Executive Summary

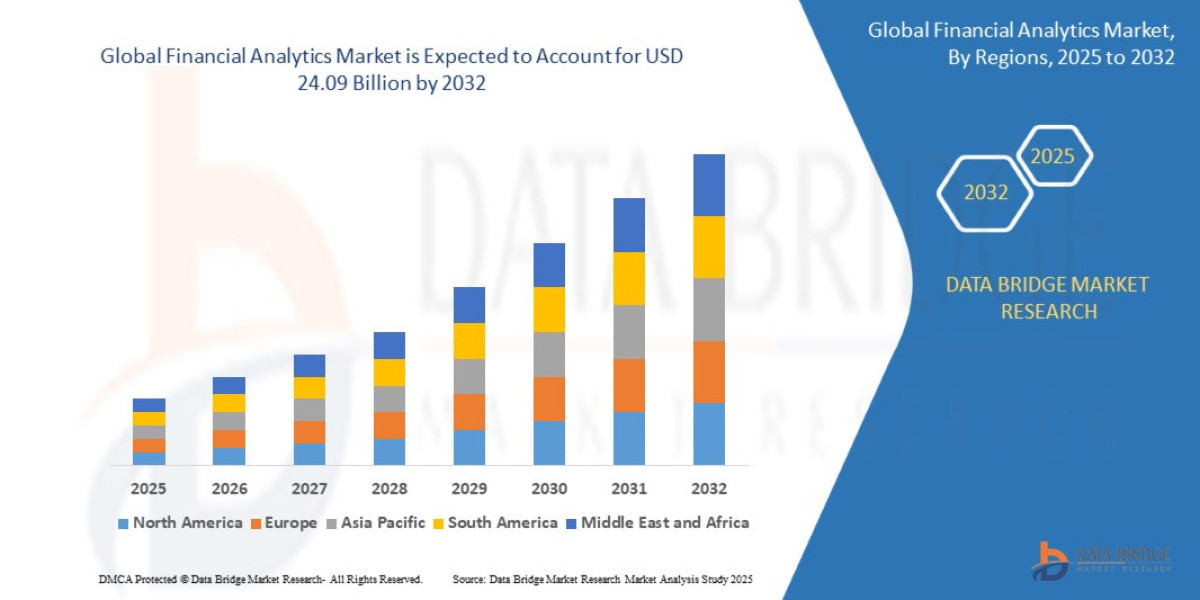

- The global financial analytics market was valued at USD 10.99 billion in 2024 and is expected to reach USD 24.09 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.30%,

Market Overview

Definition and Scope

The Financial Analytics Market provides tools and services for collecting, aggregating, processing, modeling, and interpreting financial and non-financial data to support decision-making. These solutions are delivered via on-premise, cloud, and hybrid deployment models, with cloud adoption being the dominant growth vector.

Key Market Segmentation

By Component:

Software/Platform (Largest Share): Includes core software for risk modeling, profitability analysis, and reporting tools.

Services: Consulting, implementation, maintenance, and outsourcing of managed analytical services (e.g., data cleansing, model validation).

By Application (Primary Value Driver):

Risk Management Analytics (Dominant): Market risk, credit risk (e.g., IFRS 9, CECL), operational risk, and liquidity risk. This remains the largest segment due to non-negotiable regulatory demands.

Customer & Marketing Analytics (Fastest Growth): Customer Lifetime Value (CLV) analysis, churn prediction, hyper-personalization for product offerings, and channel optimization.

Fraud & Compliance Analytics (RegTech): Anti-Money Laundering (AML), Know Your Customer (KYC), suspicious activity monitoring (SAM), and real-time transaction screening.

Financial Forecasting & Planning (FP&A): Budgeting, budgeting, liquidity planning, and scenario analysis.

By Deployment Model:

Cloud-Based (Fastest Growth): Offers scalability, reduced infrastructure costs, and faster model deployment.

On-Premise: Still prevalent in highly regulated, older Tier 1 banks due to legacy infrastructure and strict data security protocols.

Market Drivers

Regulatory Tightening: Post-crisis regulations (Dodd-Frank, Basel III/IV, MiFID II, Solvency II) mandate complex, high-frequency data reporting and capital adequacy stress testing, forcing FIs to adopt advanced analytical infrastructure.

Digital Transformation in Banking: The shift to digital-only channels requires FIs to leverage customer data for personalization, competing directly with FinTech firms that possess innate data agility.

