Executive Summary

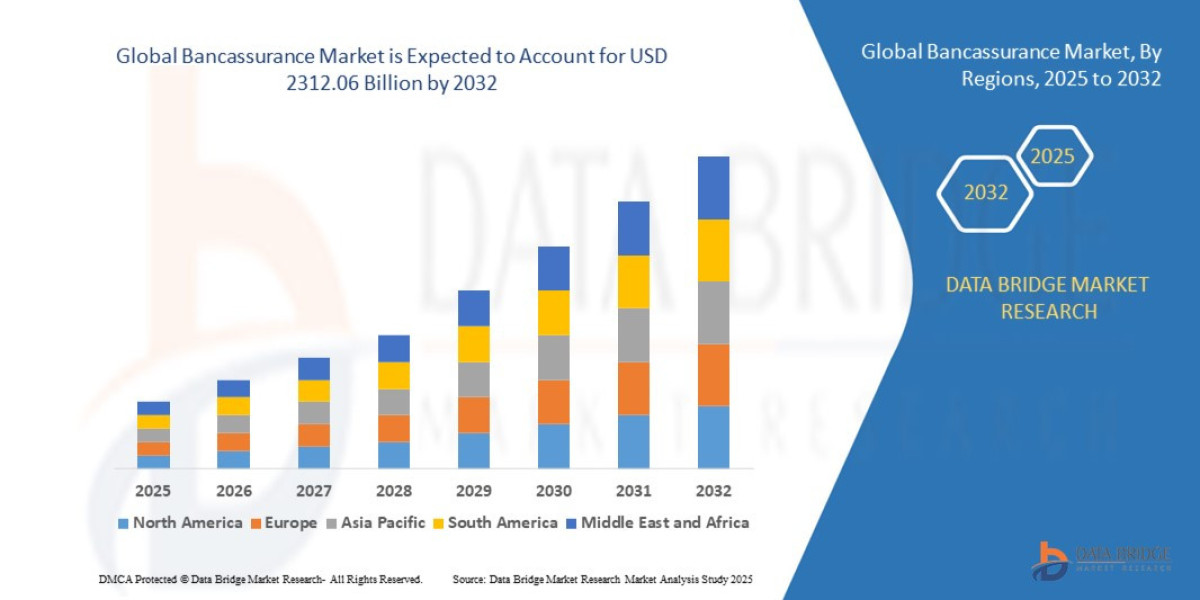

- The global bancassurance market size was valued at USD 1506.54 billion in 2024 and is expected to reach USD 2312.06 billion by 2032, at a CAGR of 5.50% during the forecast period

Market Overview

Bancassurance represents a distribution channel where insurance products are sold through a bank's distribution network, providing insurers access to a massive captive customer base and offering banks a lucrative source of fee income. This arrangement exploits the high trust customers place in their primary financial institution and facilitates the cross-selling of complementary products.

Key Market Segments by Product:

Life Insurance: The dominant segment globally, especially within Asia and Europe. Products include term life, whole life, and unit-linked insurance plans (ULIPs) which often serve as wealth accumulation or retirement vehicles.

Non-Life (P&C) Insurance: Includes motor, property, health, and travel insurance. This segment is growing rapidly, driven by the bundling of property insurance with mortgage products and the increasing adoption of bite-sized, contextual insurance policies sold digitally.

Key Market Segments by Model:

Exclusive/Joint Venture Model: A deep partnership, often involving joint ownership (e.g., a bank holding a stake in the insurer’s distribution arm). This model maximizes commitment and integration (common in Europe).

Non-Exclusive/Distribution Agreement Model: The bank partners with multiple insurers, focusing on maximizing revenue and offering customers choice, common in the U.S. and Latin America.

Key Market Drivers:

Trust and Reach of Banks: Banks possess expansive branch networks and high customer trust, providing an unparalleled point-of-sale advantage compared to traditional independent agents.

Need for Fee Income: Banks face sustained pressure on traditional net interest margins (NIMs). Bancassurance provides a stable, high-margin, non-interest revenue stream (commission) crucial for profitability.

Data Superiority: Banks hold rich, transactional customer data (salaries, loan details, savings patterns) that allows for highly targeted, needs-based insurance sales that are difficult for traditional insurers to replicate.

Regulatory Relaxation: In many emerging markets, regulations have relaxed over the past decade, formally allowing or encouraging banks to enter the insurance distribution space, unlocking massive potential.

