Executive Summary

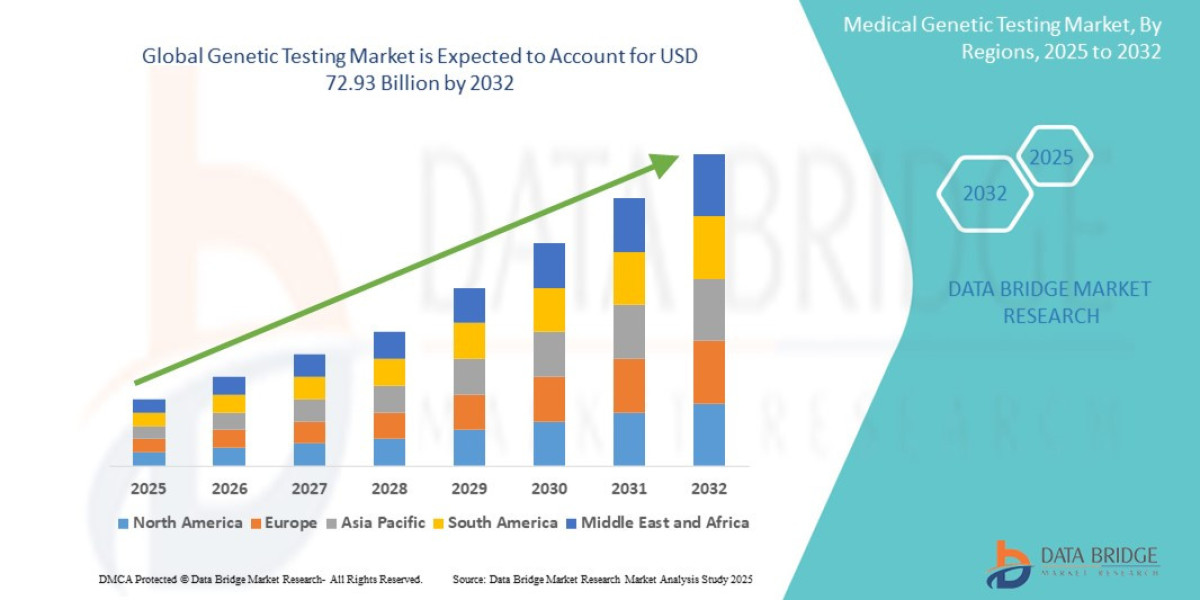

- The global genetic testing market size was valued at USD 21.49 billion in 2024 and is expected to reach USD 72.93 billion by 2032, at a CAGR of 16.5% during the forecast period

Market Overview

The Genetic Testing Market involves analyzing an individual's deoxyribonucleic acid ($\text{DNA}$) or ribonucleic acid ($\text{RNA}$) to identify inherited predispositions, diagnose disease, predict drug response, or establish ancestry.

Key Segments by Technology

Next-Generation Sequencing ($\text{NGS}$) (Dominant and Fastest Growing): Includes targeted panels, exome sequencing, and whole-genome sequencing ($\text{WGS}$). $\text{NGS}$ powers high-throughput, comprehensive genetic analysis and dominates clinical oncology and rare disease diagnostics.

Polymerase Chain Reaction ($\text{PCR}$): Used for fast, targeted, high-volume testing, particularly in infectious disease, carrier screening, and pharmacogenomics.

Microarrays: Used primarily for large-scale research studies and older-generation consumer ancestry testing.

Key Segments by Application

Oncology Testing: The largest and most complex segment, encompassing somatic tumor profiling for targeted therapy selection (Companion Diagnostics) and germline testing for inherited cancer risk.

Reproductive Health: Includes Non-Invasive Prenatal Testing ($\text{NIPT}$) for fetal aneuploidies, Preimplantation Genetic Testing ($\text{PGT}$) for $\text{IVF}$, and carrier screening.

Pharmacogenomics ($\text{PGx}$): Testing to predict an individual's response to specific medications, crucial for optimizing dosing and minimizing adverse drug reactions (ADRs).

Direct-to-Consumer ($\text{DTC}$): Wellness, ancestry, and lifestyle-related genetic testing, highly visible but distinct from clinical diagnostics.

Drivers and Current Dynamics

Core Market Drivers:

Cost Reduction in Sequencing: The cost of sequencing a whole human genome has dropped exponentially, making $\text{WGS}$ economically feasible for routine clinical use.

