Executive Summary

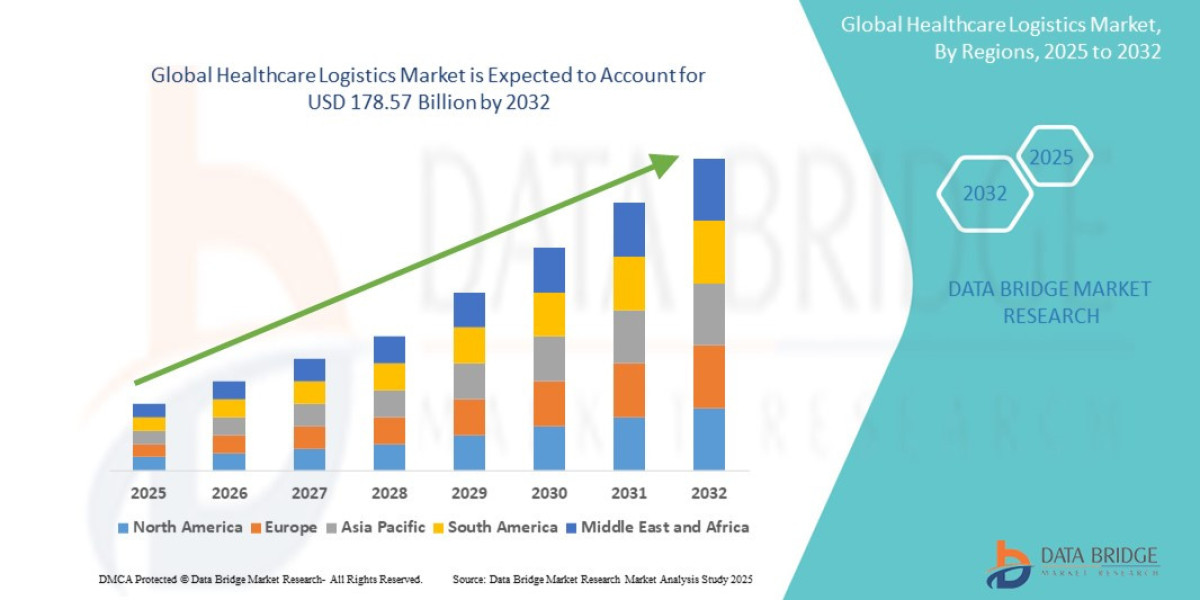

- The global healthcare logistics market size was valued at USD 99.38 billion in 2024 and is expected to reach USD 178.57 billion by 2032, at a CAGR of 7.60% during the forecast period

Market Overview

Defining Healthcare Logistics

Healthcare logistics encompasses the specialized planning, implementation, and control of the flow and storage of materials, products, and information from the point of origin to the point of consumption within the health system. Unlike conventional logistics, it is characterized by exceptionally high regulatory requirements, the need for product integrity (especially temperature control), high-value cargo, and direct implications for patient outcomes.

The market is broadly categorized by two primary service segments:

Pharmaceutical Products Logistics: This includes the distribution of branded drugs, generic medicines, and, increasingly, complex biologics and vaccines requiring stringent cold chain management. This segment typically holds the largest market share.

Medical Devices & Equipment Logistics: Covering everything from high-value diagnostic machines and surgical supplies to consumables and instruments. This segment is characterized by complex reverse logistics (for repairs and recalls) and white-glove delivery services.

Key Market Drivers

Growth of the Biopharmaceutical Industry: The surge in the development and manufacturing of biologics, monoclonal antibodies, and advanced therapies (Cell and Gene Therapies) necessitates ultra-cold and specialized transport solutions (e.g., cryogenic transport at $-196^\circ$C).

Aging Population and Chronic Disease Prevalence: Global demographic shifts are increasing the demand for consistent and specialized medication and medical device supplies, particularly in developed economies.

Rise of Outsourcing (3PL Adoption): Healthcare companies are increasingly partnering with specialized Third-Party Logistics (3PL) providers to manage the complex, high-risk, and capital-intensive nature of regulatory compliance, cold chain, and international distribution.