Explosion of Alternative Data: The ability to incorporate non-traditional data sources (satellite imagery, social media sentiment, mobile transaction data) into risk and investment models requires sophisticated analytical tools.

Demand for Real-Time Processing: The necessity of real-time fraud detection, high-frequency trading decisions, and instant credit scoring drives demand for stream processing and low-latency analytics platforms.

Current Dynamics

The FAM is characterized by convergence. Pure-play Business Intelligence (BI) vendors (e.g., Tableau, Qlik) are integrating ML capabilities, while specialized RegTech firms are bundling their compliance expertise with user-friendly dashboards. Large legacy vendors (IBM, Oracle, SAP) are aggressively transitioning their core offerings to cloud-native platforms to maintain relevance. The most significant dynamic is the increasing sophistication of AI/ML models being used in operational risk, moving from simple anomaly detection to predictive behavioral modeling.

Market Size & Forecast

- The global financial analytics market was valued at USD 10.99 billion in 2024 and is expected to reach USD 24.09 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.30%,

For More Information Visit https://www.databridgemarketresearch.com/reports/global-financial-analytics-market

Key Trends & Innovations

1. AI and Machine Learning as the Core Analytical Engine

AI and ML are moving beyond theoretical application to become the standard for critical financial functions.

Predictive Credit Scoring: Using ML models that incorporate hundreds of variables (including behavioral data) to provide dynamic, highly granular credit risk assessments.

Algorithmic Trading Optimization: AI models are used to execute trades, manage market microstructure risk, and develop complex alpha-generating strategies faster than human analysts.

Generative AI in Compliance: Emerging applications include using generative models to automate complex regulatory documentation and create synthetic, privacy-preserving data for model testing and validation.

2. The Rise of Real-Time and Streaming Analytics

Legacy batch processing is proving inadequate for modern financial operations. The trend is towards stream analytics (processing data as it is generated) to enable:

Instant Fraud Detection: Identifying suspicious transaction patterns before the transfer is completed.

Real-Time Liquidity Management: Monitoring cash flows and intraday liquidity exposure across global branches continuously, crucial for Basel III/IV compliance.

3. Hyper-Personalization and Embedded Analytics

FIs are deploying analytical models to provide banking services in the context of the customer's life (Embedded Finance). Analytical tools are used to predict what the customer needs next (e.g., mortgage refinancing, auto loan) and deliver the offer through non-traditional channels, requiring seamless integration with non-banking applications.

4. Regulatory Technology (RegTech) Specialization

RegTech firms utilize automation, cloud, and AI to help FIs manage the cost and complexity of regulatory compliance. Key innovations include:

Automated KYC/AML Onboarding: Reducing the human element and improving speed and accuracy in identity verification.

Natural Language Processing (NLP): Scanning internal communications (emails, chat logs) and regulatory documents to identify potential compliance breaches in real-time.

Competitive Landscape

The FAM is fiercely contested by three main groups:

1. Enterprise Software Giants (Legacy Dominance)

SAP, Oracle, IBM: Leverage massive installed bases and deep integration with core banking and enterprise resource planning (ERP) systems. Their strategy is heavily focused on migrating existing clientele to powerful, integrated cloud analytics suites (e.g., IBM Cloud Pak for Data, SAP S/4HANA).

2. Specialized Analytics and BI Vendors (Data Agility)

SAS Institute, FICO, Qlik, Tableau (Salesforce): Known for deep expertise in quantitative modeling, statistical analysis, and visual data discovery. They compete on model accuracy, ease of use, and specialized APIs for integration. FICO, in particular, remains dominant in the credit scoring segment.

3. FinTech and RegTech Specialists (Innovation and Speed)

Chainalysis (Crypto compliance), Mambu (Core banking integration), various boutique AI risk firms: These firms focus on niche, high-growth areas (e.g., crypto-asset risk, specific emerging regulations) and utilize cloud-native, API-first delivery models, offering faster deployment and lower overhead.

Competitive Strategies: The primary battleground is Ecosystem Integration. Vendors are competing not just on features but on their ability to integrate seamlessly with public clouds (AWS, Azure, GCP) and offer modular solutions that complement, rather than replace, existing legacy systems.

Regional Insights

North America (Innovation and AI Leadership)

North America is the largest and most mature market, characterized by rapid AI adoption, high investment in alternative data sources, and the dominance of large Tier 1 banks that drive massive software expenditure. Innovation is heavily centered on algorithmic trading and complex credit risk modeling.