Increased Clinical Guidelines: Growing inclusion of specific genetic tests (e.g., $\text{BRCA}1/\text{BRCA}2$ for breast cancer, $\text{EGFR}$ for lung cancer) into standard medical practice guidelines.

Rise of Precision Oncology: The shift from treating cancer based on tissue origin to treating based on the tumor's genetic signature.

Current Dynamics: The market is consolidating around integrated providers that can offer end-to-end solutions, from sample preparation to bioinformatics and clinical reporting. There is a strong movement towards integrating $\text{PGx}$ testing into electronic health records ($\text{EHRs}$) to make results actionable at the point of prescribing.

Market Size & Forecast

- The global genetic testing market size was valued at USD 21.49 billion in 2024 and is expected to reach USD 72.93 billion by 2032, at a CAGR of 16.5% during the forecast period

For More Information Visit https://www.databridgemarketresearch.com/reports/global-genetic-testing-market

Key Trends & Innovations

Innovation is focused on making testing faster, cheaper, non-invasive, and more actionable through digital tools.

1. Liquid Biopsy and Multi-Cancer Early Detection ($\text{MCED}$)

This is the most disruptive trend, allowing genetic analysis of circulating tumor $\text{DNA}$ ($\text{ctDNA}$) from a simple blood draw. $\text{MCED}$ tests promise to revolutionize cancer screening by detecting multiple cancer types simultaneously at very early stages, dramatically increasing survival rates and market potential.

2. $\text{AI}$ and Bioinformatics Integration

The volume of data generated by $\text{WGS}$ and $\text{NGS}$ is enormous. $\text{AI}$ and Machine Learning are now essential for:

Variant Interpretation: Rapidly analyzing and classifying genetic variants to distinguish pathogenic mutations from benign changes.

Clinical Decision Support: Integrating genomic reports with clinical data to provide physicians with actionable treatment recommendations.

3. Point-of-Care and Decentralized Testing

Moving some genetic testing out of centralized reference labs:

Rapid $\text{PGx}$: Developing automated, cartridge-based $\text{PCR}$ systems for rapid $\text{PGx}$ testing in hospital pharmacies or emergency rooms, ensuring drug selection can be guided by genetics in minutes rather than days.

Portable Sequencers: Utilizing small, portable $\text{NGS}$ devices for field testing, infectious disease surveillance, and even targeted diagnostics in rural hospitals.

4. Expansion of Non-Invasive Testing

The successful adoption of $\text{NIPT}$ is spurring development in other areas: non-invasive testing for tissue transplantation compatibility, and non-invasive diagnosis for certain neurological disorders.

Competitive Landscape

The market exhibits a clear stratification: large tool and technology providers (instrumentation), specialized clinical labs (testing services), and agile bioinformatics firms (data interpretation).

Major Players and Strategic Strategies

Instrumentation and Reagents (e.g., Illumina, Thermo Fisher Scientific): Strategy is Technology Dominance and Ecosystem Lock-in. These companies compete by controlling the sequencing hardware ($\text{NGS}$ platforms) and consumable reagents, often forming exclusive partnerships with large clinical laboratories.

Clinical Diagnostic Labs (e.g., Quest Diagnostics, LabCorp, specialized oncology labs): Strategy is Reimbursement and Clinical Validation. They compete by securing broad reimbursement coverage, achieving high-volume scale, and maintaining strong relationships with oncologists and specialists.

DTC Players (e.g., 23andMe, AncestryDNA): Strategy is Data Acquisition and Consumer Reach. Their primary value lies in generating massive genetic datasets, which are then monetized through partnerships with pharmaceutical companies for drug discovery and clinical trial recruitment.

The key competitive factor is the ability to achieve reimbursement coverage for novel, high-cost tests, which necessitates irrefutable clinical evidence demonstrating improved patient outcomes.

Regional Insights

Market maturity closely tracks healthcare infrastructure, regulatory clarity, and public expenditure on personalized medicine initiatives.

North America (Clinical Leadership and $\text{DTC}$ Innovation)

Performance: The largest and most mature market, characterized by high adoption rates for advanced tests like $\text{WGS}$ and liquid biopsy, driven by aggressive private insurance coverage and specialized clinical centers.

Opportunity: Continued growth in $\text{PGx}$ implementation and the widespread commercialization of $\text{MCED}$ screening.

Europe (Regulation and Centralized Genomics)

Performance: High technical proficiency, but growth is often constrained by fragmented national healthcare systems and slower reimbursement decisions. Strong government support for large-scale population genomics (e.g., Genomics England).

