Executive Summary

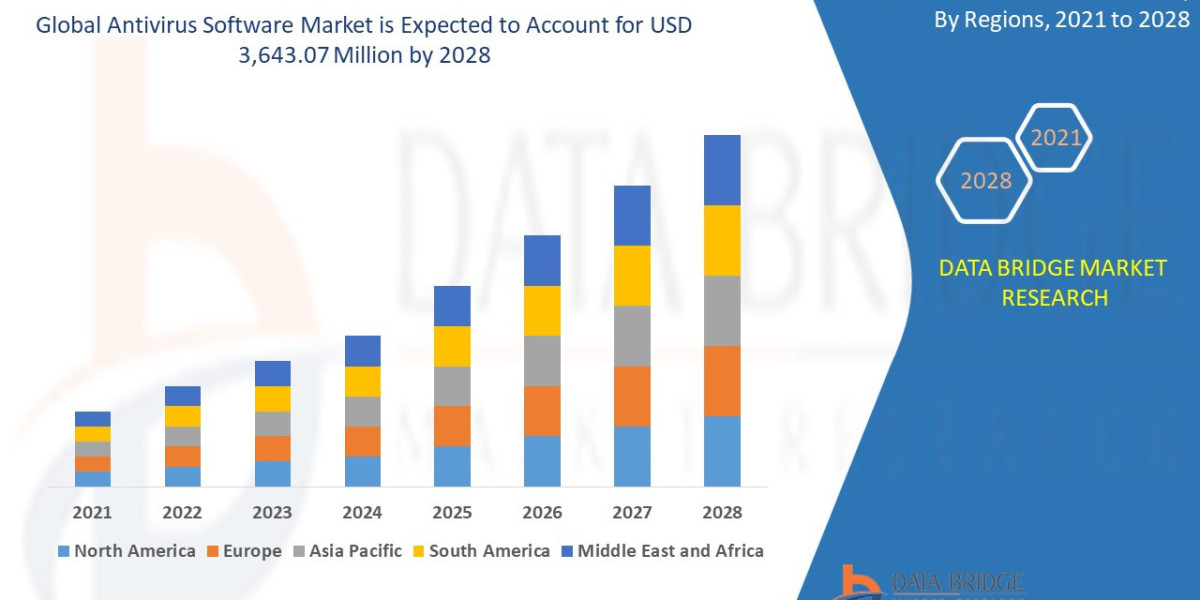

Antivirus software market size is valued at USD 3,643.07 million by 2028 is expected to grow at a compound annual growth rate of 1.6% in the forecast period of 2021 to 2028.

Market Overview

Definition and Scope

The Antivirus Software Market covers solutions designed to prevent, detect, and remove malicious software, including viruses, worms, Trojans, ransomware, and spyware, from endpoint devices (laptops, desktops, servers, mobile devices).

Key segments include:

Solution Type:

Traditional Antivirus (AV): Signature-based protection (declining share).

Endpoint Protection Platform (EPP): Next-generation AV with machine learning, behavioral analysis, and exploit prevention.

Endpoint Detection and Response (EDR): Focuses on continuous monitoring, incident response, and threat hunting.

Extended Detection and Response (XDR): A unified security platform that correlates data across endpoints, cloud, network, and email.

Deployment Model: Cloud-based (SaaS) and On-premise (rapid shift towards cloud).

End-User: Large Enterprises, SMEs, and Individual Consumers.

Market Drivers

Ransomware Proliferation: The exponential financial and operational damage caused by targeted ransomware attacks forces organizations across all sectors to invest proactively in advanced EDR and XDR solutions.

Digital Transformation & Cloud Adoption: Rapid cloud migration and the increased reliance on SaaS applications expand the attack surface, necessitating robust, cloud-native endpoint security.

Regulatory Compliance: Strict data protection regulations (e.g., GDPR, CCPA, HIPAA) mandate comprehensive security measures, pushing companies to adopt compliant and verifiable endpoint controls.

Remote/Hybrid Work Paradigm: The decentralization of the corporate network requires security solutions that can protect devices outside the traditional perimeter, accelerating the demand for cloud-delivered EPP and EDR.

Current Market Dynamics

The market is characterized by a "shift-left" towards proactive defense, moving away from simple reactive detection. Traditional AV providers are struggling to keep pace with agile cybersecurity specialists focused on EDR/XDR platforms that use sophisticated machine learning models to detect fileless malware and zero-day exploits. Pricing is increasingly shifting from a per-device model to a usage-based or feature-tier subscription model, particularly in the enterprise segment.

