Executive Summary

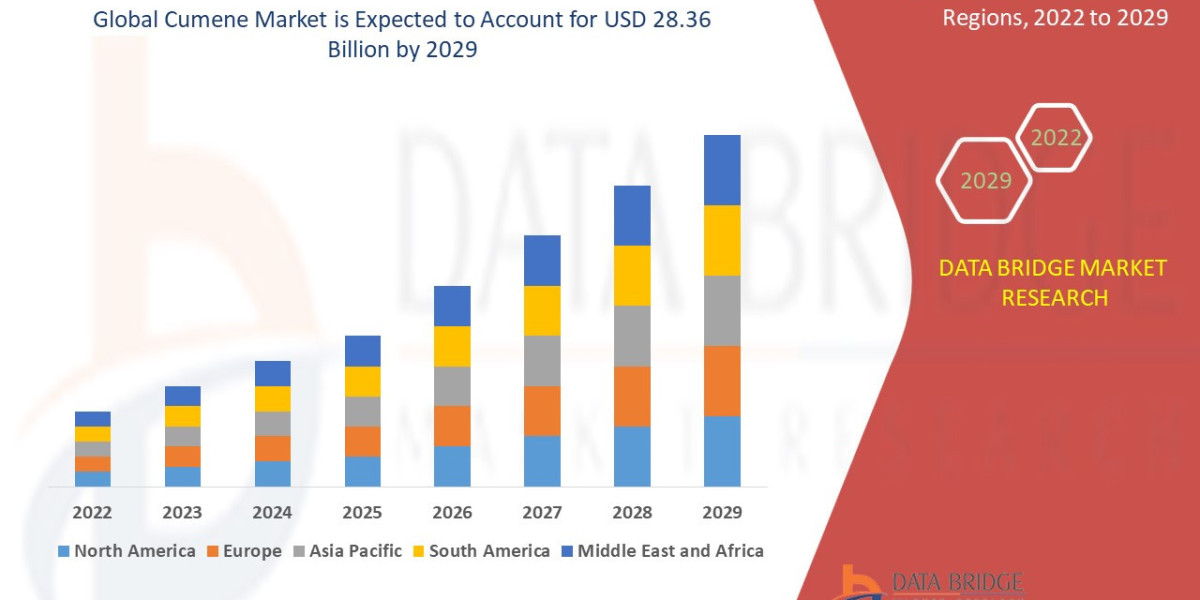

Global cumene market size was valued at USD 22.43 billion in 2024 and is projected to reach USD 32.64 billion by 2032, with a CAGR of 4.80% during the forecast period of 2025 to 2032.

Market Overview

Cumene is an aromatic hydrocarbon produced through the alkylation of Benzene with Propylene. It is characterized by its high purity requirement for efficient conversion in the subsequent hydroperoxide cleavage reaction.

Definition and Primary Function

Cumene itself has limited direct end-use applications; its market value is derived almost exclusively from its role as a precursor to:

Phenol: The largest off-take, used primarily in the production of Bisphenol A ($\text{BPA}$) and Phenolic Resins. $\text{BPA}$ is crucial for polycarbonates (plastics used in automotive, electronics, and construction glazing) and epoxy resins. Phenolic resins are used in adhesives and insulating materials.

Acetone: A co-product, primarily used as an industrial solvent and in the production of Methyl Methacrylate ($\text{MMA}$), which is vital for acrylic plastics (e.g., Plexiglas) and surface coatings.

Key Segments by End-Use

Bisphenol A ($\text{BPA}$) and Polycarbonates (Dominant): Driven by automotive glazing, consumer electronics, and construction applications.

Phenolic Resins: Used in plywood, insulation, and molding compounds.

Solvents and $\text{MMA}$ (Acetone Off-take): Driven by coatings, adhesives, and acrylic sheet manufacturing.

Drivers and Current Dynamics

Core Market Drivers:

Global Construction Revival: The primary driver for Phenolic Resins and $\text{BPA}$ in structural materials and insulation.

Automotive Industry Demand: Increasing use of polycarbonates for lightweight vehicle components (glazing, headlamp lenses) to meet fuel efficiency standards.

Growth of $\text{Laminates}$ and Composites: Use of Phenol in specialty chemicals and materials for advanced manufacturing.

