Executive Summary

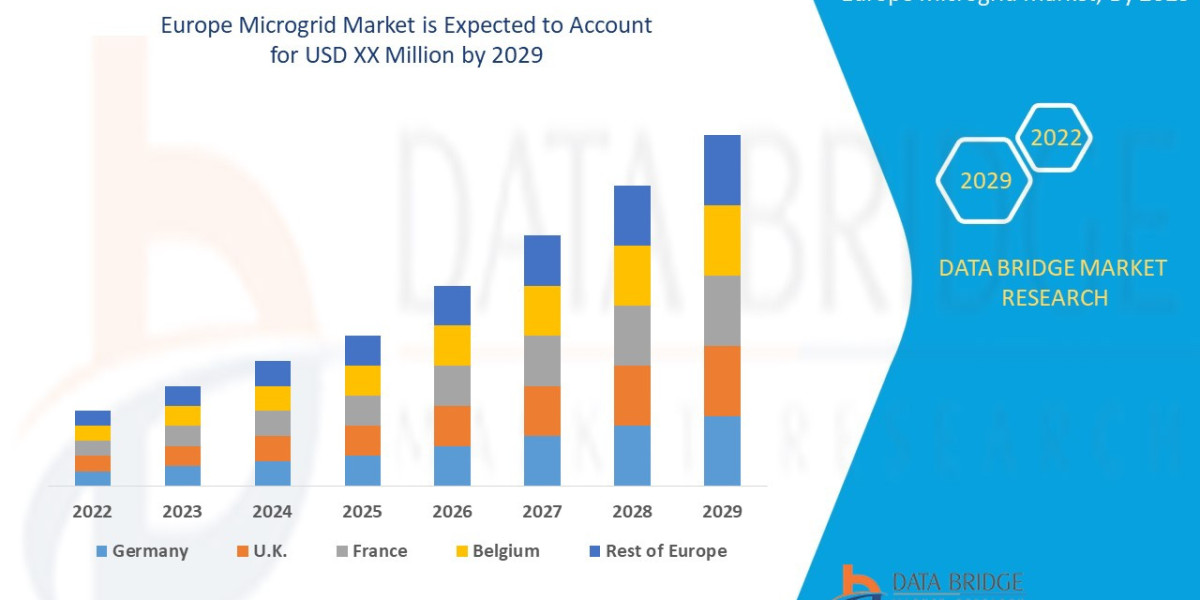

Data Bridge Market Research analyses that the Europe microgrid market is expected to reach the value of USD 7,295.30 million by 2029, at a CAGR of 15.6% during the forecast period.

Market Overview

The Europe Microgrid Market spans the design, construction, operation, and maintenance of decentralized energy systems across the continent, covering both interconnected and islanded configurations.

Key Segments by Offering

Software and Services (Dominant Value Segment): Includes the Microgrid Control System ($\text{MGCS}$), Distributed Energy Resource Management Systems ($\text{DERMS}$), and planning/consulting services. The intelligence of the microgrid—its ability to forecast loads, optimize generation, and seamlessly transition to island mode—is the primary value driver.

Hardware: Includes power components such as Battery Energy Storage Systems ($\text{BESS}$), small-scale renewable generation units (solar $\text{PV}$, wind), and diesel/gas backup generators (increasingly being phased out).

Key Segments by Connectivity

Grid-Connected Microgrids: The majority of systems, primarily focused on providing grid support (ancillary services) and resilience for campus environments (universities, hospitals, military bases).

Remote/Islanded Microgrids: Typically found in remote islands or rural industrial areas, focusing on providing primary power generation independent of the main transmission grid.

Drivers and Current Dynamics

Core Market Drivers:

EU Decarbonization Goals: The mandate to achieve climate neutrality by 2050 necessitates massive deployment of distributed renewable energy, which microgrids are ideally suited to manage and stabilize.

Energy Resilience and Security: Increased frequency of climate-related power outages and the need to protect critical military and healthcare infrastructure against external threats drive investment in local, independent power sources.

Rise of Energy Communities: The EU’s Renewable Energy Directive ($\text{RED}$ II) promotes citizen and local ownership of renewable projects, creating a viable business model for community-scale microgrids.

Current Dynamics: The market is shifting rapidly from being primarily driven by economic factors (cost of electricity) to being dominated by resilience and environmental compliance factors. The integration of high-density lithium-ion BESS is now standard in most new projects, effectively turning $\text{PV}$ assets into dispatchable power sources.