Market Size & Forecast

Antivirus software market size is valued at USD 3,643.07 million by 2028 is expected to grow at a compound annual growth rate of 1.6% in the forecast period of 2021 to 2028.

For More Information Visit https://www.databridgemarketresearch.com/reports/global-antivirus-software-market

Key Trends & Innovations

1. The XDR Convergence

XDR is rapidly becoming the standard expectation for enterprise security. This innovation moves beyond the endpoint silo by integrating telemetry from email, network infrastructure, cloud workloads, and identity platforms. This holistic approach provides analysts with a complete kill chain view, drastically reducing response times and minimizing alert fatigue. This trend is forcing EDR specialists to either build out full XDR capabilities or partner strategically to fill the missing components (e.g., cloud access security broker or network firewalls).

2. AI and Behavioral Analysis

The use of Generative AI and advanced Machine Learning (ML) is paramount. AI is leveraged not just for detecting known malware, but for sophisticated behavioral analysis, identifying anomalous process execution, lateral movement, and the subtle indicators of compromise (IoCs) characteristic of fileless or polymorphic attacks. Future innovations will focus on autonomous response capabilities, allowing AI to contain and remediate threats instantly without human intervention.

3. Shift to SaaS/Cloud-Native Solutions

Legacy, on-premise solutions are rapidly being replaced by multi-tenant, cloud-native architectures. This shift allows for faster deployment, simplified management, and instant delivery of threat intelligence updates globally. It also facilitates the integration of endpoint security with other cloud security tools, offering customers a unified security stack delivered as a service.

4. Supply Chain Security Integration

Recent high-profile attacks targeting software supply chains have driven a trend toward integrated vendor risk management within endpoint solutions. Next-generation platforms are expected to incorporate software composition analysis (SCA) and secure development lifecycle (SDLC) controls to monitor and protect against vulnerabilities injected through third-party dependencies.

Competitive Landscape

The Antivirus Software Market is characterized by intense competition across specialized niches, though consolidation is ongoing. The market can be broadly divided into three competitive tiers:

Tier | Players (Examples) | Strategic Focus |

|---|---|---|

Tier 1: Established Security Giants (Full Stack) | Broadcom (Symantec), McAfee (Trellix), Check Point, Microsoft (Defender) | Offering comprehensive, integrated security portfolios (EPP, EDR, Cloud, Identity) to large enterprises. Leveraging large existing customer bases and channel partnerships. |

Tier 2: EDR/XDR Innovators (Disruptors) | CrowdStrike, SentinelOne, Palo Alto Networks (Cortex XDR) | Leading the innovation curve with cloud-native EDR/XDR platforms, superior threat intelligence, and a focus on high-fidelity detection and rapid response. Often targeting higher-value enterprise customers. |

Tier 3: Niche & Consumer Specialists | Avast/AVG (Gen Digital), Kaspersky, ESET | Dominate the traditional consumer and lower-end SME market. High volume, lower margin business, with a focus on ease of use and basic protection features. |

Key Competitive Strategies:

MDR (Managed Detection and Response) Services: Tier 2 players are increasingly bundling their platforms with 24/7/365 human-led security operations center (SOC) services to address the cybersecurity talent gap felt by mid-market organizations.

Platform Integration: Leveraging APIs and open platforms to integrate seamlessly with adjacent security technologies (SIEM, SOAR, Identity Management) to achieve XDR functionality without complex mergers.

Focus on the Mid-Market: Targeting SMEs with simplified, subscription-based EDR packages that offer enterprise-grade protection without the associated complexity of managing a large SOC.

Regional Insights

Market performance varies significantly across regions, reflecting differing levels of digital maturity, threat exposure, and regulatory regimes.

North America (Dominant but Maturing)

North America holds the largest market share, driven by the presence of large technology companies, a highly sophisticated regulatory environment, and high rates of enterprise digital transformation. The region is the primary adopter of cutting-edge EDR and XDR solutions and is characterized by a strong appetite for managed security services (MDR). Growth is steady, focused on advanced capabilities rather than basic penetration.

Europe (Regulatory Compliance Driver)

Europe exhibits strong growth, primarily fueled by stringent compliance requirements such as GDPR and NIS 2 Directive. Organizations here are prioritizing solutions that offer robust data governance and clear audit trails. Western Europe is advanced, while Eastern Europe presents significant untapped potential, especially in modernizing IT infrastructure within the SME sector.