Europe (RegTech Focus)

Europe is strongly driven by regulatory compliance (GDPR, PSD2, MiFID II). The market is highly receptive to RegTech solutions that promise efficiency and data privacy adherence. The fragmentation of financial markets (EU vs. UK) encourages the development of localized analytical solutions.

Asia-Pacific (Emerging Market Growth)

APAC is the fastest-growing region, driven by the explosive growth of digital banking (especially in India and Southeast Asia) and the need for analytics to manage risk in often underbanked populations. The focus is on mobile-first customer analytics, micro-lending credit scoring, and AML/KYC for rapidly expanding digital economies.

Challenges & Risks

1. Data Silos and Legacy Integration

Many Tier 1 FIs operate on decades-old, siloed core banking systems (Legacy Infrastructure). Extracting, cleansing, and standardizing data from these disparate systems to feed modern ML models remains the single largest operational hurdle and a significant drag on digital transformation efforts.

2. Model Explainability and Governance (XAI)

Regulators require financial models to be interpretable and explainable (Explainable AI or XAI). Sophisticated "black box" ML models, while accurate, often fail to meet these stringent governance requirements, especially in credit risk or capital planning. This forces FIs to choose between model accuracy and regulatory compliance.

3. Data Privacy and Security Compliance

The sensitive nature of financial data demands hyper-compliance with evolving global privacy regulations (GDPR, CCPA). Moving large analytical workloads to the cloud introduces complex security and compliance risks that require continuous, specialized oversight and auditing.

4. Talent Gap

There is a chronic worldwide shortage of specialized talent—specifically Financial Data Scientists and Quant Developers—who possess both deep quantitative skills and an understanding of specific financial regulations (e.g., Basel, IFRS 9). This talent scarcity drives up costs and slows internal adoption.

Opportunities & Strategic Recommendations

For Investors and Private Equity

Target Cloud-Native, Modular Solutions: Invest in FinTechs that offer API-first, microservices-based solutions for specific, high-cost compliance areas (e.g., automated trade surveillance, liquidity stress testing), enabling FIs to 'plug and play' without ripping out legacy cores.

Focus on XAI and Governance: Fund startups that specialize in ModelOps (Model Operations) and XAI tools, which provide transparent oversight, validation, and documentation for complex ML models, solving the critical regulatory compliance bottleneck.

Geographic Expansion in APAC/LATAM: Look for firms that have successfully scaled mobile-first credit scoring and fraud analytics in high-growth, underserved emerging markets.

For Financial Institutions and Manufacturers

Prioritize Data Strategy over Software Purchase: Before adopting new tools, FIs must invest in a robust, centralized Data Fabric or Data Lakehouse architecture to break down data silos and standardize data quality for analytical use.

Shift Talent Focus to ML Engineers: Instead of solely hiring quantitative analysts, focus recruitment on ML Engineers who can operationalize, monitor, and deploy models in a production environment, bridging the gap between data science and IT.

Embrace Generative AI for Documentation: Begin piloting Generative AI tools to automate routine compliance reports, risk scenario documentation, and regulatory response drafting, realizing immediate cost efficiencies in administrative tasks.

Browse More Reports:

North America Personal Care Ingredients Market

Global FinFET Technology Market

Global Paper Dyes Market

Asia-Pacific Protein Hydrolysates Market

Global Inline Metrology Market

North America Retail Analytics Market

Global Thrombosis Drug Market

Europe Network Test Lab Automation Market

Global Perinatal Infections Market

Global Light-Emitting Diode (LED) Probing and Testing Equipment Market

Global Mobile Campaign Management Platform Market

Global Fruits and Vegetables Processing Equipment Market

Global STD Diagnostics Market

Asia-Pacific Microgrid Market

Global Fluoxetine Market

Global Food Drink Packaging Market

Global Electric Enclosure Market

Asia-Pacific Artificial Turf Market

Global Hand Wash Station Market

Global Prostate Cancer Antigen 3 (PCA3) Test Market

Asia-Pacific Hydrographic Survey Equipment Market

Global Cable Testing and Certification Market

Global Leather Handbags Market

Global Post-Bariatric Hypoglycemia Treatment Market

Europe pH Sensors Market

Global Linear Low-Density Polyethylene Market

Global Ketogenic Diet Food Market

Asia-Pacific Small Molecule Sterile Injectable Drugs Market

Global Prescriptive Analytics Market

Global Viral Transport Media Market

Middle East and Africa Composite Bearings Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com