Market Size & Forecast

Data Bridge Market Research analyses that the Europe microgrid market is expected to reach the value of USD 7,295.30 million by 2029, at a CAGR of 15.6% during the forecast period.

For More Information visit https://www.databridgemarketresearch.com/reports/europe-microgrid-market

Key Trends & Innovations

Innovation in the European microgrid space centers on intelligent control, seamless integration, and leveraging existing assets.

1. Interoperability and the Virtual Power Plant ($\text{VPP}$) Model

The goal is to move beyond isolated microgrids:

Standardization: Implementing standardized communication protocols ($\text{IEC 61850}$) to ensure easy communication between $\text{DER}$ and the $\text{MGCS}$.

VPP Integration: Utilizing microgrids as large, aggregated dispatchable units that can participate in wholesale energy markets and provide balancing services to the Transmission System Operators ($\text{TSO}$), effectively turning resilience assets into revenue generators.

2. Microgrids as Energy Communities

The $\text{RED}$ II Directive provides a legal framework for Citizen Energy Communities ($\text{CEC}$) and Renewable Energy Communities ($\text{REC}$).

Local Ownership: This trend facilitates the shared ownership and management of generation and storage assets by community members, increasing social acceptance and financing options.

Peer-to-Peer Trading: Development of blockchain-enabled platforms to facilitate transparent, automated energy trading among participants within the microgrid boundary.

3. Edge Computing and $\text{AI}$-Based Forecasting

Microgrid management requires ultra-low latency decision-making:

Edge Control: Deploying computational power directly at the asset level (e.g., inside the battery inverter or $\text{PV}$ combiner box) to enable fast, autonomous decisions during grid events.

Predictive Optimization: Using $\text{AI}$ and machine learning to forecast localized energy production and consumption down to the 5-minute interval, maximizing self-consumption and minimizing reliance on high-cost grid imports.

4. DC Microgrids for Data Centers

With the proliferation of Data Centers ($\text{DCs}$), there is growing interest in DC microgrids which offer higher efficiency and lower conversion losses when powering $\text{DC}$ loads like servers and $\text{BESS}$. This niche is seeing high investment in Ireland, Germany, and the Nordic countries.

Competitive Landscape

The competitive environment is fragmented, featuring large, established conglomerates alongside specialized software and services firms.

Major Players and Strategic Strategies

Industrial Conglomerates (e.g., Siemens, ABB, Schneider Electric): Strategy is Integrated Solutions and EPC Leadership. They leverage their deep electrical equipment heritage and global EPC (Engineering, Procurement, and Construction) capabilities to deliver full turnkey projects, often dominating the heavy industrial and utility-scale segments.

Renewable Asset Developers (e.g., Enel X, Engie): Strategy is As-a-Service and Financing. They often bundle the microgrid into a Power Purchase Agreement ($\text{PPA}$) or Energy-as-a-Service ($\text{EaaS}$) model, removing the upfront capital barrier for customers and focusing on operational revenue.

Specialized Software Providers (e.g., AutoGrid, Opus One): Strategy is Intelligence and Optimization. These firms focus on selling sophisticated $\text{DERMS}$ and $\text{MGCS}$ software that can be layered onto existing hardware, offering critical $\text{AI}$ optimization capabilities.

The primary competitive factor is the ability to prove financial savings (ROI) and guarantee uninterrupted operation during grid outages, often secured through performance-based contracts.

Regional Insights

European diversity means market maturity and drivers vary significantly by country, heavily influenced by local regulation and existing grid infrastructure.

Germany and the UK (Maturity and Complexity)

Performance: High penetration of distributed generation, creating a complex grid environment. Germany leads in industrial microgrids and $\text{VPP}$ integration; the UK focuses on campus and critical infrastructure resilience.

Opportunity: Strong focus on ancillary services and providing flexibility back to the grid, offering revenue streams for microgrid operators.

Nordic Countries (Norway, Sweden, Finland)

Performance: High renewable energy saturation (hydro, wind) and low-temperature resilience requirements. Focus is on long-duration storage and managing intermittent offshore generation.

Opportunity: Niche market for off-grid and remote community microgrids, often integrated with district heating and cooling systems.