Opportunity: Harmonization of diagnostic standards and increased public funding for genetic screening programs.

Asia-Pacific (APAC) (Infrastructure-Driven Expansion)

Performance: Fastest-growing region, driven by rising health expenditure, increasing prevalence of cancer and chronic diseases, and investment in genomics research in countries like China, Japan, and India.

Opportunity: Massive potential for the adoption of low-cost, high-volume $\text{PCR}$ and targeted $\text{NGS}$ for infectious disease and hereditary screening in emerging economies.

Challenges & Risks

The genetic testing market faces unique barriers related to ethics, data management, and the need for standardized interpretation.

1. Data Privacy and Security

The sensitive nature of genomic data makes security paramount. Breaches carry immense risk, driving high costs for compliance with global privacy regulations (e.g., $\text{GDPR}$, $\text{HIPAA}$). The $\text{DTC}$ segment is particularly scrutinized for its data handling practices.

2. Reimbursement and Clinical Utility

A major barrier for novel, high-cost tests (especially $\text{WGS}$) is demonstrating sufficient clinical utility to justify payer reimbursement. Lack of standardized evidence requirements across different payers leads to patchy coverage and slows market access.

3. Standardization and Variant Interpretation

There is a lack of global standardization in laboratory protocols and, critically, in the interpretation of complex genetic variants. This can lead to conflicting results or classifications between different labs, eroding physician confidence in complex genomic reports.

4. Ethical and Counseling Challenges

As $\text{WGS}$ becomes more routine, it yields incidental findings (information unrelated to the initial reason for testing). Managing these findings and ensuring adequate access to certified genetic counselors to interpret results for patients remains a major bottleneck.

Opportunities & Strategic Recommendations

Strategic success requires balancing technological innovation with clinical integration and regulatory compliance.

Strategic Recommendations for Stakeholders

Invest in Clinical Decision Support ($\text{CDS}$) (Tech Providers): Shift investment emphasis from pure sequencing hardware to the bioinformatics pipeline and $\text{AI}$-driven $\text{CDS}$ tools. The bottleneck is interpretation and actionability, not data generation. Solutions that seamlessly integrate actionable $\text{PGx}$ results into $\text{EHRs}$ will gain market dominance.

Pursue Diagnostic-as-a-Service ($\text{DaaS}$) (Clinical Labs): For $\text{MCED}$ and other complex tests, adopt a $\text{DaaS}$ model where the test is packaged with comprehensive clinical support, patient counseling, and follow-up guidance, justifying the premium price point to payers and providers.

Establish Robust Global Data Governance (All Players): Treat data security and privacy as a fundamental competitive advantage, not just a compliance cost. Secure international certifications and implement anonymization techniques to facilitate the ethical sharing of aggregated data for research, which provides an invaluable secondary revenue stream (e.g., pharma partnerships).

Target the $\text{PGx}$ Gap (Startups): Focus on developing high-throughput, cost-effective $\text{PGx}$ panels targeting the highest-volume drug categories (e.g., antidepressants, statins) where $\text{PGx}$ guidelines are well-established but adoption remains low due to cost and turnaround time.

Browse More Reports:

Europe Flotation Reagents Market

Global Wearable Fitness Trackers Market

Global Industrial Hearable Market

Global Micro Tube Box Market

Global Perimeter Defence System Market

Global Printed Textile Market

Italy Dental Practice Management Software Market

Global Smart Factory Market

India Food Ingredients Market

Europe q-PCR Reagents Market

Global NAND Flash Memory Market

Europe Food Bags Market

Global Wax and Wax Esters Market

Global Micro-Electromechanical Systems (MEMS) Gyroscopes Market

Middle East and Africa Probe Card Market

Global Injection Trays Market

Global Cord Blood and Cell Banking Market

Europe Protein Hydrolysates Market

Global Laminated Veneer Lumber Market

Middle East and Africa Wind Turbine Pitch System Market

Global Commercial Cleaning Equipment Market

North America Protein Hydrolysates Market

Middle East and Africa Rotomolding Market

Global (GPS) Global Positioning Systems Market

Global Sever’s Disease Treatment Market

Australia Specialty Gas Market

Global Below Grade Waterproofing Membrane Market

Middle East and Africa Intensive Care Unit (ICU) Ventilators Market

Global Beeswax Market

Europe Commercial Cleaning Equipment Market

Global Flooring and Carpets Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com