Regulatory Stringency: Governing bodies like the FDA, EMA, and others continuously update requirements (e.g., GDP – Good Distribution Practice), compelling organizations to invest in advanced tracking and validation systems.

Current Market Dynamics

The market is currently undergoing a rapid transformation driven by the shift from a centralized, volume-based model to a decentralized, value-based, and patient-centric model. The supply chain has moved from a simple factory-to-hospital linear path to a complex, bidirectional network involving patient homes, clinical trial sites, and specialized compounding pharmacies. The rapid lessons learned from the global distribution of COVID-19 vaccines have permanently reset expectations for speed, transparency, and global cold chain resilience.

Market Size & Forecast

- The global healthcare logistics market size was valued at USD 99.38 billion in 2024 and is expected to reach USD 178.57 billion by 2032, at a CAGR of 7.60% during the forecast period

For More Information Visit https://www.databridgemarketresearch.com/reports/global-healthcare-logistics-market

Key Trends & Innovations

The healthcare logistics ecosystem is being fundamentally reshaped by five interconnected trends:

1. Advanced Cold Chain Resilience

The focus is moving beyond simple refrigeration to robust, multi-temperature management. Innovations include:

Cryogenic Capabilities: The need to handle advanced therapies requiring ultra-low temperatures ($-70^\circ$C to $-196^\circ$C).

Smart Packaging: Adoption of phase-change materials (PCMs) and vacuum-insulated panels (VIPs) in passive temperature-controlled packaging, reducing dependence on energy-intensive active systems.

Real-Time Monitoring (IoT): Miniature, wireless IoT sensors, smart labels, and data loggers are embedded in packaging and vehicles, providing granular, verifiable temperature and humidity data in real time, crucial for regulatory audit trails.

2. Digitalization and Predictive Analytics

The integration of advanced digital tools is shifting the supply chain from reactive to predictive.

AI for Demand Forecasting: Artificial intelligence and machine learning models analyze historical consumption, patient census data, and demographic trends to accurately forecast demand for specific supplies and pharmaceuticals, dramatically reducing waste and stockouts.

Control Tower Visibility: Cloud-based platforms integrate data from multiple partners (manufacturers, 3PLs, freight carriers) to provide a single, end-to-end view of the supply chain, enabling quick decision-making and disruption mitigation.

3. Patient-Centric & Final-Mile Delivery (Direct-to-X)

The rise of home healthcare, remote clinical trials, and personalized medicine is driving the need for logistics solutions that bypass traditional institutional settings.

Direct-to-Patient (DTP): Specialized services for delivering high-value or temperature-sensitive medications directly to a patient's home, often requiring "white-glove" service for complex handling, privacy, and hand-off procedures.

Direct-to-Pharmacy/Clinic: Streamlined micro-distribution models that are more agile than traditional large regional hubs.

4. Blockchain for Traceability and Anti-Counterfeiting

Blockchain technology is gaining traction by creating an immutable, distributed ledger for tracking pharmaceuticals and devices. This enhances:

Product Authenticity: Providing tamper-proof verification of a product's origin and journey, critical for combating the estimated $200$ billion global market for counterfeit drugs.

Regulatory Compliance: Simplifying the audit process by having an unchangeable record of every step of custody and temperature reading.

5. Sustainability and Green Logistics

Under mounting pressure from regulatory bodies and Corporate Social Responsibility (CSR) initiatives, logistics providers are prioritizing environmental, social, and governance (ESG) factors.

Optimized Routing: AI-driven route optimization to minimize fuel consumption and carbon footprint.

Eco-Friendly Packaging: Shifting from single-use Styrofoam to sustainable, recyclable, or reusable packaging and container systems.

Carbon-Neutral Facilities: Investment in energy-efficient or carbon-neutral warehousing and use of electric or alternative-fuel vehicles for transport.

Competitive Landscape

The healthcare logistics market is dominated by global integrated logistics giants and major drug wholesalers, which leverage their vast global networks and massive investment capacity. The landscape can be broken down into three main groups:

1. Global Logistics Leaders (The Integrators)

These companies offer comprehensive, end-to-end supply chain management and have heavily invested in dedicated healthcare divisions.