Current Dynamics: The market is currently wrestling with volatility in Propylene feedstock prices and the structural challenge posed by regulatory scrutiny on $\text{BPA}$, which is driving research into alternative Phenol derivatives or non-Cumene-based processes.

Market Size & Forecast

Global cumene market size was valued at USD 22.43 billion in 2024 and is projected to reach USD 32.64 billion by 2032, with a CAGR of 4.80% during the forecast period of 2025 to 2032.

For More Information Visit https://www.databridgemarketresearch.com/reports/global-cumene-market

Key Trends & Innovations

Innovation in the Cumene market is almost entirely focused on improving the efficiency and yield of the upstream production process and the environmental profile of the downstream derivatives.

1. Zeolite Catalysis (The Gold Standard)

The transition from older solid phosphoric acid ($\text{SPA}$) and aluminum chloride ($\text{AlCl}_3$) catalysts to advanced Zeolite catalysts (e.g., ZSM-5, $\text{MCM}$-22) is complete in most major facilities.

Efficiency Gains: Zeolite technology allows for significantly higher conversion rates, improved energy efficiency (due to lower operating temperatures), and reduced by-product formation, thus lowering the cost of producing high-purity Cumene.

2. $\text{BPA}$ Substitution and Alternatives

Regulatory pressure, particularly in North America and Europe, to limit $\text{BPA}$ exposure in food contact materials and consumer products is driving strategic shifts:

Alternative Derivatives: Increased focus on specialty Phenol derivatives that feed into non-$\text{BPA}$ polymers like Polycyclohexylenedimethylene Terephthalate ($\text{PCTG}$) and bio-based polycarbonates.

Acetone Utility: This trend paradoxically benefits the Acetone co-product, as producers often rely on strong Acetone pricing to offset any weakness or investment volatility in the Phenol/$\text{BPA}$ side of the cleavage reaction.

3. Sustainability in Feedstock Sourcing

As chemical companies pursue net-zero targets, there is rising interest in bio-based feedstocks:

Bio-Propylene: Early-stage research and pilot projects are exploring the use of bio-based Propylene (from biomass or waste lipids) to produce bio-Cumene, offering a route to lower the carbon footprint of Phenol and Acetone.

Mass Balance Certification: Implementing mass balance accounting systems to track certified sustainable Benzene and Propylene inputs through the Cumene process, allowing end-product manufacturers to claim reduced carbon footprints.

Competitive Landscape

The Cumene market is oligopolistic, dominated by large, integrated petrochemical players who often produce their own feedstocks and consume the Phenol/Acetone captive to their downstream operations.

Major Players and Strategic Strategies

Global Petrochemical Giants (e.g., $\text{INEOS}$, $\text{Mitsui Chemicals}$, $\text{SABIC}$, $\text{Versalis}$): Strategy is Vertical Integration and Scale. These players prioritize high-volume, low-cost production, relying on continuous operations and the tight integration of their Benzene/Propylene units with the Cumene unit to minimize logistical costs and maximize utilization.

Asian Manufacturers (e.g., Sinopec, $\text{Formosa}$): Strategy is Capacity Dominance and Domestic Supply. Driven by massive domestic demand for $\text{BPA}$ in construction and infrastructure, these companies have rapidly expanded capacity, shifting the global center of production eastward.

Technology Licensors (e.g., $\text{CB} \&\text{I}$/Lummus, $\text{ExxonMobil}$): Strategy is Process Innovation. They compete by selling licensing agreements for next-generation Zeolite catalyst technology, offering higher energy efficiency and superior yield to non-integrated producers.

The key competitive factor is production cost (driven by feedstock price and process efficiency) and the strategic balance of Phenol-to-Acetone demand.

Regional Insights

Production and consumption are heavily concentrated in areas with robust manufacturing and petrochemical clusters.

Asia-Pacific (APAC) (Growth Engine)

Performance: The undisputed leader in both production and consumption, accounting for over half of global demand. Growth is explosive, fueled by China's infrastructure projects, electronics manufacturing, and plastics consumption.

Opportunity: Continued capacity expansion is necessary, with new entrants focusing on coastal logistics and access to imported feedstocks.

North America (Stable and Integrated)

Performance: A mature market characterized by high integration (producers often own refineries and derivatives plants). Benefits from relatively stable and low-cost Propylene supplies derived from shale gas.