Current Market Dynamics:

The market is currently pivoting away from opportunistic, hard-selling strategies (often leading to mis-selling) toward an integrated advisory approach. The focus is shifting from selling a product to selling a solution—integrating insurance offerings seamlessly into major life events handled by the bank, such as taking out a mortgage (property insurance) or saving for retirement (annuities/ULIPs).

Market Size & Forecast

- The global bancassurance market size was valued at USD 1506.54 billion in 2024 and is expected to reach USD 2312.06 billion by 2032, at a CAGR of 5.50% during the forecast period

For More information Visit https://www.databridgemarketresearch.com/reports/global-bancassurance-market

Key Trends & Innovations

The bancassurance model is being revolutionized by technological advancements that address legacy issues of sales quality and customer friction.

1. Phygital Distribution Models: This is the most critical trend. The 'phygital' model integrates the high-touch advice of a financial advisor (physical) with the speed and convenience of digital self-service (digital). Customers handle simple transactions (claims, policy renewal) via the app, while the AI-driven data collected informs the in-branch advisor on the best moment and product for a complex sale.

2. AI and Predictive Analytics for Personalization: Banks are leveraging AI and Machine Learning (ML) on their vast customer data lakes to move beyond simple demographics. Predictive models can now identify specific customer life events (e.g., marriage, new job, new baby) and proactively offer the most relevant insurance product at the precise moment of need, dramatically improving conversion rates and suitability.

3. Embedded and Contextual Insurance: A significant shift, especially for Non-Life products. Insurance policies are now being "embedded" directly into the bank's other products and services. Examples include travel insurance automatically bundled with a flight purchase on a bank card, or cyber insurance offered instantly to an SME applying for an online business loan. This makes insurance virtually frictionless.

4. Open Banking and API Integration: The move toward Open Banking is facilitating deeper integration between banks and external specialized insurers. Using Application Programming Interfaces (APIs), a bank can offer products from multiple third-party insurers, rapidly diversifying its insurance portfolio without requiring long, complex joint-venture negotiations.

Competitive Landscape

Competition in bancassurance is multi-layered, involving rivalry between insurance groups to secure bank partnerships and competition between banks to offer the most comprehensive financial product suite.

Major Players and Strategic Alliances:

Bank-Led Integration: European giants like BNP Paribas Cardif and Intesa Sanpaolo Vita are globally dominant, leveraging wholly-owned or deeply integrated insurance subsidiaries to control the entire value chain (underwriting, distribution, claims).

Insurance-Led Distribution: Companies like AXA and Allianz often rely on non-exclusive agreements, partnering with numerous local and regional banks across different geographies to cast a wider distribution net.

Asia-Pacific Alliances: Long-term, high-value exclusive deals are common, exemplified by collaborations between regional banks (e.g., DBS, OCBC) and global insurers (e.g., Manulife, Prudential) to tap into rapidly growing wealth segments.

Competitive Strategies:

Talent Alignment: Competition hinges on training bank branch staff to be effective insurance sellers. Successful firms implement specialized training, dual certification, and performance incentives to foster a synergistic sales culture rather than a conflict of interest.

Digital Customer Journey: Leading banks are competing on the quality of their mobile application experience, specifically for insurance. This includes instant quote generation, straight-through processing for simpler policies, and in-app claims submission.

Holistic Wealth Management: The competitive focus is increasingly on integrating insurance (especially annuities and savings products) as a core pillar of holistic wealth and retirement planning, directly competing with independent financial advisors.

Regional Insights

The maturity and regulatory environment dictate the strategic focus of bancassurance across key global regions.

Asia-Pacific (APAC)

Growth Engine: APAC, particularly China, India, and Southeast Asia, is the fastest-growing market globally. Driven by rising disposable income, low historical insurance penetration, and a cultural affinity for savings-linked Life products.

Strategic Focus: Exclusive partnerships are highly prized and attract massive investment. The focus is on the large-scale enrollment of the burgeoning middle class into basic Life and savings products. Technology is critical for servicing dispersed populations.

Europe

Maturity and Penetration: The most mature region, characterized by high penetration rates and often deep, integrated bank-insurer joint ventures (especially in France, Italy, and Spain).

Strategic Focus: High-margin wealth management, complex pension and annuity products, and meeting rigorous customer protection and data privacy standards (MiFID II and IDD directives). The sales process is often heavily regulated and advice-driven.