Asia-Pacific (Highest Growth Potential)

The APAC region is projected to register the highest CAGR. Rapid industrial digitalization, increasing internet penetration (especially in India and Southeast Asia), and governmental efforts to secure critical infrastructure are accelerating adoption. While cost sensitivity remains a factor, the shift to cloud security models is easing deployment and driving substantial volume growth in the mid-market.

Rest of the World (Emerging Opportunities)

Latin America and MEA (Middle East & Africa) represent emerging markets characterized by significant government and financial sector investments in cybersecurity, often skipping older AV generations and moving straight to EDR/EPP deployment.

Challenges & Risks

1. Evasion Techniques and Zero-Day Exploits

The biggest technological challenge remains the continuously evolving sophistication of threat actors. Fileless malware, living-off-the-land (LotL) techniques, and zero-day exploits are designed to bypass traditional signature and even behavioral analysis tools, forcing vendors into an endless cycle of innovation and response.

2. Alert Fatigue and Operational Complexity

For enterprise customers, the deluge of alerts generated by complex EDR platforms leads to "alert fatigue" and delays in genuine incident response. The solutions are often too complex for understaffed IT security teams, driving the increasing reliance on MDR providers but creating integration friction for vendors.

3. Talent Shortage

A global shortage of skilled cybersecurity professionals, particularly those proficient in running and tuning EDR/XDR platforms, remains a major barrier to adoption and effective utilization, particularly for SMEs.

4. Consolidation and Vendor Lock-in

The trend toward XDR platform convergence risks creating vendor lock-in, where customers are forced to accept a single vendor’s solution for multiple security needs, potentially limiting best-of-breed choices and increasing total cost of ownership.

Opportunities & Strategic Recommendations

For EDR/XDR Vendors

Prioritize Seamless XDR Integration: Focus development efforts on frictionless, pre-built integrations with third-party cloud security, identity, and network platforms. The winning platform will be the most open and integrable.

Expand MDR Services: Deepen investment in managed services to address the talent gap. This shift transforms the vendor from a software provider into a strategic security partner, unlocking higher recurring revenue streams.

Autonomous Response: Invest heavily in AI/ML models that can execute automated containment and remediation actions with high confidence, reducing the dependence on human intervention.

For Investors and Private Equity

Target the Mid-Market: Look for vendors specializing in simplified, subscription-based EDR/XDR offerings tailored for the SME segment, which is highly underserved and ripe for modernization.

Bet on Cloud-Native: Favor vendors with pure-play, cloud-native architectures that demonstrate scalability and rapid threat intelligence delivery over legacy platforms undergoing complex re-platforming.

Invest in Threat Intelligence: Seek companies that possess or are building proprietary, high-quality threat intelligence capabilities, as this forms the competitive backbone of any modern security platform.

For Traditional AV Providers

Aggressive Platform Transition: Traditional players must aggressively migrate their customer base to a cloud-native EPP/EDR platform, utilizing their brand recognition and large install base as a bridge to sell advanced features. Failure to do so will result in continued market share erosion.

Focus on Usability: Leverage the strength of the consumer segment—simplicity and ease of use—and apply these design principles to the SME/mid-market enterprise offering to lower the barrier to adoption.

Browse More Reports:

Middle East and Africa Microgrid Market

Global Febuxostat Market

Global Carbon Steel Market

Global Consumer Chemical Packaging Market

Global Plasmonic Solar Cell Market

Global Electro-medical and Electrotherapeutic Apparatus Market

Global Network Test Lab Automation Market

Global Reclaimed Rubber Market

Global Personal Care Ingredients Market

Global Protein Ingredients in Infant Nutrition Market

Middle East and Africa Frozen Ready Meals Market

Global Surgical Gown Market

Global Navigation Satellite System (NSS) Chip Market

Saudi Arabia q-PCR Reagents Market

Global Aluminum Pigments Market

Global Bearing Isolators Market

Asia-Pacific Ostomy Devices Market

North America Digital Farming Software Market

Global Reconstituted Juice Market

Global Organic Emulsifier Market

Global Metal Cans Market

Asia-Pacific Healthcare Logistics Market

Global Protein Ingredients Market

Global Regulatory Affairs Outsourcing Market

Global Self-Service Kiosks Market

Global Specialty Gas Market

Global Bathroom - Toilet Assist Devices Market

Global Benzenecarboxylic Acid Market

Global Aerospace Fasteners Market

Global Phenol Derivatives Market

Global Mucosal Atomization Devices MarketAbout Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com"