Opportunity: Focus on high-purity Phenol for advanced composites and export opportunities to Latin America.

Europe (Regulatory and Specialized)

Performance: Stable consumption but facing intense regulatory pressure (especially regarding $\text{BPA}$). Focus is shifting toward specialized, high-margin Phenol derivatives (e.g., high-performance resins) rather than commodity $\text{BPA}$.

Opportunity: Adoption of mass balance certification and sustainable sourcing strategies to meet stringent $\text{EU}$ environmental standards.

Challenges & Risks

The inherent nature of Cumene as an intermediate makes the market vulnerable to external forces, particularly commodity price swings and regulatory actions on end products.

1. Feedstock Price Volatility

Since Benzene and Propylene constitute the vast majority of the production cost, volatility in crude oil and natural gas prices directly and immediately impacts profitability. Non-integrated producers without dedicated Propylene supply lines are particularly exposed.

2. Phenol/Acetone Co-Product Imbalance

The Cumene process yields 0.6 metric tons of Acetone for every 1.0 metric ton of Phenol. Market strength rarely aligns perfectly for both products. A surge in Phenol demand can lead to an oversupply of Acetone, driving down its price and compressing the overall margin for the Cumene-Phenol chain.

3. Regulatory Risk on $\text{BPA}$

Ongoing political and scientific debate over $\text{BPA}$ safety creates substantial regulatory risk. Any widespread ban or sharp restriction on $\text{BPA}$ in non-food contact applications would necessitate massive, costly shifts in downstream investment, temporarily weakening Phenol demand.

4. High Barrier to Entry

The market requires immense capital expenditure for construction, deep technical expertise for continuous operation, and guaranteed access to a massive scale of feedstock, effectively limiting new market entrants.

Opportunities & Strategic Recommendations

Strategic success requires optimizing the utilization of both co-products and embedding sustainability into the process.

Strategic Recommendations for Stakeholders

Hedge Against Co-Product Imbalance (Integrated Producers): Invest in flexible downstream units that can rapidly shift between various Phenol and Acetone derivatives. For instance, have the capability to quickly ramp up $\text{MMA}$ production when Acetone is cheap, or specialize in non-$\text{BPA}$ Phenol derivatives when $\text{BPA}$ faces regulatory pressure.

Focus on Propylene Sourcing Flexibility (Non-Integrated Producers): Secure diversified, long-term contracts for Propylene. Explore new routes to market via pipeline or dedicated shipping to minimize logistics costs, which are often the main differentiator between integrated and non-integrated players.

Invest in Zeolite $\text{R \& D}$ and Licensing (Technology Providers): Continue refining catalyst technology to maximize conversion and selectivity, reducing utility consumption and waste. Offering modular, efficient production units can attract mid-sized players in emerging markets seeking localized production.

Embrace Mass Balance for Sustainability (End-User Collaboration): Work with key end-users (e.g., automotive $\text{OEM}$s, electronics giants) to implement certified mass balance systems for Phenol. This allows the manufacturer to capture the premium associated with 'sustainable' or 'bio-attributed' plastics and composites.

Browse More Reports:

Middle East and Africa Microgrid Market

Global Febuxostat Market

Global Carbon Steel Market

Global Consumer Chemical Packaging Market

Global Plasmonic Solar Cell Market

Global Electro-medical and Electrotherapeutic Apparatus Market

Global Network Test Lab Automation Market

Global Reclaimed Rubber Market

Global Personal Care Ingredients Market

Global Protein Ingredients in Infant Nutrition Market

Middle East and Africa Frozen Ready Meals Market

Global Surgical Gown Market

Global Navigation Satellite System (NSS) Chip Market

Saudi Arabia q-PCR Reagents Market

Global Aluminum Pigments Market

Global Bearing Isolators Market

Asia-Pacific Ostomy Devices Market

North America Digital Farming Software Market

Global Reconstituted Juice Market

Global Organic Emulsifier Market

Global Metal Cans Market

Asia-Pacific Healthcare Logistics Market

Global Protein Ingredients Market

Global Regulatory Affairs Outsourcing Market

Global Self-Service Kiosks Market

Global Specialty Gas Market

Global Bathroom - Toilet Assist Devices Market

Global Benzenecarboxylic Acid Market

Global Aerospace Fasteners Market

Global Phenol Derivatives Market

Global Mucosal Atomization Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com