North America (U.S. and Canada)

Lower Penetration: Bancassurance penetration is comparatively lower due to a strong independent agent culture and historical regulatory separation of banking and insurance.

Strategic Focus: Banks primarily focus on distributing highly regulated wealth and retirement products (annuities, 401k rollovers) to their affluent client base. Non-exclusive, open-architecture models are more common to provide maximum product choice.

Challenges & Risks

The complexity of merging two distinct financial services cultures and managing regulatory scrutiny presents significant hurdles.

1. Regulatory Mis-selling Risk: The primary risk is the potential for mis-selling. Banking staff, incentivized by sales targets and often lacking deep product knowledge, may push inappropriate or unsuitable products, leading to major fines and reputational damage (e.g., instances observed in European and Asian markets). This requires robust digital compliance checks and suitability algorithms.

2. Cultural and Operational Misalignment: Banks and insurers operate on fundamentally different sales cycles, risk appetites, and remuneration structures. Integrating these two cultures—the steady, regulated nature of banking versus the fast, commission-driven sales culture of insurance—can lead to internal conflicts, poor data sharing, and disjointed customer experiences.

3. Data Privacy and Security: Leveraging customer data is the core strength of bancassurance, but it carries the risk of violating stringent data protection laws (like GDPR). Sharing data securely and legally between the bank and the insurer requires complex, compliant IT infrastructure.

4. Channel Cannibalization: There is a risk that the highly visible bancassurance channel cannibalizes sales from the insurer's traditional agency channel. Insurers must carefully manage channel conflict to maintain the loyalty and performance of their independent agents.

Opportunities & Strategic Recommendations

To thrive in the evolving landscape, stakeholders must prioritize seamless integration and digital advisory capabilities.

For Banks:

Full Digital Integration (Phygital): Move beyond simple digital lead generation. Integrate insurance sales, servicing, and claims directly into the core banking app. Use the branch staff not as sales personnel, but as Digital Navigators who assist customers with complex digital purchases or advisory needs.

Embedded Microinsurance: Focus on high-frequency, low-premium Non-Life products embedded at the point of sale (e.g., offering a small gadget or fraud protection insurance automatically when a customer uses their debit card for a high-value purchase). This generates easy fee income and introduces insurance concepts to new buyers.

For Insurers:

API-First Product Development: Design insurance products (especially P&C) with an API-first approach, allowing bank partners to easily plug the product into their mobile apps and underwriting engines without complex bespoke IT integration.

Specialized Training and Certification: Co-develop rigorous training programs with bank partners that lead to formal industry certification. This reduces mis-selling risk and transforms banking staff into credible, specialized financial advisors.

For Investors and Technology Providers:

AI-Powered Suitability Tools: Invest in RegTech and AI solutions that monitor sales conversations (in-person or digital) in real-time to ensure regulatory compliance and product suitability, mitigating the major mis-selling risk that plagues the industry.

Modular Core Systems: Develop modular insurance core systems that can be implemented rapidly within a bank’s IT environment, dramatically reducing the time-to-market for new bancassurance products and lowering the initial high cost of integration.

Browse More Reports:

Global 3D Printing Construction Market

North America Rowing Boats and Kayaks Market

Middle East and Africa pH Sensors Market

Global Food Bags Market

Global Gasification Clean Coal Market

Global Immuno-Oncology Clinical Trials Market

Global Industrial Plastic Market

Global Gas Fire Table Market

Europe Plant Based Protein Market

Europe Bridge Bearings Market

Global Rail Public Transport Market

Global Sensor Data Analytics Market

Saudi Arabia Building Thermal Insulation Market

Global Low Profile Additives Market

Kenya, Uganda, Tanzania, and Rwanda Potato Processing Market

Global Endovascular Stent Grafts Market

Global Honeycomb Packaging Market

Global De Quervain's Tenosynovitis Treatment Market

Global Concrete Admixture Market

North America Microgrid Market

Global Organic Personal Care Products Market

Global IoT Security Market

North America Infection Surveillance Solution Systems Market

Global Hydrogen Sensor Market

East and Africa Unmanned Ground Vehicle Market

Global Soil Monitoring System Market

Middle East and Africa (MEA) Sludge Treatment Chemicals Market

Global Polycaprolactone (PCL) Market

Global Prenatal Genetic Counselling Market

Global Remote Sensing Infrared Light Emitting Diode (LED) Market

North America Plant-Based Milk Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com