DHL Supply Chain/Deutsche Post DHL Group: A global leader, known for its extensive network, large fleet of temperature-controlled vehicles, and vast pharmaceutical warehousing capacity worldwide.

UPS Healthcare: Focused heavily on specialized cold chain and clinical trial logistics, with a strong emphasis on technology integration and global expansion through strategic acquisitions (e.g., Bomi Group).

FedEx HealthCare Solutions: Offers specialized freight, express, and ground services tailored for medical products, with a robust focus on temperature-control solutions and tracking.

Kuehne + Nagel & DB Schenker: Strong European players rapidly expanding their specialized healthcare and life sciences portfolio globally, particularly in clinical trial logistics and ocean freight for pharma.

2. Major Drug Wholesalers & Distributors

Companies that traditionally control the flow of drugs within domestic markets and possess unparalleled last-mile access to pharmacies and hospitals.

AmerisourceBergen (Cencora): A pharmaceutical giant that has logistics as a core function, offering comprehensive distribution and inventory management services.

McKesson Corp. & Cardinal Health: Provide essential logistics functions for hospitals and retail pharmacies, leveraging dense domestic networks and high-volume, ambient distribution.

3. Specialty & Regional Players

Smaller, agile firms focusing on specific niches, such as clinical trial logistics, cryogenic transport, or advanced packaging solutions. Their competitive edge is deep regulatory expertise and highly specialized, often white-glove, services.

Competitive Strategy Trends:

M&A and Capacity Expansion: Leading players are aggressively using mergers and acquisitions (M&A) to expand their geographic footprint (especially in APAC and LATAM) and acquire specialized cold chain or IT capabilities.

Vertical Integration: Logistics providers are offering more value-added services, moving beyond transport and storage to include customized packaging, labeling, kit assembly, and quality control checks, creating a stickier customer relationship.

Digital Differentiation: Competition is increasingly based on technological superiority—specifically the robustness of their real-time monitoring, predictive analytics platforms, and compliance systems.

Regional Insights

The global market exhibits distinct regional characteristics based on infrastructure, regulatory maturity, and pharmaceutical manufacturing presence.

North America (Market Leader)

Market Share: Holds the largest revenue share, estimated at around $39\%-40\%$ of the global market.

Drivers: Strong presence of major pharmaceutical and medical device manufacturers, advanced and highly-regulated healthcare infrastructure, and high adoption of biologics and specialty medicines, driving intense demand for cold chain. The US is a major hub for clinical trials, demanding sophisticated logistics.

Opportunities: Continued investment in direct-to-patient models and warehouse automation to cope with high labor costs.

Europe (Mature and Diverse)

Market Dynamics: A mature market characterized by complex cross-border logistics across numerous national regulatory regimes, necessitating advanced customs and compliance expertise.

Drivers: Significant aging population, strong biopharma research, and mandatory adherence to strict EU Good Distribution Practice (GDP) guidelines.

Opportunities: Centralization and consolidation of distribution hubs, coupled with investments in intermodal transport to improve speed and reduce environmental impact.

Asia-Pacific (Fastest Growth)

Market Potential: Expected to be the fastest-growing region (high double-digit CAGR potential).

Drivers: Expanding healthcare access, rapid urbanization, increasing per capita healthcare spending, and the growth of local pharmaceutical manufacturing hubs (e.g., India and China).

Challenges: Wide geographical expanse, diverse climate zones (from tropical to high altitude), and underdeveloped cold chain infrastructure in certain developing countries.

Opportunities: Massive investment requirement in cold chain infrastructure, making it a prime target for foreign logistics and 3PL investment, particularly in last-mile solutions for dense urban centers.

Challenges & Risks

Despite the buoyant growth, the healthcare logistics market faces significant structural and operational hurdles.

Regulatory Compliance Complexity: The varying and ever-changing global regulatory landscape (GDP, country-specific licensing, import/export controls) is a major barrier. A single deviation in temperature or documentation can render multi-million dollar batches of product useless.