Southern Europe (Italy, Spain, Greece)

Performance: Significant potential for solar $\text{PV}$-driven microgrids. Drivers include high solar irradiance and the need to improve grid stability and reduce reliance on imported fossil fuels.

Opportunity: Strong regulatory support for Renewable Energy Communities ($\text{REC}$), particularly in Spain and Italy, facilitating aggregation of residential $\text{PV}$ and shared storage.

Challenges & Risks

Despite strong regulatory tailwinds, the microgrid market faces significant integration and policy hurdles.

1. Interconnection and Grid Code Compliance

Navigating the often-complex and heterogeneous technical standards and permitting processes of individual national $\text{DSO}$ (Distribution System Operators) is a major barrier. Standards for protective relaying, islanding, and reconnection vary widely, increasing project complexity and cost.

2. Financing and Long Payback Periods

While technology costs are falling, the initial capital expenditure for a full microgrid (especially including $\text{BESS}$) remains high. Securing financing can be difficult, as the primary value—resilience—is hard to monetize directly, often leading to long payback periods based solely on energy arbitrage.

3. Cybersecurity Risks

As microgrids rely on interconnected digital control systems and external data exchange, they present a wider attack surface. Protecting critical $\text{MGCS}$ and $\text{DERMS}$ from cyber threats is essential for maintaining both operational integrity and national energy security.

4. Lack of Standardized Business Models

The lack of consistent regulatory clarity across all $\text{EU}$ member states regarding ownership, cost recovery mechanisms, and participation rules for $\text{CECs}$/$\text{RECs}$ hinders the scaling of successful business models across borders.

Opportunities & Strategic Recommendations

The path to success lies in leveraging digital capabilities to unlock financial value from resilience and aligning with European decarbonization mandates.

Strategic Recommendations for Stakeholders

Prioritize Software-First, Hardware-Flexible Solutions (Integrators/Software Firms): Focus R&D on developing highly adaptable $\text{DERMS}$ that can integrate disparate hardware types and protocols. The core offering should be the optimization software that maximizes asset utilization across multiple revenue streams (e.g., self-consumption, grid services, capacity payments).

Develop Energy-as-a-Service ($\text{EaaS}$) Financial Models (Developers/Investors): Shift away from traditional $\text{CapEx}$ sales models. Offer customers zero-upfront-cost $\text{EaaS}$ contracts where the developer owns the microgrid assets and charges a fixed fee or performance-based rate. This overcomes the high initial cost barrier for commercial and public sector clients.

Target Campus and Critical Infrastructure (Sales Strategy): Focus immediate sales efforts on high-value, low-risk segments like military bases, ports, hospitals, and university campuses, where resilience is a monetizable, non-negotiable requirement backed by substantial public or institutional budgets.

Specialization in Community Microgrids (Policy Experts/Startups): Hire dedicated regulatory experts to navigate the $\text{RED}$ II frameworks in high-potential markets like Spain and Italy. Offer turnkey legal, governance, and technical solutions to citizen groups, effectively acting as an enabling platform for the rapid proliferation of $\text{RECs}$.

Browse More Reports:

Global Algae Fertilizers Market

Global Construction Film Market

Global Antimicrobial Agent Market

Global Benchtop Laboratory Water Purifier Market

Asia-Pacific Feed Flavours and Sweeteners Market

Global Catenary Infrastructure Market

Global Bus Public Transport Market

Latin America Point of Care Infectious Disease Market

Global Innovation Management Market

Middle East and Africa Indium Market

Global Antibiotics Market

Global Potassium Humate Biostimulants Market

Africa MDI, TDI, Polyurethane Market

Global Dental Diode Lasers Market

Middle East and Africa Artificial Turf Market

Global Hematologic Malignancies Market

Latin America Ostomy Devices Market

Asia-Pacific Rotomolding Market

Philippines Microgrid Market

Global Automated Beverage Carton Packaging Machinery Market

Global Surgical Power Tools Market

Europe Intensive Care Unit (ICU) Ventilators Market

Global Vasodilators Market

Global Methylene Diphenyl Diisocyanate (MDI), Toluene Diisocyanate (TDI) and Polyurethane Market

Global Constrictive Pericarditis Market

Middle East and Africa q-PCR Reagents Market

Global Artificial Turf Market

Global Styrene Butadiene Latex Market

Global Digital Farming Software Market

Global Alpha Linolenic Acid Market

Global Head and Neck Cancer Drug Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com