-commerce penetration.

Opportunity: Prime market for circular business models (repair, resale) due to highly conscious consumers and strong environmental regulatory support.

Southern Europe (Italy, Spain, Portugal)

Performance: Significant manufacturing cluster, particularly for high-quality leather and luxury goods, often leveraging skilled local craftsmanship. Retail consumption is often more resilient to athleisure trends in the formal category.

Opportunity: Focus on nearshoring solutions for brands seeking ethically traceable and rapid supply chains close to core Western markets.

Central and Eastern Europe (CEE)

Performance: High growth in both retail consumption (due to rising disposable incomes) and manufacturing (e.g., Poland, Romania, Turkey) due to lower labor costs and proximity to Western markets.

Opportunity: Investment in manufacturing modernization (automation, digital tracking) to position the region as the primary nearshoring alternative to Asian production.

Challenges & Risks

The European market is highly complex, facing both systemic economic pressure and unique regulatory hurdles.

1. Regulatory Compliance and Greenwashing Scrutiny

The proliferation of EU directives (e.g., Waste Framework Directive, Green Claims Directive) creates a significant cost and compliance burden. Failure to provide verifiable and auditable evidence for sustainability claims exposes brands to severe fines and reputation damage (i.e., greenwashing risk).

2. Rising Input Costs and Inflationary Pressure

The market faces structural cost increases from energy prices (impacting domestic manufacturing), high labor costs, and elevated material costs (especially for high-quality leather and certified recycled materials). Passing these costs on to price-sensitive consumers remains a challenge.

3. Supply Chain Volatility

Despite nearshoring efforts, Europe remains reliant on Asia for the majority of its imports. Geopolitical risks, along with increased shipping costs and delays (particularly through key global shipping channels), continue to threaten inventory flow and lead times.

4. Reverse Logistics Complexity

High e-commerce sales lead to high return rates (often 20-40% for apparel and footwear). Managing this reverse logistics efficiently—including cleaning, repackaging, and re-entry into inventory—is a massive cost sink and requires specialized infrastructure.

Opportunities & Strategic Recommendations

Strategic success requires a dual focus on digital channel mastery and robust, auditable sustainability practices.

Strategic Recommendations for Stakeholders

Invest in Digital Traceability and Material Passports (Manufacturers & Brands): Prioritize technology that enables end-to-end material tracking from source to consumer. Develop digital product passports (DPP)—a forthcoming EU requirement—to facilitate repair and recycling, transforming a regulatory burden into a strategic competitive advantage in consumer trust.

Optimize the Last Mile and Reverse Logistics (Retailers): Treat the returns process as a profit center, not a cost. Invest in local micro-fulfillment centers optimized for processing returns quickly and efficiently. Utilize $\text{AI}$ to predict returns and adjust inventory allocation dynamically, reducing the time inventory spends out of circulation.

Establish Nearshoring Footprints for Agility (Global Brands): Secure manufacturing capacity in strategically located, compliant countries (e.g., Portugal, Turkey, North Africa). Use these nearshore hubs for rapid, low-volume production of fast-fashion and limited-edition runs, reserving Asia for bulk, long-lead-time production, thereby improving responsiveness to European trends.

Target the Comfort-as-Wellness Niche (Innovators): Focus on the convergence of performance technology and medical-grade comfort. Develop footwear specifically for high-growth segments like "wellness walking," medical support, or products designed for all-day standing, capitalizing on the aging population and the permanent demand for foot health.

Browse More Reports:

Europe Flotation Reagents Market

Global Wearable Fitness Trackers Market

Global Industrial Hearable Market

Global Micro Tube Box Market

Global Perimeter Defence System Market

Global Printed Textile Market

Italy Dental Practice Management Software Market

Global Smart Factory Market

India Food Ingredients Market

Europe q-PCR Reagents Market

Global NAND Flash Memory Market

Europe Food Bags Market

Global Wax and Wax Esters Market

Global Micro-Electromechanical Systems (MEMS) Gyroscopes Market

Middle East and Africa Probe Card Market

Global Injection Trays Market

Global Cord Blood and Cell Banking Market

Europe Protein Hydrolysates Market

Global Laminated Veneer Lumber Market

Middle East and Africa Wind Turbine Pitch System Market

Global Commercial Cleaning Equipment Market

North America Protein Hydrolysates Market

Middle East and Africa Rotomolding Market

Global (GPS) Global Positioning Systems Market

Global Sever’s Disease Treatment Market

Australia Specialty Gas Market

Global Below Grade Waterproofing Membrane Market

Middle East and Africa Intensive Care Unit (ICU) Ventilators Market

Global Beeswax Market

Europe Commercial Cleaning Equipment Market

Global Flooring and Carpets Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com