Cold Chain Investment Cost: Building, maintaining, and validating the infrastructure for ultra-cold storage, specialized passive packaging, and refrigerated transport vehicles requires enormous capital investment, especially for smaller players or new market entrants.

Product Integrity and Counterfeiting: Maintaining product quality (efficacy, sterility, temperature) throughout a long, global supply chain, and guarding against the pervasive threat of counterfeit products, requires constant vigilance and technological investment.

Data Security and Privacy (HIPAA/GDPR): As logistics providers handle more patient-centric deliveries and clinical trial materials, they become custodians of sensitive health information, necessitating rigorous, compliant data security protocols.

Workforce Specialization: A lack of adequately trained personnel for handling sensitive biologics, specialized customs clearance, and operating complex cold chain monitoring systems poses a significant operational constraint.

Opportunities & Strategic Recommendations

For stakeholders, the current market dynamics present clear pathways for strategic engagement and growth.

For Established 3PLs and Logistics Providers

Prioritize Advanced Cold Chain Acquisition: Focus M&A and capital expenditure on specialized ultra-cold storage, cryogenic handling, and real-time monitoring technologies. The future of high-value pharmaceuticals resides in $\text{$-70^\circ$C}$ to $\text{$-196^\circ$C}$ requirements.

Develop Integrated Software Solutions: Move beyond basic track-and-trace. Invest in predictive analytics and AI-driven platforms that integrate supply chain data with patient demand profiles to offer a proactive, risk-mitigating service.

Expand 'Direct-to-X' Capabilities: Build out robust, compliant last-mile infrastructure for DTP and decentralized clinical trial support, which requires highly trained "white-glove" couriers and specialized home delivery packaging.

For Pharmaceutical and Biopharma Manufacturers

Strategic 3PL Partnership Review: Shift from transactional relationships to deep, long-term strategic partnerships with a limited number of global 3PLs capable of managing end-to-end complexity, regulatory risk, and temperature control worldwide.

Supply Chain Diversification: Implement multi-sourcing and regional distribution centers to build supply chain resilience against geopolitical and natural disaster risks, avoiding reliance on single-country manufacturing hubs.

For Investors and Startups

Target Niche Technology Gaps: Invest in startups developing verifiable traceability solutions (Blockchain, advanced RFID), sustainable/reusable cold chain packaging, and AI-powered customs/regulatory automation tools.

Focus on Emerging Market Infrastructure: Explore joint venture opportunities in high-growth APAC and LATAM regions to develop modern, compliant, multi-temperature warehousing and refrigerated transportation networks, thereby capturing the massive potential of these underserved markets.

Browse More Reports:

Global Algae Fertilizers Market

Global Construction Film Market

Global Antimicrobial Agent Market

Global Benchtop Laboratory Water Purifier Market

Asia-Pacific Feed Flavours and Sweeteners Market

Global Catenary Infrastructure Market

Global Bus Public Transport Market

Latin America Point of Care Infectious Disease Market

Global Innovation Management Market

Middle East and Africa Indium Market

Global Antibiotics Market

Global Potassium Humate Biostimulants Market

Africa MDI, TDI, Polyurethane Market

Global Dental Diode Lasers Market

Middle East and Africa Artificial Turf Market

Global Hematologic Malignancies Market

Latin America Ostomy Devices Market

Asia-Pacific Rotomolding Market

Philippines Microgrid Market

Global Automated Beverage Carton Packaging Machinery Market

Global Surgical Power Tools Market

Europe Intensive Care Unit (ICU) Ventilators Market

Global Vasodilators Market

Global Methylene Diphenyl Diisocyanate (MDI), Toluene Diisocyanate (TDI) and Polyurethane Market

Global Constrictive Pericarditis Market

Middle East and Africa q-PCR Reagents Market

Global Artificial Turf Market

Global Styrene Butadiene Latex Market

Global Digital Farming Software Market

Global Alpha Linolenic Acid Market

Global Head and Neck Cancer Drug MarketAbout Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com